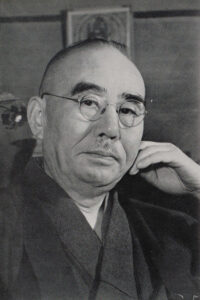

Okazaki Tetsuji, Faculty Fellow, Research Institute of Economy, Trade and Industry (RIETI), Professor, University of Tokyo Just before noon on September 1, 1923, a massive, 7.9-magnitude earthquake struck the southern Kanto region, which includes Tokyo. According to a survey by the city of Tokyo in 1925, the total number of dead and missing people from the disaster in Tokyo Prefecture and six nearby prefectures stood at about 105,000, including 70,000 in Tokyo Prefecture and 32,000 in Kanagawa Prefecture. There was also massive property damage, amounting to 5.5 billion yen (about 7 trillion yen in 2010 prices). Using the same 2010 prices for comparison, damage totaled about 8 trillion yen for the Great Hanshin-Awaji Earthquake in 1995 and about 17 trillion yen for the Great East Japan Earthquake in 2011. The Great Kanto Earthquake resulted in less damage than the other two. Compared ... ... [Read more]