The direction of fiscal and monetary policy: Be cautious and avoid slapdash normalization

“The BoJ must never lobby for its own policy changes to reverse the mild deflation process. If they do so, the BoJ might be heavily responsible for a sharp rise in prices and interest rates as well as a mounting fiscal crisis”—Saito Makoto

Photo: xiaosan / PIXTA

Key points

- Mild deflation process keeps down household consumption

- When people’s long-term expectations are overturned, there is a risk of rapid inflation

- The Bank of Japan recognizes the risk that a policy shift may cause disorder

Saito Makoto, Professor, Nagoya University

Japan’s fiscal and monetary policies are facing drastic changes in a global economic environment marked by advancing inflation and rising long- and short-term interest rates. There is also the firmly rooted view in the financial community and elsewhere that the long-term interest rate should be raised to reduce the gap between domestic and foreign interest rates as well as counter the yen’s depreciation. There is also a lot of talk about removing the upper limit on long-term interest rates. Moreover, there have been prominent proposals for the restoration of fiscal discipline in anticipation of a rise in long-term interest rates.

However, there are many, especially in political circles, who oppose the shift away from monetary easing policy and the excessive emphasis on fiscal discipline. They point out that “as long as the current monetary easing continues, a financial collapse will never occur even if fiscal discipline were shelved.”

◆◆◆ ◆◆◆

In this paper, I introduce a simple monetary model to summarize the issues in question. Even if fiscal discipline were shelved using bold monetary easing as leverage, it is still possible to explain the Japanese economy’s failure to reach the inflation target to date. In this model, the price level and long- and short-term interest rates are determined by market equilibrium. It is assumed that the Bank of Japan (BoJ) sets interest rates in line with the equilibrium interest rate.

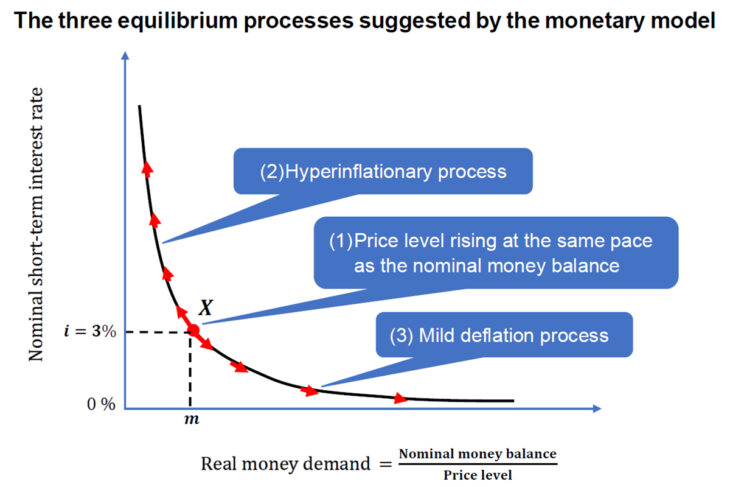

The figure shows the real money balance, which is the nominal money balance (numerator) divided by the price level (denominator), on the X-axis, and the nominal short-term interest rate on the Y-axis, while the curve descending toward the right represents real money demand. The higher (or lower) the nominal short-term interest rate, the more (less) interest income is lost by keeping money and the more money demand shrinks (expands). To simplify this discussion, let us assume that the nominal money balance increases at 2% and the real interest rate is 1% per annum. There are three equilibrium processes in this model. The first equilibrium process establishes the quantity theory of money that price level is proportional to nominal money balance. In this case, the price level rises by 2%, which is the same as the nominal money balance. The real money balance is constant at the level of m because the denominator and numerator increase at the same rate. The equilibrium level (i) of the nominal short-term interest rate is equal to 3%, which is the real interest rate of 1% plus the inflation rate of 2%. As a result, the economy stays at point X. With this equilibrium process, fiscal discipline must be maintained at all times.

Second is the hyperinflationary process. The price level rises above 2% and accelerates further. The real money balance approaches zero as the denominator increases to exceed the numerator. Meanwhile, the equilibrium interest rate skyrockets. The economy moves at a fast tempo from point X toward the upper left corner and upward along the real money demand curve.

Third is the mild deflation process. As I will discuss later, this equilibrium process corresponds to the Japanese economy over the past 30 years. The price level remains below 2% and eventually starts to decline. The real money balance gradually increases with an increasing numerator and a decreasing denominator. Meanwhile, the equilibrium interest rate declines toward zero. The economy slowly descends along the real money demand curve from point X toward the lower right corner.

The third mild deflation process has some very interesting features.

Firstly, as long as the government along with the BoJ shelves fiscal discipline and the zero interest rates allowing government bonds and money to be “borrowed” persist, it is possible to postpone principal and interest repayments. On the other hand, government bonds and money supplied to the market are held by households through private banks in the form of “loans.” As money demand rises at zero interest rates, government bonds also maintain their real value with mild deflation, even as interest rates are close to zero.

Secondly, even if a large amount of government bonds and money are issued, prices will remain stable and interest rates remain near zero because households act as recipients. However, households will also restrain their consumption to the same extent that they act as recipients for government bonds and money.

Thirdly, when the equilibrium interest rate is near zero, the deflation rate will be approximately equal to the real interest rate. In the case of our 21st-century economy, where the “natural rate of interest” corresponding to the long-term real interest rate has dropped to a zero level, prices will remain flat rather than decline.

Fourthly, and this is the most troubling feature, the equilibrium process lacks a self-correction ability that gradually returns the economy to an equilibrium (point X), where the quantity theory of money is established and fiscal discipline is maintained. When people’s long-term expectation that interest rates and price stability will remain near zero is overturned, the economy will leap to point X all at once. When that happens, the combination of the government’s continued borrowing and the households’ continued loaning will be immediately resolved, and although this will only be a one-time increase, prices will increase multifold and interest rates will increase by several percent. Furthermore, a hyperinflationary process will be initiated if fiscal discipline is not restored after the leap to point X. The mild deflation process described in the aforementioned model can explain the following characteristics of the Japanese economy over the past 30 years: (1) prices and interest rates did not soar even with the overt shelving of fiscal discipline, (2) household consumption did not recover even with large-scale fiscal policy, (3) the inflation target could not be reached even with the BoJ’s unprecedented monetary easing, and (4) the price level remained flat in the 2010s.

According to my analysis, the mild deflation process developed fairly slowly in the late 1980s, but it was not until the late 1990s that its features became more pronounced. This process has not been reversed since then, even in the face of financial crises at home and abroad, major earthquakes, and the spread of infectious diseases.

◆◆◆ ◆◆◆

So, will the recent drastic changes in the international environment overturn the mild deflation process? The following three points are important to keep in mind when considering future fiscal and monetary policy.

Firstly, the BoJ must never lobby for its own policy changes to reverse the mild deflation process. If they do so, the BoJ might be heavily responsible for a sharp rise in prices and interest rates as well as a mounting fiscal crisis.

As such, the BoJ needs to engage in persistent dialog with the market from the following perspectives. First of all, the current rise in domestic prices is a substantial corrective in response to a temporary rise in import prices due to the soaring prices of imported raw materials and the depreciation of the yen, meaning that it is not continuous inflation due to an increase in aggregate demand. Moreover, the removal of the long-term interest rate ceiling and the end of the negative interest rate policy are correctives for the over-repressive policy implemented so far, not signaling a continued rise in interest rates.

Secondly, attempts to restore fiscal discipline are completely separate from the debate of whether or not a financial collapse will occur. Even with the mild deflation process, where fiscal discipline can be shelved, the National Diet should return to the roots of parliamentary democracy, which means careful use of taxpayers’ hard-earned money, and in particular, strictly monitor the contents and sources of regular fiscal expenditures.

Thirdly, regardless of the drastic changes in the international environment, if we are hit by a shock (such as an earthquake directly under an urban center) that eats up several years’ worth of domestic savings and spells the end of household loans, this will be sure to overturn the mild deflation process. Although the risk of such a shock is low, we must not neglect crisis management preparations in the event that the mild deflation process is suddenly overturned and we are hit by soaring prices and interest rates.

The mild deflation process is inefficient compared to the equilibrium process, where the quantity theory of money is established, in terms of households’ insufficient consumption demand and excessive possession of money and government bonds. Over the past 30 years, the Japanese economy has become increasingly inefficient with overly expansive fiscal and monetary policies. In light of this, policy normalization aimed at restoring economic efficiency needs to be pursued with utmost caution.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 24 October 2023 under the title, “Zaisei, Kinyu seisaku no Shinro (II): Seijoka ha sessoku sake, shincho ni (The direction of fiscal and monetary policy: Be cautious and avoid slapdash normalization),” The Nikkei, 24 October 2023. (Courtesy of the author)

Keywords

- Saito Makoto

- Nagoya University

- monetary and economic model

- Bank of Japan

- BoJ

- fiscal policy

- monetary policy

- global economy

- interest rates

- short-term

- long-term

- real interest rate

- yen depreciation

- fiscal discipline

- monetary easing

- market equilibrium

- inflation target

- hyperflationary process

- price level

- nominal money balance

- mild deflation process

- real money demand

- quantity theory of money

- government bonds

- household spending