POPULATION TRENDS AND THE REGIONAL ECONOMY

In June this year, I published a book with the title Defure no shōtai: Keizai wa jinkō no nami de ugoku (The True Character of Deflation: How Population Trends Shape the Economy). A major factor behind Japan’s stagnant economy and the crunch in the country’s public finances in recent years has been the decline in absolute terms of the working-age population and the increase in the population of elderly retirees. Drawing on figures from several comprehensive studies, my book highlighted this fact and discussed the serious impact it was having.

I have written this article for a readership of people working in finance who are interested in the vicissitudes of Japan’s domestic economy. As well as sketching out the main points of the argument in my book, I also look at the present and future effects of recent population trends on the economy and consider policies that might be taken to deal with them.

The Longest Postwar Boom and the Slump in Domestic Demand

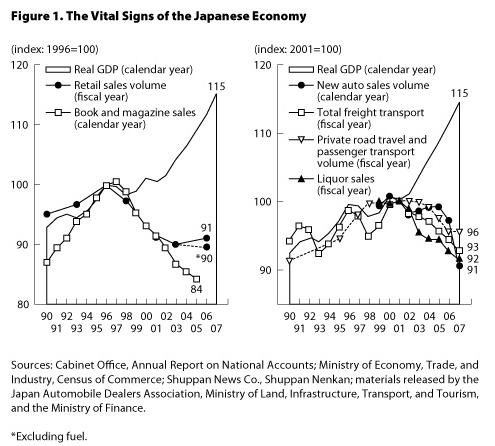

The two charts in figure 1 show the changes in Japan’s gross domestic product and in various indicators of domestic demand for the period from 1990, just before the bursting of the economic bubble, through 2007, when the economy was at the height of an extended export-led boom.

The tendency nowadays is to lump this period together, ruing it as Japan’s “two lost decades,” but in fact the first and second halves of the period were quite different. People often remember the 1990s as a period of “post-bubble slump.” In fact, however, as the figures show, retail sales and domestic freight and passenger transport volumes increased in tandem with GDP, particularly during the first half of the decade. If anything, this should perhaps be considered as an economically buoyant period.

Contrast this to 2002-7. These years supposedly represented the “longest boom of the postwar period.” GDP did indeed increase significantly thanks to a 70% increase in exports over the period. But with the exception of fuel, which benefited from the surging price of crude oil, the retail sector flattened out completely, and indicators such as domestic transportation volumes, new car sales, and liquor sales actually declined. At the time, people referred to this as a “phantom recovery”–one that had little or no discernable impact on people’s daily lives. This is not surprising, given the figures. Certainly for Japanese retailers selling to the domestic market, there would have been little evidence of a booming economy.

When my book came out in June, people who disagreed with my argument tended to point to the steady growth in sales in the service sector that showed up in macro statistics for this period. But if this growth in sales was really taking place, there ought to have been more of a sense of tangible optimism within the country about the state of the economy. According to statistics experts, these results have a margin of error of around 3% per year, owing to the lack of precision in the input-output tables on which they are based (due to the extremely small sample size). It seems likely that an accumulation of such errors was responsible for producing these inflated figures. For this reason, I have done my best to avoid using such macro statistics and have focused instead on results from comprehensive surveys.

I also want to give due attention to the arguments that take the shock caused by the Lehman Brothers collapse in September 2008 and the dramatic appreciation of the yen this year as the root causes of the economic downturn and the slump in domestic demand. The truth is that Japan’s slump in domestic demand coincided not with the bursting of the bubble or the aftermath of the Lehman shock but with the very middle of the period under discussion–around the turn of the century, at almost exactly the same time as the “longest boom of the postwar period.” Only by looking squarely at this fact (confirmed by figure 1) can we begin to understand the structural factors behind the phenomenon.

Decline in Working-Age Population Brings Slump in Domestic Demand

Figure 1 shows overall trends affecting a variety of domestic demand indicators that were rising in the first half of the 1990s but declined from the second half of the decade on into the current century. Unlike GDP, one important economic indicator matched this downward trend throughout this period: Japan’s domestic employment figures. According to the national census figures, the number of people in work (counted as anyone engaged in remunerative work for at least one hour a week) increased significantly over the first half of the 1990s before entering a decline in the second half of the decade.

These facts are quite different from the general impression held by the Japanese public. The early 1990s is generally known as an “employment ice age” in which new graduates struggled to find jobs. Those who graduated in March 1995 faced a particularly tough employment climate. Sure enough, census figures for the five-year period from October 1990 to October 1995 show that the number of unemployed rose from 1.91 million to 2.88 million–an increase of 970,000 in absolute terms and of 50% in relative terms. Over the course of the same five years, however, the number of people in employment rose by 2.46 million–2.5 times more than the increase in the number of unemployed. How have people overlooked this fact? Even more striking is the fact that this increase in employment coincides remarkably closely with the growth in retail sales over the first half of the 1990s, as figure 1 shows. The relationship between the increase of people in work and the invigoration of consumer activity is clear to see.

In the period from 1995 to 2000, on the other hand, the number of people in the workforce stopped growing, instead declining by more than 1 million. This decline accelerated in the years from 2000 to 2005–the same five-year period that supposedly marked the longest boom of the postwar period. Over this period, the number of people in employment in Japan plunged by 1.47 million. Even if the overall tendency since the 1990s cannot easily be explained by economic climate factors alone, figure 1 shows that the decline in the number of people in employment, which peaked in 1995, again coincides remarkably well with the constant fall-off in retail sales, which peaked in 1996. The pattern mirrors the tendency seen in the first half of the 1990s. Once again, there is a clear connection between the declining number of people in work and the slump in consumer demand.

Let us look at the facts a little more closely for the sake of accuracy. The results of the national census for 2005 included a large number of incomplete answers, and between 2000 and 2005 there was an increase of 1.62 million in the number of people whose employment status could not be accurately determined. If we suppose for now that all these people were in fact doing paid work of some kind or another, that would mean an increase in the number of people in work of 150,000. But even so, the difference between an increase of 2.46 million in the post-bubble period of 1990-95 and the 150,000 in the five-year period that marked the “longest boom of the postwar period” is simply too large. We are forced to conclude that there must be another structural reason besides the economic climate that was responsible for such a large discrepancy between the economic climate and employment.

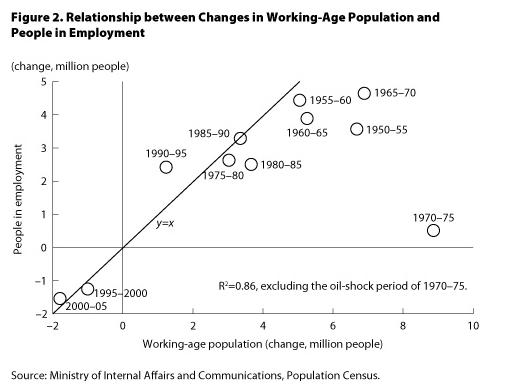

The explanation is to be found in shifts in Japan’s working-age population (people aged 15-64). Figure 2 shows the shifting patterns of the number of people in employment and the working-age population in postwar Japan in five-year intervals. The figure shows a clear correlation between the two.

Until 1995, demographic trends in Japan ensured that there were always more new graduates every year than new retirees leaving the workforce, so that the working-age population continued to grow. And since the country was maintaining more or less full employment, the number of people in employment also rose steadily. When there were large numbers of new graduates, companies in postwar Japan were willing to tolerate lower productivity for the moment in order to hire new young workers, regarding this almost as a matter of course (perhaps without being aware of it themselves). This was true even during the “employment ice age” of the early 1990s: Though the number of unemployed rose quite dramatically as the offspring born to the baby boomers born in the early 1970s entered the workforce in large numbers, growth in the number of people in employment was 2.5 times as large.

Since 1995, by contrast, the number of new graduates has been lower than the number of new retirees, and the overall working-age population has shrunk. The increasing tendency for elderly people and housewives to work part time has not been enough to offset this shrinkage, and the total number of people in employment has fallen inexorably.

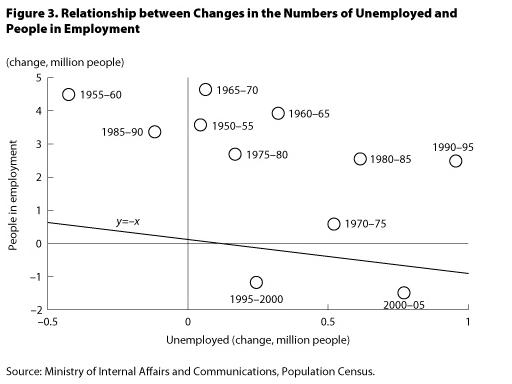

For those who consider employment only in terms of the unemployment rate and the ratio of job openings to applicants, ignoring the changes in the numbers of people employed, the above presentation may be a little difficult to follow. But as figure 3 shows, the number of people in employment and the number of unemployed people have increased simultaneously several times in postwar Japan. It was only after 1995 that the present conditions arose, with an increase in the number of unemployed accompanying a decrease in the number in employment. Naturally, there is no direct correlation between a change in the number of people in employment and an increase or decrease in the number of unemployed. In order to ascertain the true condition of the employment market, it is not enough merely to look at unemployment figures and the number of people being hired. We also need to check the number of people actually in employment and to pay close attention to demographic changes in the working-age population.

Over a three-year period starting in 2012, members of the postwar baby-boom generation (those born 1947-49), the largest demographic group in Japan, will reach age 65, which is the standard retirement age in Japan, and the working-age population will see its biggest decline in history. The surge in the number of new retirees will bring about a massive fall in the number of people in employment and will contribute to a significant cooling off of domestic demand. We need to be prepared for the consequences.

The Savings of the Elderly–Not Being Converted into Consumption

Even after the retirement of the baby boomers, Japan’s working-age population will continue to decline, at least for the first half of the century. Policies to reverse Japan’s low birthrate or encourage greater levels of immigration are unlikely to have a significant quantitative effect, for reasons I must omit here because of constraints of space. My book contains a fuller discussion of these points for those who remain unconvinced.

So what will become of the Japanese economy? If the export sector recovers while new retirees continue to outnumber new graduates, there will be an ongoing labor shortage in low-paid jobs, and the ratio of job offers to applicants will remain high, creating a situation in which the figures on paper seem to suggest a healthy economy. In fact, there are already serious labor shortages in agriculture, forestry, and fishing and in care for the elderly. As the working-age population continues to shrink further, a decline in the number of people in employment will lead to a decrease in the amount paid as wages by employers. This will lead to less consumption by workers, triggering a collapse in the price of goods and services targeted at those currently in work, a demographic crucial to the health of industries that rely on domestic demand, which accounts for the greater part of the domestic economy. This will have an adverse effect on the profitability of these industries, leading to cutbacks in hiring and wages, which will in turn cause domestic demand to stagnate even further. This vicious circle will lead to a shrinking of the national economy. Young people will thus continue to find themselves stuck in low-paying jobs, with spells of joblessness punctuating their frequent changes of employers, as a result of which the unemployment rate will remain stuck at a high level.

Export industries, on the other hand, can improve productivity and profitability by increasing investment in equipment and replacing workers with machines, cutting down on the amount they have to pay in wages. The resulting boost to corporate earnings will serve to line the pockets of stockholders (many of them affluent and elderly) in the form of dividends and higher share prices. But domestic demand will continue to shrink, and exports will account for an even larger share of the economy, with a commensurate rise in exchange rate risk. Increasing numbers of companies will be forced at some point to shift production overseas.

My thesis has been labeled by some commentators as a bizarre argument that blames deflation on a declining population. But in fact what I am claiming is that what we are seeing at the moment is not macroeconomic deflation at all but a microeconomic phenomenon resulting from the falling price of items like cars, electric appliances, and housing, which are consumed almost exclusively by the working-age population. This collapse in prices is the natural result of a decline in the working-age population–in other words, a decline in the number of consumers. This is the reason why retail sales continued to slump even during the “longest boom of the postwar period” in the early years of this century, and the reason why the many years of financial easing had no effect. Consequently, I have been quite taken aback at the number of people who have criticized my argument based on a superficial reading.

Another, equally vehement, criticism often leveled against my thesis points to the fact that there has been no deflation in Russia or Eastern Europe, even though the working-age population in those countries is declining in the same way as Japan’s. My argument, however, is that what is happening in Japan is not deflation at all, but a collapse in the price of products generally consumed only by the working population. Whether or not there is deflation in other countries is therefore irrelevant. These countries have not yet experienced a similar collapse in the price of items consumed almost exclusively by the working-age generation. But this is not especially surprising. The per capita GDP in these countries is much lower than in Japan, and many people have yet to acquire the goods they desire. Additionally, manufacturers in these countries are not producing an excess of internationally competitive products. It is only to be expected that diverse conditions in different countries will lead to a variety of contrasting economic phenomena. This much is clear from the fact that it is only in Japan where prices have not risen at all despite the long spell of loose money. It would be nice if comparison-based objections to my argument were developed a little more scientifically.

And yet Japan’s personal savings, estimated to total more than ¥1.4 quadrillion, are not being translated into consumption. Persuading people to buy almost anything at all domestically, even if it were only the equivalent of the interest on their savings–a meager 1% or so a year–would allow retail sales to easily rise to new highs every year. Further, as shown by the record high level of Japan’s current account surplus for April-September, the first half of the current fiscal year, the export sector continues to earn huge amounts of foreign currency. Is there really no way of recycling at least some of these earnings back into the domestic economy?

The problem is that the lion’s share, 83% according to one estimate, of Japan’s personal savings belongs to the elderly. And one study has reportedly found that the average age at which people receive their final inheritance from their parents is 67. Under such conditions, the channel for passing on financial assets to people of working age is remarkably restricted.

Meanwhile, the large population of baby boomers and their near contemporaries have been reaching retirement age. Many of them have received large lump-sum retirement bonuses, possess high levels of financial assets, and are earning dividends that companies are paying stockholders with profits generated by cutting personnel costs. As much as ¥50 trillion is being paid out in pensions every year, ¥10 trillion of this coming directly from the national treasury. An amount many times that of the funds appropriated for child allowances, which have attracted so much comment, is being funneled in benefits for the elderly, almost without anyone noticing.

Most seniors do not need to buy new suits, and they already have cars and homes. With a quarter century or so of life remaining after retirement, they cut down on unnecessary expenditure and focus on managing their assets so as to have enough to cover their living expenses and outlays for medical care and the like. This is the basic reason why income is not being translated into consumption.

As far as the working generation is concerned, it is probably safe to assume a normal pattern of behavior in which increased income will lead to increased consumption. But unfortunately, since the total numbers of this group are decreasing every year, total income will not increase even if there are occasional pay rises. As a consequence, domestic demand will not become buoyant either.

It is financial institutions that will suffer most. If domestic demand does not improve, investment opportunities will become scarce; meanwhile, they will have to accept the funds deposited by those seniors who find themselves with plenty of cash on hand. Inevitably, their loan-to-deposit ratios will drop. But over the next dozen years or so, there will be a steady rise in the number of people of advanced old age. It is possible that this will lead to a substantial drop in savings as these people break into their nest eggs. Even if this happens, though, their consumption will not lead to vigorous investment. There will be no increase in the number of borrowers, and ultimately we can expect to see an age of balanced contraction, in which levels of both deposits and loans fall.

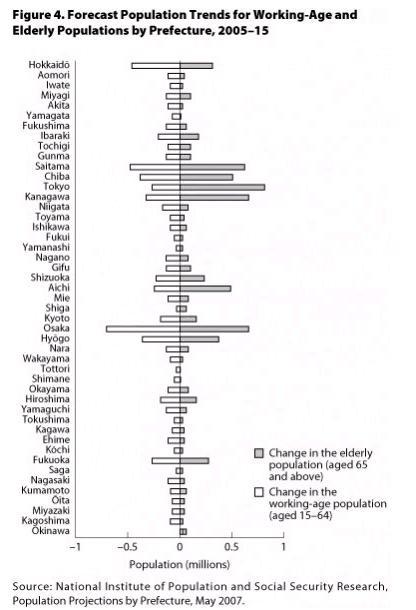

This is not a problem affecting only provincial areas. During the period of rapid economic growth, large numbers of those born during the war and the immediate postwar years flocked to the big cities for work. Since the turn of the millennium, these people have started to reach retirement age, causing a drop in the number of workers in absolute terms even in metropolitan areas. The mass retirement of those who moved to Tokyo and other big cities when they were young is no longer being covered by the inflow of young people from the provinces, whose numbers are now relatively small in absolute terms. Indeed, if we look at the absolute numbers of elderly, the Tokyo area and Japan’s other major metropolitan regions are in fact experiencing a more rapid increase in their old-age populations than anywhere else in the world. It is in the cities rather than rural regions that problems are arising from a lack of hospital beds, an overwhelming demand for care facilities, and incidents in which ambulance crews have to try several hospitals before they find one willing to accept the patient they are carrying. Rather than just studying the aging rate of the population as a whole, we need to focus on the figures that closely reflect the actual situation. An example is figure 4, which shows in absolute figures the changing sizes of the working-age and elderly populations.

Ways to Boost the Income of the Working Generation

What can be done? Only by confronting the fact that domestic demand is shrinking due to a decrease in the working-age population can we start to build a solution. Appropriate policies have not been implemented in the past because of mistaken attempts to assign the causes of the problem to the economic climate or the money supply.

Briefly, the situation is this. However much the working-age population decreases, domestic demand should expand according to theory so long as per capita income can be boosted enough to compensate for the shrinking number of people at work. That means it should still be possible to achieve economic growth led by domestic demand even without hoping for renewed growth in exports to the debt-ridden United States or to China, where limits on resources are starting to show up.

In saying this, I run the risk of being misunderstood to mean that we should immediately increase public spending. But there is no guarantee that per capita income will be increased by redistributing tax revenue to the generation of people at work, who are the ones who pay the bulk of the taxes in the first place. We need to avoid being trapped by preconceived ideas and consider ways of redistributing revenue to the working generation on a private-sector basis without going down the tax revenue route.

The first concrete measure that comes to mind is to encourage the transfer of revenue from affluent seniors to the younger generation through inheritance and gifts. An effective way of doing this would be to favor lifetime gifting, so that heirs get money while they are still of working age. Criticisms of this as preferential treatment for the rich fall wide of the mark. Only if the savings of the affluent elderly are translated into consumption via inheritance and gifts can they be paid in wages to the younger generation working to make things or provide services. For a society that respects work, getting the savings built up in these nest eggs to circulate is an extremely positive thing. It would be worth announcing that inheritance taxes will be increased from a given point in time so as to encourage people to make lifetime gifts to their heirs before then.

The second concrete idea that comes to mind is to encourage particular kinds of consumption by the elderly as a way of sustaining and expanding the income of the working generation indirectly. The policy introduced by some local governments of handing out coupons allowing items to be bought at a 10% discount, for example, has been praised for generating consumption nine times greater than the outlay of public funds, and it also has the advantage that people receiving the public subsidies cannot just put the money in the bank. We should also consider encouraging seniors to carry out renovations on their homes to make them more resistant to earthquakes, for example, or (to offer an unpolished idea of my own) selling welfare coupons that would allow users to access services provided by local governments at a 10% discount when needed in the future. Compared to the measures the government has taken to encourage people to buy electric appliances and cars, this sort of approach is less liable to result simply in eating up future demand in advance.

In addition to policies along these lines, my book also suggests providing pay raises to young workers using the savings in wage costs resulting from the retirement of the baby boomers, encouraging consumption by getting more women into the workforce, and increasing domestic demand by attracting more foreign tourists rather than foreign workers. I also suggest policies for responding to the rapid increase in the number of elderly citizens. Given the limits on what can be achieved by calling for economic growth or an increase in productivity, I tried to make my arguments as precise as possible. I hope that those with an interest in the subject will take the time to read the book.

In truth, though, the prescription I really believe in comes before any of this. As mentioned briefly above, I believe what we need most to break out of the present impasse is a shared understanding of where we stand based on figures from comprehensive surveys. Just as in the period after the Meiji Restoration (1868), the period of rebuilding after World War II, and the period when Japan went all-out to implement antipollution measures–so long as people have a shared understanding of the situation, I am confident that numerous suggestions for concrete policies to deal with it will be put forward by people working with the issues on the ground.

Translated from an original article in Japanese written for Japan Echo Web. [December 2010]