VIEWING THE ECONOMIC IMPACT OF THE GREAT EAST JAPAN EARTHQUAKE

The massive earthquake and tsunami that struck the coast of Eastern Japan this past March 11 is significantly impacting the nation’s economy as a whole. This is the largest economic shock to hit Japan’s economy since World War II. The full picture is not yet clear, but I will present what is visible at this stage, including the courses and order through which the disaster’s effects will ripple, and the responses that will become necessary given our experiences in events such as the Great Hanshin-Awaji Earthquake in 1995.

I will not, however, refer to loss of human life, injuries or harm, to people themselves. This is not because it is not economically important but because it is a huge challenge that extends beyond the economic impact.

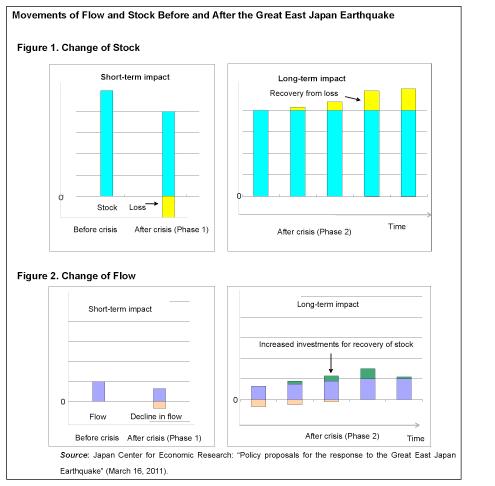

When considering the effects of a catastrophe such as what we are facing here, it is important to distinguish between flow and stock and short-term and long-term. “Flow” is a concept that describes economic activities that flow day to day, including spending, production and income. The economic growth rate and other frequently seen (economic-related) indicators are mostly variables of flow. “Stock,” in contrast, is a concept that indicates abundance as of a certain point in time. Houses, factories and social infrastructure are some examples.

Significant negative impact on the economy in the short run

Loss of stock is seen when looking at the crisis’ short-term impacts on the economy (see Fig. 1, Phase 1 of Stock). Massive stock was lost mainly due to the tsunami.

The problem is the scale of the loss. According to the Cabinet Office’s March 23 estimate, the amount of loss resulting from the Great East Japan Earthquake is estimated at 16-25 trillion yen. Damages from this quake were far greater than the approximately 10 trillion yen worth of stock lost from the Great Hanshin-Awaji Earthquake in 1995.

The flow of economic activities has suffered a serious blow (Fig. 2, Phase 1 of Flow) due to the reduction in activity immediately following the earthquake.

Real GDP for the first quarter of 2011, as announced May 19, decreased as much as 3.5% (quarter-on-quarter annualized rate). The earthquake affected the GDP data for a period of two-ninths of the entire quarter, counting from March 11 when the disaster struck. In this light, this large drop indicates that economic impacts of the earthquake were enormous. There was comparably little noticeable effect on GDP growth in the aftermath of the 1995 earthquake.

There are a number of possible explanations for why such serious economic impacts were felt.

First of all, the affected areas were large in scope in the March earthquake, and economic activities such as production and consumption were physically suspended. The GDP of Hyogo Prefecture, which was struck by the Great Hanshin-Awaji Earthquake, accounted for 4.0% of the nation’s GDP as a whole (FY1994), whereas the five prefectures (Aomori, Iwate, Miyagi, Fukushima and Ibaraki) damaged by this quake had an aggregate share of 7.1% (FY2007). This was aggravated by the effect of the nuclear plant disaster, clearly showing why the catastrophe led to a serious direct downswing in growth.

Secondly, failures in supply chain networks introduced a bottleneck-type constraint on production. Manufacture of machinery, including automobiles and electric appliances, consists of many components. Supply chains work to procure these components and distribute them between production sites, thus they are networks. Production of end products stops if bottlenecks occur in these networks. A popular analogy is that an automobile is an amalgamation of as many as 20,000 components. If just one of these 20,000 cannot be acquired, the production of the automobile is halted, which is the production-impeding bottleneck effect. (i) The larger the number of components, (ii) the more difficult to substitute the part at the bottleneck, (iii) the lower the inventory level at production sites for end products, and (iv) the denser a network is, the larger the production-impeding effect will be.

The disaster-hit Tohoku region was a center of production for automobile- and electric appliance-related components. Both these industries handle a number of components, and many of them, such as electronic control devices, were not replaceable with those produced in other districts. By establishing dense networks through the use of systems such as just-in-time inventory management, all factories in this area also try not to hold any components in inventory.

These bottleneck phenomena occurred in wide areas after the disaster, which led to falls in output in areas not hit by the quake.

Consequently, industry production for March showed significant deterioration of -15.5% compared to a previous month. This also hindered exports; in March, export volumes decreased 3.2% compared to a year ago.

The third economic impact is weak consumption that resulted from lower consumer confidence nationwide.

In the Consumers’ Behavior Survey, the Cabinet Office reported the situation of consumer sentiment in terms of a consumer confidence index. The survey showed that this index took consecutive drops of 2.6 points in March and 5.5 points in April.

Declines in consumer sentiment weighed on consumption by reducing the propensity to consume. According to the Family Budget Survey by the Ministry of Internal Affairs and Communications, real consumption spending (households with two or more people) dropped as much as 8.5% in March compared to a year ago, which was the largest drop since the Ministry began compiling this data.

This economic underperformance is expected to persist in the second quarter of 2011. The Economic Planning Association conducts a questionnaire targeting 43 top economists in Japan and presents the average of their economic forecasts in the ESP Forecast Survey. Japanese economists’ forecasts for the nation’s GDP growth (quarter-on-quarter annualized rate) for the second quarter of 2011 averaged -3.3 % according to the May survey.

Reconstruction demand will be conducive to growth in the long run

Looking at the long-term impacts of the crisis on the economy, however, the full picture shows some very different aspects. With respect to stock, the lost part will start to recover as rehabilitation progresses (Fig. 1, Phase 2 of Stock).

Flow that declined immediately after the earthquake will gradually revert to the pre-quake level. Manufacturing activities will be reintegrated, with some being replaced with production in other districts. Distribution will also recover. Consumer sentiment will eventually normalize.

Moreover, recovery of the lost stock will bring additional investments in flow. Housing investments to recover the lost housing stock and public works expenditure to restore the functions of roads, port facilities, railways, etc. are expected to increase. Considering the huge stock lost, investments to recover it will likely be sizeable.

This is the same as implementing economic stimulus measures through massive Keynesian public sector investments, which will likely boost the economic growth of flow (Fig. 1, Phase 2 of Stock).

Looking at these above explanations may give the impression that I am suggesting that what has been considered a catastrophe is really a positive factor for the economy in the long run. But this is not what I am trying to convey. Economic indicators we see daily, such as GDP, are originally based on the concept of flow and do not count loss of stock. In other words, negative aspects of disasters are ignored and only the positive aspects are counted, which leads to this mistaken impression.

This sort of view has almost become a consensus among economists in Japan. Fig. 2 shows how leading economists’ forecasts changed before and after the Great East Japan Earthquake, using the abovementioned ESP forecasts. Dotted and solid lines respectively show pre-earthquake (March) and post-earthquake (April) forecasts.

The chart suggests that many economists’ forecasts as of March showed a comparatively buoyant rise of about 2% based on the quarter-on-quarter annualized rate for the periods following the first quarter of 2011. After the earthquake, however, they expect that negative growth will continue for the first two consecutive quarters of 2011, while for the third quarter and onward they foresee higher growth rates compared to their previous forecasts.

Government’s readiness to be called into question

Now that government outlays will naturally increase, we will face the problem of finding ways to finance these outlays. For this problem, we will need to consider three paths.

The first path is a reclassification of existing budgets. The Japan Center for Economic Research wrote in the “Policy proposals for the response of the Great East Japan Earthquake” released March 16, 2011, that measures of more than 5 trillion yen are possible without additional government bond financing. The proposal contains the analysis that redirecting funds, such as those for a child allowance, free tuition program for high schools and a toll-free expressway trial, to government outlays in addition to reserve funds of FY2010 and FY2011 will suffice for measures of some 5 trillion yen. In short, the ruling party should drop the promises it made in its manifesto and use them all as a source for reconstruction.

Though this may be somewhat technical, some economic benefits can also be expected (though measures will not be implemented for economic effects) by simply redirecting funds that were originally planned to be passed on to households to public works spending. This is because all public works are categorized as demand in GDP, while a considerable part of funds passed on to households will not be spent but will go into savings. (The multiplier effect creates the difference.)

The second path is a tax increase. Since this a controversial subject, strong opinions will argue that, given the serious damage on the economy, tax increases are out of the question. Yet it would also be inappropriate if the current generation did not bear the massive rehabilitation expenses currently needed, but rather passed them on to future generations.

Various forms of tax could be used. A proposal by the abovementioned Japan Center for Economic Research suggests that a stable financial source of about 5 trillion yen can be secured by imposing a tax on all fossil fuels. This would be an environmental tax that, at the same time, aims to reduce greenhouse gas emissions.

The third path is utilization of government bonds. Given the huge fiscal deficits, it would be best to avoid additional issuance of such bonds, though to some degree it is unavoidable. Some are proposing a plan to issue special government bonds for reconstruction purposes. Whatever the case, the government deficit will likely expand further, making it necessary to revise the existing fiscal restructuring targets (moving primary balance into surplus by FY2020).

Looking at reality, a supplementary budget of some 4 trillion yen was established on May 2, 2011. This budget shows that the financial resources are provided basically through reclassification of the existing budget without tax increases or government bond issuance. However, careful examination of the budget’s content reveals that 2.5 trillion of the 4 trillion yen budget is provided through “reclassification of fiscal resources for the government-funded portion of national pension benefit payments.” This means the resources slated for use as pension benefit payments were redirected to reconstruction expenses. Pension benefit payments left unattainable by the reclassification will then be made by releasing some of the pension reserves. In other words, pension reserves were used as fiscal resources for reconstruction expenditures. In effect, this is the same as issuing additional government bonds and passing the burden on to future generations.

More fiscal resources will undoubtedly be needed in the future for disaster reduction. All party groups should devise financial measures that will not pass the burden on to future generations – in a bipartisan fashion and as soon as possible.

Devising such financial measures calls the level of government’s readiness into question. A significant issue in Japanese politics before the earthquake was how to smoothly carry out national policies given the divided state of the Diet. In this era of the two-party system where a change of government is possible, we face a “normalizing of a twisted Diet.” However, the structure for political decision making remains as one of decision-making by a one-party government with an absolute majority. Under one-party rule, opposition parties attack the ruling party by such means as manipulating Diet proceedings and forcing cabinet members to resign. Getting in each other’s way in this twisted state will only hinder decision making. This was the political state before the earthquake.

To solve this, the ruling and opposition parties will need to seek compromises through discussion and not through repetitive intraparty political maneuvering for the majority. Though Japanese politics have hardly succeeded in doing the former, bipartisan activities have begun, driven by the need for emergency measures in the quake’s aftermath. If these tasks are accomplished, we certainly hope that this case will become a model for future political decision making.

Translated from “Kyodai-jishin no eikyo wo dou kangaeruka,” Nikkei Business Online, March 23. (Courtesy of Nikkei Business Publications, Inc.)