SHIFTING TO A COUNTRY THAT INCREASES GROSS NATIONAL INCOME (GNI) INSTEAD OF GROSS DOMESTIC PRODUCT (GDP)

Nagahama Toshihiro

The Great East Japan Earthquake has forced Japanese companies to renew their awareness of the risks of operating in Japan. Meanwhile, the extremely strong yen, at less than 77 yen to the dollar, has become a persistent condition. Japanese companies, mainly manufacturers, are hit hard by the reduced export competitiveness resulting from the exchange rate. The yen is expected to remain strong for some time since investors have no choice but to buy yen given the euro zone debt crisis and the slumping economy in the United States.

On top of this, rapid aging of society and the declining birthrate have made falling domestic demand inevitable. This has accelerated a trend in which even companies from domestic demand-oriented industries, such as retail and service, seek new opportunities in overseas markets. It is time we stop regarding overseas shifts of companies as a negative movement that hollows out domestic industry, reduces domestic employment and income, and eventually reduces consumption. Instead, we now need to seriously consider how to make Japan an “investment-oriented nation” that invests wisely overseas, earns profits and brings those profits back to Japan to boost income.

Japan is no longer a trading nation

We can no longer refer to Japan as a trading nation or a country that earns foreign currency by importing raw materials and exporting high-value added industrial goods. Japan’s trade surplus is now far exceeded by profits from overseas investment, including direct investments made by private companies through merger and acquisition (M&A) of overseas companies and construction of plants outside Japan, as well as securities investments such as the purchase of U.S. treasuries, which yield dividends. Such structural change of the Japanese economy is indicated by the gap between its gross national income (GNI) and gross domestic product (GDP).

Current-account balance – the difference between the amount of money received and that of payment generated in trading of goods and services and financial transactions with overseas countries – is classified into trade balance, balance on services, income balance and current-account transfers. GDP only includes trade balance and balance on services. GNI, on the other hand, also includes income balance, such as dividends from investments abroad, in addition to trade balance and balance on services. Because the income balance surplus of Japan has been increasing rapidly since the start of the 2000s the rate of divergence between its GDP and GNI has been growing.

Accordingly, while GDP is a representative barometer of a country’s economic scale, GNI is more appropriate for measuring the amount of income of the entire country since it also includes income balance. However, though Japan’s GNI has exceeded its GDP, improvement of life has not been felt by everyone. Reasons for this are discussed later.

Japan’s trade surplus has been reduced due to the increased overseas production ratio and the rise of commodity prices, for which Japan depends on imports. Income balance surplus has therefore been its new source of income. Notably, the level of export has been low since the Lehman Brothers collapse in September 2008. The Great East Japan Earthquake this past March also caused supply chain fragmentation. These circumstances have made it difficult to maintain a trade surplus.

In contrast, income balance has been strong, compensating for the reduced trade surplus. In 2010 figures, the amount of current-account balance surplus was 17.1 trillion yen, of which 6.5 trillion yen was from balance on services and 11.6 trillion yen was income balance surplus. (There was also a 1.1 trillion yen deficit of current-account transfers).

Profit from foreign direct investment will be the key

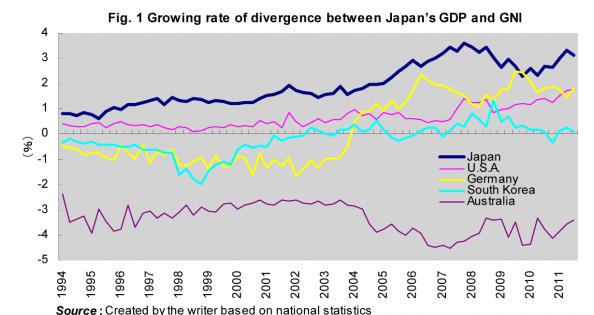

The rate of divergence between Japan’s GDP and GNI has been growing year by year. It is higher than that of key nations such as the United States and Germany, having currently exceeded 3% (Figure 1). We can go a bit further into the details about the background of the widening gap.

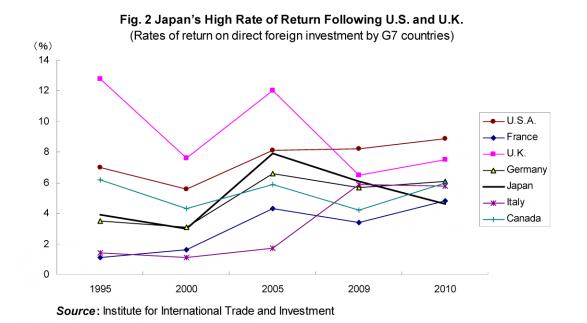

One reason is the existence of profits of overseas subsidiaries obtained through foreign direct investment, which are not included in GDP. As of 2009, Japan’s balance of foreign direct investment was $740.9 billion (approximately 57 trillion yen), nearly twice the 2005 total of $386.6 billion. Accordingly, the amount of proceeds from direct foreign investment, including dividends, was as large as $45.4 billion in 2009. The rate of return on such investment has been higher than that of other G7 countries since the late-2000s, though it has yet to reach the level of the United States and United Kingdom (Figure 2).

Looking at the regional breakdown of the amount of proceeds from direct foreign investments, we see that from Australia grew 4.3 times, China 1.8 times and Thailand 1.5 times, from FY2005 to FY2010. This has led to the increase of foreign direct investment, and growth of these countries has led to increase of profits from subsidiaries located there – a virtuous circle. Notable increase of such investments is seen in mining and chemical and pharmaceutical industries in Australia, wholesale and retail, general machinery, financing, transportation equipment, chemical and pharmaceutical, and steel and nonferrous metal industries in China, and transportation equipment industry in Thailand.

The growing rate of divergence between Japan’s GDP and GNI means that economic activity through overseas investment is contributing in no small part to Japanese people’s incomes. In other words, the Japanese economy is characterized by high profit from overseas, proved by the large income balance surplus.

For this surplus, Japan ranked fifth in the world as of 2009, following the United States, United Kingdom, Germany and France. A factor behind this is the increase of profits from securities investments, which has been accelerating since the late-2000s. Regional breakdown of proceeds from investments in foreign securities including dividends shows that the amount of proceeds from Brazil grew 10.3 times, from Saudi Arabia 6.0 times and from Indonesia 5.9 times from FY2005 to FY2010. Thus, growth of the investment destination countries has led to increase of profits from securities investments.

Take advantage of growth of overseas countries

Japan is already near being an investment-oriented nation, but the historic appreciation of the yen taking place should be regarded as a good chance to shift to a structure under which the country earns profits overseas through aggressive foreign investment. The earthquake has resulted in an increase of companies newly starting overseas production or undertaking M&A of overseas companies in response to the power shortage and supply chain fragmentation. Such a trend has expanded even to the retail, service and construction industries, which are said to be domestic demand-oriented, due to the population decline and shrinking domestic market. Irrespective of the earthquake’s impact, we are in an era when companies get out of Japan to seek opportunities in overseas markets.

Actually, however, the increase of income from overseas has not led to increased employment or wages in Japan, with a decrease in domestic investment. Therefore, consumption does not grow and the economy remains stagnant. Why is this?

It could be because profits earned overseas have yet to be diverted sufficiently to domestic employment and wages. Companies and individuals may also be too concerned about the future to divert their money to wages and consumption. This is possible considering Japan has the most aging population in the world, with roughly 25% of the population being 65 or older, resulting in rising social security expenses, including pensions, and aggravation of national finances.

Japan will therefore need to position the increase of proceeds from direct foreign investment as the new source of economic growth, while at the same time providing workers with a larger share of the profits. Fortunately, Japan is about to catch up with the United States and the United Kingdom in the rate of return on direct investments, which implies that the country is about to establish a system under which companies steadily earn profits from overseas through aggressive overseas business expansion.

Needless to say, the current high value of the yen means a weak euro and dollar. It is highly possible that Japan will also face weak home currency, or yen depreciation, sooner or later because it also has a debt problem like in the United States and Europe. This is why the country should take advantage of the yen’s current high value.

Staying within the country in the future will make it impossible even to maintain the current level of GDP. Now both the nation and companies need to change their way of thinking and try to increase GNI by making forays overseas. If Japan then becomes an investment-oriented nation and establishes a virtuous circle in which overseas profits lead to increased domestic employment and wages, this will be the country’s new course.

Translated from “Kokunaiseisan dewanaku kokuminseisan wo fuyasu kuni ni,” Shukan Ekonomisto (Weekly Economist), November 1 2011, pp. 24-25. (Courtesy of Mainichi Shimbunsha)