Economics for winning: Be skeptical about commonly accepted views Viewing something that is commonly accepted from a different angle will lead to discovery

| Q: Will Japan end up a loser if the trade gap widens? |

| A: There are no winners or losers in trade, but attention is needed on an increase in the current account deficit. Japan’s widening trade deficit: the presence of Japan, an exporting country, continues to fade, but the current account balance, rather than the trade balance, is what requires attention. |

KODAMA Yuichi, Chief Economist, Meiji Yasuda Life Insurance Company

The problem surrounding the country’s imbalance, such as the trade balance or the current account balance, is old and yet a new theme. After a period of rapid economic growth, the ensuing era for Japan that persisted for a long time was one in which its massive trade surplus was deemed problematic in the course of international negotiations, resulting in numerous types of trade friction with the United States, be it in textiles, automobiles or semiconductors. At the Plaza Accord of 1985, major countries agreed to depreciate the U.S. dollar in order to correct the U.S. trade deficit. The government of Prime Minister Nakasone Yasuhiro at that time laid out a national policy founded on expanding domestic demand and narrowing the trade surplus.

The balance of international payments is a field in which a gap easily occurs between specialists and the general public in the understanding of the meaning of a surplus, a deficit and the cause of an imbalance. A confusion in connotation tends to occur in the definition of a surplus and a deficit. This is different from the concept of profit and loss. For example, if an individual company were to be seen as a country, purchasing machinery and facilities from outside the company would be a factor contributing to a trade deficit. However, this type of transaction does not have anything to do with the company posting losses. Consequently, it does not mean that having a trade surplus would make a country a winner or posting a trade deficit would be tantamount to being a loser.

How about the causes behind an imbalance, that is, posting a surplus or a deficit? Many have a vague understanding of this, namely that a country would have a trade surplus if it has many highly competitive industries and companies, and if the contrary were true, it would have a trade deficit. This is a mistake. I say this because it is evident even in the simple fact that the United States has continued to post massive trade deficits over the years despite boasting companies that are unrivaled in the world, while on the other hand, many of the developing countries in Asia have been posting a trade surplus.

It is necessary to understand the trade theory of comparative advantage in order to better understand the meaning (see attached table). Even if a country has a comparative advantage in the rate of productivity in manufacturing various types of products versus other countries, it could engage in trade with a country that has absolute advantage, with both countries gaining a profit.

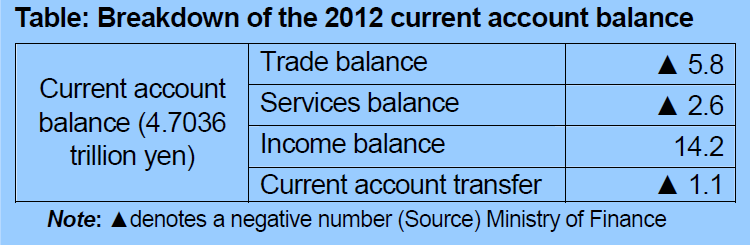

So what does the future hold for Japan’s trade balance? Japan, a trade surplus nation, is a thing of the past. According to the Balance of Payments data for 2012 released by the Ministry of Finance, the trade deficit soared to a record level of 5.8051 trillion yen, while the balance for current account surplus stood at 4.7036 trillion yen, down 50.8% from the previous year and the lowest level since 1985 when statistical comparisons became possible (see table).

Following the Great East Japan Earthquake, imports of alternative fuels have increased rapidly because of operational suspensions of nuclear power plants, making it likely that the trade deficit will remain intact. That said, it is necessary to focus on the current account balance in considering Japan’s intent and to grasp the meaning of the difference between income and outlays of one country in a broader context.

The current account balance includes trade and services income as well as the income balance, which posts income such as returns on foreign investments, and the posting of the current account transfers, which are transactions that do not carry a value, such as grant assistance. As for foreign investments, the balance includes transactions excluding those that are related to financial assets and liabilities.

For now, the current account balance has remained positive because the size of the surplus in the income balance is greater than the trade deficit. The backdrop to this is the continued expansion in Japan’s foreign assets, which totaled 662 trillion yen as of the end of December or around 1.8 times that of foreign debt holdings. There is a clash in views among those in the know, with one side stating that the current account will tumble into a deficit sooner or later due to the trade deficit remaining intact, and the other stating that the current account balance will remain in positive territory for a while because of a surplus in the income balance. Still, many point to a deficit at some point in time, even though forecasts in the timing varies.

Proponents of the current account balance moving into the red ascribe this to the growing erosion in savings due to the rapid growth of the aging generation. How do the current account balance and savings relate with each other? In fact, the current account balance has two characteristics: while it is an indicator that shows transactions on such items as imports and exports as well as investment income, it also shows whether there is a surplus or a deficit after subtracting the nation’s investments (outlays) from its total savings.

For example, even if the surge in imports of alternative fuels serves to pressure the current account toward a deficit, so long as there is no major change to the structure of the savings surplus in the country, the current account balance, theoretically, will remain in a surplus because the yen will be pressured to weaken in the foreign exchange market. Conversely, if there is more pressure toward a surplus in the balance of investments (outlays) versus savings, the yen will strengthen and consequently accelerate the timing of the current account balance dipping into the red.

A country with a current account deficit ends up being dependent on an inflow of capital from overseas for its shortage of investment capital, and this in itself is not a problem, and so for both trade and current account balances, a deficit is not tantamount to being a loser. That said, it is not completely free of problems. Aside from the United States that touts a key currency, an excessive expansion in the current account deficit spurs a depletion in the foreign currency that is to be used for payments and has a risk of triggering a currency crisis.

For Japan, another major problem is the possibility of a deficit in the current account directly leading to fiscal instability. To date, the stable holding structure for Japanese Government Bonds in which over 90% are held by domestic investors has been a factor behind long-term interest rates stabilizing at low levels. However, since a current account deficit would signify a country’s savings deficit, it would become more likely for Japan to increasingly turn toward overseas investors to absorb JGBs.

Overseas investors who carry foreign exchange risks demand a higher risk premium than domestic investors. In this way, a trend toward higher interest rates could spark fiscal instability. It is essential for Japan to make an effort to pave the way toward fiscal reconstruction while the current account remains in positive territory.

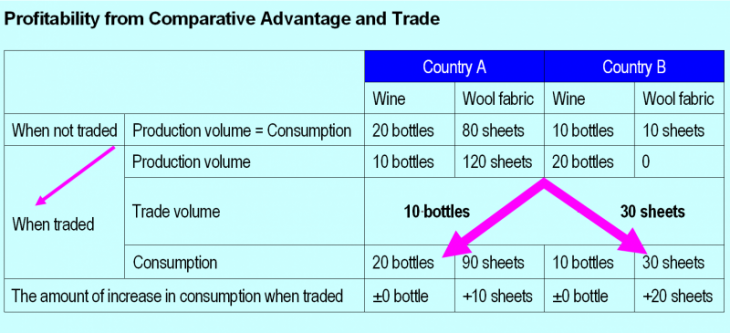

The difference between comparative advantage and absolute advantage

A correct understanding of the trade balance is not possible so long as there is a confusion between comparative advantage and absolute advantage. I will provide an interpretation by citing a specific example.

Say there are two countries, namely country A and country B, and both produce wine and wool fabrics. Country A is able to produce two bottles of wine and eight sheets of wool fabric per worker, while country B can manufacture one bottle of wine and only one sheet of wool fabric per worker. In this case, country A has a higher rate of productivity for both wine and wool fabrics, so in comparing itself to country B, country A has an absolute advantage in the production of both wine and wool fabric.

In this scenario, it looks as if country B has nothing to export, but it is not actually the case. Say there are 20 workers in both country A and country B, respectively. If countries A and B each have 10 workers producing wine and 10 workers manufacturing wool fabric, country A would be able to produce 20 bottles of wine and 80 sheets of wool fabric, while Country B would be able to yield 10 bottles of wine and 10 sheets of wool fabric.

If three sheets of wool fabric from country A can be exchanged for one bottle of wine from country B, country A would be able to move five workers, who represent manpower required to produce 10 bottles of wine, to manufacturing wool fabric in order to import 10 bottles of wine, and would be able to manufacture another 40 sheets of wool fabric. At this point, if 30 sheets of wool fabric were exported, the country would be able to obtain 10 more sheets of wool fabric compared with before the trade, without reducing wine consumption (20 bottles).

Also, country B would be able to obtain 20 more sheets of wool fabric compared with the number before the trade without having to reduce wine consumption (10 bottles) by utilizing 20 people to produce 20 bottles of wine and exporting 10 of these bottles to country A. In other words, even country B, which has an inferior productivity rate, can increase its profitability. This is when country B has a comparative advantage in wine.

In summary, a country’s overall productivity would rise if it devotes itself to a field that has a higher rate of productivity compared with that of another country (wool fabric for country A) or if a country commits itself to a field that is comparatively better than another even if productivity is lower (wine for country B).

(Kodama Yuichi)

Translated from “Tsusetsu wo Utagae: Boeki ni Kachimake wa naiga Keijoakaji no Zodaini Chui (Be skeptical about commonly accepted views: There are no winners or losers in trade, but attention is needed on an increase in the current account deficit),” Weekly Economist, October 29 2013, pp.24-25 (Courtesy of Mainichi Shimbunsha). [2013]