The Whereabouts of Household Financial Assets: The COVID-19 Pandemic Transforms Retirement Plans

Iwaisako Tokuo, Professor, Hitotsubashi University

Key points

- Both household savings and current account balances are gradually moving into the red

- The rates of return on assets are not expected to rise after the COVID-19 pandemic

- Economic policy focuses on measures to improve the productivity of workers

Prof. Iwaisako Tokuo

From a macroeconomic perspective, there has been surprisingly little change in the circumstances surrounding Japanese household financial assets in the past quarter-century. To start with, household savings rates dropped sharply at the beginning of twenty-first century. This prompted an outcry among economists about the arrival of the “zero-saving society”, backed by the simulation studies predicting negative household savings and the current account deficit (= negative national savings). But by the mid-2000s, saving rates had stabilized at a low level and the situation has remained nearly unchanged since then.

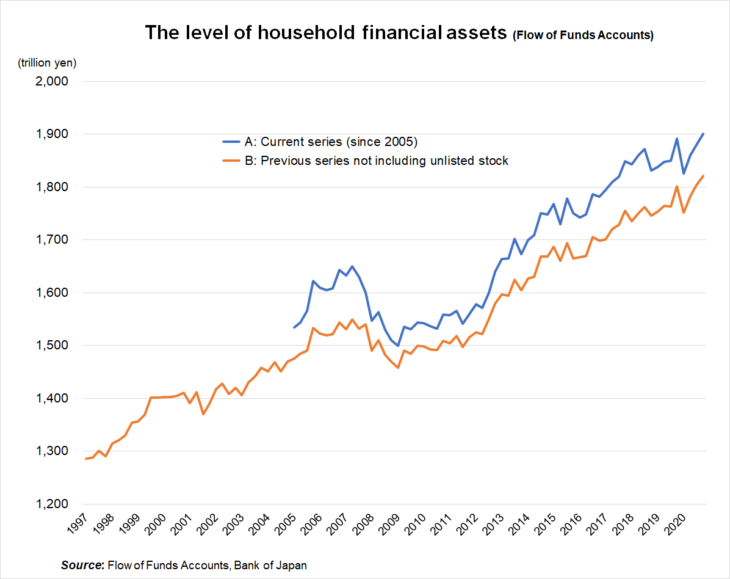

In economics, annual savings is a flow variable, and thus corresponds to the change in households’ holding of financial assets in a given year. Except for the short-term ups and downs due to fluctuating stock prices, household financial assets have continued to increase slowly but steadily during this period. The figure is a flow-of-funds table that presents data on the level of household financial assets. Looking at the growth rate, the average annual rate over the last decade was 2.4% (including stocks, A series in the figure) but in the period 2005–09 (ditto), it was 1.7%, so the increase in asset growth has accelerated in recent years.

In this quarter of a century, public finance scholars have appointed themselves the canary in the coal mine and continued to speak out about the increasing risk of fiscal crisis. Consequently, the general public started to consider them as “the boys who cried wolf” up to certain extent.

Of course, their argument about fiscal sustainability are not an unfounded concern. But, it is unlikely that a fiscal crisis will occur anytime soon, given that private savings are expected to remain positive, asset balances will continue to grow for the time being, therefore the new issues of government bonds will continue to be absorbed by domestic investors.. On the other hand, both household savings and the current account balance are edging toward a deficit over the long term. So when considering retirement plans twenty or thirty years into the future, the risk of fiscal crisis cannot be ignored.

Next, let’s take a closer look at events in the 2010s, in the aftermath of the Global Financial Crisis (GFC).

Firstly, Abenomics has extracted the Japanese economy from the “Lost Twenty Years” and the economy is now approaching the trends in other developed countries. But, at the same time, the “Japanization” of the world economy has gained ground. The growth rate of productivity has dropped across developed countries, and the rate of return on assets (long-term interest rate, natural rate of interest) has been persistently lower than it had been before GFC.

The development of AI technology is creating groundbreaking innovation such as automated driving. On the other hand, it is unclear whether AI will bring about a long-term increase in productivity growth for the entire economy like ICT did before GFC. Since the prices of risk assets simply mirror the performance of the real economy in the long run, the low interest rates will continue since the extent of the impact of ICT technology to the economy is so uncertain, and it is unlikely that stock prices will rise significantly beyond the rebound from the COVID-19 crisis.

Secondly, the twin trends of declining birth rates and longer life spans have accelerated the aging of the population around the world. As a result, the sustainability of social security systems has become, to varying degrees, a serious and urgent policy issue in all developed countries.

Looking at the same problem from the viewpoint of the individual households, pension insecurity and the risks associated with a longer life span have come to light. As a result, the elderly in developed countries have retained high levels of savings and assets. The current trend that accumulated private assets complement the public social security system as a source of income after retirement will continue to grow for the foreseeable future. Therefore, there is a need to enhance private financial services to support individual wealth accumulation and asset management, and to further reform the financial and securities tax system.

Thirdly, the direct impact of the second trend is that the working-age population will gradually stay in employment longer than the current elderly generation. Since the average life expectancy and healthy life expectancy are longer, this is a natural flow, but some will take this as an unfortunate trend since elderly people will have to work longer because Japanese social security system has become unsustainable as it is. However, compared to the West, the elderly in Japan are more motivated to work, so there may be a relatively substantial aspect of happiness.

Finally, based on recent developments, let us consider the long-term impact of the 2020 global COVID-19 pandemic on trends in the financial markets and household financial assets.

According to a paper by Jordà et.al. (2020, NBER Working Paper No.26934), there is a historic tendency for rates of return on capital to stagnate for a long period after a major pandemic. Unlike wars, pandemics do not affect the capital stock, even though they are the same exogenous large-scale shocks, but they have large negative impacts to population, so to labor supply. Consequently, there is a relative surplus of real capital.

Of course, history lessons cannot be applied directly to modern times. Compared to the plague and the Spanish flu, the number of deaths is much smaller. It has even been reported that the total number of deaths in the East Asian countries is rather lower than in previous years. Also, the death toll from COVID-19 is concentrated in the elderly who have already out of the labor market.

Nevertheless, given the current global supply of vaccines, it is highly likely that the end of the COVID-19 pandemic in developing countries other than East Asia will take years longer than in the developed countries. In the meantime, there will be a shortage of cheap labor and a surplus of capital throughout the world. The story is a little complicated because the impact on the Japanese economy is mainly through international trade, but it is difficult to imagine a scenario where the return on capital will be higher in next five years or so.

Another characteristic of the economic shock of the COVID-19 pandemic is that the impact varies greatly depending on industry and occupation. It has had an enormous impact on the retail, restaurant, and travel industries where there is a high proportion of SMEs and self-employed people. On this basis, it can be inferred that the hardest-hit individuals and households are those who rely solely on the national basic pension and are not covered by corporate pension, or even if covered, rely heavily on supporting themselves for retirement income.

For example, an employee in his or he 50s at a major airline company can continue to rely on corporate pensions after retirement, even if his or her current income declines. But, if a couple in their 60s, who had planned to work for another ten years, have no choice but to close their restaurant, the economic impact is enormous and recovery will be very difficult. How the government alleviates and helps the latter group out of their economic difficulties is an extremely important policy issue.

From a long-term perspective, improving and strengthening the resilience of individuals and households in this group to economic risks through lifetime planning is another important issue. It is necessary to consider both the design of the social security system and how they should build up financial assets for old age.

What should we think about the impact on Japan’s fiscal situation? In the experience of Japan since the 1990s, and of the developed countries after GFC, the fiscal situation deteriorated significantly after the slump in the economic growth rate, but the sharp drop in interest rates acted as a buffer, and as a result, the most pessimistic scenarios did not come true. The COVID-19 pandemic is likely to slow the growth rate of the world economy for a period of about five years or so, but interest rates will likely be suppressed too. Therefore, the probability of fiscal crisis is unlikely to rise to the threshold level.

Even so, there is no doubt that it has been a major negative shock for Japan’s fiscal situation. Unless some decisive policy measures are taken, the wolves will come for Japanese economy at some point. For the same reason, increasing public investment in real capital is unlikely to have a positive effect on the economy. If economic stimulus are needed, they should be limited to policies that enhance the productivity of workers such as improving the environment for remote work and subsidizing recurrent education in ICT.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on February 25, 2021 under the title, “Kojin kinyu-shisan 1900 choen no yukue—Korona-ka, rogo sekkei ni ihen mo (III): TPP kakudai, Bei fukki-go ni suishin (The Whereabouts of Household Financial Assets—The COVID-19 Pandemic Transforms Retirement Plans).” The Nikkei, February 25, 2021. (Courtesy of the author).

Keywords

- Iwaisako Tokuo

- Hitotsubashi University

- household savings

- current account balances

- COVID-19

- pension insecurity

- Òscar Jordà

- employment

- retirement