Super Monetary Easing and the Asset Bubble: Limited disconnect from the real economy

Ito Takatoshi, Professor at Columbia University, Adjunct Professor at the National

Graduate Institute for Policy Studies (GRIPS)

Key points

- As the economy recovers, the United States moves toward a rise in long-term interest rates

- Stock price gaps between types of industry suggest market rationality

- Central bank to communicate carefully with stock markets

Prof. Ito Takatoshi

One year has passed since the start of restrictions on economic activities in Japan, the United States, and Europe to control the COVID-19 pandemic. The economy has sustained major damage as a result of the declarations of a state of emergency and lockdowns, the unemployment rates have risen and consumption in some sectors remains weak. GDP in both Japan and the United States has dropped by nearly 10% from the most recent peak in the second quarter of 2020. In the near term, the trend is toward a recovery but not to the level of the peak reached prior to the COVID-19 pandemic.

Ignoring the situation in the real economy, the stock markets in Japan and the United States are booming. Assessing Japan by the Tokyo Stock Price Index (TOPIX) and the United States by the S&P500, the markets peaked on January 20, 2020 (February 19 in the US) as the risk of infection was coming to light before dropping by approximately thirty percents to bottom out on March 16 (March 23 in the US). But the subsequent pace of recovery was relatively quick, powering past the peak level prior to the COVID-19 pandemic on November 24 (August 18 in the US). In the near term, the markets in both Japan and the United States are 15% above their respective peaks prior to the COVID-19 pandemic.

The stock markets in the United States, in particular, have kept hitting new heights since the start of 2021. In February, the Nikkei Stock Average recovered to the 30,000 yen level for the first time since 1990. Is this perhaps a mini-bubble that is disconnected from the real economy? Is this mini-bubble inflated by the asset purchases and liquidity supply by the central banks in Japan and the United States? If so, is no one concerned that the financial markets will become chaotic and impede the recovery of the real economy when the transition from super-easing begins?

An event that seemed to substantiate these concerns occurred on March 4, 2021. Jerome H. Powell, the chair of the Federal Reserve Board (FRB), expressed concerns about disruption in the bond markets when financial policy moves away from super-easing, but he did not specify any concrete measures to curb the upward trend in long-term interest rates. As a result, the long-term interest rate rose and stock prices dropped.

The remarks by Powell are founded on a recognition that a buoyant US economy will expedite the exit from super-easing. A stimulus package of 1.9 trillion dollars (approximately 200 trillion yen) is in place and the pace of vaccinations is also picking up. President Biden has announced that he will secure vaccines for the entire adult population of the United States by the end of May. Schools will return to physical classrooms as of the autumn, raising expectations for a general resumption of economic activities. As a result, many experts believe that both the growth rate and the inflation rate will rise.

Therefore, it is reasonable for long-term interest rates to rise gradually. On the other hand, the market wishfully expected the FRB to adopt a low and stable long-term interest rate policy for a longer period of time. Since these expectations were betrayed, the result was turmoil on the market. It reminded me of the so-called “taper tantrum” of 2013. But, the chaotic conditions only lasted one day, and despite the rise in long-term interest rates, stock prices have remained stable since then.

What about Japan? The government has declared a second state of emergency and the near-term recovery is weak. Since the vaccination drive is also lagging behind other advanced countries, it is not clear when the coronavirus shock will end and normal economic activities return. If so, super monetary easing is expected to continue for the time being. The Bank of Japan (BoJ) uses yield curve control (YCC) and will not allow a continuous rise in the long-term interest rate at a speed similar to the United States.

But, if the state of emergency is lifted and economic activities gradually recover, long-term interest rates may also start to fluctuate a little within acceptable limits. With regard to purchases of exchange-traded funds (ETF), it would seem that the goal of curbing the risk premium increase (additional interest corresponding to risk) has already been achieved, but there is also the risk that a sharp decline in purchases will be perceived as the end of super monetary easing.

Meanwhile, the long-term interest rate in the United States is gradually rising while increases in Japan’s long-term interest rate are limited under YCC. In this case, the outcome is a weaker yen. The yen is already depreciating: at the start of the year, the exchange rate was 103 yen to the dollar and, at one point, it was at the 109 yen level. In the short term at least, this should have a positive impact on business conditions and the stock price in Japan.

As mentioned above, stock prices fell sharply in March 2020 as a result of the rapid spread of COVID-19, but the subsequent recovery was quick. There is no doubt that the main factor was very quick monetary easing and positive fiscal policies.

Travel restrictions, lockdown, shorter opening hours for restaurants, and other measures were introduced to try to prevent the spread of infection. Since stagnation in economic activity is similar to an exogenous disaster, taking swift measures and spending huge amounts of money did not meet with any political obstacles. This contrasts with the 1997 banking crisis in Japan and the 2008 subprime mortgage crisis in the United States when fiscal policy and central bank bailouts met with strong political resistance in the context of strong criticism of banking conduct and inadequate supervision of banks.

Another special characteristic is that the impact of the limits on economic activities due to the COVID-19 pandemic has varied greatly from sector to sector, which is also reflected in the stock price trends. Companies that provide goods and services necessary for stay-at-home consumption have performed better and their stock prices have also risen in anticipation. Meanwhile, restaurants, retail shops, and aviation businesses, which were hit by restrictions on their activities, are still sluggish performers.

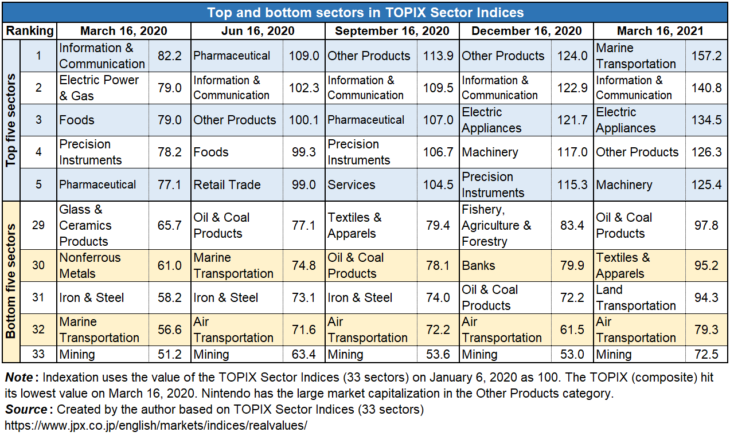

Taking January 6, 2020 when the impact of the coronavirus had not yet been felt as the baseline, let us consider the rate of increase in the top and bottom sectors of the TOPIX Sector Indices (33 sectors) every three months as of March 16, 2020 (the nearest bottom price on TOPIX). (See the table.)

Information & Communication, Electric Appliances, and many other types of industries that reflect the demand for stay-at-home consumption take turns in the top spot, while Air Transportation and other types of industries that have seen an extreme decline in sales due to the restrictions on their activities are at the bottom. Over the past year, the point gap in the rate of increase between companies at the top and those at the bottom has been widening. A process of recovery with such widening gaps is known as a K-shaped recovery.

The extent of the K-shaped recovery is greater in the United States where the IT giants Google, Amazon, Facebook, and Apple (GAFA) are located. The recovery process after the subprime mortgage crisis (the 2007–2008 global financial crisis) was not K-shaped.

A K-shaped recovery indicates that the reaction of the stock markets is rational. Even if there is a mini-bubble, it may only apply to specific types of industries. The impression of a disconnect from the real economy is not necessarily correct.

However, if it becomes clear that the degree of monetary easing is tapering and that business conditions are improving thanks to vaccination and fiscal policies, it is reasonable for the long-term interest rate to rise. Among the companies with the highest rate of increase, there is no doubt that the companies that have increased borrowing and continued to grow will have the brakes applied on expansion. The disconnect from the real economy is likely to gradually dissolve when the real economy recovers and the strong performance of the stocks that have done well out of the COVID-19 pandemic comes to a halt.

The posited risk is the possibility of a major reaction in bond prices and stock prices if market participants suddenly realize that super monetary easing for whatever reason will end sooner than expected. Such an event would be similar to what happened on March 4, 2021, but on a much larger scale. To avoid this, central banks need to communicate more carefully than ever with the markets.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 19 March 2021 under the title, “Cho-kinyukanwa to shisan baburu (1): Jittaikeizai tono kairi, genteiteki (Super Monetary Easing and the Asset Bubble (1): Limited disconnect from the real economy).” The Nikkei, 19 March 2021. (Courtesy of the author)

Keywords

- Ito Takatoshi

- Columbia University

- National Graduate Institute for Policy Studies (GRIPS)

- super monetary easing

- asset bubble

- real economy

- COVID-19

- stock market

- TOPIX

- United States

- K-shaped recovery