Climate Change and Finance: For Active Involvement in Decarbonization by Central Banks

Shirai Sayuri, Professor, Keio Universit

Key points

- Governments should promote measures to develop green finance

- Governments should support environmental projects by actively issuing green bonds

- The Bank of Japan should make greater contributions to climate issues through purchasing green corporate bonds and Exchange Traded Funds (ETF)

Prof. Shirai Sayuri

Green finance that supports improvements in environmental issues has drawn attention in recent years. To limit the global average rise in temperature to 1.5 degrees by the end of this century as compared to pre-industrial levels, a large amount of capital spending and R&D is needed to reduce greenhouse gas (GHG) emissions to net zero by 2050. According to an estimate by the International Energy Agency (IEA), more than double the current annual global investments (550 trillion JPY) will be needed by 2030 and around the same amount will be needed until 2050.

Europe is leading in the green finance fields, but an opportunity has also arrived for Japan to take the lead in the development of financial markets that support emission reduction in Asia. Let’s examine the current state of green finance, related government measures, and the role of the central banks.

In the current financial markets, the risks of climate change have not been adequately factored into prices. As a result, green finance funds are in short supply while there are ample funds allocated to fossil fuel related-investments and loans. This means that a mis-pricing in the markets has been occurring mainly due to the price of carbon being too low without reflecting true social cost.

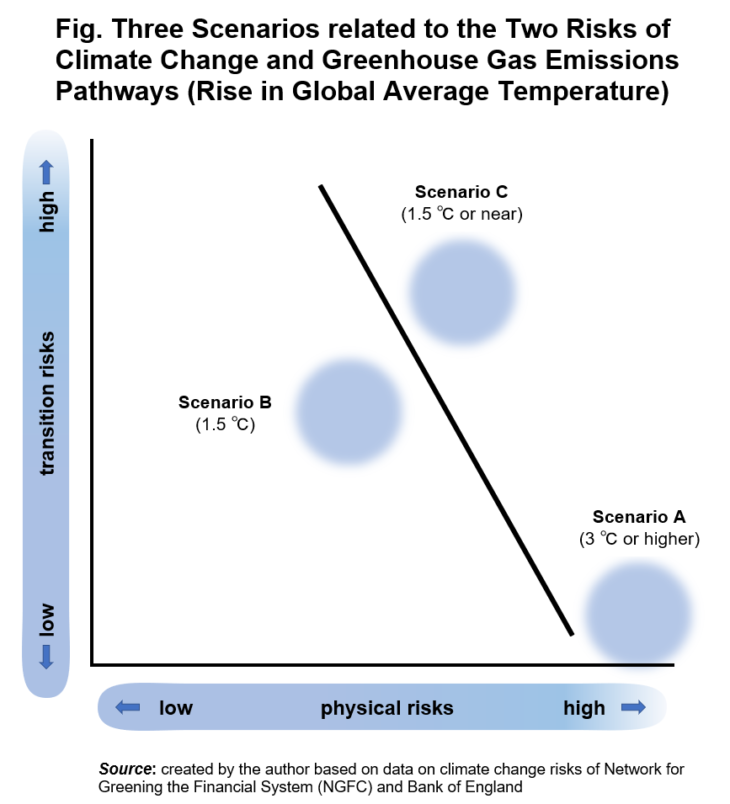

Climate change is typically accompanied by physical and transition risks. The former includes the risk of production decline, capital stock damage, and food shortages arising from severe natural disasters. The latter includes the risk of drastic inter-industry and intra-firm restructuring, stranded assets related to fossil fuels where returns on fixed investment can’t be collected fully and thus generate corporate losses, general price increases caused by carbon pricing, and numerous litigations against companies that violate strengthened environmental regulations, the process of implementing green, but risky investment in uncertain technology fields, and more.

These two risks have an inverse relationship. If climate change policies stay as they are now, transition risks will remain low but physical risks will increase over time. As a result, the average global temperature will rise around 3 degrees by the end of this century, and it is possible that there will be a substantial increase in health hazards and areas where production and living are difficult. (Scenario A in the figure below.)

Regarding the effects of climate change on financial markets, for example, with Scenario A where physical risks are extremely high but transition risks are low, securities/real estate prices will drop for companies and vulnerable countries and regions as physical risks become more and more evident. However, this process is expected to be gradually reflected over several decades. In contrast, in Scenario B transition risks become evident once governments launch the comprehensive climate and energy policies needed to achieve the net zero emission by 2050 target. Reflecting market expectations over the steady implementation of radical climate change measures, securities/fixed asset value for industries and companies with high emissions will drop, and the securities price and asset value will rise for green related industries and companies.

Dramatic changes to financial markets can be avoided in Scenario B compared with Scenario C, as measures towards realizing net zero are smoothly taken by the world from now in Scenario B, while necessary policy measures are delayed for about 10 years from now so stricter measures are needed thereafter to achieve the net zero target in Scenario C.

The fact that current financial market prices do not adequately reflect physical and transition risks is not solely because there is great uncertainty on projections due to methodologies related to climate science and insufficient data. Another factor for mis-pricing is the fact that market participants can’t easily determine in which direction or scenario the predicted greenhouse gas emissions pathways in the world are heading. This is because, in addition to the presence of many countries that made announcements on net zero but haven’t come up with coherent strategies, many developing countries that desire higher economic growth and industrialization are hesitant to reduce emissions significantly.

Many institutional investors in Environmental, Social, and Corporate Governance (ESG) investing also tend to expect reasonable returns from their investments within a few years as it is necessary to secure a certain amount of yields on investments due to fiduciary responsibility, etc. even though it takes a long time for companies to materialize returns from investing in new, environmental-related technology. This is why there are many corporations that hesitate to invest massively in projects with high-risk environmental technologies and high-cost green capital spending.

To promote more ESG investment and transform corporate behavior in line with the net zero target, therefore, the world needs to take greater measures to develop green finance. The starting point is the greater leadership by each government to promote understanding among citizens of the need to take necessary bold actions (such as carbon pricing, emission controls, tighter energy efficiency requirements, and removal of subsidies towards fossil fuel activities) as well as the related costs (such as higher general prices and restructuring cost for a time). It is crucial to increase the price of carbon over time through energy tax reform and utilization of emission allowance trading systems.

With the strengthened aspiration and leadership, governments should start to clarify the definition and scope of green activities. While some governments use green bonds (environmental bonds) principles and ESG scores, their relationship to the contribution to the net zero goal is unclear. It would become easier for investors to predict environmental effects if government-certified clear green standards such as the European Union green taxonomy were established. Once the green definitions become clear, transition activities can then be more clearly and convincingly defined provided that the detailed timelines toward the net zero goal and clear paths toward decarbonization are drawn by governments.

Next, Japan and other countries should issue Green Sovereign Bonds, which can serve as benchmarks for green corporate bonds and green loans. There is high demand for such bonds compared with regular government bonds due to the growing number of ESG investors.

It is also crucially important for governments to gradually require corporations to disclose climate-related information based on the Task Force on Climate-related Financial Disclosures (TCFD), including greenhouse gas emission data and the establishment of medium- to long-term emission goals (such as the 2030 and 2050 targets).

Central banks should contribute to correct mis-pricing in financial markets as much as possible to complement climate change measures initiated by governments. Central banks generally respect the price stability mandate (i.e. 2% inflation target in the medium- and long-term). They also tend to stick to the market neutrality principle in order to uniformly spread the effects of monetary policies across the entire economy. However, if left as is, this might slow down governments’ and companies’ efforts to achieve the goal of net zero toward 2050.

First, central banks could start to encourage the greening of investment and loan portfolios held by financial institutions through conducting climate stress testing and requiring the disclosure of greenhouse gas information from financial institutions. This makes sense because climate change risks are likely to threaten financial stability and it is a central bank’s job to ensure financial stability. The Bank of England (BoE) is taking the lead in the world by implementing comprehensive climate stress testing currently for banks and insurance companies based on the three scenarios indicated in the aforementioned diagram. Many other central banks are following suit.

As for corporate bond purchases, the BoE, in collaboration with HM Treasury, abandoned the market neutrality principle and began to reflect the environmental standards for the purchasing or reinvesting in corporate bonds from November 2021. The UK government is also taking steps to introduce mandatory requirements in line with the TCFD recommendations for listed companies and financial institutions. The European Central Bank (ECB) began investigations into similar plans in July 2021 for introducing green criteria on corporate bond purchases and for promoting disclosure of information from financial institutions. The EU is also actively implementing comprehensive measures to promote sustainable finance. From the viewpoint of climate change, both BOE and ECB aim at transforming corporate behavior reflecting their concerns that a reduction in emissions may be delayed if the inefficient allocation of resources in financial markets continues.

The Bank of Japan (BoJ) will start low-interest loans with one year maturity (renewable) for investments and loans that promote decarbonization in December 2021, focusing on financing banks. This decision is commendable, but the effects on corporate actions are indirect and can be limited as the greening of banks’ portfolios requires time and Japan lacks the clear definitions of green and transition activities. What is required at least is a mechanism in cooperation with the Financial Services Agency to encourage banks to prioritize financing companies that set greenhouse gas emission reduction targets and disclose time series emission data in line with the TCFD recommendations. It is also better for the BOJ to extend the maturity toward 4 years to better match financial institutions’ maturities of assets and liabilities. This will be in line with the existing BOJ’s lending scheme called “Measures to Support Financial Institutions’ Efforts toward Strengthening the Foundations for Economic Growth,” which includes environmental and energy projects with maturity within four years. In the future, it will be beneficial if the government introduce clearly-defined environmental standards/definitions on activities so that labeling green corporate bonds and loans becomes more trustworthy for investors. The BOJ should also investigate measures to help directly transform the corporate behavior by switching Exchange Traded Funds (ETF) purchased from the current TOPIX-linked ETFs toward green ETFs. Once the green definition is set by the government, for example, green ETFs selecting stocks based on the percentage of green related sales can be easily developed by financial markets. Then the BOJ could help develop green ETF markets by purchasing such assets. While the BOJ stressed the market neutrality principle, the development of green finance markets is more pressing of a matter.

Meanwhile, China’s central bank, People’s Bank of China (PBOC), has just started providing cheap loans to commercial banks in November 2021 conditional on their lending to companies conducting green activities. The PBOC lends 60% of the funds provided by commercial banks at an interest rate of 1.75% while such banks provide funds to companies at the loan prime rate (the one-year and five-year rates of 3.85% and 4.65%, respectively). These banks are required to disclose information including carbon emission reduction data, which must be verified by a third-party professional institution and are subject to public supervision.

The world’s central banks currently prioritize their mandate of price stability and support governmental climate change measures within the scope of this mandate. In other words, central banks continue to use short-term interest rates (policy rates) as the banks’ major monetary policy tools to affect the entire economy while the environmental criteria is applied to other monetary policy tools such as corporate bond purchases or relatively long-term bank support.

If the probability for global greenhouse gas emissions pathways ends up like the one highlighted by Scenario A in the diagram, then it may cause stagflation in the future due to a decrease in production, an increase in general prices, and a deterioration in financial stability. If this occurs, it is possible that central banks may be forced to fundamentally reconsider the current framework around monetary policy, including changes to inflation targets and refinement of mandates.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on September 17, 2021 under the title, “Kikohendo to kinyu (II): Chugin, datsu-tanso ni sekkyoku kanyo wo (Climate Change and Finance: For Active Involvement in Decarbonization by Central Banks).” The Nikkei, September 17, 2021. Some new information obtained after the publication of the original article have been reflected in this article. (Courtesy of the author).

Keywords

- Shirai Sayuri

- Keio University

- climate change

- finance

- decarbonization

- central banks

- green finance

- green bonds

- Bank of Japan

- Financial Services Agency

- Bank of England

- European Central Bank

- Exchange Traded Funds (ETF)

- Environmental, Social, and Corporate Governance (ESG) investing

- Task Force on Climate-related Financial Disclosures (TCFD)