Climate change and finance: Advantages and disadvantages of mandatory disclosures by companies

Ito Kunio, Professor Emeritus, Hitotsubashi University

Key points

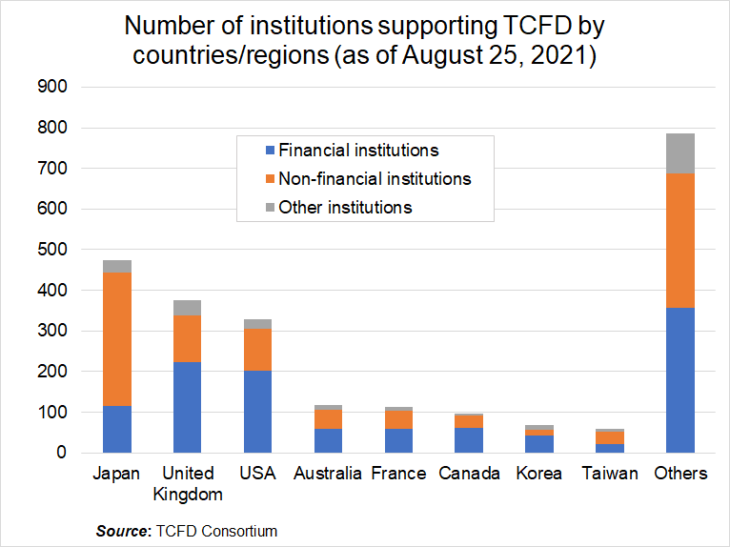

- Japanese companies rank highly worldwide for number of institutions supporting TCFD

- Mandatory financial disclosures should avoid disclosure of static information

- Need to promote corporate behavioral change through dialogue with investors

Prof. Ito Kunio

In response to worsening climate change, the Japanese government has set out its policy of becoming carbon neutral by 2050. I would like to put forward two effective approaches. The first is the disclosure by companies of just the right amount of information – not too much and not too little. The second is the proper evaluation of disclosed information by investment and loan institutions and the provision of ample funds for decarbonization activities and innovation.

The Task Force on Climate-related Financial Disclosures (TCFD) is a common framework for driving the world toward climate-related financial disclosures. The Task Force was established in 2015 by the Financial Stability Board (FSB), which is composed of financial authorities from various countries. The final report published in 2017 calls for disclosure in the four thematic areas of Governance, Strategy, Risk Management, and Metrics and Targets.

Japan leads the world in the number of institutions supporting TCFD, with 475 Japanese companies supporting the framework (as of August 25, 2021). Unlike the United Kingdom and the United States, where the majority of supporting institutions are financial institutions, in Japan the majority are non-financial institutions. The TCFD headquarters has commended “Japan’s success” and other countries have expressed a desire to collaborate.

Japan’s achievement may be attributed to the existence of the TCFD Consortium, a public-private partnership established in 2019 to discuss the country’s approach to financial disclosure. The TCFD Consortium has published TCFD Guidance and other material to promote the TCFD framework in Japan.

Currently, TCFD disclosure in Japan is voluntary in principle. However, in June 2021, the revised Japan’s Corporate Governance Code made it virtually mandatory for Prime Market listed companies, which have the strictest listing requirements. This is commendable evidence of solid progress.

Globally, the trend toward mandatory disclosures is accelerating, with the EU at the center. The US Securities and Exchange Commission (SEC) has also solicited opinions on climate-related financial disclosures. According to an analysis by the Value Reporting Foundation (VRF), established by the merger of the International Integrated Reporting Council (IIRC) and the US Sustainability Accounting Standards Board (SASB), 76% of respondents agree that disclosures should be mandatory. At the same time, many called for the inclusion of a disclaimer and consideration of industry characteristics.

This trend has generated discussions on mandatory disclosures in Japan. While it is essentially a welcome development, some points need to be kept in mind.

Mandatory disclosures under the TCFD framework extend beyond the prime market to listed companies as a whole. Disclosures in securities reports are expected to increase reliability of information. On the other hand, questions arise as to whether the information should be subject to audit (assurance); to what extent its reliability must be ensured; how to consider where responsibility lies in the event that its reliability is called into question; and whether a disclaimer should be provided.

The trend toward mandatory disclosures is inevitable the more important information becomes. However, mandatory disclosures also produce undesirable effects that must be heeded. If disclosures are mandatory, disclosed information may become static, or may be greatly reduced compared to disclosures made voluntarily. As a result, the disclosed information may diverge from the needs of investors and other stakeholders.

If disclosures are mandated, companies will need to have a sound understanding of the purpose and framework of the TCFD. Companies should also take a resourceful approach to financial disclosure using integrated reports in line with their priority issues. TCFD Guidance 2.0 released by the TCFD Consortium in 2020, based on a collection of best practices of companies, will be a useful guide. As the world leader in the number of institutions supporting TCFD, Japan must avoid a scenario where the requirement for mandatory disclosures results in disclosure of content that is inferior to that of other countries.

Regardless of whether financial disclosure is made mandatory or not, the key issues faced are twofold.

First, given the uncertainty of the impact of climate change over the medium to long term, the TCFD is calling for scenario analysis when formulating strategies. Scenario analysis is a tool to forecast possible future events due to climate change and to disclose the qualitative and financial impact of future climate change.

A disclosed scenario should not, however, be taken as a commitment by top management. Rather, it should be regarded as a product borne of the insights and perceptions of management that will assist investors and other stakeholders in properly evaluating the appropriateness of a process to arrive at a business model focused on future risks and opportunities. The background, reasons, prerequisites, envisaged timeframe, and verification method for selecting the scenario in question will be useful information for investors and other stakeholders.

Japanese companies have only just begun to conduct scenario analysis. Companies need to prepare to disclose not only the qualitative impact but also the financial impact of the “physical risks” of being unable to continue operations when natural disasters occur and the “transition risks” entailed by a tightening of environmental regulations.

The second issue is the Scope 3 problem. There are three ways to capture greenhouse gas (GHG) emissions: Scope 1, which are a company’s own emissions; Scope 2, which are emissions from the generation of purchased energy; and Scope 3, which are emissions that occur in the value chain of a company and its trading partners, including both upstream and downstream emissions.

While Scope 3 is not easy to assess, it is believed to account for 70–80% of total GHG. Scope 3 information is useful to understand the risks and opportunities of the company concerned. However, many technical issues still need to be resolved before Scope 3 disclosures can be mandated.

The second approach to solving the challenge of decarbonization is through discontinuous innovation that contributes to decarbonization. This will require both policy supports and the timely provision of an appropriate level of funding by private investment and loan institutions. Decarbonization projects such as renewable energy are indispensable to realize carbon neutrality. However, many companies in Japan belong to industries in which decarbonization is difficult at this stage.

It is also important for such companies and industries to conduct research and development into low carbonization and decarbonization, and engage in medium- to long-term initiatives in preparation for the transition (to decarbonization). This requires companies to accelerate the implementation of “transition finance,” entailing the mapping out of medium- and long-term goals and plans for the transition, which are then evaluated by investment and loan institutions and provided with the necessary funds if deemed adequate.

The withdrawal of investment for activities by non-green companies as classified in the EU taxonomy serves as a wake-up call regarding the need for urgent action. However, a more effective approach would be for investors and other stakeholders to persistently encourage behavioral change toward corporate decarbonization through engagement (constructive dialogue). This view led to the publication of the Basic Guidelines on Climate Transition Finance in May 2021, providing a framework for companies that disclose their transition plans to procure funds.

This initiative has just begun. The government has created roadmaps for each sector, implementing a system of interest subsidies linked to the certification of business models and results. In the future, it will be vital to promote sustainable engagement by investment and loan institutions with investment and loan recipients and to enhance the screening capabilities of third-party institutions to enable them to objectively evaluate eligibility.

It is hoped that Japan will not only be recognized for the number of institutions supporting TCFD, but also lead the world in the flow of funds to accelerate the transition to decarbonization.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on September 16, 2021 under the title, “Kikohendo to kinyu (I): Kigyo no kaiji kyosei, tokushitsu koryo wo (Climate change and finance (I): Advantages and disadvantages of mandatory disclosures by companies).” The Nikkei, September 16, 2021. (Courtesy of the author).

Keywords

- Ito Kunio

- Hitotsubashi University

- climate change

- finance

- mandatory disclosures

- companies

- non-financial institutions

- investment and loan institutions

- decarbonization

- Task Force on Climate-related Financial Disclosures

- TCFD

- TCFD Consortium

- transition to decarbonization

- transition finance

- transition risks

- Basic Guidelines on Climate Transition Finance

- innovation