A Wavering International Trading Order: Putting an End to “Global Optimal Procurement”

“Taking into account whether business partners are inside or outside the walls of economic security, the environment, and ethics, we will increasingly be forced to choose second best or third best options in terms of production cost.”

Kumagai Satoru, Director, Economic Geography Studies Group, Development Studies Center, Institute of Developing Economies, Japan External Trade Organization (JETRO)

Key points

- Without Chinese participation, the effectiveness of sanctions against Russia will be limited

- After the Cold War, supply chains expanded beyond the confines of East-West, North-South

- Questions raised about business partners’ aspects of economic security, environment, and ethics

Director Kumagai Satoru

Three months have passed since the Russian invasion of Ukraine began. While the North Atlantic Treaty Organization (NATO) camp has shown no signs of intervening militarily, Japan, the United States, and European countries have removed Russian banks from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and frozen the assets of Russian dignitaries. They have imposed economic sanctions, including export bans on certain commodities to Russia.

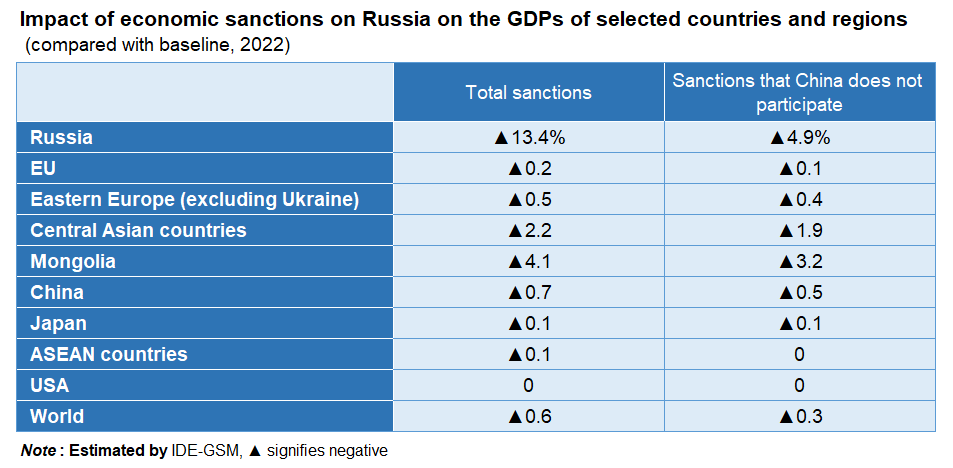

If economic sanctions against Russia are made more stringent, what will the impact be on Russia and the global economy? Also, how will the participation of China in economic sanctions affect their effectiveness? The impact on individual countries and regions was estimated using the Institute of Developing Economies-Geographical Simulation Model (IDE-GSM).

IDE-GSM is a Computable General Equilibrium (CGE) model based on spatial economics that assumes economies of scale at the corporate level. It has been used for economic impact analyses in international infrastructure development.

The mining sector, including oil and natural gas, was excluded from the assumed economic sanctions. As for Ukraine, it is assumed that 15% of industrial capital will be lost due to the war.

If all trade between Russia and the world is cut off for one year, it will have a negative impact of 0.6% on global GDP compared to the no-sanction baseline scenario (see table). The impact on Russia is minus 13.4%. Among major countries and regions, China accounts for 0.7%, the EU 0.2%, and Japan 0.1%, with no impact on the United States. It will have a significant impact on Central Asian countries and Mongolia, which are geographically close to and have deep economic ties with Russia.

Meanwhile, if China does not participate in the economic sanctions, the impact on Russia will be significantly smaller at minus 4.9%. In addition to making trade between China and Russia possible, this facilitates roundabout trade between Russia and third-party countries via China. This means that China’s participation is essential for economic sanctions to be effective. At present, the effectiveness of economic sanctions on Russia is likely to be limited.

The reason why the economic sanctions on Russia are having an unexpectedly small impact on major countries is that the size of Russia’s economy is relatively small and close to that of South Korea or Brazil, about 7% of the United States or about 10% of the EU and China in terms of GDP. It is also partly because the model does not assume a ban on imports of oil and natural gas from Russia, which is fraught with difficulties in reality as well.

On the other hand, the relatively large impact on the Chinese economy seems to be due to the strong economic relationship between China and Russia, as well as the blocking of cargo transportation via Russia.

As part of the “Belt and Road” initiative, China’s global infrastructure development strategy, China has advanced “the Trans-Eurasia Logistics,” or “China Railway Express (CRE),” which are freight railways connecting China and Europe. Several routes of the CRE reach Europe via the Trans-Siberian Railway in Russia. The volumes transported by the CRE are increasing year by year, and it is expected that they will exceed one-tenth of the volume by maritime transportation between China and Europe in 2020. Until recently, rail transport between China and Europe has been faster than maritime transport while fares have been relatively expensive, but the historic surge in ocean container freight costs since 2021 has increased the superiority of rail transport.

Since Russia is located between Asia and Europe, occupying a large territory, “excluding Russia” has also a major impact on air transport. Although the above estimate does not take this into account, many airline routes between Europe and Asia cannot fly over Russian airspace, so they are forced to use alternative routes.

Since the end of the Cold War between the United States and the Soviet Union in the 1990s, the world economy has been progressing toward globalization. With the development of container logistics systems utilizing information and communication technology, corporate supply chains have expanded beyond the confines of east-west and north-south, thus allowing for the establishment of a “global optimal procurement” system by which parts and components produced in countries that are most suitable in terms of production cost are traded through global logistics networks and assembled into final products.

The 2011 Great East Japan Earthquake and the Thailand floods exposed the vulnerability of these complex and lean production systems, but the disruption of supply chains was temporary. With some buffer and backups in place, it seemed that global optimal procurement could be sustained.

In the future, in accordance with technological trends of lowering communication costs, value chains including the service sector will be further fragmented so that outsourcing progresses further beyond geographical distance. Further globalization of corporate activities will become technologically possible.

Meanwhile, the US-China trade war from 2018 and the COVID-19 pandemic from 2020 are overlapping with Russia’s invasion of Ukraine, raising concerns that globalization might be heading toward a reversal in the real world.

The world may now once again be divided by various confines or “walls.” In terms of economic security, as seen in the exclusion of Huawei of China in the United States, it has become necessary for countries and companies to clarify whether they belong to the US camp or the Chinese camp. On the environmental front, it is necessary to scrutinize whether business partners are aiming for zero emission of CO2 and whether they are polluting the environment. On the human rights front, it needs to be investigated whether there is an abuse of foreign workers or child labor.

When advanced countries are intended end markets, it is increasingly impossible to add partner countries and companies to the supply chains unless many barriers are cleared.

At the same time, there are many countries in the world, especially developing countries, that do not consider or cannot afford to consider the environmental and ethical standards set by advanced countries. For example, with regard to palm oil, sometimes seen as a driver of deforestation, sustainability certification is becoming a prerequisite for procurement in Europe. But many businesses and consumers in India and China show little interest in these standards.

Russia’s invasion of Ukraine is shocking in that it introduces the unexpected risk of a new “East-West divide.” The worst-case scenario for the Japanese economy would be a further deterioration in relations between the West and Russia, with growing pressure to require China and the Association of Southeast Asian Nations (ASEAN) to impose economic sanctions on Russia.

There are many countries around the world that count on Russia in terms of diplomacy and security, or that want to maintain neutrality. If China and ASEAN countries were to be sanctioned by the United States and Europe for their reluctance to sanction Russia, this would be a major blow to the Japanese economy, which is closely linked to these countries through supply chains.

The Ukraine crisis seems to signal the end of the era of global optimal procurement, which has hitherto centered on production costs. Taking into account whether business partners are inside or outside the walls of economic security, the environment, and ethics, we will increasingly be forced to choose second best or third best options in terms of production cost.

Moreover, it is necessary to consider the risk that countries and companies that were thought to be inside the walls will suddenly move outside one day. Corporate managers are faced with difficult decisions about whether to keep supply chains cleanly inside the walls only and aim for enough profitable high-value-added products, or whether to choose to continue procurement from and sales to the partners outside the wall to survive.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 3 June 2022 under the title, “Yuragu Kokusaiboeki chitsujo (I): ‘Sekai saiteki-chotatsu’ ni shushifu (A Wavering International Trading Order (I): Putting an End to ‘Global Optimal Procurement’).” The Nikkei, 3 June 2022. (Courtesy of the author)

Keywords

- Kumagai Satoru

- Economic Geography Studies Group

- Institute of Developing Economies

- Japan External Trade Organization (JETRO)

- Russia

- economic sanctions

- impact

- Ukraine

- China

- Cold War

- economic security

- environment

- ethics

- Institute of Developing Economies-Geographical Simulation Model

- IDE-GSM

- global GDP

- globalization

- “East-West divide”

- “walls”

- global optimal procurement