The Weak Yen and Japanese Firms: Positive Effects with a Time Lag

“If a weak yen causes domestic consumers to purchase cars made in Japan instead of foreign cars, in addition to a rise in net exports, domestic production will also increase as foreign cars are replaced with cars made in Japan. In short, domestic production of all tradable goods (and services) will increase beyond the scope of foreign demand.”

Photo: yamahide/PIXTA

Honda Yuzo, Professor, Osaka Gakuin University

Key points

- Japanese products easy to sell despite deteriorating terms of trade

- Positive impact of weak yen on GDP and income balance

- Capitalize on the opportunity to put the Japanese economy on a growth trajectory

Prof. Honda Yuzo

When examining the merits and demerits of the rapidly depreciating yen, we should note that other factors than the exchange rate are sneaking into the discussion. It is wrong to blame the current Japanese inflation solely for the weaker yen. Prices in Japan are rising as a result of the soaring prices of global resources and foods at the same time as the yen is depreciating.

According to some commentators, the weak yen causes only losses due to the deteriorating terms of trade (the prices of exports divided by the prices of imports) and that no tangible benefits are in sight. However, the deteriorating terms of trade caused by the weak yen also suggest that products made in Japan are easier to sell and relatively inexpensive compared to foreign products in all global markets, including the domestic market. This is good for the Japanese economy where there is an ongoing lack of demand.

Since there is a time lag between the weak yen and its impact on Japan’s real economy, careful analysis is necessary. It is particularly easy to draw erroneous conclusions when analyzing input-output tables or the flow of capital with economic data for a year or two. This article will improve understanding of the current yen depreciation by focusing the discussion on the issue of the time lag between the exchange rate and its impact on the real economy.

◇ ◇

When domestic producers (or domestic exporters) operating in intensely competitive environments lower their dollar-denominated prices as a result of the weak yen, the dollar-denominated income will initially decrease if there is no change in sales volume. However, over time, the volume of sales will grow due to lower local pricing, and eventually the sales amount, which is price multiplied by volume, will increase in both dollar and yen terms.

On the other hand, since yen-denominated prices of imports increase without delay when the yen weakens, payments for imported goods rise immediately. Consequently, in macro-economic terms, the trade balance deteriorates immediately after the yen depreciates, but the situation eventually turns around, and the trade balance improves in the end. This change in the trade balance over time is known as the J-curve effect. However, for the J-curve effect to work, the volume of traded goods must be sufficiently elastic with regards to price changes.

For example, when we look at the real effective exchange rate and the ratio of net exports (exports minus imports) to real gross domestic product (GDP) for the United States from 1980 to 1990, we see that the ratio of net exports changes approximately two years after the change in the exchange rate.

According to Macroeconomics by Olivier Jean Blanchard, former Chief Economist at the International Monetary Fund (IMF), in principle, the depreciation of a nation’s currency ultimately leads to an improved trade balance in the case of the member nations of the Organisation for Economic Co-operation and Development (OECD). Blanchard also indicates that the time lag between the exchange rate and the improved trade balance is anywhere from six months to one year.

The effect of a weak yen on the real economy extends not only to the trade balance and the current account balance, but also to domestic production. If you discuss the effects of the weak yen, using only the categories of foreign demand and domestic demand, you are already downplaying the positive effects of the weak yen.

For example, if imported wheat is replaced with wheat produced in Japan because the price of imports has increased due to a weak yen, there will be two-fold effects on GDP. Firstly, net exports will increase due to a decrease in imported goods, and, secondly, domestic production will increase.

Similarly, if a weak yen causes domestic consumers to purchase cars made in Japan instead of foreign cars, in addition to a rise in net exports, domestic production will also increase as foreign cars are replaced with cars made in Japan. In short, domestic production of all tradable goods (and services) will increase beyond the scope of foreign demand.

In addition to the effect on GDP, a weak yen also boosts the primary income balance, such as dividends from overseas subsidiaries, through increased profits at local subsidiaries. This is not directly reflected in the GDP, but the effect will be to increase domestic income and to boost domestic purchasing power.

◇ ◇

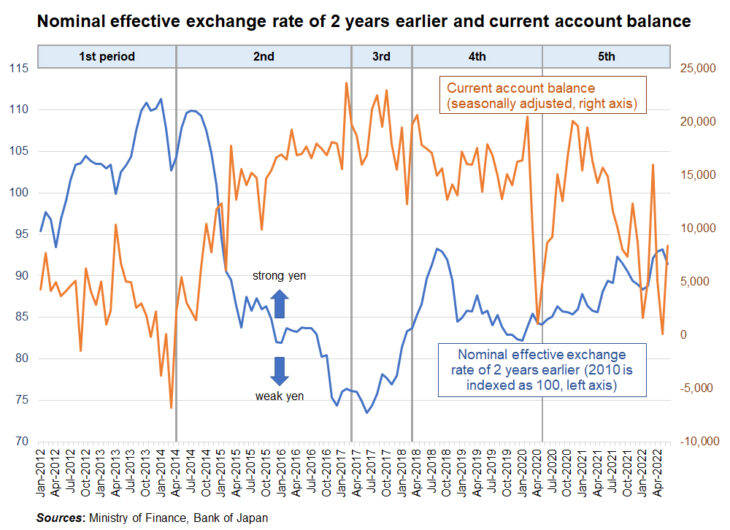

Let’s take the case of Japan to observe how fluctuations in the trade balance and current account balance lag behind changes in the exchange rate. The figure below shows the relationship between Japan’s current account balance for the period from January 2012 to June 2022, and the corresponding nominal effective exchange rate of two years earlier. I have used the two years earlier data for exchange rates in light of the J-curve effect, and also the current account balance instead of the trade balance to take into account the significance of the primary income balance in the case of Japan.

In general, inferences based on such graphs alone lack rigor as they ignore the impact of other variables. However, it is still a useful tool as a first approximation for our case because the impact of extremely large fluctuations in the exchange rate should appear in the current account balance.

I have also divided the ten-year period into five periods based on fluctuations in the current account balance and other factors. The current account balance for the first period (January 2012–March 2014) shows the lagged effects on the real economy of the extremely strong yen prior to Abenomics. The current account surplus was small and the Japanese economy was extremely sluggish.

In the second period (April 2014–February 2017), the unprecedented monetary easing introduced by the Bank of Japan in 2013 depreciated the yen exchange rate significantly and led to a large increase in the current account surplus and recovery for the Japanese economy.

In the third period (March 2017–October 2018), the effect of the yen’s appreciation from the end of 2015 to the fall of 2016, mainly due to overseas factors, is reflected as a decrease in the current account surplus.

The fourth period (November 2018–April 2020) covers the pre-pandemic period. It is the period just before COVID-19 had a devastating impact on the current account balance. The exchange rate of two years earlier had been relatively stable and the current account surplus stabilized at around 1.5 trillion yen.

There is clearly a negative correlation between the current account balance and the corresponding exchange rate of two years earlier at least up until to the third period. This suggests a time lag of about two years before the weak yen leads to improvements in the current account surplus.

The current account balance in the fifth period (May 2020–June 2022) includes the effects not only due to the weak yen, but also other factors at play such as (1) stagnation in global economic activity due to the widespread COVID-19 pandemic, and (2) soaring prices for resources and foodstuffs as a result of the Russian invasion of Ukraine.

These two variables are basically exogenous headwinds to the Japanese economy, and the current account balance is deteriorating. The ongoing yen depreciation will eventually improve the current account balance in the future, but it also has been worsening the current account balance until today because of the time lag.

As of 2022, monetary tightening by the Federal Reserve Board (FRB) has accelerated the depreciation of the yen. The full impact of a weak yen on the Japanese real economy is still in the future. In light of past experience, a weak yen is likely to improve the current account balance and domestic production due to the J-curve effect.

The price level in Japan is also rising as a result of disruptions to the global supply chains, soaring resource prices, and rising costs of imported goods due to the weak yen. However, when food and energy are excluded, the consumer price index only rose by 0.4% in July compared to the same month in the previous year. Since this suggests that there is still a lack of demand, a more thorough implementation of monetary easing policies is advisable for the time being.

Due to the zero lower bound for the Japanese economy, the real interest rate for the Japanese economy is at a higher level than it should be. A weaker yen is an effective means of monetary easing policy to circumvent the zero lower bound. A weaker yen improves demand shortfalls in lieu of interest rates. Given the limited tools currently available to Japan’s policymakers, the depreciation of the yen due to monetary tightening in the United States is also providing us with an excellent opportunity to put the Japanese economy on a growth trajectory.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 13 September 2022 under the title, “En yasu to Nihon kigyo (III): Jikansa tomonai purasu koka kakudai (The Weak Yen and Japanese Firms (III): Positive Effects with a Time Lag).” The Nikkei, 13 September 2022. (Courtesy of the author)

Keywords

- Honda Yuzo

- Osaka Gakuin University

- depreciating yen

- weak yen

- exchange rate

- soaring prices

- GDP

- income balance

- growth trajectory

- time lag

- real economy

- domestic production

- domestic consumers

- foreign demand

- trade balance

- current account balance

- zero lower bound