The Global Bank Rules that Sent Financial Systems Into Turmoil. — Macroprudential Tools are Malfunctioning. Not the Time for Tighter Rules

UBS announced in March 2023 that it would buy Credit Suisse for $3.25 billion to bail it out after Swiss authorities intervened. In June of the same year, UBS’s acquisition of Credit Suisse was completed.

Photo: Leonid Andronov / PIXTA

The Global Financial Crisis (GFC) of 2008 triggered calls for reforms that would strengthen financial regulations globally. But amid the stresses of financial disruptions in Europe and the United States, caused by the spread of COVID-19 in the spring of 2020 and the instability of banking systems in early 2023, regulatory reforms did not perform as initially intended; instead they have exposed flaws and even contributed to market fragility. This paper summarizes the malfunctioning of new regulations seen in the context of the pandemic and bank failures, and explores the root causes of the failures and a direction for improvement. Also, it provides an overview of the implications for Japan and how overseas authorities are rethinking their approaches.

Miyauchi Atsushi, Professor, SBI Graduate School of Business

Macroprudential Regulations Introduced in the Wake of the Global Financial Crisis

Various challenges for post-GFC regulatory reforms have been identified, such as procyclicality (the effect of amplifying cyclical fluctuations), negative externality at major financial institutions and the “too-big-to-fail” problem. In order to address these problems, so-called macroprudential regulations were phased in around the mid-2010s.

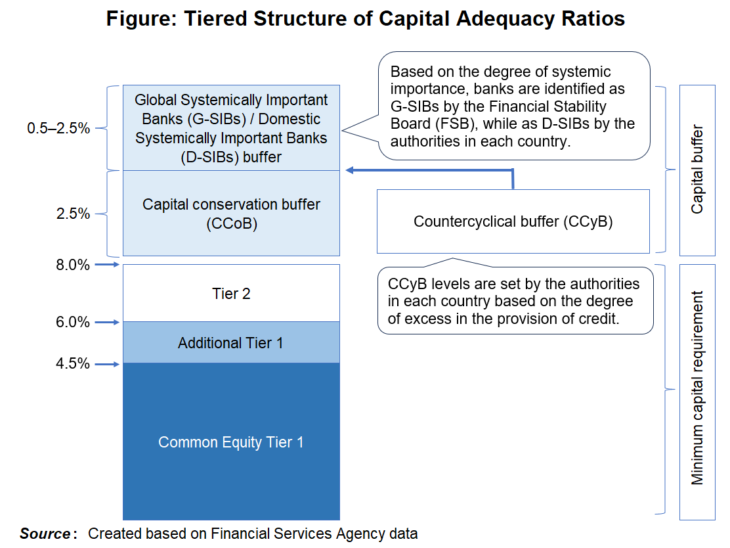

There were three main focuses of these regulations. The first focus was to address procyclicality through introduction of the capital conservation buffer (CCoB), the countercyclical capital buffer (CCyB), leverage ratio regulation and the liquidity coverage ratio (LCR). The CCoB, CCyB and LCR are designed to play a role in maintaining the functions of banks in times of stress by drawing on capital and liquidity buffers.[1] On the other hand, leverage ratio regulation and CCyBs are designed to discourage excessive growth in lending during boom times (see figure).

The second focus was to identify global systemically important banks (G-SIBs) and require them to hold higher capital buffers. This action was taken to address the alleged negative externality of G-SIBs. Once a G-SIB fails, it impacts the financial system widely owing to its externality and could cause a financial crisis, as happened during the GFC. This measure was designed to internalize negative externalities with the additional capital requiremant.

The third focus was to address the moral hazard caused by the famous “too-big-to-fail” problem of major banks. The new capital structure was intended to avoid having to bail out major bank failures with public funding.

The Malfunctioning of Regulations During the COVID-19 Pandemic

The market turmoil caused by the COVID-19 outbreak in 2020 and the more recent failures of banks were ideal field tests to gauge how well these macroprudential regulations function. The results showed that despite holding higher buffers of capital and liquidity, the regulations not only failed to produce the expected results, but even spurred the market turmoil. The failure to ensure stability through regulations led to intervention by the authorities, further contributing to moral hazard.

Let’s look back on how regulation performed during the COVID-19 pandemic. When infections were spreading in March 2020, demand for cash in European and US financial markets exploded. As a result, even US Treasury bonds came under selling pressure, market liquidity declined across the board and arbitrage among the markets collapsed.

The depletion of market liquidity was partially due to banks being unable to provide sufficient funds when faced with the “dash for cash” associated with MMF cancellations, bond sales, margin calls and the termination of arbitrage transactions. Behind this was a market structure where the liquidity supply capacity of banks could not keep pace with the expansion of the Non-Bank Financial Intermediation (NBFI) including funds, bond markets and derivatives trading.

Since the GFC, there has been a growing imbalance between the size of key markets and the business activities of major banks. This is in part due to financial intermediation increasingly taking place through NBFIs instead of banks as a result of stricter regulation of banks. Moreover, since major banks, mindful of regulations on G-SIBs, have curtailed the expansion of business operations, liquidity supply capacity to the NBFI sector has declined. On top of that, since institutions have become averse to holding low-risk, low-return assets due to the leverage ratio regulation, the government bond market makers have reduced their inventories. As a result, liquidity in the government bond market was also impaired.

Procyclicality measures also didn’t work. During the COVID-19 pandemic, authorities in various countries encouraged banks to utilize the buffers they had built up with the CCoB and the LCR, but banks were hesitant about using those buffers to make loans or supply liquidity if it meant falling short of regulatory ratios. There were various reasons for this, for instance concerns that a loss in confidence would lead to an outflow of funds and higher fund procurement costs, worries over additional supervisory measures, uncertainty over future economic down trends, and the lack of clarity about when authorities may require banks to restore those regulatory ratios.

Emeritus Professor Charles Goodhart of the London School of Economics is always skeptical of these kinds of regulations, likening them to his famous Taxi Parable, whereby an ordinance requiring that at least one taxi always be waiting in front of a train station would prevent a taxi from departing when only one remained lest the ordinance be violated (a rule established for the benefit of the customers which ultimately does not benefit them). True to this warning, the CCoBs and the LCRs have turned out to be useless. Financial institutions ended up holding on to white elephants.

The few countries that had adopted the CCyBs removed them during the COVID-19 pandemic. However, according to an experimental study, the removal of the CCyBs had only a limited effect in boosting lending. Since financial institutions responded by contracting their head room (the capital held in excess of the level required by regulations) by an amount equivalent to the CCyBs, the countercyclicality expected from the CCyBs was offset. Financial institutions have incorporated scenarios of the authorities lifting the CCyBs in times of stress into their capital strategies and lending practices. If such a scenario has already been incorporated into their strategies, the lending behavior would not change as intended when the CCyBs are lifted. The CCyBs did not work because regulators failed to take into account that banks would act in the expectation of the CCyB policy reactions by the authorities against possible shocks. Arguably, regulatory authorities in many countries, including Japan and the United States, are clever not to adopt CCyBs.

Shortcomings of Regulatory Reform Exposed by Bank Failures

In the spring of 2023, the US financial system was destabilized with the collapse of Silicon Valley Bank (SVB) and other US banks, along with Credit Suisse being forced into a rescue merger. This series of disruptions also revealed the shortcomings of the post-GFC regulatory reforms, as explained below.

First of all, the capital adequacy ratios of those failed banks were all far above regulatory levels. But they couldn’t stop the collapse of confidence. These were examples that shook the idea behind regulatory reforms, namely that “adequate equity capital creates a robust financial system.” The main reasons for the collapse of confidence were lax management of interest rate and liquidity risks by financial institutions, and ineffective bank supervision by the authorities being behind the curve. These shocks to the system made it clear that the stability of the financial system cannot be achieved through regulation alone, and that the balance between regulation and supervision is crucial.

Regulatory reforms sought to deal with failed financial institutions in a way that would not use public funds (so-called “bail-in”), but Swiss authorities ended up providing huge guarantees to cover additional losses to UBS. Also, in the US, large losses were guaranteed by the Federal Deposit Insurance Corporation (FDIC). From the viewpoint of moral hazard, these schemes are no different from public funds. In the end, the bail-in approach has not succeeded, and has failed to deter any moral hazard.

The effectiveness of the LCR is also questionable. The LCR assumes an outflow of 40% of uninsured deposits over a one-month period, but in the case of SVB, there was a single-day outflow of roughly 25% of deposits the day prior to its collapse. It is clear that the LCR is wholly unequipped to handle a “digital bank run.” The LCR has also drawn criticism for treating government bonds classified as held-to-maturity as liquid assets.[2]

It also bears noting that at SVB, unrealized losses on available-for-sale (AFS) securities were not deducted from the capital ratio. While this rule differs from international standards, it was domestically applied to mid- and low-tier banks in the US, and the same rule is employed in Japan for domestic banks. This explains why banks and regulatory authorities were on the back foot in responding to huge unrealized losses. The approach of “pretending not to see” unrealized losses appears to temporarily weaken procyclicality on the surface, while actually strengthening it. That’s because it encourages lax interest rate risk management and slows down any response.

Against this backdrop, US regulatory authorities have indicated that they will review domestic rules regarding liquidity risk, deposit insurance, AFS and so on. And since Japan handles AFS in the same way, this will probably trigger discussion about revisiting Japan’s domestic standards as well.

Why New Regulations Became Dysfunctional

To consider the regulatory dysfunctions described up to this point, we must trace them back to their original causes. Let’s consider four main points.

The first point is that the levels of required capital were too high. There is no room for doubt that this, in turn, destabilized the financial system. The BCBS has asserted that an increase in required capital more likely has the effect of improving long-term growth rates because the positive effect of avoiding crises more than outweighs the negative effect of curbing bank lending. However, this analysis overlooks the route by which an increase in required capital destabilizes the financial system.

As a result of the increase in required capital, the balance between NBFIs and banks was disrupted, making it easier for market liquidity to be depleted. Major banks have positive externality by providing market liquidity. But the G-SIB regulation focuses on the internalization of negative externalities. Ironically, it suppressed their positive externalities and made the market vulnerable. Since return on equity (ROE) worsened due to the increase in capital, some banks withdrew from capital-intensive market operations, causing greater oligopolization and concentration, and in turn lowering market functionality while concentrating risks.

Even though capital increased, it was difficult to mitigate moral hazard with a bail-in approach. Bankruptcy proceedings that denied the use of public funds were not well understood by the market participants, and it took time to stabilize the situation. As a result, a bail-in approach widened losses to be covered by public money. While an excessive reliance on the availability of public funds can lead to lax bank management, it also carries benefits, such as reducing regulatory capital and streamlining proceedings. We should not rule out bail-outs by public funds, and had better seek out ways to handle the use of them in a disciplined manner.

We can only work out the optimal level of capital charges empirically. Considering the side effects inherent to a heavy imposition of capital charges, revisions that move towards lightening them are appropriate.

Second, how financial institutions would react to regulation was not taken into account in the regulatory reforms. Financial institutions seek profitability for risk capital. Therefore, if you make regulations that do not reflect risk, you create incentives for regulatory arbitrage that encourage (or discourage) operations that are profitable (or unprofitable) for the regulatory capital. For example, since leverage ratio regulation imposes capital requirements without taking risk into account, it produces an incentive to avoid holding low-risk, low-return instruments such as government bonds. As a result, the market-making function was damaged. Note that in the past, regulations on securitized products did not properly reflect risks, leading to a concentration of risks that caused the GFC. We should reflect on this lesson and aim to develop highly rational regulations that reflect risks as much as possible.

In addition, the dysfunction of buffers such as the CCoB, CCyB and LCR is also due to a lack of insight into how financial institutions behave. Financial institutions engage in complex optimization that factors in future regulatory actions and how the market would respond. Even if regulatory authorities try to impose their optimal shape, things would not work out as expected. The design of buffer systems needs to be fundamentally revised.

The third point is that the regulatory reforms focused only on stability of the banking sector, lacking a macro-level perspective that considered the financial system as a whole, including the NBFIs. As a result, risks shifted over to the NBFI sector, creating a decline in market function. The aim of prudential policy is not to avoid the failure of individual financial institutions but to stabilize the overall financial system. This has been a consistent approach since the Basel regulations of the 1990s. But the macroprudential regulations lacked both systemic insight into micro incentives and a macro perspective of the system as a whole. Their focus was only at the semi-macro level on the banking sector in the backyard of the regulatory authorities.

Fourth, since the regulatory reforms placed an overemphasis on regulation, the balance between regulation and supervision was lost. Regulation and supervision each carry advantages and disadvantages. The best balance would be to make each function efficiently in ways that complement one another. But in the wake of the GFC, the international rule makers, as well as politicians, distrusted the risk management by banks and the supervision by the authorities. As a result, supervisory dialogue was disregarded, and too much emphasis was placed on regulation.

An overreliance on regulation results in uniformity and inflexibility that lacks the ability to adapt to technological changes or regulatory arbitrage. The current regulations cannot address new business models like those employed by SVB, or digital bank run implementations triggered by social media. The authorities should have taken advantage of the flexible and dynamic dialogue that supervision empowers. Particularly when it comes to new forms of business, if the risks are not adequately reflected in both regulatory capital and risk management frameworks, those businesses tend to expand because banks regard those products as profitable in relation to the risks they entail. This is an area in need of a dynamic risk management structure through dialogue driven by supervision.

Risks that quantitative assessment cannot cover are also hard to handle through regulation. The interest rate risk and liquidity risk that proved problematic for SVB are typical examples. It is hard for regulations to address interest rate risk owing to core deposits. As liquidity risk materializes in many forms, it should not be handled with regulations such as the LCR, only designed based on the assumption of Lehmann-type outflows of funds. This is another area suited to multi-faceted assessments through supervisory dialogue with banks.

A review of supervisory functions needs to be pursued with corrections to the overemphasis on regulation. For example, recent proposals by the Fed to strengthen supervision, which seeks to impose additional capital requirements on banks that do not take corrective action on supervisory findings, would be reasonable if implemented together with a relaxing of the base capital requirements. When we strengthen supervision, we should not forget supervision is less predictable than regulation, and there are risks related to the abuse of the authority. To prevent impeding the financial intermediation function, it is important to thoroughly ensure transparency in supervisory policies and stop abuse.

Risks Also Need to be Reviewed in Japan

While Japanese financial markets have lost energy due to ultra-easy monetary policy, we haven’t seen the turmoil such as in European and US markets. In the future, however, a similar stress on the financial system may develop in the exit process from the unprecedented monetary easing.

Although there are stabilizing factors in Japan, such as a relatively small market share of the NBFIs and few uninsured deposits, we can find some problematic factors such as the reduced liquidity of the bond market, declining profitability of regional financial institutions and rise in the number of zombie companies. Whether the process of exiting from monetary easing could spark a systemic risk needs to be considered from multiple angles. In light of the lessons learned from Europe and the US, it will be important to trace back the incentives provided to financial institutions from new regulations and new business models. Especially, we have to examine whether those incentives have created an uneven distribution of risks in the financial system. Despite maintaining high capital ratios, the financial systems in Europe and the US was thrown into turmoil once confidence was lost. The various buffers in place were of no use, and if we make the simplistic conclusion that “the financial system is sound because the results of stress tests meet regulatory standards,” we could overlook the seeds of an emerging crisis.

Regulators need to gather facts about the decision-making processes in financial intermediation, and take great care in verifying the systemic implications. They must develop a sense for gaining macro systemic implications from micro factors such as incentive distortions caused by the regulatory reforms and the ultra-easy monetary policy.

International Discussion to Address the Adverse Affects of Regulations Is Necessary

In the wake of financial shocks in Europe and the US, there have been voices calling for even stronger international regulations. But authorities in major economies have been united in asserting that “rather than stronger regulation, we need thorough supervision and implementation of the latest international regulatory package.” No steps were taken to strengthen international regulations at the G7 meeting in May, either. The FRB has gone no further than showing its strict application of the Basel III framework for large- and mid-sized banks. The calm response of authorities in various countries is commendable, as the hasty strengthening of international regulations would only make a bad situation worse.

Authorities in Europe and the US have frankly acknowledge the adverse effects of leverage ratio regulation, the dysfunction of various buffers, and issues with the LCR. Once the “end game” settles on a series of regulatory reforms, the international review process may start. However, in Europe there are some moves aimed at tightening regulations, emphasizing the utility of CCyBs, so we must remain cautious.

Japanese authorities have sounded alarm bells regarding excessive regulatory reform since the 2010s. Some progress has been made, such as the introduction of frameworks to curb the development of new regulations, but it is not easy to revise the excessive part of existing regulations. The authorities in most foreign countries have addressed the shift of financial intermediation from banks to nonbanks through stronger regulations of the NBFIs. But it is very difficult to make effective regulations for NBFI issues. Some regulations could be a source of instability in financial systems. Going forward, there will hopefully be international discussions that focus squarely on the adverse effects of post-GFC regulations.

(All views expressed in this paper are the personal views of the author.)

Translated from Oubei Kinyu-sisutemu no konranga shimeshita Kokusai-kinyu kisei no mondaitein: Makuroprudensu wa kinofuzen, kiseikyoka yori kaizen ni muketa tenkenwo, Shukan Kinyu Zaisei Jijo, May 30, 2023, pp. 12–16 (Courtesy of KINZAI Institute for Financial Affairs, Inc.) [August 2023]

Keywords

- Miyauchi Atsushi

- SBI Graduate School of Business

- Bank of Japan

- macroprudential regulation

- financial regulations

- regulatory reforms

- dysfunction

- COVID-19

- bank failures

- global financial crisis

- capital conservation buffer (CCoB)

- countercyclical capital buffer (CCyB)

- leverage ratio regulation

- liquidity coverage ratio (LCR)

- capital adequacy ratios

- procyclicality

- Basel Committee on Banking Supervision

- risk management

- monetary easing