AN APPEAL FOR DUPLEX POWER TRANSMISSION AND DISTRIBUTION NETWORKS FOR STEADY SUPPLY OF ELECTRIC POWER

The recovery operations of the crippled The Fukushima Dai-ichi nuclear power plant of the Tokyo Electric Power Company, Inc. (TEPCO) are proceeding with difficulty. Meanwhile, debates over TEPCO’s future emerged together with those on reconsideration of nuclear power plants. Without question, it is necessary to seriously examine if nuclear energy is really suitable as the energy that fuels our lifestyles and our economy.

However, the deliberations on power supply must distinguish between power sources, what is used to generate power, and the systems for delivering power to users. Following this unprecedented accident, the author will push further ahead with the emerging argument on separation between power generation and power transmission to propose constructing duplex power transmission and distribution networks that are radically different from conventional power systems in Japan.

A structural flaw in the power transmission and distribution networks

There is still no prospect of a recovery at the Fukushima nuclear plants one and a half months after the accident outbreak on March 11. After the The Fukushima Dai-ichi nuclear power plant and Dai-ni plants were disabled, TEPCO lost 14% of its power generation capacity. This situation will continue into the foreseeable future. This summer, a serious power shortage is inevitable in the zone served by TEPCO. Across the country, public sentiment is in favor of denuclearizing Japan.

The issue of power sources or of what to do with nuclear plants will be inevitably be debated. The first point to scrutinize here is a structural flaw in Japan’s power transmission and distribution system that has been revealed by this crisis. The power shortage is directly attributable to the nuclear plant accident, but there is in fact another cause. It is the fact that there is only one power firm that supplies power to the Kanto region and that there is no alternative company. Should the power supply sector have another player, as in the banking, mobile phone, and railway sectors, it should have been possible to switch suppliers.

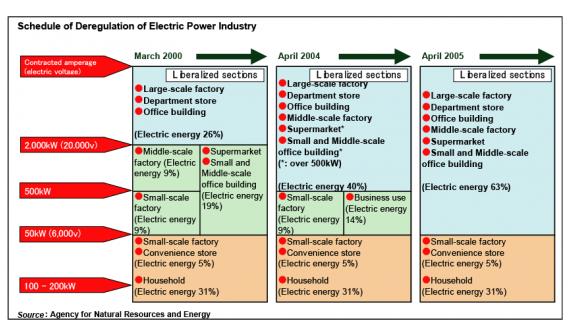

TEPCO is not the only utility with a regional monopoly. All ten electric power companies in Japan have a monopoly over their respective regions. The biggest justification for this structure is the long-term stable supply of electric power. Institutionally, the electric power market has been gradually deregulated (see figure) to authorize independent power producers (IPPs) and power producers and suppliers (PPSs). IPPs own their private power plants, and can sell power to conventional electric power companies, whereas PPSs sell their power retail to major businesses and other customers. However, the power transmission and distribution networks, central to the power supply networks, remain under regional monopolies and are controlled by the original utilities. This regional monopoly structure is a key reason why the damage from this nuclear accident has been so great and prolonged. Conventional government authority over electric power is premised on monopoly control over the transmission and distribution networks and is now totally impaired, as detailed below.

One specific example is the concern about degradation of the green level at the Shin-Marunouchi Building near Tokyo Station. In compliance with the anti-warming regulations introduced by the Tokyo Metropolitan Government in 2010, Mitsubishi Estate Co., Ltd., owner of the building, purchases what is called raw green power generated using a wind power generator at Rokkasho-mura in Aomori Prefecture via Idemitsu Kosan Co., Ltd., a PPS. The deregulation of the electric power market has made it possible for a business based in Tokyo to purchase electric power generated in Aomori with the use of a wheeling service. Since wind power generation is regarded as generating zero carbon dioxide (CO2) emissions, the Shin-Marunouchi Building has reduced its total CO2 emissions to nearly one third the usual level.

Japan’s Agency for Natural Resources and Energy has approved the wheeling service and adopted an imbalance charge system for this service. Aimed at supporting both deregulation of the electric power business and the monopoly of the existing power companies on transmission and distribution networks, the wheeling service permits PPSs to use the networks owned by traditional power companies for the purpose of supplying the power they independently produced to their power subscribers. If the amount of electricity received by a PPS subscriber exceeds the amount supplied by the PPS through the wheeling service (beyond the standard fluctuation range), the difference is deemed as have been supplied by the existing power company. In this event, the PPS has a penalty-like liability to pay a charge for any imbalance.

However, although the wind power generator at Rokkasho-mura has recovered from the earthquake, TEPCO’s transmission and distribution capacity remains damaged. That hampers the PPS from delivering its power to the Shin-Marunouchi Building, even though it has the available supply. Diamond Power Corporation, which is the leading PPS affiliated with Mitsubishi Corporation, announces on its website that it is unable to supply its power to customers in regions where TEPCO is conducting rolling blackouts.

In fact, the current system defines no imbalance charges that would apply when wheeling is not performed due to problems attributable to the conventional power companies. The accident at the nuclear plant has revealed that the existing wheeling service system itself is out of balance.

The cost of power transmission and distribution networks

The argument from the utilities is that the power transmission and distribution networks, or power transmission in particular, should be exempt from deregulation. They claim that power transmission and distribution equipment entails huge capital investment and that the investment would be excessive if there was more than one player in the market. It is true that investment in power transmission facilities is enormous. Take TEPCO, for example. For the fiscal year ended March 2010, its power transmission systems had a book value of 2,170 billion yen, its power distribution systems 2,230 billion yen, and power transformation systems 860 billion yen. The total value stood at 5,260 billion yen. In contrast, nuclear, hydraulic and thermal power generation facilities had a total value of 2,400 billion yen. It is certain that the capacity to invest in power transmission and distribution networks is decisive to the fate of an electric power company.

The factors behind this huge investment in power transmission and distribution networks are as follows. First, power must be steadily transmitted from remotely located power generation facilities to consuming regions. Second, the power distribution equipment must be sufficient to supply power to every part of the service area. And third, it is necessary to ensure that power is supplied stably even when power demand peaks. Should any single region have more than one company engaged in power transmission and distribution, there is a risk power companies will be unable to obtain power sale contracts commensurate with their investment.

However, regional monopolies give rise to a reverse problem with capital investment. This is namely that the absence of competitors may deter power transmission and distribution companies from making any additional capital investment, if they can secure a certain level of profit without it. With respect to The Fukushima Dai-ichi nuclear power plant, TEPCO eventually made an inadequate investment in seawall construction and in storage facilities for used nuclear fuels, although these are not included in the transmission and distribution networks. This is a negative effect of monopolies.

In public economics, the collection of access charges and introduction of incentive regulations have been proposed for averting negative incentives arising from monopolies. Access charges are based on the idea of recovering the costs of capital investment to meet peak demand from power generating companies that make use of the transmission and distribution networks.

An example of the incentive regulations is to introduce a price capping scheme under which power transmission companies may increase their profit as they meet a predetermined productivity improvement goal. However, both approaches are premised on the monopoly of power transmission networks and fail to resolve several issues such as actual tax burden sharing and pricing.

Power transmission poses a question in deregulation in the West.

Although leading the way in the deregulation of the electric power business, Europe and the United States also face lingering questions about power transmission and distribution networks. The European Union (EU) has since the 1990s been deregulating its internal electric power market. In 1996 and 2003, it issued the first and second directives for deregulation of the power industry in a bid to unbundle the existing electric power companies from the power transmission and distribution sector. In July 2007, full deregulation of the electric power retailing market was put into place.

At present, a third deregulation plan proposed by the European Commission in September 2007 is being debated. This plan suggests unbundling the power transmission function, setting up an organization for EU-wide collaboration among regulatory authorities and responding to the acquisition of utilities by outside operators. While aiming to increase efficiency in the EU power market, it includes measures for maintaining the public good, which is the interest of individual state governments.

The United States has been ahead of the EU in deregulating the power market. Under the Energy Policy Act of 1992, the Federal Energy Regulatory Commission (FERC) ordered electric power operators owning power transmission networks to open them to other independent power businesses under certain conditions. The FERC pushed ahead with the separation between power generation and power transmission, arguing that ensuring access to power transmission and distribution networks and introducing cost-based wheeling charges would help stimulate inter-regional power transactions, lower power rates, and secure constant supply.

However, rolling blackouts following a power supply shortage occurred in 2000 in California, the U.S. state that took the most aggressive stance on power deregulation. In Japan, many refer to this failure in California as a reason for their opposition to deregulation of the power market. The turmoil in this particular state was due to failure in pricing policy.

Despite a price increase in natural gas and other fuels, power supply companies were not permitted to raise retail prices. In addition, those owning transmission and distribution networks were obliged to purchase electric power. In contrast, stringent environmental regulations and soaring fuel prices dissuaded individual power generation companies from producing enough power to meet the demand. As a result, power transmission and distribution companies were unable to pass on higher costs to consumers and one major utility in fact declared bankruptcy.

Distributed networks would need no massive investment in power transmission.

As discussed above, the biggest challenge even in the West is to secure an adequate level of capital investment in the power transmission and distribution function and to give consumers reliable access to electricity at reasonable prices. Now, a change is taking place in the hitherto inseparable linkage between power transmission and capital investment. One factor behind this is the widespread use of natural energy for power generation as communities seek to combat global warming.

Small power generation facilities using wind, sunlight, geothermal, and other natural energy have now been erected in many places. Regional-scale, distributed networks are sprouting all over the world. A power transmission and distribution network established by interconnecting these networks constitutes a grid-like network and does not require huge investment in power transmission and distribution. If any failure occurs somewhere on the network, it is easy to switch to another power source. This is made possible by the grid-style interconnection.

Another underlying factor is the possibility of creating a network of private power generation and storage facilities owned by enterprises and local governments. After the earthquake, power storage systems owned by businesses and households increased in a manner in which they are dispersed into individual districts. They can also be incorporated into grid networks.

In the future, more and more electric cars will be used in households to help reduce global warming. They can be used at night for storing electricity generated from solar energy. A grid-shaped network may thus be constructed by incorporating combinations of households and vehicles.

A feed-in tariff (FIT) scheme ensures that households may sell any power generated that is in excess of their consumption at a fixed price. Under the current FIT system, in which regional monopoly electric power companies unilaterally purchase the surplus electricity, the selling price changes when the regulations are changed. If there is more than one company engaged in power transmission and distribution, consumers may choose which company to sell electricity to at their discretion on the basis of the market price. This is the smart grid in its genuine form.

A grid network will help reduce the required investment in power transmission and distribution. Excessive investment could be prevented by introducing an obligation for interconnection between new and existing electric power operators, by authorizing their rights to transmit electric power and by providing a transmission rights trading market to redress the balance.

The existing power companies are not the sole entities that can bridge distributed grid networks by means of power trading. Possible intermediaries include telephone and telecommunication operators, gas supply companies and water services operated by local governments. All these operators have already constructed networks of wiring and piping to reach households and businesses. They will easily be capable of additionally constructing a power network.

Actually, many leading power operators in the United States and Europe serve as public utilities offering not only power supply services but also gas supply, waste disposal, water supply, sewerage, and other public services. Japan should also be able to build global utility firms by accelerating the integration and bolstering of the utility businesses and by stimulating competition between them.

Electric power, gas, water, telecommunications, rail transport, and other highly public services are part of the infrastructure that supports our daily life and the economy. Universal availability of these services must be maintained, even while ensure they remain feasible businesses. Japan addressed just this question with the reorganization of Nippon Telegraph and Telephone Public Corporation and the postal service reform.

As a result of that reform, a number of operators now compete in the telecommunications market. The former Japan National Railway has been split into regional JR companies, which compete with local private railway operators and with automobiles in their respective regions. With respect to postal services, Japan Post Service Co., Ltd. continues to exclusively deal with postal mail after the reform, while it competes with door-to-door delivery services in the parcel market.

These past examples imply that users’ perspective is vital to maintaining universality. In other words, it is important to design a market structure that is convenient for users, while being reliable and efficient. To this end, it is necessary to focus attention on creating competitive conditions rather than on the current monopoly system favoring operators.

The creation of municipal-scale, regionally distributed networks for the transmission, distribution and retail of power generated from wind, solar, geothermal, and other natural energy will lead to regional revitalization and job creation. Particularly for the purpose of reconstructing the Tohoku region devastated by the recent Great East Japan Earthquake, it would be ideal for a large number of small, local electric power operators to be created.

Split and sell the power transmission and distribution systems

Finally, we need to think about what to do with the nuclear power plants. It is likely that TEPCO’s The Fukushima Dai-ichi nuclear power plant and Fukushima Dai-ni Nuclear Power Stations will remain off limits for a long time, given their damage, suspension, and contamination. All ten reactors are likely to be decommissioned.

How much will it cost to decommission the ten reactors? In normal circumstances, decommissioning a reactor is believed to cost 30 billion to 40 billion yen. After an accident, however, it is necessary to acquire the surrounding areas. After the Three Mile Island accident, the U.S. Government Accountability Office (GAO) estimated that decommissioning a crippled reactor would be ten times as costly as decommissioning a normal reactor.

In the light of these data, handling of the Fukushima accident is likely to cost approximately 10 trillion yen. If compensation for long-term health hazards as well as for the impact on agriculture and fisheries are included, the cost will obviously be beyond the ability of TEPCO alone to pay.

Some argue that TEPCO must be protected from bankruptcy as it engages in a highly public business. On the other hand, many say that TEPCO cannot be allowed to survive precisely for that reason, given its responsibility for this terrible accident.

For the purpose of rehabilitating TEPCO, the author believes that it should be temporarily nationalized, that its huge power transmission and distribution facilities in its service area should be split into ten segments and that these segments should be auctioned to businesses wishing to enter the power transmission and distribution market, on the assumption that the network take a duplex form. Then, the revenues from the sale of the facilities can be appropriated to compensation and other costs and the power supply operations can be maintained.

There is an option of confining eligibility for submitting bids to Japanese firms, as the EU did for EU-based firms. However, Japan’s reputation may remain negative for some time. To ensure stable competitive conditions, Japan should actively invite foreign businesses to enter Japan.

These matters are not unrelated to other electric power companies. The need for a duplex configuration is true of all electric power networks. In addition, each of them must carry out many costly measures, including earthquake-resistant reinforcement and tsunami control measures for existing nuclear plants, and reconsideration of the storage of used nuclear fuels.

As a result, some electric power companies may be unable to meet these enormous costs, or growing unrest about people living in neighboring areas may force some nuclear power stations to shut down. However, nuclear plants are vital, responsible for 30% of total power generation. According to a current cost comparison, natural sources of energy alone cannot offset nuclear power.

The author proposes that the nuclear power plants owned by the nine electric power companies (not including the Okinawa Electric Power Company, Inc.) in Japan be placed under the centralized control of a public power generation body, such as a public corporation for nuclear plants. This public institution would be responsible for investing in enhancing the safety of nuclear plants and risk management. The electricity generated would be sold to electric power operators, which will be diversified after the introduction of market pricing. To see if the public corporation envisioned above will be viable for the long term, it is necessary to objectively assess the cost effectiveness of nuclear power plants with enhanced disaster control.

For the purpose of achieving a swift recovery from the great earthquake, the international community wants Japan to build a framework for stable, long-term supply by shifting from an energy policy excessively dependent on existing electric power companies to a new user-oriented policy.

Translated from “Gakusha ga kiru:Denryoku antei-kyokyu no tame so-,hai-denmo no fukusen-ka wo,” Shukan Ekonomisto, May 17 2011, pp. 48-51. (Courtesy of Mainichi Shimbunsha)