Freedom of Finance and the Debt-laden Economy

Prof. Kojima Akira

Paul Volcker, a legendary policy man and the former chairman of the Federal Reserve Board (FRB), published a new book Keeping at It in 2018 at the age of 91. It is a book that allows us to sense the creed of Volcker, who continues to call for the maintenance of healthy finance.

Maybe we should say it is an irony, but in August 2018 there was a move to render the Dodd-Frank law, which focuses on the Volcker Rule that restricts the market transactions of banks, ineffectual. That is, the US House of Representatives passed a bill to revise the Dodd-Frank law. This law had come out of reflections following the economic downturn precipitated by the Lehman Brothers bankruptcy in 2008, which resulted in the global financial crisis. It seems that the sense of crisis that prevailed at that time has already become a thing of the past.

It reminds me of discussions when I participated in a symposium commemorating the 200th anniversary of the death of Adam Smith, which was held at the University of Glasgow in 1990.

The theme was “whether freedom of trade (goods) and freedom of finance (money) can co-exist in a healthy form.” Under the Bretton Woods system, the international economic order after the Second World War, trade was free while finance and currencies were regulated (managed). Based on the General Agreement on Tariffs and Trade (GATT), nation states intensely pursued the liberalization of trade, but they were obligated to intervene in the foreign exchange market and make adjustments to their macroeconomic policies to maintain the official parity rates under the fixed exchange rate system. In 1971, however, the United States, worried about the structualization of trade deficits and the outflow of gold reserves, unilaterally forced through the suspension of the dollar’s conversion into gold and the introduction of import surcharges. While the fixed exchange rate system was originally maintained, the US made a shift to the floating exchange rate system after 1973. Since then, the liberalization of trade has made progress, and the floating exchange rate system has taken root. As a result, both goods and money were pushed toward liberalization.

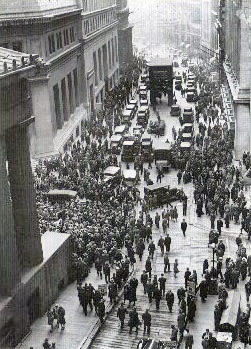

Crowd gathering on Wall Street after the 1929 crash, PUBLIC DOMAIN

However, financial crises were frequent, and protectionism came to penetrate trade. In the mid 1980s, Peter Drucker noted the “near uncoupling of the real economy and the symbol economy.” Subsequently, the liberalization of money continued to advance, and the volume gap between financial and foreign exchange transactions and the real economy and trade widened rapidly. At the time of the Asian Financial Crisis, George Soros said that regulations on money were necessary, observing: “Finance differs from the real economy and deviates indefinitely from a theoretical equilibrium point of neoclassical economics. This is the reason for the frequent crises.”

This Time is Different, a book written by Kenneth Rogoff and others, points out that the introduction of new financial products as a result of the evolution of financial engineering, including the development of derivative products, is a “new version of financial liberalization.”

This year marks the 90th anniversary of the meltdown of the stock market in New York (Black Thursday) on October 24, 1929, which heralded the start of the Great Depression. The Glass-Steagall Act (1933), which emerged from the lessons learned from Black Thursday to separate commercial and investing banking, was abolished in 1999, before the 2008 global financial crisis. The Volcker Rule, which emerged from the lessons learned from the 2008 global financial crisis, is also at stake under the Trump administration. Money has begun heading towards further liberalization. Meanwhile, trade friction between the United States and China is intensifying, and the trend of trade protectionism is accelerating.

I have an acute feeling that we need further discussions over how to deal with the slumping economy in recent years, while recalling the questioning at the University of Glasgow.

President Donald J. Trump and President Xi Jinping at the G20 in Germany, July 8, 2017.

At this meeting Trump said, “trade, as you know, is a very, very big issue for the United States now. Because over the years and — it’s really been over a long period of time many things have happened that have led to trade imbalances. And we’re going to turn that around. And I know that with China in particular which is a great trading partner, we will be able to do something that will be equitable and reciprocal.”

Photo: Official White House Photo by Shealah Craighead

Translated from an original article in Japanese written for Discuss Japan. [January 2019]

Keywords

- Paul Volcker

- Volcker rule

- Dodd-Frank law

- Lehman Brothers bankruptcy

- Bretton Woods system

- GATT

- symbol economy

- Asian Financial Crisis

- Kenneth Rogoff

- trade friction

- Trump administration

- Black Thursday

- trade protectionism