THE NATION NEEDS TO CONDUCT FISCAL POLICY REFORMS THAT CORRECT THE UNFAIRNESS BETWEEN THE GENERATIONS

As society ages, childbirth declines, and the economy globalizes, the Japanese economy and its fiscal situation have continued to stagnate and worsen since the collapse of the bubble economy in 1990. Public debt is about to reach a figure that is about 200% of our gross domestic product (GDP). And when the Great East Japan Earthquake hit on March 11, the situation was exacerbated.

While recovering from the quake is important, we must at the same time work on two reforms today to solve the medium- to long-term issues faced by Japan. One is a growth strategy to increase the potential growth rate of the Japanese economy, and the other is correcting the unfairness between the generations by reforming fiscal policy and social security.

In terms of the latter, the politicians are currently split between being pro-tax increase and anti-tax increase, but this is not the real point of this issue. As the term “political aging” suggests, as the population ages, democracy tends to give greater political power to the retiring generation that comprises the greater population volume, and the remaining younger and future generations may see their interests compromised. Accordingly, the real debate in this situation should be between maintaining the status quo, which expands the inter-generational inequities, or to correct the inter-generational inequities. Whether or not the latter occurs depends on how the new government deals with the Plan to Reform Social Security/Tax that the ruling party drafted in late June.

Truth be told, the current generation is passing the burden of fiscal and social security onto future generations, as the social security budget is inflating at a rate of one trillion yen every year and the national budget deficit is remaining a constant (e.g., 44 trillion yen in FY2011). It is imposing a load on future generations that they cannot possibly bear.

– Knowing the burden imposed on future generations with Generational Accounting –

Generational inequities: 120 million yen

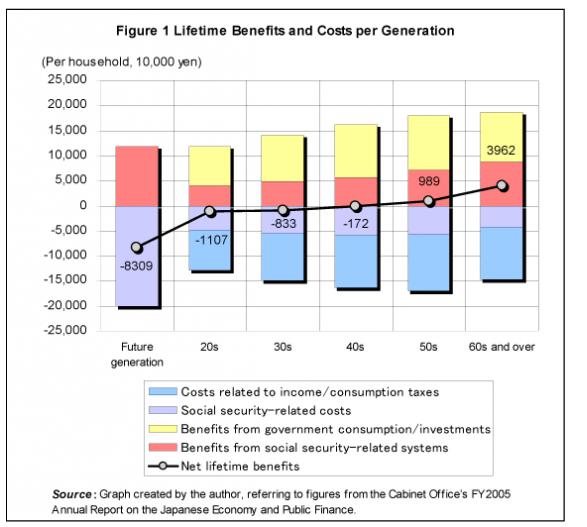

We can see this truth using the method shown in Figure 1, called generational accounting, which derives the difference – or generational inequities – between the current generation aged 60 and over (defined at the time of estimate as born up to and including 1945) and future generations (born from 1986 onward; includes people under 20 years of age). According to the results of my estimation, the inequity between the current and future generations amounts to 120 million yen per household. Assuming that the lifetime wage of an average businessperson is 200 million yen, the inequity amounts to almost 60 percent of the lifetime wage.

The generational accounting that I used in this estimation is a method of estimating the amount of costs a citizen imposes on the government and the benefits he or she gains from the government throughout his or her lifetime. Specifically, it estimates the lifetime benefits and costs per generation – age groups such as the 20s, 30s or 50s – and assesses the nation’s fiscal policy.

It accounts for the benefits acquired from social capital such as roads and dams and public services such as police, defense, medical and nursing, along with the cost burdens such as the tax and insurance premiums the nation requires in order to offer those services. The difference between the costs and benefits – the amount derived from subtracting the lifetime benefits (discounted to the present value) from the costs (discounted to the present value) that the current and future generations will pay over their lifetime, assuming the current policy – is called the net cost (discounted to the present value).

According to this method, the net cost for the group aged 60 and over is in negative figures, a benefit of approximately 40 million yen (excess benefit), and the 50s group has a benefit of around 9.9 million yen (excess benefit). On the other hand, the net cost for the remaining lower generations is positive, with the future generation at a loss of approximately 83 million yen (excess payment).

The advantage of generational accounting is in making the net cost of future generations visible. Usually, when the government discloses figures on public debt, it only indicates the amount of the debt at that point in time, which reveals nothing of the true cost that future generations will bear. The government could always reduce pension benefits or increase costs to keep the current budget deficit and public debt unchanged and leave the future generation to bear the costs. But by using generational accounting, we can see all that and the entire cost burden.

– A public pension would run a debt of 150% of GDP –

The massive amount of unmentioned debt

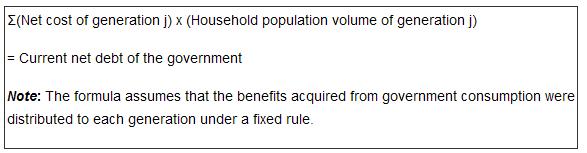

With regard to the net cost (discounted to the present value) of each generation as obtained from generational accounting, we can derive the following formula:

The left-hand side of the formula refers to the total sum of, from Figure 1, the net cost of the 60s and over generation multiplied by that generation’s household population volume, the net cost of the 50s generation multiplied by its household population volume, […], the net cost of the 20s generation multiplied by its household population volume.

This formula therefore basically explains that the net costs of generation groups work like a zero-sum game. In other words, if the current net debt of the government (>0) is a given, and the net cost of the 60s and 50s groups is a negative figure (excess benefit), then the net cost of other younger and future generation groups will inevitably be a positive figure (excess payment).

The right-hand side of the formula, the net debt of the government, refers to the government’s public and other debts minus its sellable financial assets. However, it is regarding this formula that the government is undergoing debate on the government’s balance sheet.

This claim does not take the correct view. From the generational accounting perspective, Japan’s public pension is estimated to be running an implicit debt of close to 150% of GDP (if GDP were 500 trillion yen, it would be 750 trillion yen), and such a claim runs the risk of undervaluing this debt. Implicit debt is defined as “the difference between savings that should have existed if the pension were completely under a funding method, and actual savings.” The funding method is the method of saving for one’s own retirement, and savings that should have existed if the pension were under a savings method are almost equivalent to the total amount that the senior generation received at no cost back when the pension system commenced. Japan’s public pension today, on the other hand, is called ” Shuseifuka Houshiki” (pay-as-you-go pension with a part of funding method), under which the current generation is liable for the amount paid to the senior generation, yet saves its own as well practically. These savings are what is saved from the part of its premiums that was not spent on pension payments.

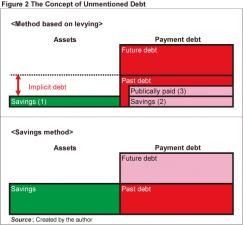

With regard to public pensions, the government bears the obligation to pay pensions according to the amount of premiums expended by the citizens — or in other words, it bears a payment debt. The savings that should have existed if the pension were under a savings method refers to the area within the Payment Debt in Figure 2 that applies to past expenditure, or Past Debt (the amount of payments made to current recipients of the pension plus the amount of future payments [discounted to present value] made to the current generation calculated from the years of pension membership up to this point). And by definition, the difference between Past Debt and Savings (1) in Figure 2 is the implicit debt.

– Conduct sweeping reforms with government leadership –

Medical and nursing care takes the same structure

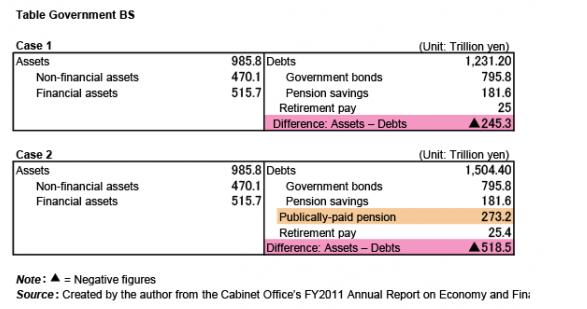

Let us look at the two types of government BS that the Cabinet Office drafted (Cases 1 and 2 in the Table). From the viewpoint of the method based on levying in Figure 2, Case 1 accounts for Savings (= (1); the amount that the Cabinet BS invests as financial products as part of financial assets) as assets, and 181.6 trillion yen of savings within Past Debt (= (2); Pension Savings in the Cabinet BS) as debt. But since (1) and (2) almost cancel each other out unless the P/L from investing the pension savings does not amount to a massive figure, they do not have a significant impact on the surplus debt (the difference resulting from subtracting assets from debt) of 245.3 trillion yen in the government BS.

Case 2 accounts for Savings (1) as assets, and 181.6 trillion yen of savings (2) within Past Debt and publically paid 273.2 trillion yen (3) as debt, and records the surplus debt on the government BS as 518.5 trillion yen. Yet in this case as well, what the BS indicates is merely part of the implicit debt in Figure 2. The issue of whether or not to include in the government BS all or part of debts (2) or (3) that public pension runs is only secondary; more important is the scale of the implicit debt.

And when the implicit debt is 150% (of GDP), the public pension (approx. 270 trillion yen) included as debt in the government BS in Case 2 would apply to the public pension (3) in Figure 2 that is part of the implicit debt (750 trillion yen), so when we include the remaining implicit debt (approx. 480 trillion yen) in the government BS, we get a surplus debt of approximately 1 quadrillion yen.

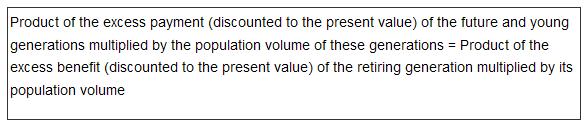

The presence of this implicit debt could also be explained from the formula mentioned earlier. In doing so, we should consider a case that involves no government expenditure/income other than the public pension to simplify our discussion. To clarify the meaning of implicit debt, we would also assume that the government had no assets or debts when it launched the public pension system. In other words, we will consider generational accounting that limits itself to the public pension. An intuitive image of the formula would be as follows.

Strictly speaking, the retiring generation — the right-hand side of this formula — includes the generation that did not pay premiums when the public pension system commenced, and died after receiving only pension benefits. This right-hand side of the formula is itself the implicit debt. This formula therefore explains that unless we compress the excess benefits of the retiring generation, the implicit debt will have to be paid off as excess payments on the part of the young and future generations.

What is more, there are implicit debts other than what is run by the pension. While the levy-method pension is a system of transferring income from the current generation to the senior generation, medical and nursing care are also fields that see expenditure concentrated in the senior phase of life, and the current generations bear the costs. These systems have a structure that is almost identical to that of the pension, and are also running implicit debts. Some experts estimate that medical and nursing care are running implicit debt amounting to 80% of GDP.

We can pass the buck no longer

As all this shows, the discussion that we really need to be having concerning the government BS is regarding how much the current implicit debt in social security (pension, medical, nursing care) amounts to, and how the current and future generations should bear its cost.

The most crucial point regarding common discussions on the government BS is the view that we cannot calculate the true burden of future generations. This, I repeat, is because the government could always reduce pension benefits or increase costs to keep the current budget deficit and public debt unchanged and leave the future generations to bear the costs. But generational accounting has ultimately unraveled this, and we now know that the current fiscal policy and social security system are imposing a load on the young and future generations that they cannot possibly bear.

In any case, Japan today runs about half its annual expenditure as a budget deficit, and its social security budget is inflating by one trillion yen every year. This financial state could not continue forever, and we can clearly see that it is approaching its limit. When it reaches this point, we will only have a limited set of solutions to choose from, and in order to avoid a financial crisis and correct generational inequities, we will have no choice but to conduct fundamental reforms of our fiscal policy and social security while we recover from the earthquake.

Yet whether or not the reform plan mentioned in the beginning will pass in the political proceedings to come is relatively uncertain. The political scene that needs to undertake the reform is utterly confused, due in great part to the twisted parliament, and its prospects are far from clear. Even recently, the ruling and opposing parties staged a battle over the Special Act on Issuance of Government Bonds required in issuing debt-covering bonds. Tactics are always part of politics, but we will not tolerate unproductive conflicts between the ruling and opposing parties in times of emergency. Many still embrace the wishful hope and illusion that Japan will somehow find its way even if it postpones reforms on fiscal policy and social security, and some profess that Japan would be better off facing an economic collapse if it cannot reform anyway.

According to the Medium/Long-term Estimate on Economy and Public Finance released by the government in August, even though the reform plan plans to increase consumption tax rate to 10% by the year 2015, the rate would have to be set at around 17% if the government were to achieve its goal of a profitable standing in terms of basic financial balance by the year 2020. In other words, we should know that the latest reform plan is only the first stage in correcting generational inequities, and the government needs to undertake additional reforms to comprehensively improve fairness.

Now is the time for the government to take a position of leadership in the true sense of the word to improve generational inequities. Commitment to this issue is demanded of the government.

Translated from the series titled Gakusha ga kiru “‘Sedaikan kakusa’ wo zeseisuru zaiseikaikaku wo,” Shukan Ekonomisto, September 13 2011, pp. 52-55. (Courtesy of Mainichi Shimbunsha)