Consumption Tax Rate Hike and Social SecurityPension: Reform has slightly progressed, but cutting of benefits is unavoidable in the future

The consumption tax rate hike has set a course for securing of steady financial resources for the basic pension, but it is also necessary to take measures to cut benefits for achieving a sustainable pension system.

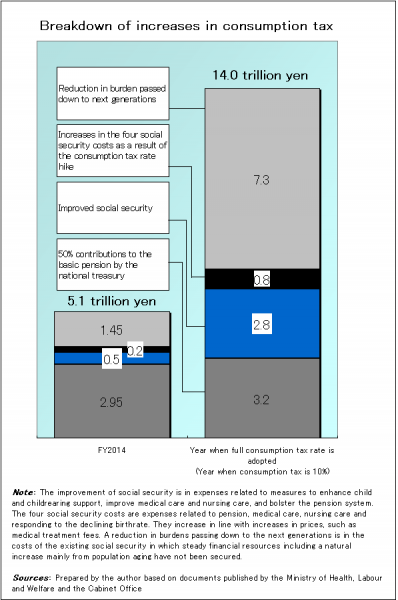

An increase in the consumption tax rate to 8% from April 2014 is expected to generate additional annual tax revenues of approximately 8 trillion yen. However, the increase of tax revenues for FY2014 is likely to be limited to 5.1 trillion yen, given a gap in tax payment periods and a slump in consumption. Of additional tax revenues of 5.1 trillion yen, 2.95 trillion yen will be used to finance the national treasury that contributes half of the basic pension (Figure).

The consumption tax rate hike has been determined, but…

Responding to the major issue of the pension system, the question of its sustainability due to the declining birthrate and aging population, the four acts related to pension reform were enacted in 2012. With this enactment, the course has been set out for reforming the pension system, which included permanent contributions by the national treasury to half of the basic pension, integration of the employees’ pension plan and the mutual pension plan, expansion of the inclusion of short-time workers in the employees’ pension plan and elimination of the 2.5% special level for pension payments.

Apply the macroeconomic slide even in the deflationary economy

Pension reform advanced a certain amount in 2012, but implementing further reform to control benefit payments is unavoidable for strengthening the sustainability of the pension system.

In the Bill Related to the Promotion of Reform with an Aim to Establish a Sustainable Social Security System (the program bill submitted to the Diet on October 15, 2013), which sets out the overall picture of social security system reform and its implementation methods, four items of deliberation related to pension reform are presented: (i) the way to implement the macroeconomic slide (a system to control a pension revision rate in accordance with the progress of the declining birthrate and aging population), (ii) expansion of inclusion of short-time workers in the employees’ pension plan, (iii) the way to pay pension benefits to the elderly and (iv) pension benefits for high-income earners, deduction of public pension, etc. All these items have been included as a reflection of the items pointed out in the report of the National Council on Social Security System Reform (National Council).

However, the bill does not state a specific period for implementing pension reform. It simply states that examinations of the four items mentioned above and other matters will be conducted, and necessary measures will be taken in accordance with the results of the examinations. This is a clear contrast with medical and nursing care reform, whose implementation periods are specified.

Of the four pension reform examination items, measures that will directly work to control benefits are reform proposals (i), (iii) and (iv).

Although the national treasury once contributed financial resources of the basic pension accounting for one-third of the total resources and premiums for two-thirds, since FY2004, contributions of the national treasury have been raised in stages, and since FY2009 the resources have been equally contributed, 50/50. However, financial resources for raising the share of contributions of the national treasury have been financed by special bonds covering public pension funding (bridging bonds) whose redemption will be made based on income from extraordinary financing and a consumption tax rate hike. Therefore, steady financial resources have not been secured.

Because the tax raise in April 2014 has been determined, permanent 50% contributions by the national treasury are expected to be achieved from FY2014 by using additional income acquired from it.

Moreover, if a consumption tax rate of 10% is introduced in October 2015, 3.2 trillion yen will be used to finance the national treasury’s contributions to the basic pension.

As for (i) the macroeconomic slide, if it is conducted during the deflationary period, the pension benefit level will be promptly controlled. Pension benefits are structured to be automatically revised in accordance with fluctuations of prices and wages, and in 2004, the macroeconomic slide system, in which pension benefits are controlled in accordance with the declines of the working population and extension of average life expectancy, was adopted. For example, if prices rise 1% and the slide adjustment rate that takes into account the declines of the working population and the extension of the average life expectancy is 0.9%, the actual increase of benefits paid to pensioners will be limited to 0.1% (1.0%–0.9%).

However, in the macroeconomic slide system, pension benefits will not be lowered at a rate greater than declines in prices and wages during the deflationary economy. And if the growth of prices and wages is small, a negative revision will not be conducted.

In the current system, by the implementation of the macroeconomic slide, the benefit level is expected to be cut by approximately 20%. In fiscal examinations in 2009, the income replacement rate (level of household pension benefits against after-tax income of the working generation) of a standard household with the employees’ pension plan (a household with a husband who earns the average income and has a forty-year employment history and a wife who has been a full-time homemaker during the entire period) was 62.3% in FY2009. With the control over benefit payments following the implementation of the macroeconomic slide, the income replacement rate will gradually decline and stand at 50.1% from FY2038.

However, during the period when the special level, in which pension benefits remain unchanged when prices are falling, is adopted, the macroeconomic slide is not implemented. As a result of pension reform in 2012, because the special level will be eliminated in April 2015, the macroeconomic slide will start from April 2015.

Moreover, as explained above, it is possible that the control over benefits through the macroeconomic slide will not sufficiently function even from 2015, depending on the fluctuation level of prices and wages. To ensure that the control over the pension level is implemented in a planned manner, it is desirable to amend laws so that the macroeconomic slide is adopted even in the deflationary economy and other situations.

With respect to (iii) benefits for the elderly, after completing postponing the benefit start age to sixty-five, if the further postponement is adopted, total pension benefit payments can be controlled. According to the Ministry of Health, Labour and Welfare, every increase in the age for the start of benefits by one year is expected to reduce public expenditures by 500 billion yen a year. During the discussion on pension reform in 2012, proposals of raising the benefit start age to 68–70 were presented, but these were not included in the final reform proposals.

Elimination of the special pension level

The pension has originally been structured in such a way that benefit payments are reduced in accordance with price declines. However, from FY2000 to the present, payments have been made at a level (special level) 2.5% higher than the level (original level) originally set forth by law. Bringing the pension payment level back to the original level means elimination of the special pension level, which is provided in the four acts related to pension reform in 2012. Accordingly, the pension payment level will be lowered by 1.0% in October 2013, 1.0% in April 2014 and 0.5% in April 2015.

Providing pension at the special level has been causing excess annual payments of approximately 1 trillion yen. The total excess payments for the period between FY2000, the year when payments at the special level began, and April 2015 when the special level will be eliminated, are expected to be approximately 9.5 trillion yen. The elimination of the special level is a positive factor for achieving sound pension finance.

As for (iv) pension benefits for high-income earners, if the payments of the basic pension are controlled, the total benefit level will be contained. The national treasury and premiums each contribute 50% to the basic pension. However, examinations were conducted on reducing the basic pension of high-income earners by an amount at most equivalent to the contributions made by the national treasury. Full monthly benefits of the basic pension are approximately 65,000 yen, so it will be reduced by a maximum of about 32,000 yen.

The scale of the financial impact from benefit restrictions for high-income earners will vary depending on the setting of the level of annual income of targeted high-income earners. According to the Ministry of Health, Labour and Welfare, if a benefit reduction is applied to those starting with an annual income of 10 million yen or more, and the total amount equivalent to the contributions from the national treasury is fully reduced from people with annual income of 15 million yen or more, annual public expenditures of around 45 billion yen are likely to be cut.

However, all these benefit control measures are reform proposals that have been examined but still been passed over several times in the past. It is extremely difficult to achieve reform that forces people to accept lower benefits. But delaying implementation of reform will not only mean postponement of responsibilities to future generations, but also cause concerns about the pension system’s sustainability. Urgent examination of specific measures is needed.

The fiscal examinations in 2009 also presented examination results wherein if premiums for the employees’ pension plan were set at 18.3% and monthly national pension premiums at 16,900 yen (premiums for FY2004) from FY2017, an income replacement rate of 50.1% in a household with an employees’ pension plan will be able to be sustained from FY2038. However, economic preconditions for this examination were a price increase of 1.0%, wage increase of 2.5% and investment returns of 4.1%; levels higher than the recent records.

Reversal of reserves

According to the Ministry of Health, Labour and Welfare, based on the fiscal examinations in 2009, the total combined amount of reserves of the employees’ pension plan and the national pension plan was expected to stand at 151.9 trillion yen as of the end of FY2011, but it actually came to 148.8 trillion yen; a shortfall of approximately 3 trillion yen. In FY2012, because investment returns improved in the second half, the gap between forecast reserves and actual reserves as of the end of the fiscal year is likely to be eliminated. However, depending on future performance, the possibility of occurrence of the situation in the future, in which the reversal of reserves progresses sooner than anticipated and the balance of contributions and benefits is broken, cannot be eliminated.

Fiscal examinations conducted every five years are expected in 2014. Their challenges will be to present future forecasts on the results of the implementation of benefit control proposals by using several different cases based on highly feasible economic preconditions, and to examine reform based on these results to achieve a sustainable pension system.

Translated from “Nenkin: Kaikaku wa sukoshi susundaga shoraitekiniwa kyufu yokusei ga fukahi (Pension: Reform has slightly progressed, but cutting of benefits is unavoidable in the future),” Weekly Economist, October 29 2013, pp.90-91 under the permission of both author and publisher (Courtesy of Mainichi Shimbunsha). [2013]

The Japan Journal has all the responsibility of this translation.

Horie Naoko

Senior Researcher, Mizuho Research Institute Ltd.