Evaluating the “Comprehensive Assessment of Monetary Policy” The Preoccupation with Rationalization of the New Framework ― Messaging Lacks Introspection

< Key Points >

- There is a limit to demand brought-forward through monetary easing

- Fixing long-term interest rates is indivisible from Japanese government bond (JGB) management policy

- Improve messaging when trying to manage market expectations

Okina Kunio, Professor, Kyoto University

Quantitative and qualitative monetary easing (“QQE”) was a “decisive battle of brief duration” designed to achieve the two-percent inflation target within two years. But now three-and-a-half years after its introduction, since we still have a negative inflation rate and there is no reliable outlook for when that target will be achieved, the question of how to reorganize into a protracted battle has attracted considerable interest.

*** ***

In the “comprehensive assessment” it announced on September 21, the Bank of Japan asserted that with the natural rate of interest following a downward trend, it would need toraise inflation expectations, and in doing so further lower real interest rates.

In light of this, the BoJ decided to adopt the policy of “Quantitative and Qualitative Monetary Easing with Yield Curve Control.” This approach employs “yield curve control” to maneuver short-term interest rate to -0.1% and 10-year government bonds rate to around 0% under an “overshoot commitment” that continues with its policy to expand the monetary base until actual figures for the rate of CPI increase exceed its “price stability target” in stable fashion.

As this framework is not consistent overall, there are differing interpretations. The inconsistency stems from the simultaneous commitments to both interest rates and quantity. If you try to control 10-year interest rate, the amount of long-term government bonds purchased is determined endogenously at the level consistent with target rate. This does not strike a balance with the commitment to exogenous monetary base expansion policy that involves maintaining the enormous target for government bond purchases of eight trillion yen a year.

Many reports view the continued expansion of the monetary base as “a token position out of loyalty to previous policies.” My interpretation is that this actually represents a change in direction from quantitative expansion that was imminent limitations to an interest rate policy which makes a long drawn-out battle possible. On the other hand, the fact that long-term interest rates are well below 0% could also be seen as reflecting bond market forecasts that monetary base expansion will likely continue for the foreseeable future. It looks like it will take a while for these interpretations to converge.

The latest review (i.e. comprehensive assessment) focused on the objective of rationalizing the new framework, and only went no further than to conduct review within a limited scope that was focused on the mechanism of inflation expectations formation. Viewed against the Bank of Japan Act, which sets forth the principle of “achieving price stability, thereby contributing to the sound development of the national economy,” the BoJ should have conducted a review that considered broader prospects for society and the economy. As well as advocating the importance of “raising inflation expectations,” there should have been some introspection with regard to the communication style that has been taken to date.

One point of discuss that warrants consideration of broader prospects is that of the natural interest rate. It was appropriate for the review to point out the downward trend in the natural rate of interest. But stronger monetary easing will only further depress the natural interest rate.

Allow me to explain this using the example of investment in housing, which the BoJ has emphasized as showing the effects of negative interest rates. If the interest rates on home loans fall due to negative interest rates policy, more people will consider building a home this year. But if more homes are build this year, the number of homes built in the future will fall by the same amount.

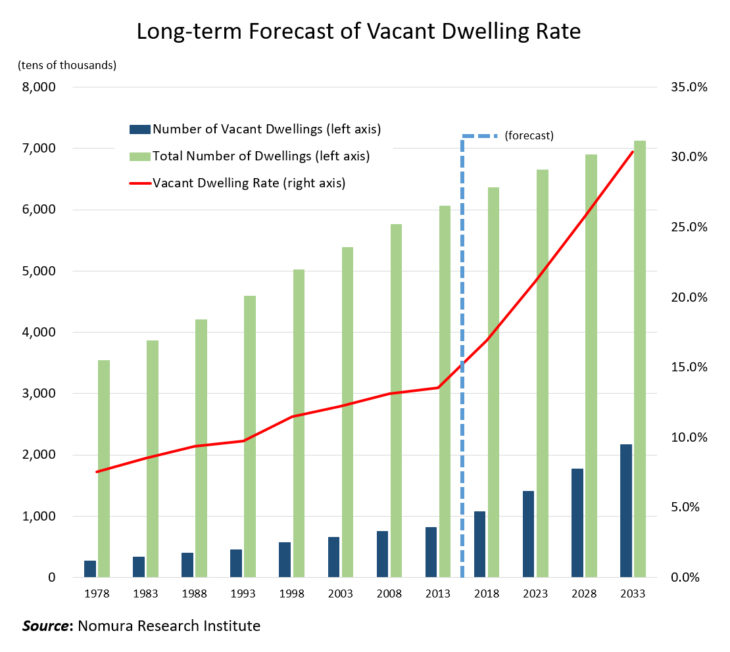

In Japan with its declining population, we have already seen a downward trend in housing investment. According to estimates by Nomura Research Institute, by the year 2030 the number of new housing starts (540,000) will fall to around 60% of 2015 levels mainly due to reductions in populations and the number of households, and even with that reduction, the vacant dwelling rate is expected to surpass 30% by 2033 (see figure).

In Japan with its declining population, we have already seen a downward trend in housing investment. According to estimates by Nomura Research Institute, by the year 2030 the number of new housing starts (540,000) will fall to around 60% of 2015 levels mainly due to reductions in populations and the number of households, and even with that reduction, the vacant dwelling rate is expected to surpass 30% by 2033 (see figure).

Under those circumstances, if we bring forward the demand and attempt to cover the resultant decline in future demand (decline in the natural rate of interest) through monetary easing, real interest rates will need to fall lower and lower.

These effects of monetary easing are similar to relying on improved fishing methods such as introducing nets with finer meshes to maintain the volume of fish catches amid depleting fish resources. Just as increasing fishery resources is vital to protecting the fishing industry, strong measures (growth strategy) to raise the natural rate of interest in the economy are vital to the economy as a whole. As long as that part of the policy puzzle is absent, the two-percent inflation target will eventually fail because the downward spiral of brought-forward demand and a declining natural rate of interest will require accelerated inflation.

The structural flaw in monetary policy will only reinforce the limitation on effects the more monetary easing is bolstered, heightening expectations towards fiscal policy. In Japan, government debt as a percentage of GDP is extremely high and the government has continued to run large budget deficits. As a result, there is an inevitable shift in financial interest away from economic stimulation and towards fiscal financing (making up for the fiscal deficit). Seen in this context, the recent upsurge of the support to “helicopter money” can be regarded as inevitable.

From the perspective of the relationship between fiscal financing and monetary policy, the BoJ’s commitment to induce the rate on 10-year government bonds to around 0% through yield curve control carries great significance, because in form, it is the same as a policy to set the cap on long-term government bonds at 2.5% that was adopted by the Federal Reserve System in 1942 to curb US government debt servicing costs. The commitment to maintain long-term interest rates around 0% and further reduce the rates if required could also have a profound impact on fiscal discipline.

It should also be noted that at an intensive inspection meeting in the council of economic and fiscal policy on raising of the consumption tax in August 2013, Bank of Japan Governor Kuroda Haruhiko emphasized the risk of interest rates rising sharply due to the postponement of tax hikes. Noting that “if that kind of thing were to happen, the action we could take would be limited,” Kuroda negated the BoJ’s ability to control long-term interest rates, and this was reported as a “tremendously high-risk utterance.” But at the latest press conference, referencing experiences during the 2008 Lehman Shock, he remarked that while they couldn’t do exactly the same for short-term interest rates, yield curve control could do enough.

The Bank of Japan emphasized the need of expectation management in its review. But if we cannot see the crux of the matter, namely the reasons for this significant shift in judgment and how the BoJ will improve mechanisms to restore a degree of freedom to interest rate inducement without causing debt management policy problems, for examples, market participants will feel uncertain and the formation of expectations will not stabilize.

From the perspective of raising inflation expectations, many points should have been reviewed and subject to greater introspection. Since the introduction of QQE, the Bank of Japan has continued with the baffling policy of forecasting the early meeting of inflation targets in its “outlook reports,” leading to their being ridiculed as “wishful thinking reports.” Moreover, repeated surprises have occurred by ignoring the common sense of recent macroeonomic theories, which emphasize the importance of predictable policy implementation, and market participants have been coerced and disrupted like times when adversarial speculators have been reined in.

Finance minister Aso Taro described the April 2013 introduction of QQE as “shock and awe,” referring to the strategy employed by the United States military to reduce the morale of the Iraqi Army. Governor Kuroda continued to deny both the additional easing in October 2014 and introduction of negative interest in January this year up until the last minute, and then dropped the surprise.

The introduction of negative interest rates in particular suddenly imposed charges on financial institutions that had cooperated with the BoJ’s quantitative easing and accumulated a large portion of the bank’s outstanding current deposits. When financial institutions pushed back, BoJ Governor Kuroda dismissed their concerns, saying “monetary policy is not something we implement for financial institutions but for the Japanese economy as a whole.” These communication strategies resulted in a loss of trust, especially from financial institutions, with respect to the Bank of Japan, which should serve as the foundation for the expectation management.

The Bank of Japan must have realized these fatal mistakes. It is commendable that prior to the determination made on September 21, the BoJ governor and deputy governor suggested the direction of the review, and we could even see signs of reflection in the governor’s speech in June. But they should have faced their communication failures head on and given a serious review. Unless the market comes to accept that the remarks made by the Bank of Japan are not for the purpose of propaganda and producing surprises, efforts to expectation management will continue to fall flat.

Translated by The Japan Journal, Ltd. The article first appeared in the interview column of The Nikkei newspaper on 3 October 2016 under the title, “‘Kinyuseisaku no sokatsukensho’ no hyoka (3): Shin-wakugumi no seitoka ni shushi” (Evaluating the “Comprehensive Assessment of Monetary Policy” (3): The Preoccupation with Rationalization of the New Framework).” The Nikkei, 3 October 2016, p. 16. (Courtesy of the author)