Do expectations raise prices? Expectations Have Hardly Had Any Impact on Wages, The Key Factor ― Deflation is not a monetary phenomenon

< Key Points >

- The postponement of the timing of achieving the price target indicates the failure of the “different dimension” of easing.

- Expectations are not taken into consideration when prices and wages are determined.

- It is not the quantity of money but oil prices that cause prices to change.

Yoshikawa Hiroshi, professor, Rissho University

The “different dimension” of monetary easing that started in April 2013 has failed to achieve its target: a core CPI (all items less fresh food) inflation rate of 2% in two years. The latest core CPI inflation rate was negative 0.4%. This rate is lower than the level towards the end of the term of office of the former BOJ Governor Shirakawa Masaaki.

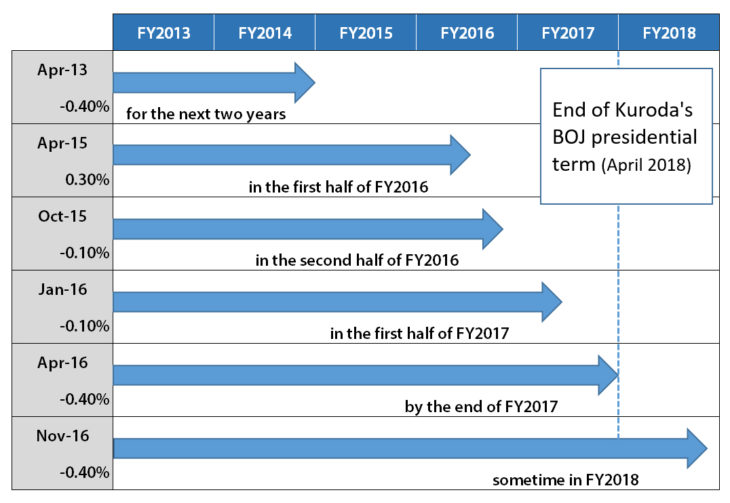

Finally, at the Monetary Policy Meeting held on 1 November 2016, the Bank of Japan postponed the timing for achieving the 2% price target from “during FY2017” to “around FY2018.” The target date was postponed for the fifth time in the past three and a half years (please refer to the chart). The Bank of Japan has admitted that it will not achieve the target during the term of office of Governor Kuroda Haruhiko, which will end in April 2018, or within five years.

Why have prices not risen after the Bank of Japan bought 250 trillion yen’s worth of government bonds and expanded its current account to 300 trillion yen? In this paper, I will focus on expectations, which are claimed to play an important role in quantitative easing in a zero-interest-rate environment. On August 27 in the United States, BOJ Governor Kuroda Haruhiko delivered a lecture titled “Re-anchoring inflation expectations via quantitative and qualitative monetary easing with a negative interest rate.” Inflation expectations, or expectations of price hikes, are discussed as a key point in monetary policy.

The accomplishment period for the CPI inflation target of 2% was revised five times

Note: The figures show the growth rate of consumer prices after holding the BOJ Monetary Policy Meeting in terms of the ratio to the same month of the previous year. Fresh foods are excluded; after adjusting the amount of consumption tax increase.

In normal economic conditions, monetary policy is interest-rate policy. How is monetary policy effective in a zero-interest-rate environment? The nominal interest rate may have a lower limit in negative territory. However, it is the real interest rate that affects the economic behavior of companies and households. The Bank of Japan’s official position is that BOJ Governor Kuroda’s monetary easing aims to push real interest rates down. The real interest rate is the nominal interest rate less the expected inflation rate. If the nominal interest rate does not fall, the real interest rate falls if the expected inflation rate rises.

The expected inflation rate indicates expectations of changes in prices. Naturally, the way prices are determined is the biggest question. Reflationary policy, which assumes that an increase in the quantity of money raises prices, is based on the quantity theory of money. Deflation (declines in prices) occurs because of an insufficient supply of money. According to the quantity theory of money, increasing the quantity of money is the only way to stop deflation.

The logic of the quantity theory of money is stronger than advocates of reflationary theory say it is. The “comprehensive assessment” of policy announced by the Bank of Japan on September 21 states that one of the reasons that prices had not risen as initially expected (in April 2013) is falling oil prices from the summer of 2014. US economist Milton Friedman, who was a champion of the modern quantity theory of money, emphasized that the trends of general prices are not affected by oil prices, but are determined by the quantity of money.

As the economy has been stagnant for a long time and the potential growth rate has declined, monetary policy is hardly effective. As a result, prices do not rise. The quantity theory of money says that this is not correct because the theory says that prices are determined not by the real growth rate, but by the quantity of money.

According to the classical quantity theory of money, the relationship between the quantity of money and prices is in a black box, and expectations do not play any particular role. “Expectations” has become a key word in macroeconomics, which has changed significantly in the past thirty years. According to the new macroeconomic theory on which the theory of reflation is based, if the central bank expands the money stock (money supply) significantly, the expected rate of inflation climbs and prices also rise. This is the global standard of macroeconomics.

The question is whether or not this macroeconomic model is an appropriate model of the real situation of the economy. In the theoretical model, there is only one representative consumer who believes in the quantity theory of money. I do not think that the mainstream macroeconomic model is a macro model that describes the real situation correctly.

Some point out that the expected inflation rate has climbed since the “different dimension” of easing was introduced in April 2013. The Bank of Japan has often mentioned expected inflation statistics. However, these statistics do not describe meaningful expected inflation. What is in question in relation to the goal of monetary policy is individual companies and households’ expectations of percentage changes in prices.

The difference between the returns of inflation indexed bonds and straight government bonds (premium) is a measure of expected inflation. However, these are only expectations on which participants in the financial market of inflation indexed bonds have agreed. This is the result of the Keynesian beauty contest.

When we think about prices, we need to start by distinguishing the prices of commodities, such as crude oil, which are significantly affected by market conditions, from the prices of a number of goods and services that constitute the consumer price index. The former prices, or prices of primary commodities, including agricultural products and crude oil, are determined on international markets in accordance with supply and demand. A number of commodities are traded on futures markets, and expectations play a considerable role.

The prices of manufactured goods and services are determined in a completely different way from the way the prices of primary commodities are determined. The prices of manufactured goods and services are determined by producers, who place the greatest importance on production costs.

The producer needs to set prices that companies and individuals, the potential buyers, are expected to agree on. Bakeries that raise the price of bread without careful consideration will lose customers if the price is not considered to be fair. Production costs should be able to be observed by both sellers and buyers, and should make sense to them. The quantity theory of money is useless for this pricing process at a micro level. No sellers will raise the prices of coffee or steel sheets merely because prices are expected to rise.

The production cost is determined by the labor cost and raw material expenses (the expenses for energy and finished goods include the costs of raw materials). The prices in yen of imported raw materials change due to international prices of primary commodities (in dollars) and exchange rates. Domestic prices fall (rise) when the crude oil price falls (rises) or the yen appreciates (weakens).

A fall in the oil price will certainly lower commodity prices, but advanced economies other than Japan have not fallen into deflation. I pay particular attention to trends in nominal wages, which have a significant impact on production costs, as a variable that is the key to deflation in Japan. Advanced economies did not experience deflation after the war because nominal wages did not fall after the war as they did before the war. The downward rigidity of nominal wages blocked deflation. In Japan, however, the downward rigidity ceased to exist from towards the end of the 1990s to the first decade of the 2000s.

Expectations do not play a major role in the pricing process at a micro level. Expectations mean expectations of future events, such as price hikes. Two entities, such as the seller and buyer and the company and labor union, cannot agree on the future. When both parties determine prices and wages, it is the past and present that play the key role. In this respect, the pricing process is fundamentally different from financial and asset markets, which are constantly looking to the future.

The experiment that ran for three and half years from April 2013 has revealed that deflation is not a monetary phenomenon. Some say that the “different dimension” of easing succeeded in the first year, but I doubt that. Looking at the individual items of the consumer price index, we find that utility charges and a number of services, as well as energy, reflected the effect of rises in utility costs.

The main factor that has caused prices to change is not the quantity of money, but oil prices. During the period, expectations have not played a role in determining prices. Expectations will not play a significant role in determining consumer prices.

Translated by The Japan Journal, Ltd. The article first appeared in the interview column of The Nikkei newspaper on 29 November 2016 under the title, “Kitai de bukka wa agerareruka” (Do expectations raise prices? [1]). The Nikkei, 29 November 2016, p. 26. (Courtesy of the author)