COVID-19 Pandemic and the Economy: Need Sound Public Finance for Maintaining Social Safety-Net

Nobuhiro Kiyotaki, Professor of Economics, Princeton University

Key points

- Should corporate bankruptcies increase, credit crunch may follow

- Postponing retirement is more effective than high inflation for fiscal consolidation

- Promoting open economy is important for growth after the containment of COVID-19

Prof. Nobuhiro Kiyotaki

Following COVID-19 pandemic and government restrictions on social and economic activities, the global economy plunged into the deepest recession of the postwar era and the lives of people have been affected profoundly. This article discusses the impact of the COVID-19 pandemic, policy responses and the future direction from a macro-economic perspective.

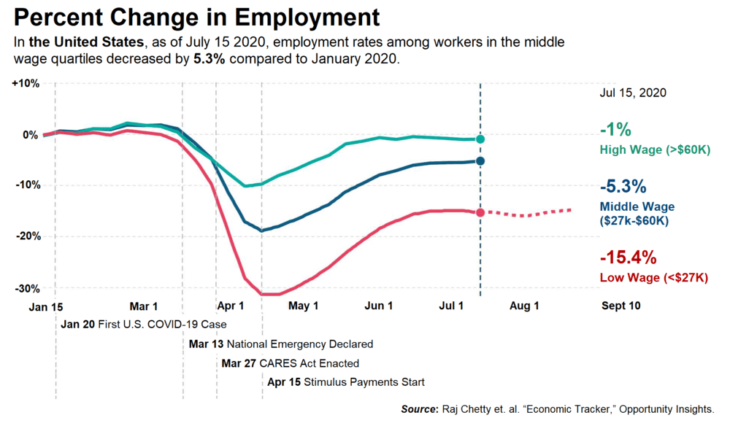

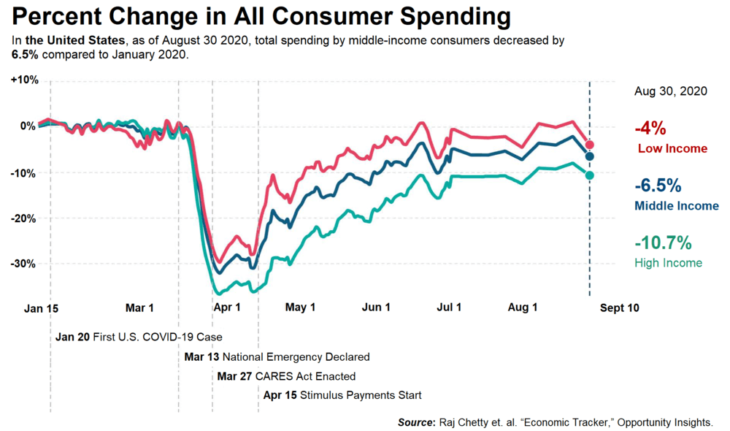

The COVID-19 pandemic makes it difficult to engage in activities that involve social contact and possibility of infection. Consumption, especially services consumption in restaurants, leisure and hospitality, has decreased significantly. Let us look at consumption and employment in the United States by referring to data collected by Professor Raj Chetty of Harvard University and others. (See Figures.)

Consumption plummeted and has been recovering slowly in the areas where the average income of residents is high, whereas it decreased less and has recovered quickly in the areas with low average income. In particular, consumption of relatively poor areas bounced back since April 15, 2020 when the stimulus payments started. On the other hand, low-wage employment dropped significantly and has been recovering slowly, while high-wage employment fell less and returned to normal in June 2020.

In Japan, according to research by Professor Sagiri Kitao of University of Tokyo and others, the employment of regular, male, middle-aged and old workers remained almost unchanged as of June 2020, while the employment of contingent, female, young workers has been deteriorating. As a result, the savings of high-income households increased and those of low-income households decreased. The high-income households still refrain from expanding spending because they worry about the infection. We do not expect consumption and the economy to recover fully as long as the risk of infection remains high.

Concerning fiscal policy, governments around the world expanded the expenditures on scales larger than during the Global Financial Crisis from 2008 to 2010. In Japan, citizens received a lump sum transfer of 100,000 yen (approximately 950 dollars) per person. The cost-performance of this policy was low, considering that high-income households have increased their savings and were not overly in need of a cash transfer. Meanwhile, this could be a second-best option, because there were only a limited number of measures available to promptly help financially struggling households. Because of such fiscal expansion, fiscal deficit has risen quickly and the Bank of Japan has continued to purchase government bond in the secondary market.

Regarding finance, unlike the Global Financial Crisis which was triggered by the defaults of residential mortgage-backed securities, the current crisis is characterized by the rising credit risk of corporate sector and emerging markets. In March, the interest rates rose sharply for the low-grade corporate bonds, the collateralized loan obligations secured by corporate loans and commercial real estate loans, and government bonds of emerging market economies. Facing a danger of financial crisis, central banks around the world cut policy interest rates and injected large amounts of liquidity into markets. They also introduced new measures, including the direct purchases of corporate bonds and the support of commercial bank loans to small and medium-sized businesses. As a result, the turmoil in the financial markets subsided temporarily. However, if corporate bankruptcy increases, financial institutions’ balance sheets will deteriorate, leading to the possibility of credit crunch.

What policies should we adopt next?

First and foremost, we should maintain and enhance social safety-net. Maintaining a minimum standard of wholesome and civilized life for the people is the responsibility of the government. It is necessary for the government to strengthen the system for promptly identifying and helping struggling households, rather than providing transfers lump sum.

Despite policy interventions for encouraging businesses to maintain employment in the short run, it is inevitable for some old businesses to close and be replaced by new businesses in the medium term. The government should protect people, not businesses. Considering needs to revitalize the economy and society, it is important to provide job finding assistance to those who lost jobs with business closures. Social safety-net such as job finding assistance, health care, elderly care and public pensions is costly, but is absolutely necessary.

What should we do with the fiscal deficit? Governments in developed countries are responsible for providing insurance against disaster risks that private insurance companies are unable to cover. One can think that governments are paying insurance claims to support people’s lives when a large disaster, such as earthquake and the Covid-19 pandemic, strikes. Naturally, this will result in a budget deficit in the short run. In the medium term, however, insurance premiums must be charged to balance the budget.

In Japan, some argue that a majority of the government bonds are denominated in yen and held within Japan, so that there is no need to worry about the fiscal deficit. However, it will be necessary to sell Japanese government bonds (JGBs) overseas in the near future, as the population continues to age and the birth rate continues to be low. If the oversea holders will not roll over the JGBs, the yen will weaken as the inflation rate will rise, even if the Bank of Japan provides support for the roll-over in the short term. In that event, it would be difficult to control inflation and continue to refinance JGBs without fiscal consolidation. Taxing businesses and high-income households would not attain full-fledged fiscal consolidation, because they may move out of the country.

Some others believe that because the interest rates on government bonds have been lower than the growth rate of the nominal gross domestic product (GDP), the ratio of government debt to GDP will stabilize even if the government primary balance is in deficit. In this case, the question is at which level the debt-to-GDP ratio will stabilize. Assuming, for example, that the government primary balance is 3% of GDP in deficit and that the interest rate on government bonds is lower than the nominal GDP growth rate by 1%, the ratio of government debt to GDP will be 3%÷1%=300% in the long run. I think that in an open economy with a declining population in the future, leaving such a large amount of government debt for the next generation is the egoism of the present generation.

Then, what should we do to consolidate public finance in the medium term? There are three measures to restore fiscal balance: spending cuts, increasing revenues, and inflation. If the inflation rate rises significantly, purchasing power is transferred from the low-income and old households who have a majority of savings in monetary assets to the high-income and middle-aged households who have houses, stocks, and other real assets. This would be unfair and should be avoided.

The life expectancy of people in Japan is one of the longest in the world, and this is a good reason to postpone retirement and advance women in the workplace. Unless we work about half a lifetime and pay taxes and insurance premiums, the period in which we rely on our own savings, government and our families will be longer than our working years. If the retirement age is extended, pension expenditures would decrease and revenues from tax and social insurance premiums would increase. Accordingly, this would be an effective way of restoring fiscal balance.

As the population ages in China and many other countries in the future, the world economy will be likely to shift from too-much savings to too-little savings, which may put upward pressure on real interest rates. Fiscal consolidation cannot be postponed for a long time. On the other hand, if the fiscal balance is attained in the medium term, and if the Bank of Japan maintains its independence and is able to control policy interest rates – including the interest rate on reserves, high inflation can be avoided.

In general, if there are several policy targets and instruments, it is appropriate to assign the most effective policy instrument to achieve each target. Regarding macroeconomic policy, monetary policy plays the major role of adjusting inflation and macroeconomic conditions; social safety-net protects people’s lives; and fiscal policy takes responsibility for income distribution and fiscal sustainability.

What should we do to ensure the Japanese economy recovers? Most likely, if the COVID-19 pandemic is contained, consumption will expand and corporate investment in tangible and intangible assets will recover. To sustain the growth further, it is important to promote an open economy. Direct investment and intra-industry and intra-firm trade are two-way between relatively affluent countries. This benefits both countries through increased productivity and consumption variety. As travel and immigration also contribute to the vitality of the economy and society, it would be better to gradually lift restrictions, while controlling the adverse effects, such as infection.

During the recent implementation of policies, the importance of data for policy making and evaluation became clear. Collecting data to figure out what is happening now (so-called now-cast) in cooperation with the private sector is particularly useful for policy making. Furthermore, it is important to critically assess the effects of each policy intervention and make the most of such evaluations for designing future policies. To achieve this, panel data of individual households and businesses should be collected and made available for research and policy evaluation, while respecting people’s privacy. The people have the right to know whether tax money is being used properly.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on September 17, 2020 under the title, “Korona kiki to Keizai/kinyu (I): Shakaihosho iji e, zaisei kenzen ni (COVID-19 Pandemic and the Economy: Need Sound Public Finance for Maintaining Social Safety-Net).” The Nikkei, September 17, 2020. (Courtesy of the author).

Keywords

- Kiyotaki Nobuhiro

- Princeton University

- COVID-19

- corporate bankruptcy

- credit crunch

- consumption

- savings

- retirement age

- social security

- public finance