A Review of Abenomics: Results in Terms of Escaping Deflation and Positive Economic Change

ITO Takatoshi, Professor at Columbia University, Senior Professor at the National

Graduate Institute for Policy Studies (GRIPS)

Key points

- The “first arrow” succeeded, but the “Price Stability Target” of 2 percent has not been reached

- Building a framework for monetary and fiscal collaboration to combat COVID-19

- Success in terms of TPP11 coming into effect and attracting tourists to Japan

Prof. Ito Takatoshi

The reason the Abe administration stayed in power for such a long time was that it maintained an approval rating of more than 40%. Moreover, a major contributing factor to that high approval rating was positive macroeconomic change through the success of Abenomics. This paper mainly discusses the Abe administration from December 2012 to September 2020.

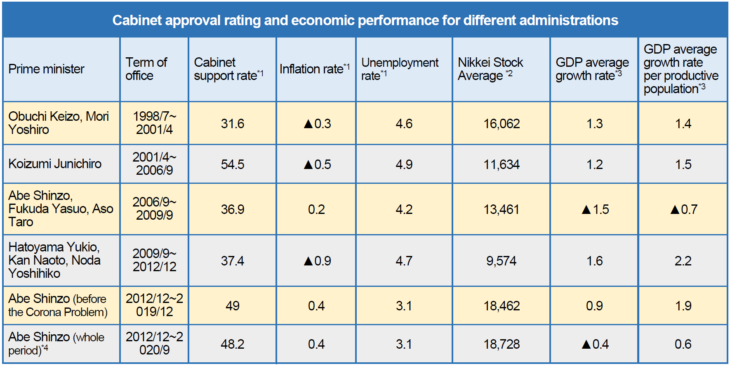

Let us compare the inflation rate, unemployment rate, and Nikkei Stock Average during the Abe administration with those of cabinets since 1998 (short-lived cabinets are totaled) (see table). The inflation rate was 0.4%, which was the highest for the period, so it appears true that deflation was ended. The unemployment rate was 3.1% and the hiring situation kept improving. The Nikkei Stock Average also exceeded an average of 18,000 yen throughout the period. All three were the best in the past two decades or so.

Looking at the Cabinet approval rating since 1998, it was the highest only after the Koizumi administration. However, if we examine the economic performance of the Koizumi information, the inflation rate was -0.5% and the unemployment rate 4.9%, thus trailing behind the Abe administration. Both were administrations with high approval rating and a long life, but the Abe administration had a positive macroeconomic change that the Koizumi administration did not.

Meanwhile, the Abe administration’s average growth rate was 0.9% until the fourth quarter of 2019, before the effects of COVID-19 started showing, but that whole increase was lost in the six months that followed. However, it may be apt to take into consideration the population decease since the average growth rate for the working-age population during the Abe administration was 1.9% before COVID-19 and 0.6% if we include everything up to the second quarter of 2020. Before the COVID-19 pandemic, they outperformed the Koizumi administration and had achieved a growth rate of nearly 2%. Thus, I believe it is reasonable to say that Abenomics showed remarkable success as far as growth rate goes.

*1: period average, %

*2: month end, period average

*3: on an annualized basis, %

*4: The Cabinet approval rating is taken from the NHK’s “Cabinet Approval Rating Poll.” The inflation rate is in comparison with the consumer price index (CPI; all goods except fresh food and energy) of the same month one year prior. The GDP average growth rate is an annualized rate from the quarterly growth rate calculated based on an assumption of constant-rate growth from real GDP at the time of inauguration to real GDP at the time of retirement. * In addition, the GDP average growth rate is until the 2nd quarter of 2020, while the inflation rate, the unemployment rate, and the Nikkei Stock Average are until August 2020. ▲ means negative.

The “first arrow” of Abenomics was “aggressive monetary policy,” identifying an escape from deflation as a priority task. This is why the Bank of Japan (BoJ) and the government issued a consensus document on a policy of 2% inflation target in 2013 and Kuroda Haruhiko was appointed BoJ Governor since he understands inflation-target policy. Governor Kuroda announced a quantitative and qualitative easing (QQE) policy that exceeded market expectations in April 2013, which caused the yen to depreciate and raised stock prices. Subsequently, he increased asset buying in October 2014. This further lowered the yen and raised stock prices.

The negative interest-rate policy was introduced in January 2016, which dropped the long-term interest rates below zero and greatly diminished the profit margins of financial institutions. Amid criticism from financial institutions, yield curve control (YCC; control of short-term and long-term interest rates through market operations) was introduced in September 2016, thus more or less stabilizing the long-term interest rates around zero. The BoJ removed quantitative easing (purchases of Japanese government bonds) itself from its operational goals and switched to make the level of the yield curve as a whole into a target.

At the same time, Governor Kuroda stated that tightening would not come as soon as the 2% target is reached but introduced an “inflation-overshooting commitment” that would allow them to exceed 2% for a time.

The policy adopted by the BoJ also includes some progressive contents. In August 2020, four years after the BoJ, the Chair of the Board of the Federal Reserve (FRB) Jerome Powell declared that they would introduce an inflation-overshooting commitment in the United States as well.

Nonetheless, the inflation target of 2% could not be achieved under the Abe administration. The reason for this failure was that there was no wage increase exceeding the inflation rate, which did not allow consumption to increase so much and thus suppressed commodity prices. Moreover, despite the government and the BoJ pursuing the 2% target, the inflation forecast did not rise. The “first arrow” was a success, but it is marred by the failure to achieve the 2% target.

The “second arrow” was a “flexible fiscal policy.” Right at the time of its formation, the Abe administration put together a major supplementary budget for FY2012 (13.1 trillion yen). This became a powerful fiscal stimulus to escape deflation. Owing to the fiscal stimulus and QQE in FY2013, there were rapid improvements to growth rate, inflation and employment. Then, the consumption tax rate was raised from 5% to 8% in April 2014 just as planned.

It came as no surprise to most economists when this led to negative growth in the second quarter of 2014. However, they had not anticipated that consumption would not return to the growth trend observed prior to the tax increase after the third quarter. A tax increase to 10% was postponed twice and then finally realized in combination with an introduction of a reduced tax rate for food in October 2019.

Raising the consumption tax rate twice was a major accomplishment for the long-term health of public finances. At the same time, reducing the budget deficit is not proceeding as planned. A major supplementary budget had to be put together for FY2020 to combat COVID-19 and if we include the two supplementary budgets, the issuance of new government bonds amounted to about 90 trillion yen, which was about 2.5 times more than the previous year. This greatly exceeded the issuance of new bonds (about 52 trillion yen) in FY2009 after the Lehman Shock.

The BoJ’s YCC promotes the buying of government bonds to keep the long-term interest rates from increasing, so the government resolutely can boost the issuance of new bonds without any worries. As the central bank became more passive about buying government bonds, all counter-cyclical policy was entrusted to the government’s fiscal policy. In this sense, YCC is facilitating the building of a system of monetary and fiscal collaboration in Japan. What is important is that this is backed by the inflation-target policy. If the inflation rate were to greatly exceed 2%, that would incentivize the central bank to resolutely raise the interest rate from a monetary policy perspective.

The “third arrow” was growth strategy. Private investment is to be stimulated by relaxing regulations, revitalizing the capital market, developing infrastructure, entering free trade agreements (FTAs), and so on, thereby boosting productivity and causing the potential growth rate to rise. I will briefly introduce some success stories.

The Abe administration has made some key decisions about FTAs and economic partnership agreements (EPAs). Less than two months after the administration’s formation, they decided to join the negotiations for the Trans-Pacific Partnership Agreement (TPP). They subsequently agreed on the TPP, but US President Trump decided to withdraw after his inauguration, thus leaving the matter unsettled. Even so, Japan has shown leadership and persuaded the other 11 countries to adopt the TPP11 (Comprehensive and Progressive Trans-Pacific Partnership, CPTTP). An EPA was formed with the EU in 2018 and it came into effect in February 2019.

They also succeeded in attracting tourists from abroad. The number of visitors to Japan was about 10 million in 2013 and then it rose to about 20 million in 2015 and more than 30 million in 2018. The reasons for the success were the significant relaxation of criteria for visas to visitors from Asian countries and the successive arrival of low-cost carriers (LCCs) to Narita Airport, while slots at the Haneda Airport for international flights were expanded significantly.

Another success story is the womenomics, which increased the female employment rate. The M-shaped curve, which describes a drop in employment rate among women during child-bearing and -caring ages, had disappeared almost completely by 2020.

There is one thing I would like to add with regard to these success stories. All of these examples of successful growth strategy were actually discussed by the Council on Economic and Fiscal Policy during the first Abe administration and the Fukuda administration (2006–2008). The reinternationalization of Haneda Airport was decided after persuading the Ministry of Land, Infrastructure, and Transport. The importance of FTAs and other agreements was also discussed.

This concludes my quick evaluation of the three arrows. My conclusion is that the “first arrow” and the “second arrow” were successful overall while it is difficult to claim that the “third arrow” was. The Abe administration has come to an end, but the importance of Abenomics remains intact.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 28 September 2020 under the title, “Abenomikusu no sokatsu (1): Defure dakkyaku to Keizai koten, seika (A Review of Abenomics: Results in Terms of Escaping Deflation and Positive Economic Change).” The Nikkei, 28 September 2020. (Courtesy of the author)

Keywords

- Ito Takatoshi

- Columbia University

- National Graduate Institute for Policy Studies (GRIPS)

- Abe administration

- inflation rate

- unemployment rate

- Nikkei Stock Average

- growth rate

- first arrow

- 2% inflation target

- aggressive monetary policy

- second arrow

- flexible fiscal policy

- third arrow

- growth strategy

- yield curve control

- COVID-19

- EPAs

- TPP11

- womenomics