Corona Crisis and Fiscal Expansion: Continued Debt Refinancing Entails High Risk

Ueda Kazuo, Professor, Kyoritsu Women’s University

Key points

- A shift to a total rejection of fiscal deficit and government debt

- Large government debts negatively impact potential growth rate

- Continuing to refinance entails the risk of heavy losses

Prof. Ueda Kazuo

Every country’s finances have deteriorated significantly, mainly due to expansionary fiscal policies in response to COVID-19. According to the International Monetary Fund (IMF), the ratio of outstanding debt to GDP in developed countries in 2020 will exceed that immediately following World War II, making it the highest since the late nineteenth century. Currently, governments have no choice but to continue to support their economies through fiscal policy. However, a major challenge is the medium- to long-term reduction of fiscal deficit and government debts, which have ballooned to an unprecedented scale.

Modern Monetary Theory (MMT) has become a hot topic in relation to how to address this issue. MMT asserts that as long as inflation does not occur, countries that can issue their own currency need not be concerned about increased government debts. A recent applicable example is the sharp rise in the government bond interest rate at the time of the Euro crisis around 2010 in countries such as Italy, which has a high level of government debt and does not have the right to issue its own currency.

However, this discussion can be had within the scope of traditional economics without drawing on MMT. Also, when considering questions such as whether a high level of outstanding debt is really sustainable in the absence of inflation, and whether it will have an adverse impact on the economy, we need to go beyond MMT.

The key determinant of whether a fiscal deficit is good or bad or whether it is sustainable is the relative relationship between interest rates and growth rates. If interest rates are higher than growth rates, current government debts, which are the result of past fiscal deficit, must be financed by future tax increases. High interest rates are good in that they result in high productivity, increased investment, and an expanded economic pie. Conversely, when interest rates are below growth rates, capital is over-accumulated and productivity is low. There is room to increase consumption and fiscal spending, but not investment.

Moreover, this creates room for a “Ponzi game” in which, for example, the fiscal deficit caused by transfer payments to the elderly is covered by the issue of government bonds, with the principal and interest also covered by the issue of government bonds. This is because outstanding government bonds increase at the interest rate, but the economy expands at a higher rate, so the ratio of government bonds to GDP shrinks.

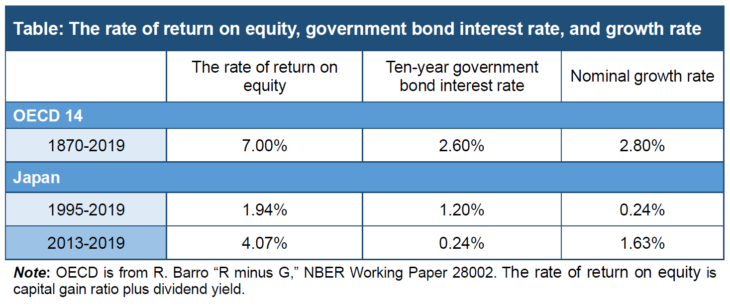

It is not easy to determine which is larger in reality. This is because there are various interest rates, such as the government bond interest rate, and the rate of return on equity, which is similar to the productivity of capital. The table shows the results of comparing the ten-year government bond interest rate and nominal growth rate, using the rate of return on equity to proxy productivity. The average of the OECD14 countries over the past 150 years shows the rate of return on equity higher than the growth rate. Capital accumulation does not seem excessive.

On the other hand, the government bond interest rate is slightly below the growth rate, and there would seem to be room for a Ponzi game-like issuing of government bonds to continuously cover the fiscal deficit. If the interest rate is on average much lower than the growth rate, the Ponzi game is likely to succeed, but the possibility that the opposite will continue and the ratio of government bond to GDP will explode cannot be ruled out.

If the Ponzi game is successful, increased fiscal spending and the continued refinancing of debt may improve economic welfare even without excessive capital accumulation. The tone of the academic community has changed considerably from asserting as it once did that fiscal deficit and high levels of government debt are always bad and should not be neglected.

Turning to the situation of Japan in recent times, over the past 25 years, on average the rate of return on equity has been higher than the growth rate and interest rate, while the growth rate has been lower than the interest rate (see Table). However, during the seven years of Abenomics, the growth rate has been higher than the interest rate.

During this period, the interest rate was higher than the growth rate, except in the short term, owing to the negative deflationary nominal growth rate in many years. In contrast, the past seven years have seen a reversal phenomenon, with Abenomics pushing up the growth rate and the Bank of Japan (BoJ) pushing down long-term interest rates to the lowest level. However, it is not clear from this data alone what the relationship between the two will be outside these unprecedented times.

A more fundamental problem is that during this period, the primary balance deficit continues to exceed 4% of GDP on average, and outstanding government bonds continue to increase. As long as this deficit is not corrected, the ratio of government debt to GDP will continue to grow unless the interest rate falls significantly below the growth rate for a sustained period. The intergenerational income redistribution, which is considered to potentially raise economic welfare, has already progressed to the limit in Japan.

One of the harmful effects of high levels of outstanding government bonds that are continually increasing is that the economy is vulnerable to rising interest rates. If the interest rate remains above the growth rate as in deflationary years, the burden on government finances will increase drastically.

There is also the possibility of a bank run-type scenario of rising interest rates, as seen in developing countries. If many investors sell government bonds believing that Japan’s finances are unsustainable, interest rates will rise sharply and public finances will collapse. Naturally, this possibility is more likely to occur the higher the outstanding debts are.

Another harmful effect of high levels of government debts is that it anticipates future taxation. Taxation usually distorts the economy. The fact that rates of taxation change over time is a further source of distortion. In an aggravated fiscal situation, the government may be expected to raise tax rates in the future, either of its own accord or driven by the debt crisis. For example, if the taxation of asset income is expected to increase in the future, it may reduce the potential growth rate through the subsidence of the animal spirit of entrepreneurs or the outflow of talented people overseas. This may be an important factor in the recent economic downturn in Japan.

So, returning to the MMT argument, will the situation be saved by the Ponzi game option of giving up on fiscal consolidation through increased taxation, letting the BoJ continue with its long and short interest rate control measures, and continuing with debt refinancing?

One scenario where this policy will be successful is if the BoJ is able to continue to curb the long and short interest rate because inflation and growth rates remain low. However, it may be that the expected increase in taxation mentioned above never stops, and the potential growth rate continues to be severely negatively impacted long term. Also, this option is not a solution when the economy falls into a deflationary phase as in the late 1990s to the early 2000s. Since the interest rate is stuck at the zero lower bound and the growth rate is negative due to deflation, the ratio of government debt to GDP will continue to grow.

Another possible scenario for success is if for some reason the inflation rate slowly rises to around 2%, and if fortuitously the interest rate and growth rate rise by about the same amount, and the growth rate continues to exceed the interest rate. A decline in the real value of existing debt will also be positive for public finances. In this scenario, however, the BoJ will no longer be buying long-term government bonds. This means it will not be able to contain large increases in the interest rate when a debt crisis ocurrs on the high level of outstanding debt. If the BoJ is forced to continue its bonds buying operations, the risk of hyperinflation ensues.

According to one researcher who analyzed the government’s Ponzi game, the choice is similar to that of a homeowner not purchasing fire insurance (which in this analogy equates to fiscal reform) and pray that a fire does not occur. A fire may in fact not occur and the person will benefit from the savings on insurance premiums. However, we cannot rule out the chance that a fire does occur (the interest rate is higher than the growth rate), and the residents of that house (the Japanese economy) are exposed to the risk of severe damage.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 23 December 2020 under the title, “Korona kiki to zaisei bocho (II): Saimu norikae keizoku, ko-risuku (Corona Crisis and Fiscal Expansion: Continued Debt Refinancing Entails High Risk).” The Nikkei, 23 December 2020. (Courtesy of the author)

Keywords

- Ueda Kazuo

- Kyoritsu Women’s University

- COVID-19

- fiscal deficit

- fiscal expansion

- government debt

- debt refinancing

- growth rate

- Modern Monetary Theory (MMT)

- interest rates

- Ponzi game

- rate of return on equity

- Abenomics

- taxation