Protect Workers rather than Zombie Firms: How Do We Rejuvenate the Economy?

Takeo Hoshi, Professor, University of Tokyo

Key points

- Staying afloat with support despite no hope for performance recovery

- Hurting the profitability of healthy firms and the economy as a whole

- Urgent need for policy shift to protect employment rather than firms

Prof. Takeo Hoshi

When the main character Barbara and her brother visit their father’s grave in the cemetery, an unknown man approaches them with clumsy steps from afar. This is the first scene where a zombie appears in the Night of the Living Dead (1968), which is credited with inventing the zombie movie genre.

There are firms that perform badly and have little hope of recovery but that are kept afloat with support from creditors and the government, negatively affecting other firms and stagnating the economy. Likening this to zombie movies, Ricardo J. Caballero, Professor at Massachusetts Institute of Technology, and Anil K. Kashyap, Professor at Chicago University, started writing their economics paper on zombie firms almost twenty years ago.

Initially, it was an analysis that focused on the problems of the Japanese economy in the 1990s, but as the number of suspected zombie firms increased in Europe and among Chinese state-owned firms after the global financial crisis, the issue of zombie firms came to be discussed more generally. There are also worries that governmental relief financing during the current COVID-19 crisis will only exacerbate the zombie problem post-COVID in the case of firms whose performance was poor already beforehand.

People talk a lot about zombie firms these days, but there are many misunderstandings about what it means as well. In this paper, I hope to clarify what zombie firms are in the first place, why they are an issue, and what is needed to resolve it.

Zombie firms are defined as firms that (1) perform badly and have little hope of recovery, but (2) are nonetheless kept afloat with support from creditors and the government. It cannot be a zombie firm unless both of these conditions are met.

For example, simply performing badly does not make the firm a zombie. This applies to cases where the poor performance is due to short-term causes and recovery will happen after a while or when business restructuring is ongoing to recover performance. Likewise, a firm that performs badly and is going bankrupt because it cannot receive support is not a zombie.

What is the problem with zombie firms? Firstly, the resources used to support the zombie firms (bank financing, governmental interest subsidies, etc.) come with opportunity costs. It is the cost of letting firms survive when they ought not to.

There is another important aspect to the zombie problem. It is that when zombie firms remain in the market, they will engage in price competition with other firms and keep hiring staff without being able to draw out their potential, thereby reducing the profitability of the other firms and making it difficult for new firms to enter the market. Zombie firms cause congestion phenomena in a variety of markets and reduce the profitability of healthy firms.

The argument goes that even if a firm performs badly, it will act like a safety net as long as it keeps hiring staff, which makes this more attractive than the alternative of it going bankrupt and increasing unemployment. Yet this argument does not sufficiently take into account the damage done to the profitability of healthy firms and the economy as a whole.

Even if employees keep working at a zombie firm, it is not certain that they will be entirely satisfied. I suspect that most people would rather work somewhere they can exert their ability to increase profit. The management would also be reluctant to continue running a firm without a future since they feel an obligation to look out for their employees.

So, how can this zombie problem be solved? One way is to restructure in an effort to restore profitability. It is possible that the government could support this. However, we also have to be wary of the risks that support can disincentivize restructuring. This becomes an issue especially when the support takes the form of financing.

As the support increases the firm’s borrowing and most of the profit from the new investments to increase profit goes to repaying past loans, so we get an issue of debt overhang that disincentivizes. To begin with, it is difficult to discern whether a company will be able to restore profitability through their own efforts.

The University of Tokyo recently conducted a questionnaire on the COVID-19 crisis together with Tokyo Shoko Research. I analyzed the results together with Professor Kenichi Ueda and Professor Daiji Kawaguchi and found that relatively many of the firms making use of financing with a de facto no-interest guarantee, which was introduced as a COVID-19 measure, had performed badly even before the crisis. We need to pay attention so that we do not get issues of debt overhang after the pandemic and that it does not develop into a zombie problem.

Another way to solve the zombie problem is to stop giving support to zombie firms, although this will unavoidably come with the risk of employees losing their jobs and struggling to make ends meet.

What ought to be culled is not the workers but the firms that are not doing well and the employment relations they have. You could say that employees stuck in zombie firms are victims. It is important to have ways to protect the livelihoods of workers who lose their jobs due to bankruptcy and finally to help them find jobs where they can exert their ability. If they require skills that differ from what their former job needed, then it is important to support them in acquiring those new skills.

Because of the premise of the lifelong employment system, Japan has not developed a sufficient governmental safety net for employment. When employment is threatened by major shocks, such as the COVID-19 shock, there is a strong tendency to try to protect employment by supporting the firms and preventing bankruptcy.

The approach of trying to protect employment by protecting the firms not only causes zombie firm issues but also narrows down the range of employment protected. In a time where the irregular employment, freelancing, and other workstyles that do not fall under lifetime employment are becoming the majority, there is a need to create a new safety net that protects the livelihoods of workers without causing a zombie problem.

We need to accelerate business and industrial restructuring so as not to cause a zombie problem at the same time as making a new safety net that can protect the livelihoods of workers. This is also one of the main points of “Proposals of the Research Society on Balance Sheet Issues during the COVID-19 Crisis 2,” of which I am one of the authors.

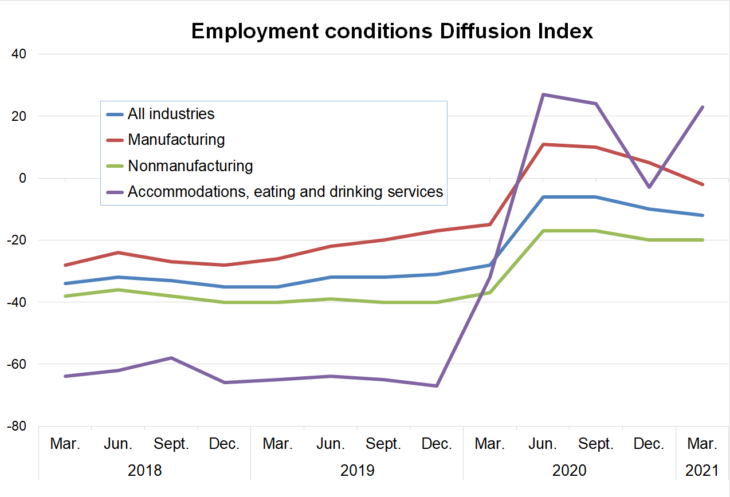

Japan has a manpower shortage even after the COVID-19 shock. If we look at the Employment Conditions Diffusion Index (DI) by the Bank of Japan’s Short-Term Economic Survey of Enterprises in Japan (Tankan Survey), the number of firms with a manpower shortage consistently exceeds the number of firms with a manpower surplus in all industries and the non-manufacturing industries as a whole also since the start of the COVID-19 crisis (see figure). Also for the accommodation and food service industry, where employment is said to have been hit hard, the manpower surplus was resolved at least temporarily in December 2020.

The employment issue is not one of overall surplus, so the question is how to ensure a smooth transfer of workers from surplus firms to shortage firms. It is our urgent task to create a system for supporting workers rather than firms, for example by developing the occupational training system.

The movie I mentioned in the beginning went on to become the prototype of Hollywood zombie movies, but the first movie to have the word “zombie” in the title was White Zombie from 1932. It is a story set in Haiti about American travelers who are put in a trance state through voodoo, used for heavy labor, and finally liberated. Zombie firms really are the kind of zombies that attack people as depicted in Hollywood movies, but the people who work there are not. As with the zombies in Haiti, we need to come up with ways to liberate them.

Note: The values represent the proportion of firms responding “insufficient employment” subtracted from the proportion of firms responding “excessive employment”

Source: Bank of Japan’s Short-Term Economic Survey of Enterprises in Japan (Tankan Survey)

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 13 May 2021 under the title, “Zonbi kigyo yori Rodosha wo Mamore: Keizai no shinchintaisha do susumeru (Protect Workers rather than Zombie Firms: How Do We Rejuvenate the Economy?).” The Nikkei, 13 May 2021. (Courtesy of the author)

Keywords

- Takeo Hoshi, Professor

- University of Tokyo

- Ricardo J. Caballero

- Massachusetts Institute of Technology

- Anil K. Kashyap

- Chicago University

- zombie firms

- employment

- safety net

- profitability

- financial crisis

- COVID-19

- restructuring

- Proposals of the Research Society on Balance Sheet Issues during the COVID-19 Crisis 2

- manpower shortage

- occupational training