Reasons for the Long-term Stagnation of Wages in Japan

Fukao Kyoji (Faculty Fellow, RIETI) and Makino Tatsuji (Hitotsubashi University)

Fukao Kyoji |

Makino Tatsuji |

In order to achieve the Kishida administration’s policy goal of raising wages, it is necessary to understand why real wages in Japan have been stagnating for the last two decades. This article therefore examines the reasons for the prolonged stagnation of wages in Japan using long-term data from the JIP Database of the Research Institute of Economy, Trade and Industry (RIETI) and Hitotsubashi University, and considers measures that should be taken.

The labor productivity of a country as a whole is measured by how much real gross domestic product (GDP) is produced per hour worked. In Japan, real GDP per hour worked in 2018 was 4,416 yen (in 2018 prices). Of this, 2,580 yen accrued to workers in the form of wages, employers’ social security contributions, etc., so that the labor share of income in 2018 was 58.4%. If real wages grow at a faster rate than labor productivity, the labor share increases.

However, such wage increases could not be sustained for long because if the labor share were to continue to rise, the rate of return on capital would fall and capital investment would decline. This is the main reason that it is important to pay attention to developments in labor productivity when considering wage increases.

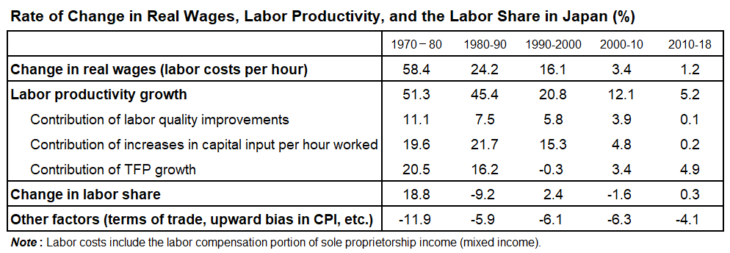

The table below provides an overview of developments in real wages by decade as well as developments in (1) labor productivity, (2) the labor share of income, and (3) other factors. By definition, the sum of (1) through (3) equals the change in real wages, ignoring errors due to approximation. Real wages are calculated by dividing hourly labor costs (wages paid directly by firms plus employers’ share of social insurance premiums) for Japan as a whole by the Consumer Price Index (CPI). Real wages in Japan have essentially stagnated since the 2000s, with the increase from 2010 to 2018 totaling only 1.2% for the entire eight-year period. The main reason is the slowdown in labor productivity growth.

The table also shows the results of growth accounting, in which labor productivity growth is decomposed into three sources. Until 1990, total factor productivity (TFP) growth, reflecting vigorous capital accumulation, technological innovation, and more efficient resource allocation, was the driving force behind the growth in labor productivity and real wages. While TFP growth decelerated substantially in the 1990s and turned negative for the decade overall, labor productivity continued to grow thanks to measures to promote investment, such as large-scale monetary easing and credit guarantees for small and medium-sized enterprises (SMEs). Meanwhile, although there was a slight recovery in TFP growth in 2000–2010, labor productivity growth almost came to a standstill due to a slowdown in capital accumulation.

The increase in TFP from 2010 to 2018 was 4.9%, which is higher than the corresponding figures for the United States, the United Kingdom, and France. However, growth in capital input per hour worked and improvements in the quality of labor fell to almost zero, so that labor productivity growth slowed further from the preceding decade. The lack of improvements in labor quality reflects the increase in part-time employment (part-time employees often receive little training and therefore do not accumulate skills) and the reemployment of retired workers at low wages. Such a period of eight years with almost no increase in capital input per hour worked and no labor quality improvements is unprecedented during the post-war period.

Moreover, unlike in the United States, Britain, and France, where the slowdown in TFP growth was compensated for by rapid capital accumulation which allowed labor productivity and real wages continued to grow, in Japan, capital accumulation essentially came to a standstill during this period. Given Japan’s declining population and slow TFP growth, the natural growth rate of the economy – that is, the rate of growth that can be sustained over the long term – is very low, so that corporate investment has also been falling. However, the weakness of capital accumulation in Japan is so severe that it cannot be explained by this low natural rate of growth alone.

The biggest disease of the Japanese economy in recent years has been the lack of investment in the future, including investment in human capital. Moreover, Japan’s TFP level is only about 70–80% of that of major European countries and the United States and there is a great deal of room for raising TFP, particularly in the non-manufacturing sector and among SMEs.

Next, let us have a look at the labor share of income. While the labor share declined in the 1980s, resulting in lower real wage growth, it has generally been stable in Japan since the 1990s and has not plummeted as in Europe and the United States. However, there are major differences across sectors. In the non-manufacturing sector, the labor share has risen slightly since 2000, while in the manufacturing sector, it has fallen markedly from 62.4% in 2000 to 55.6% in 2010 and 52.9% in 2018.

Turning to developments in real wages per hour worked by sector, whereas the non-manufacturing sector (market economy only, excluding general government, education, nursing and medical care, etc.) saw a 6.9% increase between 2010 and 2018, the manufacturing sector saw a 1.2% decrease. Therefore, although real wages per worker in the manufacturing sector rose by 2.6% between 2010 and 2018 as the average hours worked per worker increased due to the economic recovery, this is less than the increase in real wages per worker of 7.4% in the non-manufacturing sector (market economy only) during the same period.

While Abenomics – introduced at the end of 2012 – has led to a weakening of the yen and a recovery in the manufacturing sector, it was shareholders and managers who benefited, not workers. Evidence of this is provided by the fact that the average markup rate (how much sales exceed total production costs), a measure of excess returns on capital, rose sharply from 1.1% in 2012 to 5.3% in 2018.

Another interesting fact about developments by sector is that real wages per hour worked fell by 10.5% between 2010 and 2018 in sectors of the non-market economy that provide public services such as general government, education, and medical and nursing care. Of this 10.5% decline, 4.2 percentage points are due to the increase in part-time employment and the reemployment of the elderly at low wages. In 2018, the manufacturing sector accounted for 17% of total hours worked in Japan and the non-market economy for 20%, so raising real wages in these two sectors, which both have seen a substantial fall in real wages, is an important issue.

Finally, let us look at the “other factors” in the table. While GDP includes export and investment goods as well as government final consumption, the CPI does not cover these and includes the prices of imported goods. For this reason, changes in relative prices, such as a decline in export prices relative to import prices (i.e., a deterioration in the terms of trade), will cause real wages to fall even if the labor share and labor productivity remain unchanged.

Moreover, real wages also fall when indirect taxes such as the consumption tax are raised. Furthermore, the CPI tends to overestimate price increases due to peculiarities in the way it is calculated. Our estimates suggest that the negative value of “other factors” since 2000 has been generated mainly by factors other than a deterioration in the terms of trade, such as the upward bias of the CPI.

Looking at the period since 1980, in each of the decades “other factors” have lowered real wages by around 5–6%. Since labor productivity growth has fallen over the decades and the labor share has become comparatively stable, the relative importance of these “other factors” has increased. Therefore, when considering measures related to real wages, it is also essential to re-examine and improve CPI statistics and analyze the determinants of the terms of trade.

In addition to further raising TFP growth, the primary challenge for raising real wages in Japan is to increase investment in physical and human capital, which has essentially stagnated since 2010. Important issues in this context are how to best utilize low-wage part-time workers and rehired elderly workers and raise their wages, and how to increase the skills of those currently working part-time.

It is also necessary to create an environment in which Japanese firms, many of which have been focusing on non-strategic mergers and acquisitions, building up liquidity, and cutting labor costs, can boldly invest in innovation. One possible explanation for the reluctance of Japanese firms to take risks is that under the long-term employment system future wage payments to regular workers have the same effect as massive long-term debt. This is also one of the reasons why firms are hesitant to raise wages.

In this context, it is interesting to note that the government is said to be examining whether to eliminate expiry dates for “specific skilled worker” visas – a new visa category created in 2019 to attract blue-collar workers in 14 industries suffering particularly severe labor shortages. Although workers need some skills to be granted such a visa to work in Japan, the requirements are relatively lax, and the scheme is frequently used to hire cheap labor for construction, cleaning, and agriculture. Eliminating expiry dates for such visas would potentially work against wage hikes, and one concern is that the current administration lacks a coherent policy to achieve an increase in real wages.

Translated by the Research Institute of Economy, Trade and Industry (RIETI).* The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 6 December 2021 under the title, “Chingin choki-teitai no haikei (Reasons for the Long-term Stagnation of Wages in Japan).” The Nikkei, 6 December 2021. (Courtesy of the authors)

*RIETI: http://www.rieti.go.jp/en/index.html

Keywords

- FUKAO Kyoji

- Faculty Fellow, Program Director, Research Institute of Economy, Trade and Industry

- RIETI

- MAKINO Tatsuji

- Institute of Economic Research

- Hitotsubashi University

- raising wages

- prolonged stagnation of wages

- real wages

- labor productivity

- real GDP per hour worked

- labor share

- Consumer Price Index

- CPI

- total factor productivity

- TFP

- capital accumulation

- technological innovation

- resource allocation

- capital input

- average markup rate

- upward bias

- investment

- innovation