Development of Central Bank Digital Currency in the Asia-Pacific Region

Bakong, the digital currency issued by the National Bank of Cambodia, has approximately 8.5 million users as of the end of 2022. The payment amount was 15.5 million USD (2.2 trillion yen) as of the end of 2022. Although it is not possible to make a simple comparison, Cambodia’s nominal GDP is 3.8 trillion yen in 2021, so Bakong has grown to the point where nearly 60% of that amount was used through Bakong. Cooperation with overseas payment methods, such as cross-border e-commerce, is progressing rapidly.

Photo: Courtesy of Soramitsu

In Cambodia, Bakong, the world’s first digital currency issued by a central bank, has been welcomed by the people and widely established. The author, who helped design and implement it, discusses the factors behind its success in the country, as well as its further development and future opportunities in the Asia-Pacific region.

Miyazawa Kazumasa, President, Soramitsu Co., Ltd.

1 Introduction

This article introduces the development of central bank digital currencies (CBDCs) in the Asia-Pacific region and the efficiency of cross-border remittances, taking into account the latest developments in Cambodia. In Cambodia, the digital currency “Bakong” issued by the National Bank of Cambodia (NBC) officially launched in October 2020. Japanese fintech startup Soramitsu Co., Ltd. also participated in the development and design of Bakong.

I currently serve as the president and representative director of Soramitsu, and since 2017 I have also served as the general manager of Bakong development. In addition, I previously worked at Sony and was involved in the establishment of the Edy electronic money and the development of the Suica transportation IC card.[1]

Currently in Cambodia, QR code payment services provided by major banks such as ABA Bank and ACLEDA Bank are available everywhere in the city, including street stalls, markets, and taxis. Also, unlike Japan, QR codes in Cambodia are standardized to one code, “KHQR.” With this one type of QR code, you can use payment services provided by about 50 companies. Money transfers are completed instantly, in about 2 seconds. This convenient payment method is now available in Cambodia.

Since its official launch in October 2020, Bakong has quickly become popular. But in reality, ordinary people in the city don’t know much about the name “Bakong” itself. People make payments through apps such as ABA Bank and ACLEDA Bank, or the e-money app called Wing. Bakong is the backbone between the central bank and the commercial banks/payment operators, which is the wholesale part, so the general public uses digital payments without knowing that Bakong exists.

2 Bakong features and design

2.1 Features of Bakong

First, I will explain the general structure and overview of Bakong. Bakong currently uses a type of issuance called “indirect issuance.” Bakong issued by the central bank is distributed to commercial banks, which in turn distribute it to general consumers and enterprises. In addition, ordinary bank deposits are linked using interbank APIs based on ISO-20022, so when you move bank deposits, Bakong increases or decreases in real time.[2]

Bakong has approximately 8.5 million users as of the end of 2022. Users directly use the apps of each bank/operator, and this is the number of people who use Bakong indirectly. Until 2021, the number of users was around 500,000, but the number of users increased rapidly in 2022. It is believed that the aforementioned unification of QR codes by KHQR contributed greatly to this rapid expansion. The number of merchants has also increased dramatically, from 230,000 stores in 2021 to 1.5 million stores in 2022. The payment amount was 15.5 million USD (2.2 trillion yen) as of the end of 2022. Although it is not possible to make a simple comparison, Cambodia’s nominal GDP is 3.8 trillion yen in 2021, so Bakong has grown to the point where nearly 60% of that amount was used through Bakong.

Next, we will introduce Bakong’s features in more detail, focusing on five points. The first feature is that it provides a compatible mechanism among many financial institutions/payment operators. As of November 2023, 31 banks and 13 payment operators (money transfer operators) are participating in Bakong. These participants use a common API provided by the central bank and integrate it into each company’s applications, creating a compatible system.

The second feature is that you can use the apps of any company that offers payment services in any store. Before the introduction of Bakong, each bank and merchant issued QR codes individually, and stores had to display a large number of QR codes for each service. Therefore, NBC took the lead and unified the QR codes into KHQR. At present, all payment services can be used with just one KHQR, so users feel safe, and stores only need to display one KHQR, making it more convenient.

The third feature is that payments between stores and companies can be easily made across borders. KHQR is based on a format that complies with EMV, the unified global standard for electronic payments, and is compatible with other countries.[3] For example, the apps from Cambodia are also available in Thailand and Vietnam. Currency exchange can be done instantly, so there is no need to go to a currency exchange shop. In the past, the EU unified its currency into the Euro, but I believe that if one country’s currency can be used anywhere in Asia through digital technology, there will be no need for currency integration from now on.

The fourth feature is that there are no fees for transferring money between financial institutions, and there are no fees charged to merchants. I think it’s meant to be a promotion, but the NBC has issued a directive to reduce merchant fees to zero by the end of 2024, and banks are currently unable to collect merchant fees.

The fifth feature is that even Cambodian citizens who do not have a bank account or foreigners such as tourists can open an account online. However, if you open an account with only a simple form of identity verification, such as authentication using only a phone number, the maximum daily payment amount will be limited to $250. On the other hand, if you go through strict identity verification, either in person at a bank or through the eKYC (electronic Know Your Customer) system, the maximum daily withdrawal amount will be $2,500 or more. Another feature of Bakong is that it sets the payment limit in two stages, depending on the method of identity verification.

2.2 Bakong’s design policy

Next, I will summarize Bakong’s design policy. This policy was formulated in 2017, after six months of repeated discussions between Soramitsu and NBC in preparation for the introduction of Bakong.

First, we have established the following five basic policies: (1) [Bakong] to coexist with cash, (2) to realize exchange and coexistence with private payment methods, (3) the central bank has access to the ledger but does not have any personal information, (4) as with deposits, commercial banks must verify your identity and manage your personal information, and (5) commercial banks must obtain necessary user information according to the maximum transaction amount.

The issuance policy of Bakong is to “take the form of indirect issuance through an intermediary institution.” Bakong is positioned as a substitute for cash, i.e. “M0” (banknotes + central bank reserve deposits), and the same amount of Bakong is issued when cash is collected. Currently, there are two types of currency in circulation in Cambodia: the local currency, the Cambodian Riel, and the US dollar, but in both cases, cash is collected and the same amount of Bakong is issued. In this way, we keep the amount of currency circulating in the market unchanged and prevent inflation. Bakong also has no credit creation function and no interest. We believe these are the functions that bank deposits should perform and Bakong is positioned solely as an alternative to cash.

In addition, we simplify the management system by assigning one account to one mobile phone number. It also provides a common API for connecting to external systems and enables real-time money transfers with bank deposits and payment providers under an ISO-20022-compliant mechanism. In addition, we have set up a system to issue licenses to companies that use Bakong based on the amount of money they handle.

2.3 Blockchain-based design

Bakong is designed using blockchain. There are four main advantages to using blockchain.

First, blockchain has extremely strong security, so it cannot be tampered with or used twice, and it also prevents spoofing. It is also considered ideal for digital currency because the system does not stop.

Second, blockchain can shorten long payment chains, significantly reducing costs and promoting economic circulation. Instant payments and quick turnover have been realized, contributing to improved cash flow among companies.

Third, cross-border remittances/payments can be made more efficient. Cooperation with overseas payment methods, such as cross-border e-commerce, is progressing rapidly. We are having discussions with various companies, and we hear many voices calling for the early implementation of digital currencies in trade and finance in Japan and Southeast Asia. We believe that the digitalization of supply chains will also be a major theme in the future.

Fourth, blockchain enables the use of smart contracts (programs that are executed according to predefined rules or when certain conditions are met), which makes digital currencies programmable (various functions can be added, such as automatic payment according to conditions and usage restrictions). In the future, various assets will be digitized, tokenized, and divided into smaller units, and payments tied to digital assets will become more efficient, and automation and cost reduction will also become a reality. We believe this will lead to innovation in the entire financial system in the future. Soramitsu is also in talks with the central banks of Thailand and Indonesia. Although they have already achieved interoperability of non-blockchain payment systems, instant payment and standardization of QR codes, they are still actively considering the adoption of CBDC and blockchain. The goal is to enable further innovation and improve the sophistication of financial systems. This is because we are very excited about further innovation using automation and smart contracts, beyond the current interoperability of payment systems.

3 Introduction of Bakong, major change from failure

Although Bakong has these characteristics and design principles, there are different backgrounds to its introduction and development, and it did not always take its current form from the beginning. Before the introduction of Bakong (before 2020), Cambodia had multiple payment methods, similar to Japan and other countries. The central bank conducted interbank payments through FAST (Fast And Secure Transfers), a wholesale payment system, and each bank developed its own payment services using QR codes. There was also a lack of compatibility between banks. Non-bank payment operators (money transmitters) were not directly connected to the central bank and moved funds through specific banks. However, not all banks were connected, making it difficult and costly to transfer funds between payment operators. There was also the risk of payment operators going bankrupt and committing fraud.

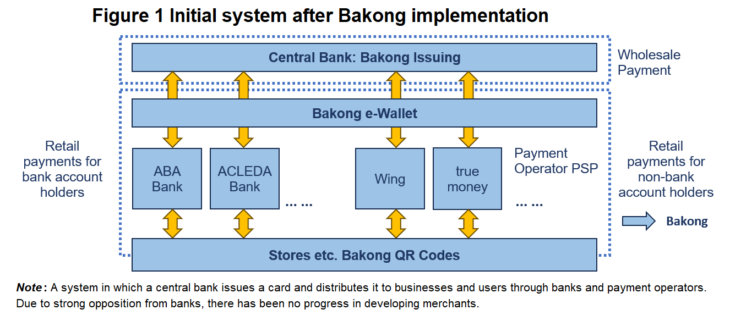

NBC’s initiative to address these issues was to introduce a digital currency and “provide a unified wallet (digital wallet) nationwide.” NBC’s first idea was to develop an indirect CBDC that would cover wholesale and retail payments, with banks acting as intermediaries (see Figure 1). Under this mechanism, Bakong is distributed by the central bank to individuals and businesses through banks and payment providers. The central bank provided banks with the apps and asked their branches to use QR codes for Bakong.

Unfortunately, this mechanism did not work. With the introduction of Bakong, the unique QR payment and debit systems that each bank had previously provided will become unnecessary. As a result, banks would no longer be able to earn fee income, and there was a fear that they would lose their payment business. NBC received a huge backlash from the banks. The reaction of the banks was either that they would not participate in this system, or that they would participate but would not develop member businesses because the central bank had told them so. That was the situation in 2020–21, and it was a huge failure.

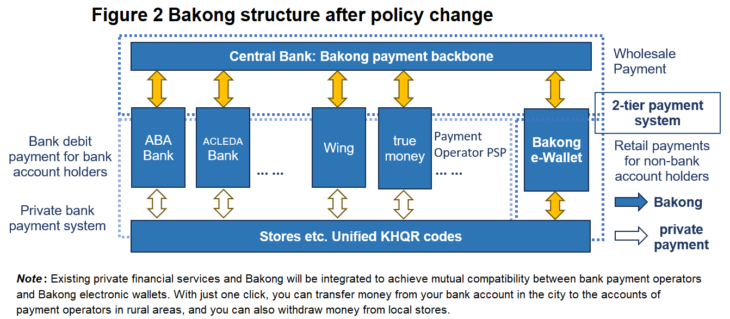

NBC then made a major change in policy, with Bakong specializing only in wholesale payments. Central banks call this wholesale payment system the “payment backbone.” The original policy was to act as a backbone between the central bank and each commercial bank, including retail payments. This was changed to a policy of integration between banks and individuals and businesses, so that each bank’s existing systems could be used as they were (see Figure 2). At this stage, however, the problem remained that each bank and payment operator’s QR codes were different and could not be used interchangeably. In response, the central bank took the lead in unifying QR codes through KHQR, and proceeded with the renovation of each commercial bank’s applications and the replacement of QR codes at the same time, resulting in the current form.

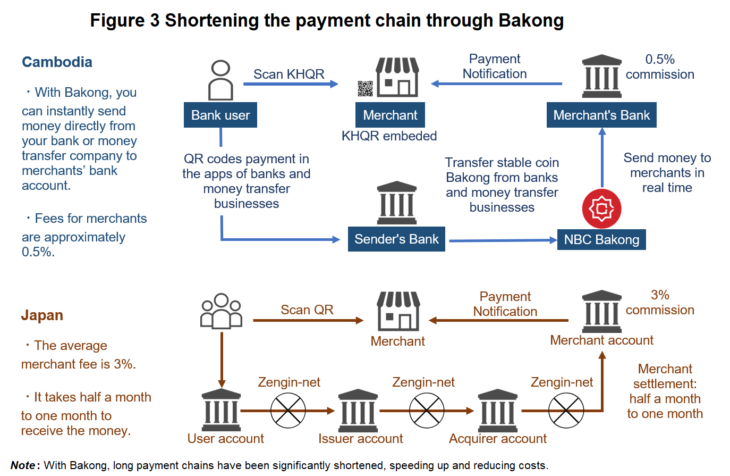

Under the new system, payment operators, like banks, are now directly connected to the central bank. In this case, it passes through Bakong. Therefore, each payment operator does not need to have a current account with the central bank, and is able to connect to the central bank’s Bakong system through a certain standard that is less strict than that of a bank. This shortens long payment chains, significantly reduces costs, and allows money to be transferred from payment operators to banks in real time (see Figure 3, above).

For example, when using QR codes or credit cards in Japan, you go through about four banks: (1) the user’s bank, (2) the issuer’s account (the company that issues the card to the user), (3) the acquirer’s account (the company that contracts with the merchant for the card payment), and (4) the merchant’s account. Zengin-net (Japanese Banks’ Payment Clearing Network) is inserted between each of these, and fees are accumulated. The average fee paid by merchants is about 3% of sales. In addition, it takes half a month to a month for the money to be finally deposited in the merchant’s account (see the bottom of Figure 3). In Cambodia, on the other hand, Bakong transfers money instantly from the user’s account to the merchant’s account.

We also provide easy financial access to people in rural and other areas who do not have bank accounts. The father works in the city and has a bank account, but his family lives in a rural area and has no bank account. Even if you only have an account with a payment service provider instead of a bank account, you can instantly send money from the metropolitan area to your family in the rural area. For example, there are many Wing merchants in rural areas, so you can go to a nearby store and withdraw the money you sent from Bakong in the city. At present, my impression is that almost no one uses cash in urban areas. Even in rural areas, about half of the payments are now made through Bakong. We use Bakong to buy fertilizer and pay gas bills, so we are using less and less cash. Before, people in rural areas had to go to a counter and wait in line to pay their gas bill, which took half a day. But with Bakong, payments can be made instantly using a smartphone, which is very popular because it saves a lot of time. Bakong has made significant strides in financial inclusion, including in rural areas.

4 Cross-border payments through Bakong

Next, let’s talk about cross-border payments, which is one of the advantages of Bakong. As mentioned earlier, QR codes are unified by international standards and are compatible with each other, so QR codes from countries such as Thailand, Vietnam, Malaysia, and Laos can also be read by apps in Cambodia. For example, QR codes from “PromptPay,” which is popular in Thailand, can be read with the app in Cambodia. The money is then transferred and exchanged from Cambodian banks and payment operators via Bakong to ACLEDA Bank in Cambodia, transferred to ACLEDA Bank in Thailand, and immediately transferred to shops in Thailand. In the case of cross-border payments, payments can be made to the merchant in about 10 seconds, including currency exchange. This type of payment system is becoming increasingly popular in Asian countries.

In addition, in November 2023, NBC announced the start of cooperation with China’s Alipay. Alipay has 63 million merchants, and when Cambodians visit China, they can pay at Alipay merchants using the apps in Cambodia. On the other hand, when people who use Alipay come to Cambodia, they will soon be able to pay using Alipay’s apps. In addition, we are also seeing new connections with India and Singapore, which makes us realize that Asia is getting smaller and smaller. Unfortunately, Japan is not currently included in these connections. Under these circumstances, Soramitsu is also considering building a cross-border payment system that connects countries such as Japan, Cambodia, and Thailand.

5 Bakong’s success factors and future prospects

Here we summarize the factors that have made Bakong as successful as it is today and its prospects for the future. The first success factor was that we were able to gain the support of financial institutions. As mentioned in Section 3, there was a lot of resistance when it was first introduced, but now everyone is on board and actively using it. Financial institutions are also actively working to develop affiliate businesses, and the rate of account openings is increasing. Traditionally, most cash in rural areas was held in the form of mattress money, but by depositing this money in banks, the banks can use it to make loans. Money that has been sitting in rural areas is finally starting to flow and contribute to the economic development of the country as a whole. As this movement continues, it will no longer be necessary to borrow from countries like China. At present, activities are progressing in a virtuous cycle, in which as the number of affiliated branches increases, the usage rate of users increases, the benefits to financial institutions expand, the amount of deposits increases, and the number of affiliated branches increases further. In addition, short-term lending businesses such as microfinance that operate in rural areas have traditionally had to visit every village to collect money, making collection work very difficult. However, about half of repayments are now made online through Bakong, and operational efficiency appears to be improving.

The second factor is that we have provided a system that is overwhelmingly convenient for users. The spread of the new coronavirus has also contributed to the spread of Bakong.

For example, some consumers say “Cambodian banknotes are old and dirty, so they don’t want to touch them,” and there was a case of a new coronavirus infection spreading while waiting in line at a bank to withdraw cash. Against this backdrop, cashless payments suddenly became widespread. And in modern Cambodia, there are QR codes everywhere you go, you can use any payment method, cashless payments have become commonplace, and remittances both domestically and internationally have become very easy.

In this way, Bakong has achieved the sophistication of Cambodia’s financial system, stimulated the economy, improved productivity, and strengthened the country’s currency. NBC Governor Dr. Chea Serey announced on November 10, 2023 that the circulation of the Cambodian riel has increased about 17 times in the past 20 years. Bakong’s contribution is likely to be included in the announcement. Bakong also brings far-reaching benefits to finance, industry and the people, helping to improve Cambodia’s financial situation. In addition, NBC is currently focusing on improving inbound convenience by expanding cross-border remittances/payments, increasing tourism business, and earning foreign exchange. We are also working to expand cross-border payments. For example, we are developing payment methods for selling Japanese products to Southeast Asian countries through cross-border e-commerce. Many Cambodians don’t have credit cards, but they can use Bakong. So we are creating a system to do e-commerce from Japan through Bakong. In addition, the Cambodian government seems to want to work on improving transparency and reducing crime and corruption through digitalization.

6 Conclusion: Further development of CBDC

Finally, we will introduce current CBDC trends in the Asia-Pacific region other than Cambodia. Soramitsu has been selected for the Ministry of Economy, Trade and Industry (METI)’s “Feasibility Study Project for Overseas Development of High Quality Infrastructure and Energy Infrastructure” in 2023. Through this, we are studying CBDC proposal activities for Southeast Asia and Pacific Island countries, cross-border remittances within the region, and the possibility of cross-border remittances with Japan. In addition to Cambodia, the target countries in Southeast Asia are Thailand, Indonesia, Vietnam, and Malaysia, and we are currently visiting the central banks of each country and holding discussions. In the Pacific Island countries, we are in discussions with the central banks of Fiji, Tonga, the Solomon Islands and Vanuatu. In addition, we have already agreed to explore CBDC with Laos and conducted a proof of concept in February 2023. In the trial, we provided a customized version of Bakong’s applications for Laos.

In addition, Soramitsu, together with Cabinet Secretariat and METI members, visited the central banks of Solomon Islands, Vanuatu, and Fiji, and started a research project aimed at introducing CBDC in Pacific island countries. Pacific island countries, especially the Solomon Islands, are strongly influenced by China. The Cabinet Secretariat regards Solomon Islands as extremely important due to economic security issues, and Solomon Islands also wants to improve relations with Japan. In November 2023, a proof of concept was conducted on Solomon Islands based on a mechanism jointly developed by the country’s central bank and Soramitsu. On November 28th, a ceremony for the CBDC proof of concept was held with the participation of the Solomon Islands Prime Minister, Finance Minister, Central Bank Governor, Ambassador Extraordinary and Plenipotentiary of Japan to the Solomon Islands, the Cabinet Secretariat of the Government of Japan, and JICA (Japan International Cooperation Agency). At a meeting held on November 29th that brought together the central bank governors of eight countries, including island countries, we conducted a CBDC demonstration and reported the results of the field test. Solomon Islands amended its law on November 3 to allow the central bank to issue CBDCs. Preparations for the introduction of CBDC are complete, and we are continuing to finalize the system operations, which is very exciting. I strongly feel that digital payments in Asia is a very hot field right now.

References

Miyazawa Kazumasa (2018) Kakushite Denshi-manei Kakumei wa Sonii kara Rakuten ni Hikitsugareta (Thus, the e-money revolution was inherited from Sony to Rakuten) (CardWave Editorial Department, Infcurion Consulting)

Miyazawa Kazumasa (2020) Soramitsu, Sekai-hatsuno Chugin Dejitaru-tsuka ‘Bakong’ wo Jitsugenshita Sutatoappu—Nihon hatsu no burokku chain de Sekai wo kaeru (Soramitsu: The startup that realized the world’s first central bank digital currency “Bakong”—Changing the world with blockchain from Japan” (Nikkei BP).

Translated from “Ajia/Taiheiyo chiiki ni okeru Chuo-ginko Dejitaru Tsuka no tenkai” (Development of Central Bank Digital Currency in the Asia-Pacific Region),” The Keizai Seminar, February/March 2024, pp. 7-15 (Courtesy of Nippon Hyoron sha Co., Ltd.) [April 2024]

[1] See Miyazawa (2018) for the electronic money business, and Miyazawa (2020) for details about Bakong and digital currency.

[2] ISO-20022 is an international standard that specifies the format and procedures for communication messages in financial services.

[3] EMV is a unified standard for electronic payments developed by Europay, Mastercard, and Visa.

Keywords

- Miyazawa Kazumasa

- Soramitsu

- Cambodia

- National Bank of Cambodia

- NBC

- Bakong

- central bank

- central bank digital currencies

- CBDCs

- Asia-Pacific

- cross-border remittances

- digital currencies

- cashless

- Sony

- Edy

- Suica

- QR codes

- KHQR

- indirect issuance

- API

- app

- EMV

- CBDC

- blockchain

- e-commerce

- cross-border payments

- Zengin-net

- PromptPay

- AliPay

- Chea Serey

- Cambodien riel

- circulation

- METI

- Solomon Islands

MIYAZAWA Kazumasa

MIYAZAWA Kazumasa