Views on the Chinese economy: Step-by-step Action on Capital Outflows ― Avoiding a hasty transition to a floating system

< Key Points >

- Reform state-owned enterprises to promote private sector development

- Strengthen the financial system to prevent international capital outflows

- Liberalize trade and investment to avoid friction with the United States

Kawai Masahiro, Professor, University of Tokyo

China’s economic growth rate for 2016 was 6.7%, a persistent slowdown from the peak of 2010 (10.6%) in the post-Lehman shock period. The economy has clearly shifted from high growth to medium growth. This is due to both long-term and structural factors affecting the Chinese economy and medium-term factors triggered by domestic and overseas economic changes in the wake of the 2008 global economic crisis.

Long-term and structural factors relate to China’s trend towards a lower potential growth rate. Specific factors include (1) a peak-out in the country’s working-age population (aged 15–64), (2) reduced labor movement from rural to urban areas (passing of Lewis’ turning point), (3) lower growth in public infrastructure and firm equipment investment, and (4) limitations on growth driven by high levels of resource and energy consumption due to environmental constraints.

Medium-term factors meanwhile include (4) a slowdown in international trade due to weak economic growth in Europe and the United States, leading to no realistic prospects of growth propelled by external demand, and (5) the presence of excess capacity and debt in the real estate and manufacturing sectors, triggered by large-scale economic stimulus measures taken in the wake of the economic crisis, thereby acting as barriers to self-sustaining private investment.

China is currently in a situation where, through supply-side reforms, it is dealing with the aftereffects of large-scale stimulus measures, while also attempting to structurally change the economy and soft-land from high to medium growth. Immediate issues include eliminating excess manufacturing capacity and real estate inventories, and getting rid of inefficient “zombie enterprises” (mainly state-owned enterprises that are being kept alive by subsidies or other state assistance despite being essentially bankrupt).

Efforts are underway to implement such reforms in the steel and coal industries to some extent, resulting in a turnaround in steel and coal prices. To take these reforms to the next level, it will be necessary for healthier firms and industries to absorb workers that are released from sectors with excess capacity and inventories.

From a long-term perspective, China pursues a number of major structural reforms to achieve sustainable economic growth, as otherwise China might not be able to get out of the so-called “middle-income country trap.” Essential structural reforms include engineering a number of shifts, (1) from an investment-driven to a consumption-driven economy, (2) from a manufacturing-driven to a services-driven economy, (3) from a resource- and energy-intensive economy to a high productivity economy based on innovation, energy conservation and low carbon emissions, and (4) from a government (central and local)-driven economy to a market-driven economy.

Shifts such as these are already happening, slowly but steadily. For example, the economy’s main growth driver is gradually shifting from investment to consumption. Since 2014, the growth contribution made by final consumption expenditure has exceeded that made by gross capital formation. A transition is also occurring from the manufacturing to the services industry. The share of the tertiary industry in gross domestic product (GDP) has been higher, and growing, than that of the secondary industry since 2012.

To invigorate consumer spending even further, China has been trying to support its burgeoning middle classes in a variety of different ways. Effective measures include, for example, closing the income gap and strengthening the social security system.

From the supply side, increasing labor productivity is vital to boost China’s potential growth rate. Raising total factor productivity (TFP) growth is particularly important through advances in technology and innovation. Until now, workers migrating from rural to urban areas in search of work have helped to drive up TFP. Capital and labor moving from the state to the private sector have also contributed to higher TFP and economic growth.

As the number of migrant workers from rural areas is likely to decline in the future, it will be crucial for China to maintain economic growth by further expanding the private sector, improving human capital through education and training, and promoting technological advances through investment in research and development.

The problem is that sufficient progress has not been made with reforms to state-owned enterprises (SOEs). At present, SOEs as a whole are still using capital and management resources inefficiently, which in turn impedes market competition and the development of private enterprises. Investment in the SOE sector continues to rise at a high rate despite low rates of return, while investment in private enterprises grows only slowly even though it offers a much higher rate of return. The SOE sector needs to be scaled back, to allow the private sector to expand.

Good progress was made with SOE reforms under Premier Zhu Rongji during the Jiang Zemin administration, but reforms stalled during the following decade under the Hu Jintao administration due to opposition from vested interests. The Xi Jinping administration initially seemed keen to push ahead with reforms, but in reality has not made much progress since then.

In the meantime, there has been a drive to merge and consolidate SOEs under the control of central government and reduce their number to around one third in the future. Although this is an attempt to create a smaller number of much larger SOEs that would be more competitive in the global market, it could also stifle vitality in the private sector. China will likely face difficulties in raising its potential growth rate unless it carries out serious SOE reforms in a way to promote the development of the private sector.

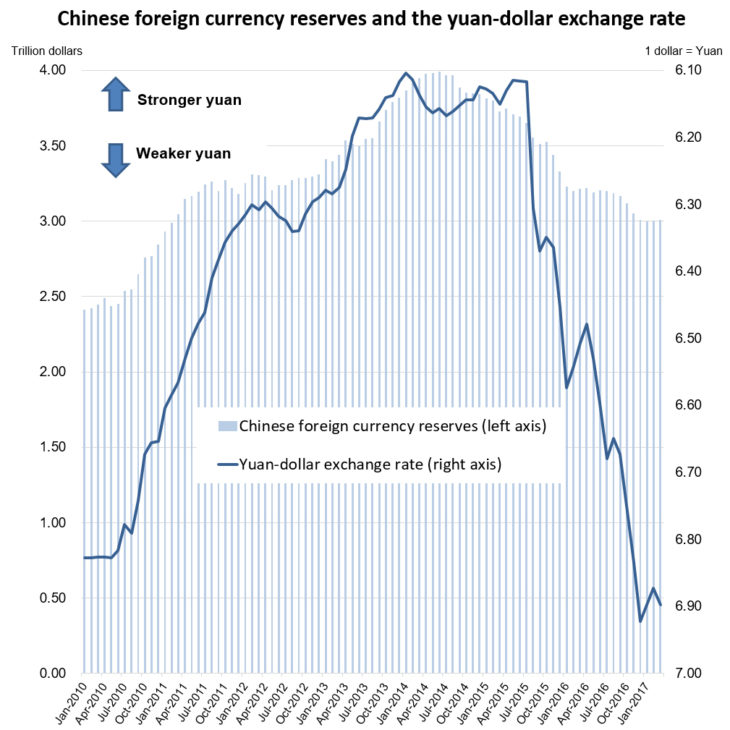

There has been a massive international capital outflow from China since the second half of 2014, putting downward pressure on the yuan exchange rate (see figure). Reasons for this outflow of capital include (1) market sentiment of the yuan’s exchange rate appreciation not being sustained with persistent economic growth slowdown, (2) perceived instability in the financial system due in part to the excessively high level of corporate debt, (3) monetary policy easing by the People’s Bank of China (central bank), and (4) rising interest rates in the United States (US) due to likely changes in monetary and fiscal policy in the US (normalization of the US Federal Reserve’s monetary policy and anticipated tax cuts and infrastructure investment by the Trump administration).

Speculation that the yuan would lose value as China’s growth slowdown would continue prompted indebted firms to repay dollar-denominated debt sooner rather than later and encouraged investors to sell yuan in favor of dollar, thereby creating pressure to lower the yuan exchange rate.

The People’s Bank of China (PBOC) reacted by intervening in the foreign currency market, lowering the reference rate of the yuan against the dollar three days in a row in August 2015. This sparked a further outflow of capital however, and led to continuous market interventions as well as losses on foreign currency reserves. From nearly $4 trillion at their peak in June 2014, foreign currency reserves had fallen below $3 trillion by the end of January 2017, because of the outflow of roughly $1 trillion over the course of two and a half years.

The authorities issued administrative guidance and notices to banks, enterprises and individuals, tightening capital outflow regulations even further. Despite a moderate shift to monetary policy tightening in early 2017, pressure on capital outflows has not diminished.

How should the PBOC respond? I suggest that the bank should achieve a transition to a floating exchange rate system and capital account liberalization in three stages.

First of all, as long as pressure on capital outflows persists, the PBOC needs to avoid any sharp drop in the yuan rate by putting in place a tighter monetary policy, maintaining capital outflow controls, and intervening in the currency market. As it stands, abandoning market intervention and adopting a floating system would most likely result in an overshooting of the exchange rate, triggering its significant fall beyond the equilibrium value. This would be undesirable as it could invite more speculation to add further downward pressure on the yuan and would also lead to currency war particularly among emerging market economies which would be tempted to see their currency values go down.

Next, as pressure on capital outflows subsides, the PBOC can then scale back market intervention and move to a floating system, while still maintaining a certain degree of capital outflow controls.

Finally, as the domestic financial system restores health through reduction of debt in the corporate sector, the PBOC can return to the previous path of gradually liberalizing the capital account or lifting restrictions on the movement of international capital.

Another risk China faces is trade and currency policy under the new US administration.

President Trump has focused his policy on reducing bilateral trade deficits. China has the largest trade surplus with the US among all countries. Hence the Trump administration is likely to urge China to increase the value of the yuan, or impose high tariffs on products imported from China. Increasing tariffs could provoke retaliation from China, potentially escalating into a serious trade war.

China needs to make it clear that protectionist policies from the US will have a negative impact on the US economy, not to mention US firms operating in China, and the global economy as a whole. It should also take action to lower or eliminate barriers to trade in goods and services, and to inward foreign direct investment.

Once interest rates in the US rise more rapidly than market forecasts meanwhile, there is a possibility that capital outflows from China could increase further still. To guard against that, China should be working to strengthen the domestic financial system and alleviate pressure on capital outflows due to domestic factors, as well as making the necessary preparations to move to a much more flexible exchange rate arrangement.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 1 March 2017 under the title, “Chugoku Keizai wo domiruka (1): Shikin ryushutsu taisaku wa dankaitekini (Views on the Chinese economy (1): Step-by-step action on capital outflows).” The Nikkei, 1 March 2017, p. 33. (Courtesy of the author)