The Good and the Bad of a Negative Interest Rate Policy:Zero Interest Rate on Cash Constrains the Policy’s Effectiveness Fears of currency weakness inviting competition ― Market senses limits to monetary policy

<Key points>

The real economy’s limited response to monetary policy

Views also exist that quantitative easing has limited room for further expansion

Agony deepens among central banks as unstable market conditions continue

UEDA Kazuo, Professor, University of Tokyo

The Bank of Japan blindsided most forecasts and decided to adopt a negative interest rate policy (a policy that sets the interest rate at below zero on current account deposits that banks keep with the BOJ) at its Monetary Policy Meeting on January 29.

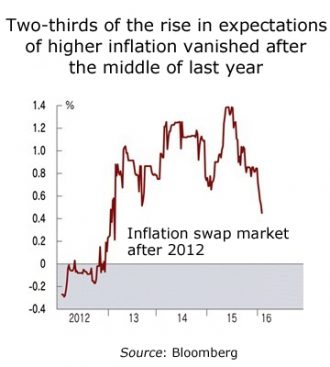

The context that can be suspected here is the concern, among others, that the economy would struggle further as a result of the great market volatility that has been occurring since the beginning of the year, as the inflation rate did not rise as intended despite the unprecedented quantitative and qualitative monetary easings that were implemented over a period of three years. In fact, expectations of inflation that can be ascertained from the inflation swap market – although problems exist in viewing it as an indicator – show that two-thirds of the rise in expectations of higher inflation, which had been occurring since the end of 2012, vanished after the middle of last year (refer to chart).

Central banks in industrialized nations other than the BOJ are also up against such a predicament surrounding monetary policy. The Federal Reserve Board (FRB) decided on a rate hike in December last year, but it has not been able to paint a clear picture of further rate hikes also due to market trends. The European Central Bank (ECB), like the BOJ, is exploring the possibility of an additional easing. Market activity, which has been sensitive to detecting the limitations to recent monetary easing policies, is the reason behind the agony among central banks.

Central banks in industrialized nations other than the BOJ are also up against such a predicament surrounding monetary policy. The Federal Reserve Board (FRB) decided on a rate hike in December last year, but it has not been able to paint a clear picture of further rate hikes also due to market trends. The European Central Bank (ECB), like the BOJ, is exploring the possibility of an additional easing. Market activity, which has been sensitive to detecting the limitations to recent monetary easing policies, is the reason behind the agony among central banks.

One limit to the nontraditional monetary easing policies that have been implemented since the Lehman scandal in 2008 is the sluggish response of the real economy to monetary policy, despite financial asset prices responding strongly to it.

The markets have had a robust response to monetary easing policies more than generally expected the past several years, as represented by the movements in the weak yen and stock prices. Further, market dependence on monetary policy was seen until sometime last year to the point where the market saw news that would be negative for the economy as a positive factor based on expectations that it would lead to more monetary easing policies.

In contrast, indicators for the real economy, such as those for manufacturing and general prices, have been sluggish in their response. Movements seen in rising wages and overall prices have been sluggish not only in Japan, but also in Europe and the United States where the monetary base (cash and reserve balances) has expanded substantially. The quantity theory of money, which states that the inflation rate will rise if the rate of increase in money supply amplifies over a period of around two to three years, is powerless when it comes to explaining the experience of the past several years.

One of the reasons that has limited the response of the real economy to nontraditional monetary policy is likely the after effect of the global financial crisis. Investor risk-aversion, which had prevailed since the financial crisis, did ease vis-à-vis financial asset investments, to which impact from monetary policy can be anticipated, but this risk aversion can been seen as still continuing in real asset investments. In Japan, where the experience of a serious financial crisis occurred substantially ahead of time, factors, such as a slump in expectations of inflation as a result of protracted deflation or the loss of growth expectations associated with the declining population, were instead acting as a drag.

In addition, what is probably happening here is that decisions on actual investments, which take a long time to consider, cannot readily respond to price movements in financial assets, which may be temporary. For example, a return of manufacturing bases back to Japan would be difficult merely on a weak yen lasting around two to three years.

Another factor is the concern of the dissipating impact of easing methods in the context of the markets’ perception of limits to monetary easing policies. The quantitative easing that was implemented recently was originally to serve as an inventive scheme employed under constraints of further lowering interest rates.

However, for example, regarding the outright purchase operation of Japanese Government Bonds (open market operations), concerns have been mounting since last year on how much room might be left in these purchases going forward if the operations were to continue for the foreseeable future, although the BOJ’s JGB holdings total a little over 30% of the outstanding total at this point in time. This observation was reinforced when the BOJ passed up on implementing additional easing during the second half of last year.

The weak response in asset prices in the real economy, as noted earlier, was convenient for the markets as it would result in a longer period of monetary easing. However, in addition to the Fed’s rate hike in December last year, fear that there might be limited room for additional easings in Japan and Europe – regardless of the weakened impact of monetary easing policies on the real economy – turned out to be a major factor promoting concern in the markets, which were becoming increasingly dependent on monetary policy. The weakening Chinese economy was a worry at that time, and sales of risky assets, including commodities such as crude oil, and funds being taken out of emerging countries, can been seen as having accelerated since the beginning of the year.

Of course, looking at it from the standpoint of central banks, reinforcing monetary easing measures simply to support asset prices is out of the question. But if asset prices plunge substantially, they will not be able to ignore their negative impact on the real economy, including the possible re-emergence of concerns about the financial system. Regarding Japan, if the weak yen – which has supported corporate profitability and has positively affected prices, albeit in a moderate manner – reverses, the prospect of freeing itself from deflation will likely become remote.

As a result, ECB President Draghi signaled an additional easing in March, and the BOJ instituted negative interest rate policy. Risky assets, which had deteriorated substantially, rebounded temporarily.

*** *** ***

Now, what kind of potential exists for negative interest rate policy, which the BOJ implemented following that in Europe? A major problem is that as long as the interest rate on cash is zero, other interest rates cannot dip into negative territory in a substantial way. This is because people will shift from assets that carry negative interest rates to cash, thereby weakening the ripple effect that could be expected from negative interest rates. For this reason, the BOJ’s framework this time includes a scheme that puts a brake on cash holdings among banks.

That said, recent experience among countries like Switzerland and Denmark is that interest rates on central bank deposits could drop to around -1% while keeping interest rates on small-lot bank deposits at around zero. If this were the case, it means that the BOJ has created room for another two or three rounds of additional rate cuts.

Seve

ral facets of the impact of negative interest rates on the economy remain unclear. Coupled with the outright purchase operations of JGBs, the policy will likely prompt strong downward pressure on JGB yields as well as yields on corporate bonds with high ratings. However, the ripple effect it would have on lending rates and real asset investments is uncertain, also given the experience in Europe. There are also concerns that the ripple effect would be weakened because the negative interest rate was limited to just a portion of the reserve balance.

The foreign exchange market also reacted strongly to negative interest rates temporarily. However, herein lies a major risk. So long as the path of monetary easing becomes increasingly focused on currency weakness, other nations will make more of an effort to prevent their own currency from strengthening, which would increasingly make the impact of easings close to zero for the entire world.

In addition, if China reinforces its policy to weaken its currency on the back of easings by Japan and Europe, a global competition of weakening currencies could be possible. To start with, the global market confusion that has been occurring since the summer of last year is in part caused by China approving a weaker yuan, however limited, amid concerns that a stronger U.S. dollar, which was prompted by expectations of a Fed rate hike, would negatively impact the Chinese economy that broadly moves along with the U.S. dollar.

*** *** ***

Central banks in Japan and Europe entered a new phase of nontraditional monetary policy in which they are testing the lowest limit of the constraints tied to zero interest rates. However, the lowest limit is probably not that far off as long as they do not utilize the powerful medicine of keeping interest rates on cash in negative territory, which carries a risk of damaging the trust attached to the currency system. The hope is that the real economy undergoes a more vigorous strengthening before Japan reaches its limit to additional easings, the impact of which has permeated albeit in a limited manner.

Still, market conditions have been far from calm since it entered the month of February. Factors that are placing downward pressure on asset prices and the economy are too numerous to count: the dead end seen in the economic growth models of emerging nations, the after effects of China’s 4 trillion yuan economic stimulus policy and the various types of disparate levels of accumulation resulting from the protracted monetary easings of industrialized nations. Concerns are relentless as the BOJ and some central banks cannot help but face further monetary easings.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 8 February 2016 under the title, “Mainasu Kinriseisaku no Kozai (1): “Genkin no Kinri Zero,” Koka Seiyaku (The Good and the Bad of a Negative Interest Rate Policy (Part 1 of 2) ―Zero Interest Rate on Cash Constrains the Policy’s Effectiveness)” The Nikkei, 8 February 2016, p. 17. (Courtesy of the author)