The Bank of Japan Can Continue Quantitative and Qualitative Monetary Easing for Only Two More Years: The Adoption of Negative Interest Rates Is Proposed – Eliminating the Zero Lower Bound is Crucial

< Key Points >

- * Deflation and long-term stagnation continued in Japan for almost two decades.

- * QQE will reach its quantitative limit in the middle of 2017 at the earliest.

- * A structure based on negative interest rates that does not cause a flight to cash is proposed.

The Bank of Japan (BOJ) decided to put off additional easing at a meeting held at the end of October 2015 for setting a monetary policy. In my opinion, whether or not the BOJ takes such a step depends on whether market participants’ inflation expectations fall sharply.

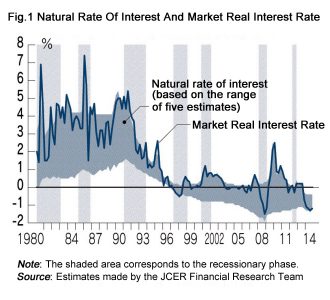

The important thing here is the natural rate of interest. It is an equilibrium real interest rate that is neither stimulative nor tightening for the economy (in other words, neutral for the economy). According to analysis by the Financial Research Team of the Japan Center for Economic Research (JCER), the natural rate of interest for Japan fell below zero in the mid-1990s. The rate was around negative 0.5% in the latest period. (Refer to Figure 1.)

The real market rate of interest, calculated by deducting the expected inflation rate from the nominal interest rate, is determined by the size of inflation expectations, given that the nominal market rate of interest is close to zero at present. When the rate of inflation gained from index-linked bonds falls from the current level of 0.8% to 0.5% or below, the real market rate of interest surpasses the natural rate of interest and strengthens the risk of deflation.

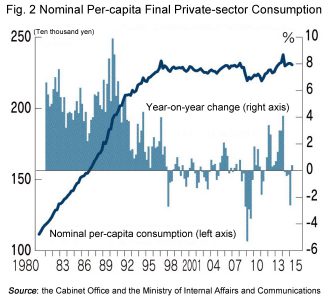

The mid-1990s was a period when the Japanese economy sank into deflation and long-term stagnation. Nominal per-capita consumption became greatly distorted and stopped growing after this period. (Refer to Figure 2.) This means that real per-capita consumption, excluding the effects of commodity price falls, remained unchanged as well. The natural rate of interest moved into the negative range under “zero lower bound (ZLB) on interest rates,” at which the nominal interest rate could not fall below zero, and remained in that range for twenty years.

The sustained conditions of the yen’s sharp appreciation, and changes in the population structure following the burst of Japan’s economic bubble, appear to have caused an “abnormal change” with the natural rate of interest constantly in the negative range. It will not be easy for the BOJ to exit from quantitative and qualitative monetary easing (QQE).

The sustained conditions of the yen’s sharp appreciation, and changes in the population structure following the burst of Japan’s economic bubble, appear to have caused an “abnormal change” with the natural rate of interest constantly in the negative range. It will not be easy for the BOJ to exit from quantitative and qualitative monetary easing (QQE).

According to estimates by John Williams, President of the Federal Reserve Bank of San Francisco, and others, the natural rate of interest for the United States declined into the negative range in 2012 and has remained in that range since. Asked what he thought about the negative natural rate of interest last year, Ben Bernanke, former Chairman of the Federal Reserve Board (FRB), replied, “It is a phenomenon based on a business cycle.”

Market participants recognize the emergence of the negative natural rate of interest as the “new normal”, taking the view that the nominal interest rate calculated from the natural rate of interest will remain in a forecast range of around 2%. On the other hand, the FRB appears to be tacitly assuming that the “new normal” will disappear before long. Such a gap in interpretations between the FRB and market participants is increasing uncertainty in terms of exit strategies.

Market participants recognize the emergence of the negative natural rate of interest as the “new normal”, taking the view that the nominal interest rate calculated from the natural rate of interest will remain in a forecast range of around 2%. On the other hand, the FRB appears to be tacitly assuming that the “new normal” will disappear before long. Such a gap in interpretations between the FRB and market participants is increasing uncertainty in terms of exit strategies.

*** *** ***

Accordingly, how long can the BOJ sustain QQE? The BOJ is currently spending an annual total of around 110 trillion yen on buying long-term government bonds in a bid to expand the monetary base (the volume of supplied funds) by 80 trillion yen per year. In addition to newly issued government bonds, the BOJ is buying such bonds held by private financial institutions, because the difference between bonds issued and redeemed by the government is about 40 trillion yen, excluding short-term government bonds and government bonds for individual investors.

In a working paper released in August 2015, International Monetary Fund (IMF) staff estimated government bonds owned by private financial institutions that are available for sale by the end of 2018 at around 220 trillion yen, and argued that QQE would reach its quantitative limit in 2017 or 2018. This analysis is based on the assumption that Japan Post Bank and other private banks will own government bonds required as collateral at the rate of 5% of their respective total assets.

However, government bonds that the BOJ is able to purchase from holders, such as banks, life and nonlife insurance companies and public pension program administrators, will come to about 150 trillion yen, or slightly less than 70% of the IMF estimate, when factors such as collateral management by private banks and government bond disposal for reviewing working assets by public pension program administrators are taken into consideration. Consequently, there is a strong chance that QQE will reach its quantitative limit in mid-2017, ahead of the IMF assumption. The period available for continuing QQE will grow even shorter if the BOJ increases the volume of government bonds it buys.

As a matter of course, this quantitative limit on government bond acquisition also depends on the price level of government bonds bought by the BOJ. This is because the BOJ can acquire more government bonds by presenting high prices that cause the yield on government bonds traded to fall into the negative range. The yield on traded two-year government bonds dropped below zero from the end of 2014 to the beginning of 2015. The BOJ purchased government bonds at this point, and was prepared to post losses on their acquisition.

Similar limits also exist for exchange traded funds (ETFs) and real estate investment trusts (REITs). With regard to private asset purchases, sustained support provided by the Japanese government and the BOJ after the normalization of asset prices cannot be considered desirable except in emergencies.

*** *** ***

Under these conditions, I believe the BOJ should consider negative interest rates as a policy choice from this point on.

Faced with zero interest restrictions, ever since the collapse of Lehman Brothers in 2008, central banks in developed nations have implemented quantitative monetary easing, a balance sheet expanding policy. In the meantime, the European Central Bank (ECB) and central banks in Switzerland, Sweden and Denmark have implemented negative interest rates on deposit accounts. In Denmark, negative interest rates have also emerged for private housing loans.

A flight to cash is predicted to occur when negative interest rates are imposed on bank reserves and such interest rates fall below the cost of carrying cash (retention cost). In Sweden, negative 1.1% interest was imposed on deposit accounts at the central bank from November 2015, but it does not seem to have caused a flight to cash, indicating that the cost of carrying cash is about 1% to 2%. Even if the ECB suffers a loss resulting from government bond acquisition under negative interest rates, the loss can be offset as the ECB can expect income growth from imposing negative rates on deposits.

Needless to say, there are also limits to such negative interest rates, because of the presence of interest-free cash. ZLB constraints need to be overthrown and nominal interest rates must be brought down to levels below zero, to realize a return to an interest rate policy framework that includes negative interest rates from the current QE policy framework.

These points have been discussed at deeper levels in the field of economics. The following three methods of breaking through the ZLB have emerged through the course of such discussions: (1) impose a tax on cash, (2) replace cash with electronic currency, and (3) leave bank reserves as units of account and make the rate of their exchange with cash variable. In method (3), cash will be reduced in value against bank reserves at a fixed rate.

*** *** ***

I find the conversion of cash into deposited currency, an idea proposed by U.S. economist James Tobin in 1985, attractive in that respect. Deposit accounts will be used for all transactions and settlements if not only financial institutions but also individuals and companies are permitted to hold accounts directly at the central bank. When that happens, cash will disappear and the central bank will become able to impose negative interest rates on deposit accounts as well as on bank reserves.

The Federal Reserve Bank of New York has recently reevaluated Tobin’s idea. Controlling market interest rates without eliminating massive excess reserves is never easy for a central bank. The Federal Reserve Bank of New York proposed enabling investors to participate in a short-term money market (the federal fund market) in effect by widely allowing them to keep deposit accounts at a central bank through private banks.

Markets become competitive when participants increase. Greater competitiveness is expected to make transmission channels of monetary policy more effective. I believe that leading industrialized nations should deepen their examination of a monetary policy that proves effective under the new normal.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 18 November 2015 under the title, “Nichigin no Ryoteki, shitsuteki kanwa ― Keizoku kano wa ato 2-nen” (The Bank of Japan Can Continue Quantitative and Qualitative Monetary Easing for Only Two More Years ― The Adoption of Negative Interest Rates Is Proposed).” The Nikkei, 18 November 2015, p. 34. (Courtesy of the author)