Future of the Automotive Industry Strategies with a View to the Future of EVs and Beyond: Exploring the Application of Technologies to Other Fields

Key Points

- The elimination of either FCV or EV by market competition is unavoidable

- Competition will intensify as obstacles to market participation are lowered by the widespread popularization of EV

- Current revenues cannot be maintained with a changeover to EV

Shibata Tomoatsu, Professor,

Tohoku University

Both the British and French governments have announced policies to ban the sale of conventional combustion engine-powered vehicles by the year 2040. This, together with the toughening of environmental regulations by other countries such as China and the United States, indicates that the global movement shifting away from engine-powered cars is accelerating.

Amidst all of this, the greatest issue for Japan is that the road that lies ahead, after this shift away from engine-powered cars remains unclear. Does it lead to electric vehicles (EV), or to fuel cell vehicles (FCV)? The major reason for this uncertainty is that manufacturers have divided into two camps. There is the Toyota Motor Corporation camp, which views FCVs—with their long-distance driving capabilities—as the favorite, and launched its Mirai FCV in 2014; and there is the Nissan Motor Corporation camp, which has long viewed EVs as the favorite, and launched its Leaf EV in 2010. What is more, the Japanese government is actively supporting both of these camps. It seems that the background behind this is the optimistic outlook that both EVs and FCVs can coexist in isolated segregation in the future.

It now seems quite certain, however, although this might be an inconvenient fact as far as Japan is concerned, that EVs and FCVs will be unable to coexist in the future; that the paths of these two technologies will eventually converge, with one of the pair being selected for extinction.

EVs and FCVs are the same in terms of the fact that they both use electricity to drive their motors. EVs drive their motors using electricity that is stored in their onboard battery in advance by charging. FCVs, on the other hand, store hydrogen fuel in onboard tanks and drive their power-generating motors by initiating a chemical reaction in their onboard fuel cells.

In other words, EVs require charging stations for recharging their batteries, while FCVs require hydrogen fueling stations for replenishing their supply of hydrogen. Neither the cars nor the stations generate any value for customers by themselves, and so a complementary relationship exists in which the cars and the stations need—and depend upon—one another in order to create customer value. This relationship gives rise to a powerful form of mutual enhancement whereby strong entities become increasingly stronger, creating a winner-takes-all situation.

For example, an increase in the number of charging stations will increase the convenience of EVs, thereby increasing the number of EV users, which in turn boosts and encourages the construction of more charging stations. In this way, there is a force of mutual enhancement of value at work between EVs and charging stations. Once the cycle begins it creates a positive feedback loop. Of course, the same kind of force is at work in the relationship between FCVs and hydrogen fueling stations, so it seems fair to say that it will all come down to a competition as to which camp can create such a cycle first.

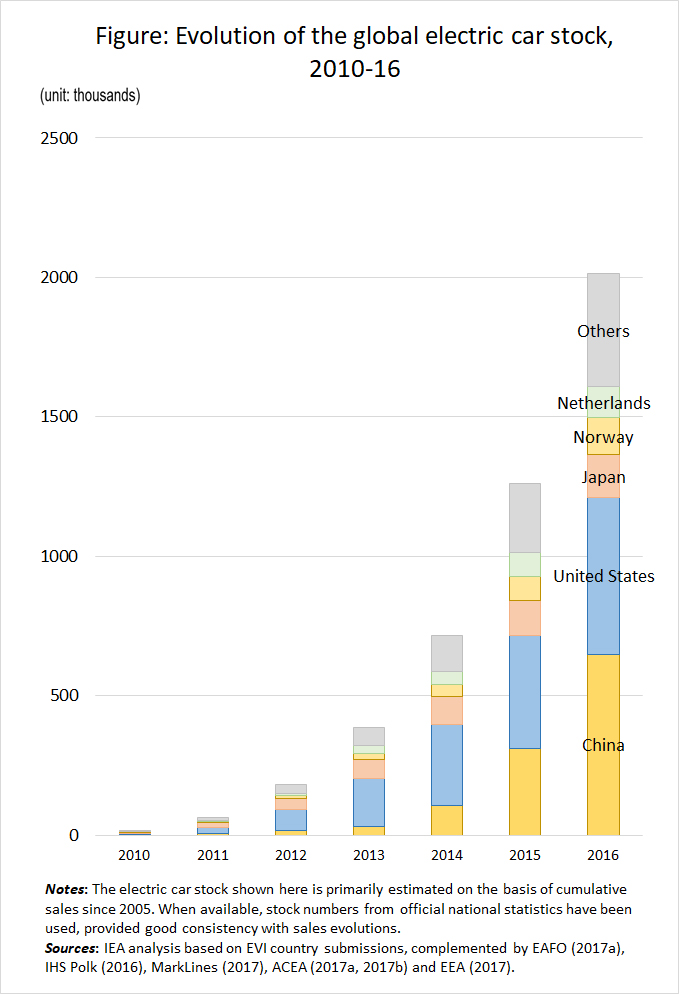

Looking back at the current state of affairs globally, it must surely be said that EV has the advantage at this present time. In 2015, the United States sold over 100,000 EVs, and the various European nations are also expanding their EV sales. In Japan, EV sales for FY2016 stood at around 15,000 vehicles, while sales of FCVs stopped at around the 1,000 mark. In terms of infrastructure, too, while the number of EV charging stations installed in Japan currently stands at around 20,000 locations, the number of hydrogen fueling stations is below 100.

In terms of overall burden placed on the environment, there is definitely also the view that it is FCVs—and not EVs—that are the ultimate eco cars. Once the flow towards EVs begins, however, it will be difficult to halt the tide of consumer opinion, and extremely difficult for the FCV camp to catch up.

The Japanese government is currently supporting lending its support to the widespread popularization of both EVs and FCVs, such as by offering subsidies both for the purchase of vehicles and the installation of charging/fueling stations. But it is simply impossible for these two vehicle types to coexist in isolation. There is surely a need for companies to formulate their corporate strategies and for the Japanese government to determine its policies based on this premise.

What is even more important to realize, regardless of whether the future beyond engine-powered vehicles lies with EVs or FCVs, is that neither of these destinations is a place of safe refuge where automobile manufacturers can live in peace. In terms of both sales turnover and profitability, it can be considered that it will be difficult to maintain the same level of business performance as with engine-powered vehicles. This is because, although it is the same industry, the technology and product characteristics of engine-powered cars are completely different from those of EVs.

The structural characteristics of EVs lie in the fact that the main components are electrical components such as batteries, motors and charging units. These are connected together by cables, meaning that the mutual dependencies between the main parts are more simplistic. In engine-powered vehicles, on the other hand, the main components are mechanical components such as engines and transmissions. Their movements are transmitted mechanically, meaning that they form complex dependencies with one another.

What this means, in real terms, is that by procuring batteries and other main components and assembling them, one can create EVs to a certain level or standard. In the case of engine-powered vehicles, it was important to control the complex mutual dependencies between components, painstakingly build and assemble over 30,000 individual components, and carefully mate and fine-tune them to increase the integrity of the vehicle overall. The key factor underpinning the competitiveness of the Japanese automobile industry has been this high-level capability to fine-tune components, which has been difficult for other countries to imitate.

With EVs, however, there is no need for such sophisticated component-mating abilities, making it easier for new players to participate in the industry. As a result of this, even firms with no experience developing engine-powered vehicles—such as US firm Tesla or China’s BYD—are able to stand at the top of the market rankings in terms of EV sales. This participation of firms from other industries will lead to intense competition, and energize and revitalize the industry overall, but is expected to result in a decline in the profitability of individual automobile manufacturers. Even if they are successful in the transition from engine-powered vehicles to EVs, they will be unable to cover the lost portion of their earnings from engine-powered vehicles with EVs alone.

A similar thing happened with the transition from film to digital cameras in the past. Although they are the same in terms of industry, the technology employed is completely different, and their product characteristics differ greatly. The shift from film to digital lowered the obstacles to market participation, and major electrical appliance manufacturers also entered the digital camera market along with newly emerging companies. Competition intensified, and both Japan’s Fujifilm and America’s Kodak were unable to cover their losses in revenues from the film camera market with digital cameras alone. Corporate strategy as to how to advance the exploration of new businesses aside from digital cameras became the key factor that made the difference between success or failure.

Fujifilm focused its attention on the possibilities of diverting and applying technologies to other fields, and chose to explore the healthcare field, such as in the skillful application of collagen and active oxygen control technologies accumulated through its film camera business to cosmetics and other health and beauty products. Kodak, meanwhile, took a meandering course through areas such as pharmaceuticals and inkjet printers, before its exploration strategy ultimately wandered off course.

Although these phenomena may appear different on the surface, the fundamental principle at work is the same. Automobile manufacturers need to adopt the outlook that EV is not the final landing point, and that they must begin preparing for “Act 2” of the performance, so to speak. Car sharing and various other developments are also having the effect of spurring the decline in demand. If manufacturers are to maintain the same level of market scale and revenues as with engine-powered vehicles, it is crucial for them to work strategically in exploring new businesses with a view to the future of EVs and beyond.

We must also not forget that Toyota Motor Corporation also was launched by Toyota Industries Corporation as a new business in 1933. One viewpoint is for companies to focus their attention on technologies, etc., as intangible assets, overcoming shortsightedness and explore widely for other areas of industry to which those assets they can be skillfully diverted and reapplied, as Toyota Industries Corporation did in the case of Toyota Motor Corporation. Some examples that surely come to mind are the possibilities of deploying technologies accumulated through automotive-oriented information services to data services businesses, or applying control technologies to different markets such as medical treatment.

Toyota President Toyoda Akio once said that the automobile market of the future would be a “battle in uncharted waters.” But it isn’t the case that there are no hints to follow at all. If we turn our eyes to other industries we can see that similar events, at least in principle, have continued to repeat themselves ever since the time of the industrial revolution. If anything, we could surely say that the automobile industry—in which the basic technology model, the combustion engine, has been maintained for over 100 years—is a special exception to the rule.

What is important for the top management standing at this kind of technological turning point is not to become caught up in the past experiences of just their own companies, but to take a humble approach and learn widely from history. The history of innovation repeats itself, and there are surely more than a few things that can be learned from it.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 25 September 2017 under the title, “Jidosha sangyo no mirai (1): EV no saki misueta senryaku wo – Ibunya eno gijutsutenkan sagure (The Future of the Automotive Industry (Part 1): Strategies with a View to the Future of EVs and Beyond – Exploring the Application of Technologies to Other Fields).” The Nikkei, 25 September 2017. (Courtesy of the author)