Future of the Automotive Industry: Preparing for structural changes in the supply chain networks

Hamaguchi Nobuaki, Professor of Kobe University; Faculty Fellow, Research Institute of Economy, Trade and Industry (RIETI)

Although a gasoline-fueled car is usually said to contain approximately 30,000 parts and components, a closer look reveals that depending on the way of counting, it can be as large as 100,000 with some 10,000 parts used to make just an engine.

In the case of an electric vehicle (EV), which runs on a battery-powered motor instead of a fuel-powered engine, there is no need for fuel system parts such as a fuel tank, ignition system components such as a spark plug, exhaustion and emission control system parts such as a muffler, air intake system parts such as a throttle, lubrication system parts such as a fuel pump, cooling system components such as a radiator, and transmission system components such as an automatic transmission (AT) (according to the EVsmart Blog). As such, the number of parts and components used to make an EV is approximately 10,000 or 1/10th of the number of those required for a gasoline-fueled car.

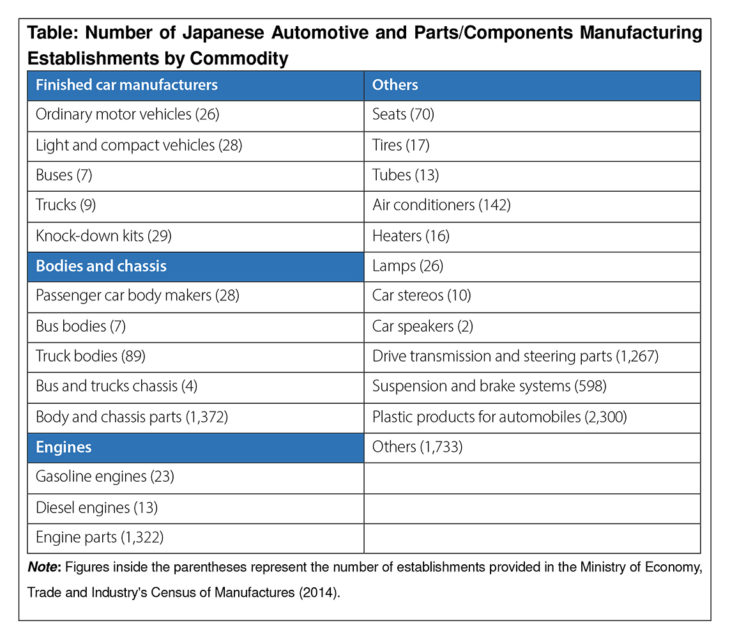

As shown in the Table, the Japanese automotive industry has a pyramid structure with a small number of finished car manufacturers at the top and more than 1,000 parts and components suppliers—such as those producing engines and bodies—in the bottom. An increase in the market penetration of EVs will force those automotive parts and components suppliers to make a significant shift.

Note: Figures inside the parentheses represent the number of establishments provided in the Ministry of Economy, Trade and Industry’s Census of Manufactures (2014).

The presence of highly developed supply chains has been one of the primary sources of Japan’s competitive advantage in the global automobile market. It remains uncertain whether and how the Japanese automotive industry can build new strength in the emerging EVs-dominant market.

However, it is no use just worrying. EVs are coming under the spotlight in the world’s major automobile markets such as Europe where stricter environmental regulations are becoming the norm, the United States where electricity prices have come down considerably thanks to the shale revolution, and China where air pollution and other environmental problems in urban areas pose a serious problem. As such, Japan has no choice but to follow suit.

Production and employment would suffer a negative impact if the shift occurs too rapidly. Thus, the pace at which the change will proceed is the focal point. However, given the current state of affairs in Japan, it will unlikely be a drastic one.

One reason for this is constraints in terms of electricity supply infrastructure. For instance, it takes seven to eight hours to charge a 20kwh battery installed in a typical small EV with a range of 200km, using a 200-volt EV charger with a capacity of 3kwh. In order to address consumers’ anxiety over the short range, automakers may want to increase the capacity of the battery. However, even if they manage to do so, they would end up facing another barrage of complaints, because the output voltage of alternate current (AC) power supplies at home is limited due to safety reasons, and hence greater battery capacity translates into longer battery charging time.

According to the Federation of Electric Power Companies of Japan (FEPC), an average household consumes 300kWh electricity per month, meaning that more than two days of electricity currently consumed will be required to charge the battery to its full capacity just once. Significant enhancement of electricity supply infrastructure must take place to expand the market penetration of EVs. This will involve not only increasing the overall capacity for power generation but also reforming the entire electricity supply system including the introduction of smart grids to optimize the supply network by utilizing information technology (IT).

Another reason why the realignment of supply chains will likely take time is the presence of the aftermarket such as repair and maintenance services. According to the Automobile Inspection & Registration Information Association (AIRC), the number of vehicles (passenger cars, trucks, and buses) currently registered in Japan totals some 76 million. Even if all of the new vehicles to be sold in the coming years (five million new vehicles sold in 2016) are assumed to be EVs, it would take about eight years to have 1/2 of the vehicles on Japanese roads replaced by EVs. More realistically, it would take more than 10 years considering the time required to change various systems.

In the meantime, there will continue to be demand for repair parts and components for gasoline-fueled vehicles already on roads. Thus, the market for automotive parts and components suppliers will not disappear immediately in Japan. Looking beyond the national boundaries, there exists an enormous international aftermarket, and there will be room for Japanese companies to pursue growth by actively exploiting it.

Thus, the situation faced by companies producing items made unnecessary by EVs is not necessarily imminent, and they still have time to adapt to the evolving structural changes. However, this does not mean that they can afford to put off making strategic decisions. Although the future shape of supply chains is not clear, I would like to attempt to envisage some possible directions of development.

Even though the electricity supply system does not change overnight, it is quite possible to promote the use of EVs as a means of in-town transportation exclusively for short-distance travel, which would require relatively short charging time, while people continue to use gasoline-fueled vehicles for long-distance travel.

Miyadai Haruyuki, senior fellow at the Institute for International Economic Studies, points to the possibility of EVs serving as a complement or substitute for public transportation means by evolving into autonomously driven slow-speed vehicles designed for in-town operations. Small EVs that can drive down the streets too narrow for conventional buses are attuned to the needs of an aging society and will help improve the quality of people’s lives.

Such in-town EVs will be connected to the Internet and the basis for the utility of vehicles will shift from ownership to use with the rise of sharing services. EVs will operate at a higher utilization rate than gasoline-fueled vehicles that are “parked at a parking lot or elsewhere 95% of the time” (according to a report by the Ministry of Economy, Trade and Industry (METI)).

By eliminating the possibility of using them for long-distance high-speed driving, it will be possible to apply somewhat relaxed safety standards to such in-town EVs as compared to those currently applicable to conventional cars. If realized, this would facilitate the standardization of parts, and components as automakers would not find it necessary to select suppliers by applying stringent criteria, such as those observed today, and demand them to produce customized parts and components.

Miyadai points out that because of the need to be connectable to external devices via interfaces for telecommunications and recharging, parts and components for EVs must conform to common standards, leaving little room for customization and providing ready ground for standardization. If the standardization of parts and components for EVs occurs on a significant scale, automakers may drastically change their way of thinking in designing cars, prompting them to press forward with the standardization of gasoline-fueled vehicles.

Standardization may increase business concentration and production scale, because economies of scale becomes more important. At the same time, however, emerging technologies for enabling small-lot production at low costs, such as three-dimensional (3D) printing, may give rise to decentralized production systems in which companies with innovative technologies work in networks to manufacture small volumes of products. In either case, quality is the key to success in competition when it comes to parts and components. This is an area in which Japanese parts and components makers have a good track record.

For instance, if the utilization rate of EVs increases with the rise of sharing services, the length of their useful lives will inevitably become shorter. Durability will likely be an important factor in technological competition among EV parts and components suppliers. To date, they have focused on extremely precise adjustments with automakers to fine-tune the specifications of parts and components in the suriawase or integral production model. From now on, however, they should shift their efforts to undertaking research and development (R&D) from a viewpoint aligned with that of consumers to differentiate their products and establish their own brands, while keeping an eye open for how EVs are accepted and used in society.

Some of those companies producing items made unnecessary by EVs may evolve into major players in other growth areas by building on their current core technological capabilities, following the example of harness makers of bygone days. Following the transition from the horse and buggy age to the era of automobiles, some harness makers transformed themselves into coach builders, the origin of automotive body builders, while others evolved into high-end leather brands.

Needless to say, it is imperative that the automotive industry as a whole should continue to develop and drive the Japanese economy. However, efforts on the part of automakers and their suppliers are not enough to promote the penetration of EVs in a way conducive to the betterment of people’s lives. Various regulatory and institutional systems—including those for electricity supply, transportation, telecommunications, safety, and sharing services—must change as well. Such changes must be acceptable to consumers, and it is necessary for the government and various businesses hitherto unrelated to the automotive industry to come up with innovative ideas.

Translated by the Research Institute of Economy, Trade and Industry (RIETI)* The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 26 September 2017 under the title, “Jidosha sangyo no mirai (2): Buhin-mo no kozohenka ni sonae (The Future of the Automotive Industry (Part 1): Preparing for structural changes in the supply chain networks).” The Nikkei, 26 September 2017. (Courtesy of the author)