Challenges after the TPP-11 agreement: A guide towards establishing global rules

Key Points

- TPP-11 is a great achievement in Japanese economic diplomacy

- “Frozen” items will not detract from the quality of the agreement

- Move towards data localization should be restrained

Prof. Kimura Fukunari

In November, a new broad agreement based on the Trans-Pacific Partnership (TPP) was reached between 11 countries, excluding the US, in Da Nang, Vietnam. The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP, or TPP-11) represents a major step towards putting the TPP into practice. Four points were listed as requiring further negotiation. They were on state-owned companies (Malaysia), services and investment in the coal industry (Brunei), dispute settlement (Vietnam), and cultural exceptions (Canada). Once these points have been agreed and signed off however, the agreement will be ratified by at least six countries, irrespective of their economic scale.

With the US currently distancing itself from the TPP under the Trump Administration, some have claimed that this will drastically reduce the economic effects of the TPP. The value of TPP-11 however is that it sets out the direction in which the Asia-Pacific region should be heading, in terms of high-level liberalization of trade and establishing international rules. If the US were to put domestic politics aside and think things through rationally, they would probably realize that returning to the TPP would be more efficient than going to the trouble of setting up bilateral free trade agreements (FTA).

Once the agreement comes into effect, other Asia-Pacific countries will no doubt get on board, even without waiting for the US to return to the table. There are plenty of countries that would be interested in a valuable agreement such as this. The precursor to the TPP was the P4 (Pacific 4), agreed between Brunei, Chile, New Zealand and Singapore. Comparatively speaking, the TPP-11 is an excellent middle ground because it will consist of at least six countries.

Japan took the initiative ahead of the recent negotiations, by submitting an early bill that would facilitate procedures to ratify the TPP, and by resolving a number of outstanding domestic issues. Along with the economic partnership agreement (EPA) that Japan has almost finished negotiating with the European Union (EU), the broad agreement on the TPP-11 is a tremendous achievement that heralds the dawn of a new era in Japanese economic diplomacy.

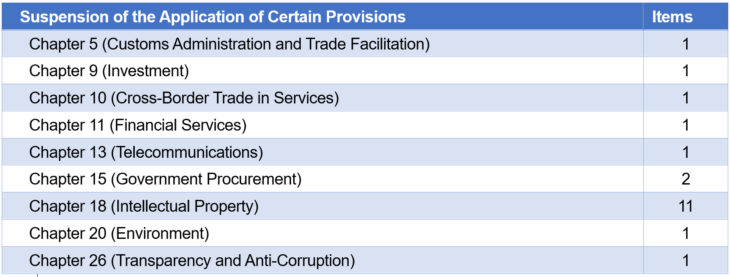

20 items covered by the agreement have been “frozen” until the US comes back to the table. The frozen items are listed according to each section in the table above, with details specified in the text under individual items. There are no frozen items relating to areas such as customs or rules of origin. 11 of the frozen items, more than half, are under the section on intellectual property, reflecting serious concerns from the US. These include matters such as biological data protection and copyright periods. The other key point is in the section on investment, where a partial freeze has been imposed on the scope of investor-state dispute settlement (ISDS). On the whole, these are relatively narrow items that will not detract significantly from the quality of the agreement.

As well as abolishing a high percentage of tariffs, the TPP-11 sets out a level of service and investment deregulation that has been beyond most of the existing FTA in East Asia, and includes stipulations such as the principle of non-discrimination with regard to government procurement. It is also set to have a considerable impact on other FTA negotiations, including the East Asia Regional Comprehensive Economic Partnership (RCEP). On top of all this, the TPP-11 is attracting attention as a guide towards establishing global rules and formulating rules for e-commerce and state-owned enterprises.

The section on state-owned companies and designated monopolies is aimed at standardizing competitive conditions, so that goods and services should be sold or purchased by state-owned companies on the same footing as private companies. Provisions include requiring state-owned companies to act in line with commercial practices, ensuring that non-commercial assistance granted to state-owned companies does not impact negatively on the interests of other signatory countries, and requiring countries to provide information on state-owned enterprises.

Many state-owned enterprises receive subsidies from the relevant government, whether directly or indirectly. This may give them an unfair advantage when it comes to competing with private companies. Action of description needs to be taken to avoid this sort of market distortion. In recent years, there have also been more and more state-owned enterprises branching out overseas. Under the principle of non-discrimination increasingly imposed in relation to investment based on FTA or bilateral investment treaties (BIT) however, it is increasingly important to ensure fair competition. In the future, readjustments will probably need to be made in relation to development assistance and investment too.

Now that emerging countries with different economic systems are establishing a stronger presence, not least China, the need for international rules to ensure fair competition is greater than ever before. Aside from World Trade Organization (WTO) regulations on countervailing duties against subsidies however, there are virtually no rules being implemented globally. Even in this section of the TPP, there were numerous exceptions in both the main text and appendices. It will be necessary to keep a close eye on things after the agreement comes into effect, to determine the extent to which rules are effective. This is nonetheless a significant first step towards establishing important international rules.

The section on e-commerce stipulates (1) free flow of data, (2) prohibition of requirements on data localization, and (3) prohibition of requirements on forced disclosure of source codes. The first two of these provisions include disclaimers, stating that countries shall not be prevented from taking and continuing noncompliant actions if they are for the purpose of legitimately implementing public policy. It is therefore unclear as to whether these provisions will be rigorously enforced. This section is nonetheless crucial, because it sets out broader principles.

Attitudes towards e-commerce vary significantly between the US and the EU. In May 2018, the EU will be bringing the General Data Protection Regulation (GDPR) into effect, in order to protect the privacy of individuals living in the EU. This will involve strict data localization, meaning that restrictions will be placed on removing data from the EU. In fact, prohibiting requirements on data localization is one of the areas in which EPA negotiations between Japan and the EU have failed to reach an agreement. While it is unclear how far major countries will go to align their systems in the future, at the very least, economic activity involving the EU will be subject to a number of restrictions.

According to estimates published by the McKinsey Global Institute in the US, the flow of data across international borders increased 45-fold during the decade from 2005 onwards. This reflects ongoing qualitative changes in the international socioeconomic environment. There are countless issues that need to be addressed, including consumer protection, ensuring privacy, clamping down on market domination and tax avoidance by platform (infrastructure) companies, and defending against cyberattacks. There is nonetheless a deep chasm between the US, which believes in the principle of freedom, and the EU, which is approaching these issues from a defensive point of view. China meanwhile intends to bring in a Cybersecurity Law in June, as part of an ongoing drive towards strict data localization.

While emerging and developing countries may adopt policies aimed at restricting the flow of data, in the interests of nurturing companies in their own country, the cost involved in doing so is considerable. Whereas China has undoubtedly restricted outside market entry in order to nurture the Alibaba Group and Tencent, among others, countries that are smaller in scale might struggle to protect budding industries in the same way. Platform companies also have very similar business models, which can be imitated with relative ease in some cases.

Although there are definitely economies of scale to be had from the network effect, it is getting a lot harder to achieve prolonged market dominance, as with large capital stock industries in the past. Even if emerging and developing countries were unable to develop platform companies right away, it would be wise for them to open up real gateways towards worldwide innovation, and to draw on current applications to create more jobs.

Bringing the TPP-11 into effect is also important from the point of view of pushing back against the current worldwide trend towards protectionism. Japan needs to continue playing an active role in establishing a new international economic order in the future.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 14 December 2017 under the title, “TPP11 goigo no kadai (I): Sekai ruru kochiku no shishin ni (Challenges after the TPP-11 agreement (Part 1): A guide towards establishing global rules).” The Nikkei, 14 December 2017. (Courtesy of the author)