Stalled Fiscal Consolidation: Government Must Act Soon on Policy Normalization

Key Points

- Japanese economy: Likely to slump after Tokyo Olympics

- Emergency Measures: Continuing through 2020s not possible

- Healthcare Insurance: Adopt funded individual savings account system

Prof. Ihori Toshihiro

This autumn Prime Minister Abe Shinzo is expected to decide whether or not to proceed with the 10% hike in the consumption tax rate, which is scheduled for October, 2019. During the House of Representatives election held in October of last year, the ruling party promised to allocate a portion of the revenue increase from the consumption tax hike to educational expenses, as by strengthening preschool education.

Originally, 80% of the revenue increase was supposed to be allocated to paying down debt. But that would not benefit the younger working generation, and yet cutting social security spending to fund preschool education would be opposed by the elderly, so that’s not an option either. The government has secured a funding source in the budget for the fiscal year ending March 2019 by not paying down debt but will have to issue deficit bonds to cover the shortfall, meaning that the funding burden will be passed to future generations who have no voting rights.

On the other hand, the opposition parties have come out with promises even more naïve than those of the ruling party in calling for a freeze on increases in the consumption tax while saying that social security could be strengthened and fiscal consolidation achieved even without an increase in the consumption tax.

The House of Representatives has been dissolved before the elapse of three years, and a House of Councilors election takes place every three years. Each time a national election is held, politicians try to offer spending to please all voters and the consumption tax increase is rolled back further, undermining progress on fiscal consolidation. In the national election, the ruling Liberal Democratic Party and Komeito coalition won an overwhelming victory, but while the political situation may be stable, the will for fiscal consolidation is nowhere to be seen.

As usual, the government is groping for an aggressive stimulus package, nominally, to boost the economy. Social insurance spending is characterized by inequalities and ineffective policies, but no progress has been made on rectifying these.

As a result, it will be impossible within the fiscal year ending March 2021 to achieve the fiscal consolidation target of bringing the primary balance into equilibrium. Moreover, most of the revenue increase from the next consumption tax hike will be allocated to government expenditure increases, and the tiered consumption tax system (applying a lower rate on fresh food) will also come into force. Since the tiered system for consumption tax will reduce the tax base, tax revenues will fall. It’s as yet uncertain how this revenue shortfall will be made good.

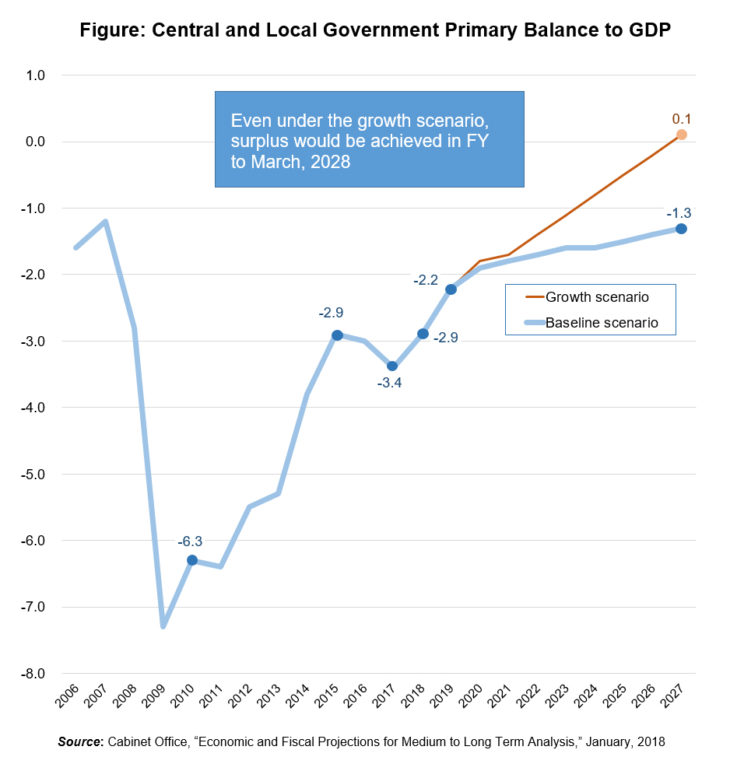

According to Cabinet Office estimates announced in January, even if the consumption tax rate is raised in October of 2019, under the government’s growth scenario, the deficit in the primary balance for the year ending March 2021 will swell from the 8.2 trillion yen estimate made in July of last year to over 10 trillion yen. Achievement of an overall surplus will also be pushed back two years to the year ending March, 2028 (see figure). According to the baseline scenario, which assumes that the economic growth rate does not recover along the lines projected by the government, the government’s fiscal status will become even more severe.

It is also doubtful that it would be possible to achieve the nominal growth rate of 3%–4% as projected under the growth scenario for the 2020s and after. The Olympics will be a major event, but when it is over, there will be a major pullback as the enthusiasm cools. Given the many regulations in Japan which hamper innovation, the rate of economic growth can only slump once the impact of aging and the population decline are felt.

As long as talented young workers are not hired from foreign countries, Japan can not expect to see very much human capital accumulation. Looking to 2020 and beyond, it is very possible that the real economic growth rate will fall to nearly 0%, and it will be very hard even to achieve a nominal grow rate of 3%–4%. Achieving that will by no means be easy even under the baseline scenario.

The fiscal consolidation strategy of Abenomics adopts the position that revenues will increase naturally along with economic recovery, but such a leisurely approach means that fiscal consolidation will remain out of reach. When the economy slows from the middle of the 2020s, the baby boom generation will become late-stage elderly, and social security demand, especially for medical care, will rise dramatically.

Theoretically, if expenditures can be reduced under the optimistic projections of the growth scenario, it would be possible to work out a fiscal consolidation scenario with the consumption tax rate at 10%. However, given the trend of rising demand for social security services as the Japanese population ages, it will not be easy to cut expenditures. In the formulation of the budget for the year ending March 2019, the revision of medical treatment remuneration became a focus of debate, and although drug prices were lowered, medical care remuneration itself was increased.

One promising option for reviewing the fiscal consolidation targets is the proposed extension of the targeted date for achieving equilibrium in the primary balance from the year ending March 2021 to the year ending March 2028. However, if the target date is postponed seven years or more, investors at home and abroad may doubt the government’s resolve to achieve fiscal consolidation, which may lead to market volatility.

According to Cabinet Office estimates, the ratio of outstanding public debt to gross domestic product (GDP) will decline for the present despite the deficit in the primary balance. This will result from the action of the Bank of Japan, which will maintain a policy of massive monetary easing to keep interest rates below the growth rate. For practical purposes, the BoJ’s continued buying of Japanese government securities amounts to monetization of the fiscal deficit (or making good the fiscal deficit), and continuing such emergency measures through the 2020s will almost certainly be impossible.

On the whole, Abenomics is an emergency policy package. Since the economy is in a state of emergency, unorthodox measures are adopted in both monetary and fiscal policy. If the government goes on raising expenditures as by expanding public works financed with large supplemental budgets and continues extravagant fiscal spending despite the state of the economic climate, there will be no exit from the complacency of profligate financial policy. Extravagant fiscal spending is not the way to fiscal consolidation.

Abenomics has been underway for five years since the start of the second Abe administration but it’s hard to see when the emergency policies will end. Recently the government’s assessment of the economy has been positive, and the economy has been near full employment. The government must now focus on its strategy for fiscal and monetary policy normalization.

The merits of fiscal consolidation should be judged based on whether economic conditions are better or worse now than they will be in the future. The tax increase must be borne at one time or the other, so debate should focus on whether it is better to ask the present or future generations to bear the burden.

If the tax increase is postponed to a period of economic weakness, the burden will be shifted onto future generations who will be less able to bear the burden. Japan’s population will decline in the future, and Japan’s existing pay-as-you-go social security system taxes the present working generations to provide benefits to the older generation, so future generations will have to face a heavier burden and less benefits in social security. It is very likely that macroeconomic growth will also weaken. One can easily imagine that economic conditions for future generations will be severe, so it would be preferable for present generations, including the elderly, to share the burden of the tax increase.

When baby boomers become late-stage elderly around 2025, it will become even more difficult politically to reduce the vested interest supporting social security benefits. If macroeconomic conditions are severe at that time, both the government’s financial position and the social security system could miscarry. Instead of obsessing with the next election or present economic trends and postponing solutions to pending issues, the government should change course on the second arrow of fiscal stimulus, stress the interests of future generations and take action on fiscal consolidation and social welfare reforms to attain fiscal sustainability and intergenerational equity.

Healthcare insurance will require massive funding in the near future, so the best option is to build up a fund by identifying funding sources now while there is still time, prepare for the increase in healthcare demand expected in the future and adopt an individual account funded system.

For instance, Singapore has adopted a healthcare reserve system based on a self-help approach through compulsory savings in individual accounts. A similar healthcare funded account system has been adopted in the United States. In public pensions too, it will be important to build a good individual account funded pension system. Australia has implemented a retirement pension fund system featuring compulsory contributions by business enterprises, and many workers participate in the funded pension system.

Japan’s individual type defined contribution pension plan (iDeCo) is a similar system but its adoption has been slow. If all workers had such accounts by default and elderly savings were strengthened through self-help efforts, it would be possible to streamline the current pay-as-you-go public pension system.

We can not expect to stimulate the economy if excessive concerns for agricultural and self-employed interests lead to safe and secure policies designed to please everyone. It is important that the government proceed with bold reforms in healthcare, agriculture, distribution and other fields, adopting a strategy to encourage private sector creativity and lift the potential growth rate.

While raising the consumption tax in stages, the government must cope with vested interests of the elderly in such areas as social security and act boldly to use expenditures more efficiently, restore fiscal discipline and implement fiscal consolidation over the long term.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 8 February 2018 under the title, “Tonoku zaisei-kenzenka (Part I): Hijouji taiou no seijouka isoge (Stalled Fiscal Consolidation (Part I): Government Must Act Soon on Policy Normalization).” The Nikkei, 8 February 2018. (Courtesy of the author)