Asia’s Growth and Japan III: Understanding the Values Attached Locally is the Key

Key Points:

- A proper understanding of Asian markets is indispensable for building strategies.

- Values related to consumption vary from one region to another.

- Look for the key to adjustment to local conditions in visitors from abroad.

Kawabata Motoo, Professor, Kwansei Gakuin University

Japanese companies’ forays into overseas markets are heating up. According to the 2017 edition of Kaigai shinshutsu kigyo soran (Source Book on Japanese Companies Expanding Operations Overseas, published by Toyo Keizai Inc.), the highest ratio of companies establishing subsidiaries abroad, 30% of surveyed firms, cited overseas market development as the objective for establishing them. Companies with subsidiaries in Asia comprised 72% of them. Asia is attracting attention to this extent.

Naturally, we see many companies advancing into Asian markets to develop an overseas production network. However, we should not forget that many of the overseas manufacturing plants that those companies have established in recent years are meant for local markets. Expanding consumption is propelling not only markets for companies that make goods for final consumption, but also markets for others that produce the various components, materials and equipment for manufacturing them. That is the current picture of Asia.

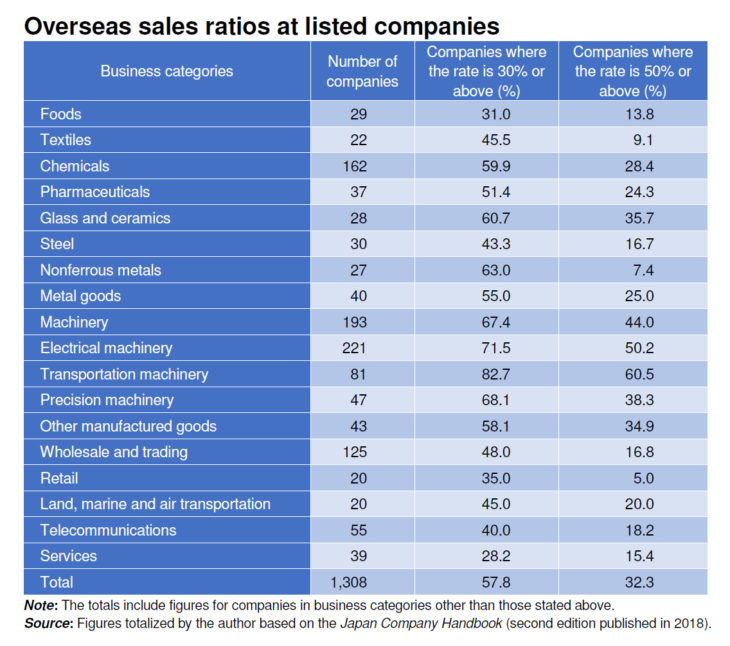

The following table shows the overseas sales ratios at listed Japanese companies. The author prepared this table based on the Japan Company Handbook (second edition published in 2018). There were about 1,300 Japanese companies whose overseas sales were mentioned in the Handbook, and they accounted for approximately 35% of all listed companies. Companies where the overseas sales ratio is 30% or higher and those where the ratio is 50% or above accounted for about 60% and 30% of them, respectively.

The author thinks that the actual ratios are a little higher than these figures, considering partial statement omissions found in the material and sales for overseas subsidiaries outside the scope of consolidation that are not reflected.

By business category, companies in the machinery and electric machinery categories stand out in terms of numbers and ratios. A closer examination shows high overseas sales ratios at companies manufacturing automobiles, cellular phones, and semiconductors—materials and components used in automobiles and cellular phones. By region, North America and Asia are major markets for many companies. Their sales have been increasing in Southeast Asia in recent years.

Compared with figures from seven years ago, the overseas sales ratio rose sharply in business categories that are closer to consumer markets, such as foods, telecommunications, retail, restaurants and services. Many companies for which the ratio climbed sharply expanded their sales in Asian markets.

The overseas sales ratio tends to be particularly high among start-ups that have listed their shares in recent years. This tendency suggests that strong demand for new information services, such as those related to games, Internet advertising, management systems and medical services, also exists in Asia. In addition, food service companies that are increasingly moving into overseas markets through franchisees are not reflecting overseas sales in their operating results in many cases. In reality, food service companies that are increasing their number of stores overseas are growing rapidly in number.

Japanese companies are continuing to expand their overseas operations in this way. Interesting matters become visible when we move a step closer to them.

Many companies whose overseas sales ratio rose substantially from seven years ago advanced the acquisition of local companies to make forays into new overseas markets and develop sales channels abroad. In the meantime, many companies whose overseas sales ratio fell sharply pulled out of unprofitable overseas markets or sold local companies that they had taken over earlier.

We can say that Japanese companies are beginning to learn about the difficulties involved in extending the lines of battle overseas and the problems with leaving sales channel development up to local companies through experiences. Japanese companies’ forays into overseas markets have already entered the second stage.

The author has traveled throughout Asia as a location of consumption for almost a quarter of a century since the middle of the 1990s. The author has witnessed many Japanese companies attempting to enter consumption markets there. In the course of doing so, the author has come across many companies that appear to have built no credible strategy because of their inability to understand the Asian markets properly. To put it plainly, the author has discovered widespread misunderstanding of the Asian markets.

For this reason, the author would like to discuss the three basic perceptions necessary for properly understanding the Asian markets in the following section.

The first perception is the perception regarding income. The multiplication of income by population is used to measure the potential of overseas markets, including those in Asia in many cases. Discussions on matters such as the expansion of the middle class and the wealthy class lie on the extension of discussions on income as well. However, people do not buy things in which they can see no value, even if their income is high. The purchasing behaviors of Japanese people make this point clear. On the other hand, people attempt to obtain things that they consider to be valuable no matter what it takes and even if their income is low by finding ways including curbing other expenditure and taking out loans.

In Asian markets, wide gaps exist between actual income and sales of consumer durables because people start buying durables when their income reaches a level at which they can take out a loan. The standards for values depend largely on the values (tacit knowledge) that people have come to share through living in the natural and social conditions of a given region (market), even though portions of those values are based on personal preferences. For these reasons, evaluations differ in the respective regions.

Accordingly, the problem lies not in the income level, but in how to approach the different values of people living in different parts of Asia.

The second perception concerns the middle class. The author has observed numerous arguments that identify the middle class in Asia with the Japanese middle class in the period of high economic growth, and that expect the former to display consumer confidence. To put it accurately, however, it was the people who wished to be the middle class or join the middle class, rather than the actual members of the middle class, who acted as the driving force behind Japan’s consumption in those days. In short, a reserve army of people who were unable to reach the middle class were buying consumer durables that symbolized the middle class, or the so-called three status symbols, by paying for them in monthly installments.

The same thing is happening in Asian markets today. For this reason, how to approach the values of that reserve army of people, instead of the middle class, is the key. We must remember the need to consider education levels and occupational categories, in addition to income levels, when grasping such social class.

The third perception relates to adjustment to local conditions. The product development and sales divisions of global companies have been showing a tendency to advance their adjustment to local conditions in varying degrees in recent years, while global standardization is underway for their administrative divisions. The substance of their local adjustment includes numerous adaptations in the so-called visible areas, such as product functions, sizes and designs. In many cases, however, products that catch on in overseas markets carry unexpected meanings and values that are attached by local consumers.

For example, Chinese noodles from Japan served in pork bone soup, known as tonkotsu ramen, are popular in China because consumers there find extremely high value (strong attraction) in soup extracted by boiling pork bones. Pork bone soup never existed in China in the past. For this reason, Chinese people see a Japanese value in ramen, whereas Japanese people generally have a strong image of ramen being a Chinese dish. Consequently, very few customers in China leave the soup in their bowl, even if they leave some of the noodles uneaten.

We can refer to adjustment to peculiar meanings and values attached to the respective overseas markets, in other words, adjustment on an invisible level, as a future strategic issue for Japanese companies. Those attached meanings and values are difficult to grasp because they are tacit knowledge shared by the people living in a particular region. Visitors from abroad, who have been growing in number in recent years, are valuable in that respect because they offer clues for gaining an understanding of those meanings and values.

Asian markets have now become places in which to earn profits with effective strategies. There is no guarantee that products, business models, technologies and expertise developed in Japan can gain the same values and meanings in overseas markets.

It is better for us to assume that different meanings and values are attached overseas, even if the same things catch on in Japan and abroad. Globalization is nothing more than working to overcome the different meanings and values attached in the respective markets one by one. We cannot evolve the next strategy if we misread this point.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 13 April 2018 under the title, “Ajia no seicho to Nihon III: Genchi no kachidzuke haaku kagi (Asia’s Growth and Japan II: Understanding the Values Attached Locally is the Key).” The Nikkei, 13 April 2018. (Courtesy of the author)

Keywords

- Asia’s growth

- overseas production network

- expanding consumption

- foods

- telecommunications

- retail

- restaurants

- services

- middle class

- wealthy class

- purchasing behaviors

- tacit knowledge