In preparation for the worst-case scenario of a national default: Can the current generations resign themselves to the costs for the future generations?

Governments don’t default? The Logic of Infallibility undermines Japan

Prof. Kobayashi Keiichiro

While the realities of the Japanese economy are progressing smoothly, with stocks surging and competition on the employment front becoming overheated, it is widely known that government finances are continuing to worsen. Some may be concerned that if the present situation holds, a national default will occur. Unless confidence in the Japanese economy is lost, chances are slim that a default will occur within ten years. But because government debt will continue to increase if government finances are not reconstructed, a financial collapse is certain to occur someday. That time may be in the next twenty to forty years, a point of time in the long-term future. But the possibility of a national financial failure is a matter that each of us has to consider in our life in the sense that it will occur by the time we retire or around the time our children reach middle and old age.

This April, I compiled the discussions held at the Study Group for Research on Fiscal and Inter-generational Issues of the Canon Institute for Global Studies and published After the Collapse of Public Finances: Crisis Scenario Analysis (Nikkei Publishing Inc., 2018). This meeting was attended by experts in social security, finances, medical economics and monetary policy, and they discussed the theme of “What if the government defaulted?,” a question that challenges a taboo in policy circles. The publication of this book does not automatically mean that I want to contend that a national default is imminent. What I wanted to argue the most strongly is the fact that the current situation, in which people consider a worst-case scenario to be taboo and nobody tries to discuss it, is extremely unsound for policy discussions.

The characteristics of Japanese policy debates of avoiding thinking about a worst-case scenario originate from the logic of infallibility, which can typically be seen in major Japanese organizations. It goes as follows:

“Because the government bears the responsibility for successfully reconstructing national finances, it runs counter to the government’s responsibility to consider the case in which it will fail (that is, a national default). Accordingly, the government must not think about what it should do if a national financial failure should occur.”

Because the government will never fail, or rather it must not fail, you do not need to and must not think about when it fails. This is the logic of infallibility. This way of thinking is widely shared among every Japanese bureaucratic organization, including large corporations and local governments, as well as the central government.

But if you think a little further, you will soon notice that the logic of infallibility is totally unsound and unreasonable. Even if the government strives to reconstruct public finances, the effort may fail because human beings do it. It is important for a policy debate to consider the specific meanings of a worst-case scenario (a national default) due to the failure of the government’s policy and what would be able to be done as remedial measures in that situation. This is what the government should do. The government is required to fulfill the duty of never failing. But there is no rational logic for drawing the conclusion that you must not consider a worst-case scenario on a national default. It is extremely unreasonable and unsound for Japanese bureaucratic organizations to be so trapped by the logic of infallibility that they must not consider the case in which they fail to fulfill their duties. Fundamentally speaking, the government should examine the impact of a national default on national lives by bringing together the specialized knowledge and insights that government organizations have and consider a contingency plan (crisis management plan) for minimizing damage to the nation, just like measures for huge earthquakes and measures for severe accidents, including nuclear power plants. In After the Collapse of Public Finances, a group of several researchers attempted to do so, but failed to delve into the details.

However, this argument may induce you to argue against me, saying, “You should not make people unnecessarily concerned” or “If the government mentions national default, the people will be concerned about their future, which will depress the economy.” But this is a typical obscurantist way of thinking (you should make people trust you, but never let them know), which underestimates the Japanese people’s ability to shoulder the responsibility of democracy. If the people are informed that the government is preparing policy plans for the worst-case scenario, they will deepen their trust in the government and gain more confidence in the future, which will eventually have a positive impact on the economy.

If I take this argument further, the logic of infallibility, which has spread among Japanese organizations, is the same as the logic of the spirit of unfailing victory, which was used by the wartime Japanese army that rejected the necessity of military logistics in preparation for the worst case and executed reckless operations. (They believed that they would definitely win and did not need to think about their defeat.) That is, it appears to be reasonable, but in fact, it is quite an irrational Japanese way of thinking.

In this connection, the phrase “I cannot answer a hypothetical question,” which we often hear in parliamentary statements and at press conferences, is exactly the same logic as the logic of infallibility. If you think about it carefully, you will notice that this is also a strange phrase. Because leaders such as politicians, bureaucrats and company managers are burdened with the duty of considering and carrying out various plans in preparation for contingencies, they should always keep hypothetical questions based on a worst-case scenario in mind. Why can leaders not answer such questions? Why are many interpellators and citizens persuaded and silenced by the answer “I cannot answer a hypothetical question”? This suggests how deeply the logic of infallibility is rooted in many people.

What will begin to happen in 2020?

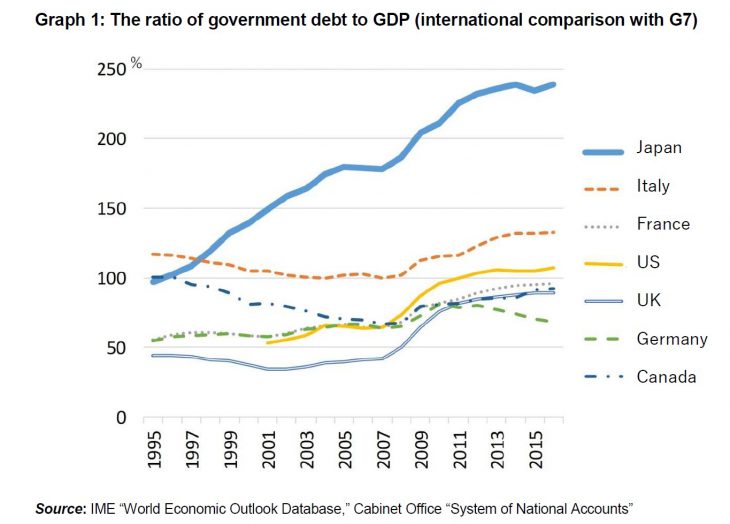

First of all, I will confirm the Japanese government debts. As shown in Graph 1, the Japanese government debts have continued to increase since the collapse of the bubble economy. This is because annual government expenditure has always surpassed tax revenue. Graph 1 shows an international comparison of the percentage of government debts (debt ratio) to gross domestic product (GDP), which shows the economic scale of G7 countries. What distinguishes Japan from other countries is the fact that its debt level is remarkably high, and that debts have continued to increase steadily. Japan’s debt ratio is approaching 250%. This is higher than the level immediately after the end of World War II, and there are no cases in world history in which advanced countries have had a debt level of more than 200% of GDP in peacetime. The current Japanese debt has reached a level that is unprecedented in the history of humankind.

For reference, the debts shown in this graph are gross debts and are values including assets owned by the government. Some argue that you should note net debts, which are calculated by subtracting the assets owned by the government from government debts, to compare the true size of debt burdens. By net debt, Japan’s debt ratio is about 150%. But even this figure is the worst of all G7 members and is an unusually high level for an advanced country in peacetime. In addition, the rapid continued increase in the debt ratio can also be observed by net debt.

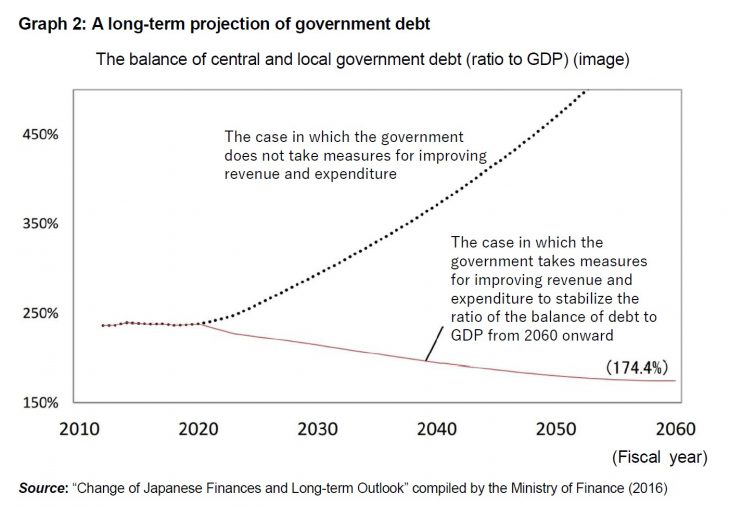

Graph 2 shows a long-term projection of the debt ratio (gross debt) based on a simulation as to what will happen if the current situation holds. The debt ratio will remain stable due to low interest rates until around 2020. But if the government leaves the social security system as it is now and does not increase taxes, the debt ratio will continue to increase endlessly because the burden of interest will mount gradually and accumulate at a rapidly accelerating rate. It is shown by the dotted lines. According to this scenario, you will see an unrealistic situation in which government debts will have surpassed 450% of GDP by 2050.

According to macroeconomics academic research taking all general equilibrium effects into consideration, which has been undertaken by Japanese and American economists, many of them have reported that unless the Japanese government increases the consumption tax rate to about 40% to 50%, it will be unable to stabilize national finances. This is unrealistic politically, but if you analyze Japanese economic data with an open mind, you will find such outcomes.

What is a national default?

However much the debt ratio continues to increase, if investors (mainly Japanese domestic financial institutions) continue to buy Japanese government bonds, the economy will keep on running. But if investors suspect that the Japanese government may not be able to repay its debts, a default will occur. Fundamentally, why do investors continue to buy Japanese government bonds? It is because investors believe that the Japanese government will repay its debts someday. It is often said that because the Japanese people have financial assets of 1,800 trillion yen, the increase in government debts is not a problem. But this is just like saying, “Because the government will definitely impose massive taxes on national assets and allocate them to the repayment of its debts someday, the Japanese government will not default on its bonds.” That is, the reason markets have confidence in Japanese government bonds is their tacit expectation for a major tax hike in the future.

There is no guarantee whatever that this market observation is correct. Certainly, the government makes a tacit promise to prevent the default of its bonds. But the government does not announce that it will launch a major tax hike in the future, and such a major tax hike may be impossible politically. Accordingly, there are no certain grounds for market observation, and it is no wonder that markets could lose confidence in Japanese government bonds at any time.

If markets lose confidence in Japanese government bonds, no investors will buy them, which can be considered to be national default.

In such a case, the government will have no other choice but to raise the bond interest rate (that is, lower bond prices) so that investors will buy bonds, or to ask the Bank of Japan to increase bond purchases. Because the bond interest rate is linked to those of housing loans and bank lending, the increase in the bond interest rate will lead to a rise in interest rates in the entire Japanese economy, which will depress consumption and plant and equipment investment and result in a serious recession. The government cannot make such a choice.

If this occurs, all the government can do is to ask the Bank of Japan to buy government bonds on an unlimited basis. Investors hand government bonds to the Bank of Japan and receive a large quantity of Bank of Japan notes (including BOJ Current Accounts) from the Bank of Japan. In this process, government bonds that have circulated in the market are absorbed by the Bank of Japan, and the same sum of Bank of Japan notes will circulate in the market. If market investors hold Bank of Japan notes, there will be no problem. But it is highly likely that the market will lose confidence even in the Bank of Japan. This is because confidence in the Bank of Japan is ultimately supported by confidence in the Japanese government. For example, if the Bank of Japan becomes insolvent, the government has to bail out the bank. But because the bailout funds are raised by the government by issuing bonds, if the public confidence in those bonds is lost, the government cannot bail out the Bank of Japan. Accordingly, if public confidence in government bonds is lost, the Bank of Japan will also suffer a loss of confidence from the market.

In accordance with this line of reasoning, it is inconceivable that the market will put its confidence in the value of Bank of Japan notes in case of a national default with the public confidence in government bonds being lost. People would part with Bank of Japan notes one after another. This would trigger inflation, with prices doubling and tripling in no time.

What will happen to national lives?

If high inflation suddenly occurs, you will find it more difficult to buy the products and services you need for your daily lives. Because inflation causes money to devalue, people will part with money as soon as possible and try to buy assets that are resilient against inflation (real estate, precious metal, stocks and foreign currencies). There will be capital flight as people avoid holding yen-denominated assets and escaping their assets overseas. Workers and pensioners who only have bank deposits will see their wealth decline due to inflation and will struggle, while people who have land and other assets will gain unexpected income, which will widen the income gap.

Because hyperinflation means the devaluation of the yen, it will trigger a severe depreciation of the yen, which will lead to a sharp increase in the prices of imported products. An all-round increase in the prices of medical supplies, food and energy will lead to a deterioration in the quality of medical services and diets. You will see a clear decline in the standard of living in Japan.

The government will be forced to carry out fiscal reforms to calm the inflation. But it will have to make national finances healthy to a greater extent than necessary at a rapid pace to restore market confidence. As a signal to the market, the government will have to impose consumption tax at a considerably higher rate than it should fundamentally be. Assuming that a consumption tax rate of 25% is fundamentally necessary, the government might have to convince the market by increasing the rate to 35% to gain confidence from the market.

In addition, the government will also need to work out a package of measures for reducing annual expenditure immediately to restore market confidence. The government will cut expenditure haphazardly. Because the government cannot afford to show consideration for the disadvantaged in this process, the socially disadvantaged will be badly affected. If the government is unable to inject national funds into pensions and medical services, it will result in a fatal situation. A remarkable example of this occurred in Russia after the collapse of the Soviet Union. The average life expectancy of Russian men in the 1990s was six years less than before the collapse of the Soviet Union. (The average life expectancy of women was three years less.) There are some accounts of the reasons for this. According to one account, the collapse of the compassionate social security system during the Soviet era deprived the Russian people of appropriate medical and welfare services.

To prevent the recurrence of such a tragedy, the government needs to consider a triage of cutting expenditure in peacetime, when it is possible to think calmly with a focus on the specific budget items and orders concerning the reduction of expenditure in the event of national default. This is the reason why the government should draw up a crisis management plan in advance. For example, in the simulation of After the Collapse of Public Finances, I modulated my version of the plan by not reducing the expenses of medical and nursing care services for national lives and of childcare and educational services for future generations and by boldly reducing public employees’ salaries and earnings-related components of welfare pensions. But due to the logic of infallibility that is peculiar to Japanese organizations, which I mentioned at the beginning of this paper, the government cannot officially draw up a crisis management plan.

Is the argument that there are no problems with public finances correct?

While some people have a sense of crisis regarding public finances, others contend that in fact, we do not need to be concerned about Japanese national finances.

For example, some argue that because the present situation in which the government sells more than 90% of its bonds to domestic investors is just like the situation in which the Japanese people (the nation) lend money to other Japanese (the government), it is equal to the situation in which a wife lends money to her husband. Their logic says that if the wife (the nation) continues to lend money to her husband (the government) permanently, there will be no trouble. Because the government owes a per capita debt of about 10 million yen to the nation, this means that each Japanese national is lending 10 million yen to the government. But unless the government increases taxes or cuts annual expenditure, it cannot repay this money. That is, the wife is a creditor of 10 million yen to the husband, but the husband has used up the debt and is unwilling to work. If this situation holds, even if the wife (the nation) needs money after retirement, she is unlikely to be able to get 10 million yen repaid by the husband. The wife’s continuing to lend money to the husband means a tacit cancelation of debt. This can also be said to mean the implementation of a major tax hike involving 10 million yen for each Japanese national.

In addition, there is the deep-rooted argument that as long as the Bank of Japan continues to buy government bonds, a national default will never occur. This is also incorrect. As noted above, because the government plays a role in ultimately supporting public confidence in the Bank of Japan, the loss of public confidence in government bonds means the loss of public confidence in the Bank of Japan. This will lead to the loss of public confidence in the yen as well as Japanese government bonds, and inevitably to the intractable problem of hyperinflation.

Should economic growth come before the reconstruction of national finances?

The argument that the reconstruction of national finances before high-level economic growth is achieved will deteriorate the economy, which ruins everything, also seems to be persuasive. This is the fundamental philosophy behind the economic policy adhered to by the previous Japanese administrations that high-level economic growth should come before the reconstruction of national finances.

Fundamentally, however, why is the Japanese economy sluggish? One of the reasons for this is that people are concerned that a national default may occur in the future. It is thinkable that people hesitate to consume and companies shy away from plant and equipment investment due to their concerns regarding public finances. Author and Professor Ueda Kozo from Waseda University showed with a theoretical model that in the situation where consumers and companies are concerned that a default may occur in the future, economic activities shrink even before the default, and the economic growth rate declines in the long term.

In fact, opinion polls conducted by the Cabinet Office and other organizations show that a higher percentage of respondents responded that public finances are the reason for their concern regarding the future. In addition, according to a questionnaire (targeted at consumers and company managers) conducted by Morikawa Masayuki, Vice President, Research Institute of Economy, Trade and Industry (RIETI), the average answer to a question about the probability of Japan defaulting by 2030 was about 25%.

Theoretically, it is highly likely that people’s concern regarding a default will make people shrink from economic activities, which is causing the current economic growth rate to be low. If this is the case, the argument that economic growth should come before the reconstruction of national finances will become considerably less convincing. Because, in the situation in which concern about default stunts economic growth, this concern will not be shrugged off without the reconstruction of national finances, the economic growth rate will not increase. It is theoretically impossible to achieve high-level economic growth before the reconstruction of national finances.

Of course, it is also true that if the consumption tax rate is increased and annual government expenditure is cut, the economic conditions will worsen in the immediate term. It is certainly necessary to implement shock-absorbing policies, for example by introducing a fiscal policy in a supplementary budget to prevent the economy from deteriorating through the reconstruction of national finances. But unless people are prepared to accept the inevitable pain of a certain level of recession triggered by the reconstruction of national finances, they cannot break away from the vicious cycle in which concern about public finances causes prolonged low growth, which impedes an increase in tax revenues and worsens national finances.

The vicious cycle of the worsening of national finances and poor growth shows that the magic stick that enables the reconstruction of national finances and economic growth to be achieved at the same time without causing pain to anybody does not exist.

An agreement for future generations: Future design

It is not difficult to draw up policy menus that are necessary for repairing national finances, such as increasing the consumption tax rate to 25% and increasing the percentage of medical expenses paid by elderly people to 30%, the same percentage as the working population. The necessary figures, including tax rates, can be calculated easily.

The difficult question is that whatever policy menu is chosen, a structure exists in which the current generations have to live with huge costs (a recession triggered by a tax hike, etc.). That is, the current generations need to sacrifice themselves for the benefit of the future generations. It is therefore quite clear that the government needs to implement a policy of increasing taxes or reducing annual expenditure, but it cannot choose this policy.

The reconstruction of the national finances can also be said to be an intergenerational investment project in which the payment of costs by the current generations yields returns to the future generations. In this project, the current generations only pay costs and cannot gain returns. It is quite unlikely that selfish and rational contemporary people will choose a policy project in which they cannot get returns themselves.

If voters have a strong sense of altruism for their descendants, they may be able to choose a self-sacrificial fiscal policy. But disappointingly, the history of previous Japanese finances shows that the Japanese did not have such a strong sense of altruism for their descendants.

A method of policy debate called “future design” attracts attention as a way of breaking away from such a deadlock. The future design proposed at the initiative of Professor Saijo Tatsuyoshi at Kochi University of Technology and Associate Professor Hara Keishiro at Osaka University is the name of an interdisciplinary policy research field, and its method of policy debate is extremely unique. More specifically, for example, in terms of a choice of policy, a local government asks the participants in a community debate to evaluate the policy of the present times (2018) from the perspective of 20XX in the future, identifying themselves completely with future persons who live in 20XX, dozens of years from now. Professor Saijo calls persons who identify themselves with the future persons of 20XX “imaginary future persons” and “imaginary future generations.” The experiment of future design is a role-playing game in which its participants get into the roles of imaginary future persons.

From experiments conducted in Yahaba Town, Iwate Prefecture, and elsewhere, a research team led by Professor Saijo discovered that participants who got into the roles of imaginary future persons learned to choose policies that were clearly different from ordinary contemporary people. By taking the perspective of the future, participants learned to look at things from the two points of view of future and current generations. In addition, they also obtained a self who can mediate between “the self as a future-generation person” and “the self as a current-generation person” from a bird’s-eye view. This mental change is currently being analyzed by future design researchers, and may provide significant evidence of boosting people’s altruism for descendants. If the role-playing game of imaginary future generations is truly effective enough to have an impact on intergenerational altruism, policy decisions that are really for future generations may be able to be realized by introducing imaginary future generations to school education and real parliamentary and administrative fields. As an imaginary but easy-to-understand example, the members of the team led by Professor Saijo propose the establishment of a Ministry of the Future as part of the central government and a Department of the Future as a unit within local governments. If officials who identify themselves with the representatives of future generations made policy plans in those organizations, we would be able to agree on reforms involving great pains, including the reconstruction of national finances.

What we are faced with through the financial issue is not just to solve numerical issues, such as a tax hike and the reduction of annual expenditure: We are confronted with the political philosophical question, “Why must we shoulder the burden of huge costs for future generations?” Supposing that like A Theory of Justice by John Rawls, people agree to social contracts in a primary state (a state of not knowing what generation they will be born in) covered by the veil of ignorance, everyone will fear being in a generation affected by a default. Accordingly, people must agree to introduce imaginary future generations (a Ministry of the Future, etc.) as a political system. There is a need for a new democratic design through such “re-conclusion of social contracts” (Professor Emeritus Ikeo Kazuhito at Keio University).

Translated from “Tokushu: Posuto 2020 nen no daimondai. Zaiseihatan toiu Saiakuno jitaini Sonaeo (Special Feature: Post-2020 Major Question. In preparation for the worst-case scenario of a national default: Can the current generations resign themselves to the costs for the future generations?),” Chuokoron, August 2018, pp. 42-51. (Courtesy of Chuo Koron Shinsha) [August 2018]

Related article: https://www.japanpolicyforum.jp/archives/society/pt20190109210522.html

Keywords

- national default

- current generation

- future generation

- logic of infallibility

- contingency plan

- government debt

- government bonds

- triage

- crisis management plan

- future design

- imaginary future generations

- altruism for descendants

- Ministry of the Future