China’s Forty years of Reform and Opening: Industrial Advancement will be Inevitable for Growth

Key points

- China is standing at the crossroads of the middle-income trap

- The reform of state-owned companies will proceed with difficulty because there are multiple vested interests

- New startups are rising and will drive industrial advancement

Prof. Maie Yoichi

Forty years ago, in 1978, China embarked on reform and opening up. It achieved rapid economic growth, surpassed Japan in terms of GDP in 2010 and grew to be the world’s second largest economy. After its transition to reform and opening up, China carried out painful domestic reforms of negative heritage, such as state-owned companies saddled with chronic deficits and financial institutions engulfed by nonperforming loans to reconstruct the devastated economy under a centrally planned economy.

Externally, by opening up China not only introduced technologies, capital and business management from overseas, expanded exports and increased foreign reserves, but also increased employment and tax revenue. There is no doubt whatsoever that foreign capital contributed to China’s economic development. According to the Ministry of Commerce of the People’s Republic of China, a total of around 860,000 foreign companies had made direct investments in China as of the end of 2016.

Among other things, China’s entry into the World Trade Organization (WTO) in December 2001 was a significant turning point in its reform and opening up. China’s entry into the WTO worked to further promote reform and opening up by utilizing international promises, such as market opening and deregulation, as pressure from foreign countries.

The reform and opening up, by which China made great achievements including the world’s largest trade volumes and foreign reserves and the world’s second largest GDP, now faces an important turning point in the year of its 40th anniversary. From 2011 onward, the Chinese economy came to the end of the high-speed growth phase of continuing two-digit growth and entered the stable growth phase where the growth rate decreased to the one-digit range. The real GDP growth for 2018 was only in the mid-6% range, and it is forecast that the rate will slow further from 2019 onward.

To maintain its economic growth, China is required to overcome a restrictive factor called “the middle-income trap.” The middle-income trap is a state in which, while the standards of personnel costs rise after developing countries continue to achieve high-speed growth by utilizing the advantage of low wages and develop to the level of middle-income countries, they lose their international competitiveness without industrial advancement and suffer a prolonged stagnation of economic growth. It is considered that currently, many developing countries worldwide, including Latin American countries, are stuck in this trap.

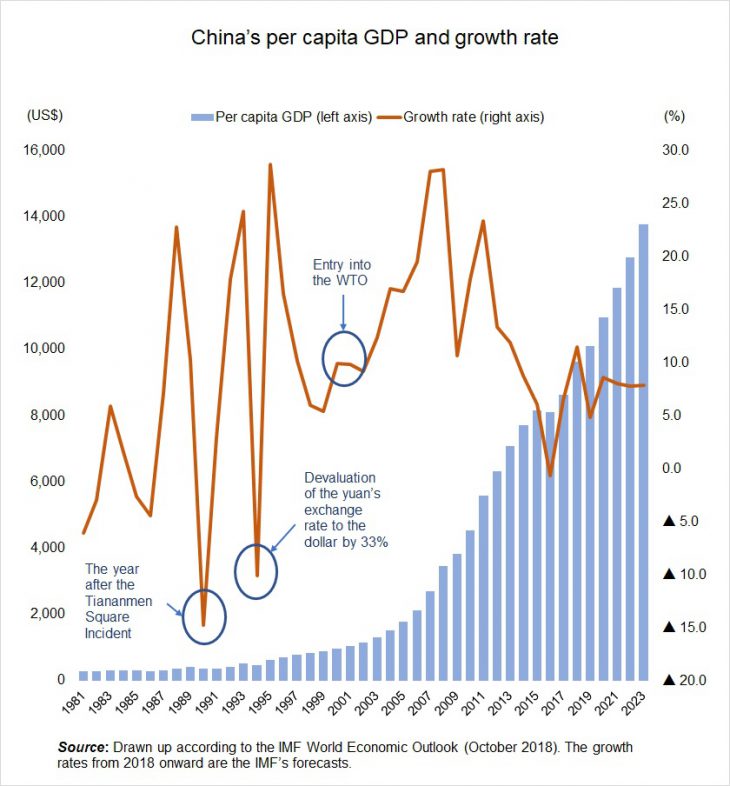

According to the International Monetary Fund (IMF), China’s per capita GDP was 8,643 dollars in 2017, already entering the level of the middle-income trap. This growth rate exceeded 10% every year from 2003 to 2013, but it has tended to decrease in recent years (see chart). China is now standing at the crossroads between avoiding the middle-income trap and growing to be an advanced country, and becoming stuck in the middle-income trap and remaining a developing country.

To avoid falling into this trap, it is essential for China to promote structural reforms involving industrial advancement and improved productivity. In terms of industrial advancement, the Chinese government announced the “Made in China 2025” initiative in May 2015; China set a goal of significantly increasing the overall level of the manufacturing sector in the ten years to 2025 and of joining the circle of countries with strong manufacturing capability. Currently, the United States is applying strong pressure to China, which is pushing forward with this policy. The United States has a sense of crisis toward China’s improving its technical prowess through Made in China 2025 and the possibility of China’s threatening the advantages of US high-tech industries and national security. In this situation, the United States pointed out that the policy of injecting massive subsidies into high-tech industries was unfair in terms of competition and demanded that China withdraw Made in China 2025. The United States imposed tariffs as sanctions to put pressure on China to correct the policy.

Unless China accepts the United States’ demand, the United States will continue to take a strong stance against China. On the other hand, however, China cannot withdraw Made in China 2025 to overcome the middle-income trap. Considering this situation, I would say that the US-China trade war will likely become prolonged.

According to the IMF, China’s GDP comprised only 10.7% of the US GDP in 1980. China’s GDP increased to 61.7% of the US GDP in 2017, however. It is forecasted that China’s GDP will increase to 79.4% of the US GDP in 2023. The US-China trade war revealed a situation where China is increasing its economic presence as an emerging economy and the United States is struggling to stop China from becoming a hegemon.

The US move to exclude its allies from the procurement of communications devices from Huawei Technologies and other Chinese companies for security reasons can be said to symbolize this situation.

In the meantime, to improve productivity, it is necessary to reform the structure where inefficient state-owned companies with excessive human resources, equipment and debts have a monopoly in heavy industries. In September 2015, the Chinese government announced “instructive opinions regarding the deepening of state-owned company reforms” and put forward a policy of obtaining “decisive results” by 2020. However, the basic policy of corporate management is to make state-owned companies stronger, better and larger. It is not easy to proceed with reforms controlling the resistance of state-owned companies that have a range of vested interests.

In this situation, private companies rise rapidly, replacing state-owned companies, and take a great leap forward, particularly in the area of the digital economy, which creates the fourth industrial revolution.

“The Report on the Implementation of Chinese Monetary Policy,” which was published by the People’s Bank of China (China’s central bank) on November 9, emphasized that “private companies had played an important role since the reform and opening up.” The report points out that “private companies currently contribute to more than 50% of tax revenues, more than 60% of GDP, more than 70% of technological innovations, more than 80% of urban employment and more than 90% of the number of companies, and that unless private companies develop, the overall economy will not be able to develop in a stable manner.”

Baidu, the Alibaba Group and Tencent, which rank in high positions in the world market capitalization rankings of IT companies and are called as BAT, are major private companies. These three corporations operate Internet searches, e-commerce and social media, respectively, as their main businesses. The managers of the three companies were selected to appear on the list of 100 outstanding private company managers, which was announced by the Chinese Communist Party and the Chinese Nationwide Industry and Commerce Association on October 24 to commemorate the 40th anniversary of reform and opening up.

There are also many private Chinese startups that are expected to grow following BAT, and these startups are also anticipated to play a role in achieving industrial advancement.

Amid the intensifying US-China trade war, with China pushing its policy for industrial advancement, including Made in China 2025, and the United States imposing tariffs as sanctions, how should Japanese companies face up to China going forward?

First, Japanese companies should maintain progressive technologies. The key is for them to constantly get ahead in research and development in their competition with Chinese companies, with China starting to move on a full-scale basis with the aim of being a strong manufacturing power.

Second, Japanese companies should tap markets in areas where they enjoy advantages. The priority areas targeted by Made in China 2025 include many areas in which Japanese companies enjoy advantages, including industrial robots. If Japanese companies form alliances with the Chinese government and Chinese companies in need of technologies and tap new markets, they will be able to obtain business opportunities.

Third, Japanese companies should strengthen their protection of intellectual properties. It will also be important to try to prevent technological leaks in collaboration with the United States, for example by avoiding hostile takeovers by Chinese companies that make rapid efforts to become strong manufacturing powers for the sole purpose of acquiring technologies.

On the other hand, both the United States and China are important economic partners for Japan, and Japan should basically maintain a neutral stance. It is extremely important for Japan to act according to the international rules (WTO rules) without backing either the United States or China.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 14 December 2018 under the title, “Chugoku Kaikakukaiho no 40 nen (3): Seicho e sangyo kodoka fukahi (China’s Forty years of Reform and Opening (3): Industrial Advancement will be Inevitable for Growth).” The Nikkei, 14 December 2018. (Courtesy of the author)

Keywords

- Made in China 2025

- middle-income trap

- US-China trade war

- China’s reform and opening up

- high-tech industries

- national security

- Huawei Technologies

- hegemon

- decisive results

- People’s Bank of China

- BAT

- Baidu

- Alibaba Group

- Tencent