The Effects and Limits of Monetary Policy: The Need for a New Framework of Macroeconomic Policy

Key points:

- Decreased expectations for the effects of unconventional monetary easing policy

- Monetary easing is used as an alternative to appropriate policy measures

- Wise spending should be emphasized in expanding fiscal policy

Hayakawa Hideo, Executive Fellow, Fujitsu Research Institute

Up until 2018, a lot of attention was focused on an exit from monetary easing. The situation completely changed in 2019, when the Federal Reserve Board (FRB) lowered interest rates three times starting in August and the European Central Bank (ECB) decided in September on additional monetary easing, including the further lowering of already negative interest rates. Financial markets are caught up in the atmosphere of global monetary easing.

Now, however, we are in a different environment than in 2010 to 2012, when unconventional monetary easing policies were implemented all around the world. Quite a few economists and economic analysts have a critical view of the recent monetary easing.

First, developed countries saw a slow economic recovery after the 2008 “Lehman Shock,” and shortages of demand were considered the largest macroeconomic policy issue. Second, the effects of monetary policy garnered much greater public confidence than today. Third, it was thought that there was little room for putting fiscal policy into action after global fiscal stimulus measures had been implemented from 2008 to 2009.

That was the reason why the central pillar of macroeconomic policy was naturally seen to be monetary policy and was even described as “the only game in town.”

In contrast, unemployment in both Japan and the United States is at record lows at present, which suggests that shortages of demand are not a global issue. Certainly, the world economy is slowing down, which can partially be attributed to the growing uncertainty caused by the trade war set off by US President Donald Trump. As Federal Reserve Chairman Jerome Powell pointed out, this supply shock cannot be properly dealt with by monetary policy alone. If low interest rates are further lowered, authorities will be unable to cope well with a new recession and may end up expanding a monetary imbalance.

Decreased expectations for the effects of monetary policy, especially unconventional policy, also represent a significant change. The clearest representation of the limits of quantitative easing is the fact that although “easing of a different dimension” by the Bank of Japan (BOJ) led to an extremely bold increase in the monetary base (money supply), the measure was a dead end, failing to help achieve the 2% price goal.

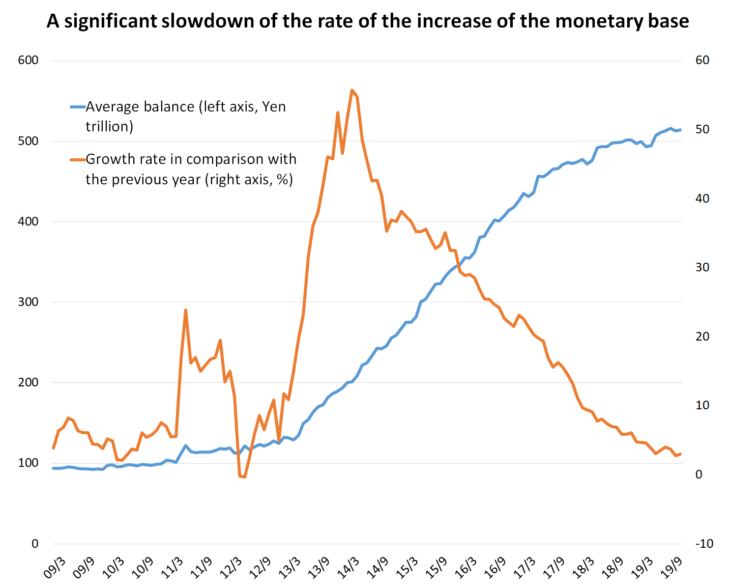

Currently, BOJ policy is to annually increase long-term government bond holdings by about 80 trillion yen. But at that pace, the BOJ cannot sustain its purchasing of government bonds. In reality, the rate of the increase of the monetary base has slowed significantly since the introduction of the current Yield Curve Control (YCC) in which the goal of monetary easing shifted from quantity to long-term interest rates in the fall of 2016 (refer to the Chart below).

Meanwhile, it was the ECB that revealed the limits of negative interest rate policy. Europe is showing typical signs of “Japanification,” of failing to realize the normalization of monetary policy even in a period of economic recovery and pushing toward more monetary easing in anticipation of recession. There is a general observation that additional easing in September 2019, which lowered the negative interest rates by just 0.1%, will stimulate the economy only slightly.

Because monetary easing is basically about borrowing against future demand, the prolonged extremely low interest rates will inevitably lead to the decreasing effectiveness of the lower interest rates to provide additional economic stimulus. In addition, economists have begun to pay more attention to the reversal interest rate theory postulating that extremely low interest rates may adversely affect the economy. Recently they have even discussed the possibility that the neo-Fisher effect may be seen in excessively prolonged low interest rates leading to decreased expectations for inflation.

In addition, increased expectations for fiscal policy also represent a significant change, as discussed in this column in October 2019. Modern Monetary Theory (MMT), which posits that government bonds denominated in one’s own national currency are free from anxieties about fiscal deficits, is a heretical doctrine. But the secular stagnation theory that the lower natural rate of interest (real interest rates neutral to the economy) significantly spoils the effectiveness of monetary policy, a doctrine put forward by Lawrence Summers, former US Treasury Secretary, is now becoming a generally accepted theory.

Although slightly opportunistic, the view growing among mainstream economists is that if the low interest rates last for the time being, fiscal policy should be put to further use. Mario Draghi, then-President of the ECB, stressing the importance of fiscal policy in a press conference after the decision on additional monetary easing was impressive.

You should see recent US and European monetary easing as representing a lack of a framework for macroeconomic policy, and focus on the reality that they are forced to depend on monetary easing, not because they can anticipate the effects of monetary policy, but because they cannot carry out more appropriate policy measures (ending the trade war and German fiscal stimulus measures) for political reasons.

In October 2019, some observed that the BOJ would also decide on additional monetary easing following the US and European central banks. But the BOJ only altered the language of forward guidance on a key interest rate. I think that it was a commonsense measure at the present time.

Having said that, as long as there is little prospect of the 2% target being achieved in the near future, Japan also cannot expect much from monetary policy and needs a framework for macroeconomic policy in preparation for a future recession. Or rather, given how large the figures on its central bank’s balance sheet are and how long the extremely low interest rates have been prolonged, Japan’s inability to depend on monetary policy is the most serious.

Paradoxically, however, a short-term policy assignment problem seems to be almost nonexistent in Japan. Probably because they’ve gotten used to the extremely low interest rates and forgotten fiscal discipline, the Abe administration has shown a very positive attitude toward fiscal stimulus measures, compiling a large supplementary budget many times. That is why the government’s immediate economic measures are free from anxiety. But in Japan, with a national debt balance more than double its nominal gross domestic product (GDP), easy fiscal stimulus measures must not be repeated.

The only conceivable immediate macroeconomic measures available are: (1) Fiscal policy playing a leading role in dealing with the economic cycle; and (2) monetary policy playing a supplementary role by maintaining the framework of the YCC and controlling an increase in long-term interest rates. In its fiscal policy, the government is expected to handle the difficult balancing act of aiming to achieve a primary budget surplus consistent with full employment in the medium term.

Another important point is the specifics of fiscal expenditures. As discussed above, the lower natural rate of interest significantly spoils the effects of monetary policy. In the 1990s when fiscal stimulus measures were repeated, Japan learned the lesson that the expansion of inefficient public works projects resulted in a declining potential growth rate (almost the same as the natural rate of interest).

It is quite natural that fiscal policy is more effective than monetary policy in a liquidity trap. But the solution to the fundamental problem of the decline of the natural rate of interest must entail wise spending in the specifics of fiscal expenditures. You should keep in mind that some mainstream macroeconomists arguing for the effectiveness of fiscal policy at the same time stress the importance of the specifics of fiscal expenditures.

I do not have an optimistic view of the possibility of overcoming these extremely difficult challenges in the political process. For example, there is a lot of criticism that the current government’s projections for achieving fiscal balance are premised on overoptimistic calculations. An institutional mechanism to stopping easy fiscal stimulus measures and consider fiscal expenditures that will contribute to improving productivity is necessary.

In recent years, independent fiscal institutions that provide fiscal projections independent of the government and make a wide range of policy recommendations for fiscal policy have been established in many advanced countries. Now is the time for Japan also to set up such an independent fiscal institution as soon as possible.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 19 November 2019 under the title, “Kinyuseisaku no koka to genkai (II): Makuro seisaku no shin wakugumi wo (The Effects and Limits of Monetary Policy (II): The Need for a New Framework of Macroeconomic Policy).” The Nikkei, 19 November 2019. (Courtesy of the author)

Keywords

- Hayakawa Hideo

- macroeconomic policy

- monetary easing

- easing of a different dimension

- negative interest rate policy

- Yield Curve Control

- low interest rates

- neo-Fisher effect

- fiscal policy

- monetary policy