Issues Concerning Social Security for All Generations: A System for Contribution According to Individual Income Levels

Key points:

- The government outlook is premised on growth, with some uncertainty.

- Distinguish between risk dispersion and redistribution functions

- Intensively direct public funds to those in desperate need

Prof. Oguro Kazumasa

The consumption tax rate has been raised to 10%, marking the end of the comprehensive reform of social security and taxation systems that started in the mid-2000s. But we face the 2025 problem of the baby boomers reaching the age of 75 and social security reform is now entering a crucial stage.

As poverty grows amid slower economic growth and depopulation and population aging begin deepening in earnest, politicians are now expected to reconstruct sustainable social security; that is, to carry out sweeping reforms to facilitate the balance between social security benefits and contributions.

The starting point for the fiscal reform debates is the May 2018 paper, “The Projections for the Future of Social Security with a Hard Look at 2040 (Material for Discussion).” Naturally, the government must have taken prediction errors into account in its estimates of social security benefits. But given the uncertainty of the growth rate, advancing discussion on reforms based on only predictions involves some risk.

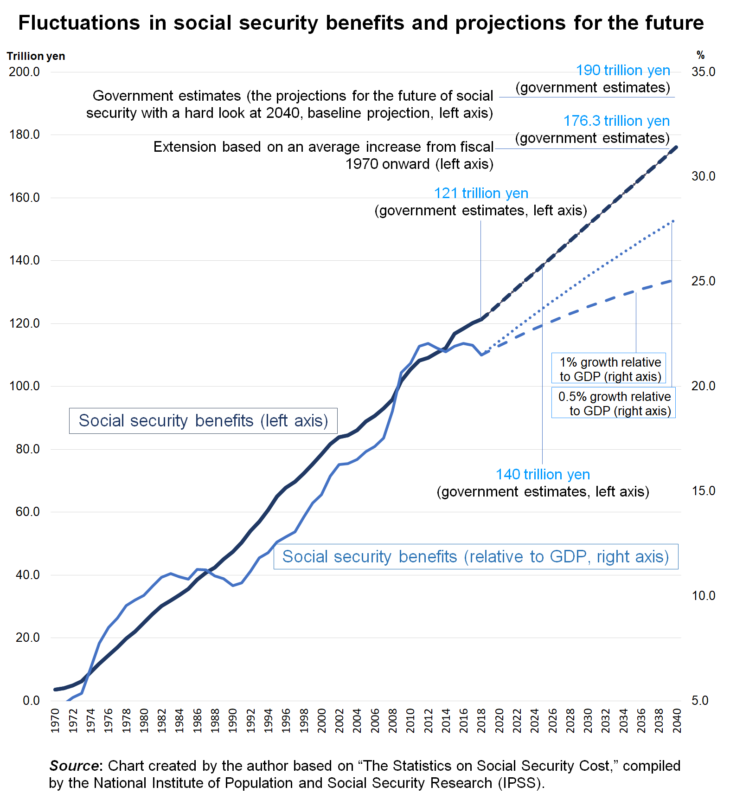

For example, according to baseline government projections, social security benefits will go from 121.3 trillion yen (21.5% relative to GDP) in fiscal 2018 to about 140 trillion yen (21.8% relative to gross domestic product, GDP) in fiscal 2025 and reach about 190 trillion yen (24% relative to GDP) in fiscal 2040.

Some say that the government has no urgent need to carry out the reform because social security benefits are projected to rise by just 2.5 percentage points in terms of the GDP ratio. But social security benefits based on the budget for fiscal 2019 hit 123.7 trillion yen, up 2.4 trillion yen from the previous year, 22.1% relative to GDP, as estimated by the Cabinet Office in July. Social security benefits have already exceeded the predictions for fiscal 2025 (21.8%) in terms of GDP ratio.

The bold solid line in the chart below shows the real fluctuations in social security benefits from fiscal 1970 to fiscal 2018. Social security benefits increased at a pace of an annual average of 2.5 trillion yen or so (equal to a consumption tax rate of 1%). The bold dotted line of the chart extrapolates the increase in social security benefits based on the assumption that this pace will continue.

In fact, the baseline case is based on the assumption that the nominal economic growth rate is projected to stand at 1.3% in and after fiscal 2028. After 2095, this projection represents a bold figure, about three times the average growth rate of fiscal 2018 (0.39%), based on the scenario, even if social security benefits rise, if the economy grows significantly, the rise in the rate of social security benefits to GDP can be curbed.

However, an estimate of the annual average increase of social security benefits as a percentage of GDP of 2.5 trillion yen based on a realistic growth rate of 0.5% suggests that the value will soar to 28% by fiscal 2040. Assuming a growth rate of 1%, social security benefits as a percentage of GDP in fiscal 2040 will stand at 25.1%, nearly the same as the government estimate based on a growth rate of 1.3% (24%). Having said that, a mere 0.3-percentage-point decrease in the growth rate results in the social security benefits as a percent of GDP jumping by as much as 1 percentage point.

A 1% increase of the consumption tax rate results in approximately a 0.5% increase in tax revenue relative to GDP. This means that if social security benefits increase by as much as 6.5% point (=28%-21.5%) from fiscal 2018 to fiscal 2040, sources of revenue equal to a consumption tax hike of about 13% will be needed, even excluding the amount of the current fiscal deficit. Of course, sources of revenue are not limited to the consumption tax; conceivable political measures include streamlining social security, as well as raising social insurance contributions and increasing medical and nursing care expenses.

In addition, it is theoretically possible to secure revenue by issuing government bonds. But I am skeptical of that being a truly sustainable means under the current tough financial circumstances. The real severity of the current finances can be confirmed by the Domar proposition in economics.

According to this proposition, even if fiscal deficits continue, with a certain nominal growth rate, if fiscal deficits (relative to GDP) are kept at a certain level, the debt balance (relative to GDP) will converge on a certain level. If the fiscal deficit ratio is expressed as q and the nominal growth rate as n, the convergence value of the deficit balance (relative to GDP) holds as q/n.

In the baseline case presented in An Estimate of Medium- and Long-Term Economy and Finances (July 2019), compiled by the Cabinet Office, the fiscal deficit ratio in fiscal 2028 is projected to stand at 2.3%. This estimate is optimistic because the deficit continues to be on course to expand. But let me let p equal 2.3%. Then, if n is set as the above-mentioned average growth rate of 0.39% from fiscal 2095, the convergence value of the debt balance ratio stands at about 590% (=2.3%/0.39%), a level as much as roughly three times the current debt balance ratio of 200%. Even if the growth rate is set at 0.5%, the fiscal deficit ratio must be reduced to about 1% to keep the debt balance ratio at the same level as the present.

Under these circumstances, the government set up a Planning Meeting on a Social Security System Oriented to All Generations as the headquarters for reforms, which has discussed the direction of a new social security system that would enable all generations to be free from anxiety and will draw up an interim report by late 2019 and a final report by the summer of 2020.

Now, what is necessary for a true reform? The concept of social security for all generations was originally proposed in August 2013 by the National Council on Social Security System Reform with the aim of shifting from a social security system mainly focusing on benefits for elder generations to a social security system seamlessly focusing on all generations. Through the proposal, the Council declared that it would aim to modify the conventional 1970s social security model centered on pensions, medicine and nursing care and create a new 2025 social security model focusing on supporting the employment and child-rearing of the working-age generations, issues of low income residents, and housing.

I am generally in favor of the principles of the reform. But if the reform lacks financing, it could end up as a new pork-barrel measure for the working-age generations. It would just result in inflating the fiscal deficit that future generations will have to bear. In addition, discussions about reforms excessively dependent on growth are also risky.

For example, looking at projections for the nominal economic growth rate (government economic outlook), real economic performance surpassed the projections just six times in the last twenty-one years. That is, government projections turned out to be correct just 28% of the time, and it is important for lawmakers and the general public to be ready to advance reforms based on an austere scenario.

Then, what is the most important perspective as poverty grows amid sluggish economic growth? For example, public funds are injected into basic pension and medical insurance under the current system regardless of whether incomes and assets are large or small. But is this really an efficient use of limited financial resources?

It is inevitably necessary to review the scope of public insurance benefits and reorganize public hospitals. But it is also significant to distinguish between the role of insurance with its function of risk dispersion, and the role of taxes with their function of wealth redistribution, from the perspective of an efficient redistribution policy and to take the political initiative in showing a new philosophy of reform, especially intensively distributing public funds to those in desperate need, regardless of the generation they belong to.

It is also necessary to make efforts to increase the numbers of those supporting social security, to save those in real need. Policies are also important to prompt work-style reforms and asset formation based on promoting employment at least until the age of 70, such as reviewing a reduced-rate old-age pension paid to active workers and expanding the postponement of pension payments to the age of 65 or older.

It is also necessary to review contributions in relation to this. For example, it is inevitably necessary to change the current age-based discriminatory payments for medical services to payments based on individual income levels. But it is desirable to create a system of paying insurance contributions and taxes according to individual income levels, including assets, by utilizing the social security and tax number systems and adding up all earnings, including pension payments, regardless of age.

To begin with, the immediate challenge facing us is to carry out reforms necessary before 2022, when baby boomers will be at least 75 years of age. A sweeping reform from a medium- and long-term point of view is clearly necessary instead of a patchwork of short-term reforms. It is necessary to create a new philosophy of social security based on a national perspective of what to protect and what to give up and also a vision that can be shared by the public.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 6 November 2019 under the title, “Zensedai-gata shakaihosho no kadai (II): Noryoku ni ojita futanseido wo (Issues Concerning Social Security for All Generations (II): A System for Contribution According to Individual Income Levels).” The Nikkei, 6 November 2019. (Courtesy of the author)

Keywords

- Oguro Kazumasa

- poverty

- people in need

- public funds

- sluggish economic growth

- 2025 problem

- social security reform

- sustainable social security

- consumption tax increase

- pension payments

- medical insurance

- work-style reforms

- retirement age