Japan-US Trade Negotiations on Promise of Trade Liberalization: Results in Better Than Equal Terms

Key points:

- Virtually sealed off the imposition of additional tariffs on automobiles

- Digital trade rules to be applied to the Japan-US Trade Agreement in advance

- Persuade the US to return to the TPP

Prof. Nakagawa Junji

On October 7, the Japan and the US governments signed the Trade Agreement between Japan and the United States of America (Japan-US Trade Agreement) and the Agreement between Japan and the United States of America concerning Digital Trade (Japan-US Digital Trade Agreement). One year since the agreement on the start of negotiations in the Japan-US joint statement announced on September 26, 2018, and half a year since the start of substantive negotiations in April 2019, they have concluded the following.

In the Japan-US Trade Agreement, Japan responded to the US demand for the liberalization of agricultural products, including beef, while negotiations will continue on the US’ elimination of tariffs on automobiles (passenger cars: 2.5%, trucks: 25%) and auto parts. Is it reasonable to suggest that Japan made a one-sided concession? In this agreement, the likely agenda that they would reach an earlier agreement was handled and the next phase of negotiations will be planned after the agreement is brought into force. What should the outlook be for the next phase of negotiations?

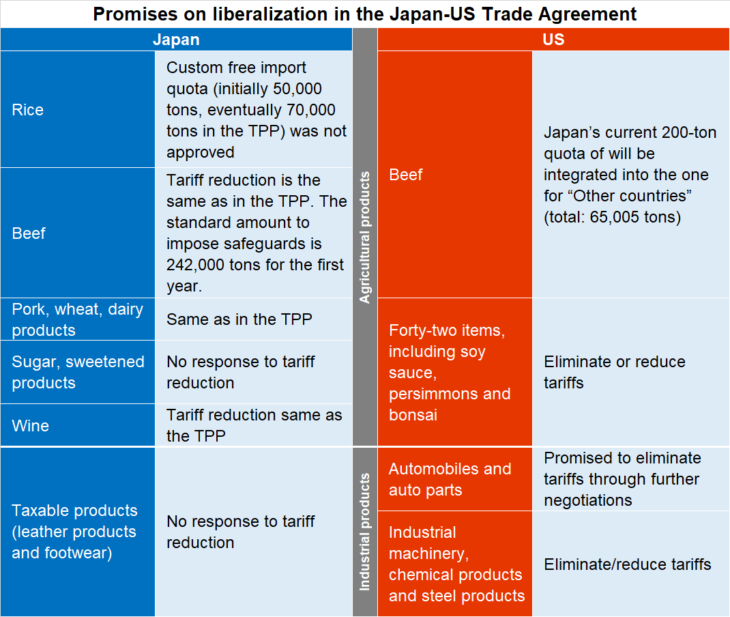

Looking at the promise on liberalization in the Japan-US Trade Agreement (refer to Table), with respect to agricultural products, Japan promised the overall reduction/elimination of tariffs to levels below those agreed on in the TPP (negative TPP). With respect to rice, Japan approved a custom free import quota for the US in the TPP (initially 50,000 tons, eventually 70,000 tons), but did not approve it this time. Concerning products such as sugar, sweetened products and confectioneries, Japan set a tariff-rate quota in the TPP, but did not respond to tariff reduction this time.

Japan agreed to tariff reduction at the TPP level for beef, in which the US was very interested, but set standards slightly lower than the actual 2018 imports for the implementation of safeguards (tariff reduction in an emergency of a surge in imports) out of consideration for Japanese livestock farmers. Regarding pork, wheat and dairy products, Japan also agreed to reduce tariffs to similar levels in the TPP. However, Japan did not respond to the elimination or reduction of forest products and fishery products. In addition, Japan did not respond to the elimination or reduction of tariffs on taxable industrial products, such as leather products and footwear, which differs from the TPP.

On the other hand, in the liberalization of agricultural products promised by the US, the current 200-ton import quota with a low tariff rate on beef from Japan was integrated into the quota of “other countries,” which resulted in the substantive increase of its import quota. In addition, the US eliminated or reduced tariffs on 42 products, including soy sauce, persimmons and bonsai, in which Japan was highly interested. Concerning industrial products and industrial machinery, the tariffs on chemical products and steel products were eliminated or reduced, but Japan did not make similar promises for automobiles and auto parts.

Regarding these products, the general note “Further negotiations will be conducted to eliminate tariffs” is stipulated in the schedule of concessions, which indicates the schedule of the elimination or reduction tariff rate, and elimination through continued negotiations is clearly described. However, no schedule or deadline of negotiations is provided.

In this negotiation, Japan had the greatest interest in the sidestepping of additional tariffs on automobiles based on Section 232 of the U.S. Trade Expansion Act.

Section 232 allows the US President to impose trade restrictions for security reasons, having imposed additional tariffs of 25% and 10% on steel and aluminum products, respectively, to exporting countries including Japan. Additional tariffs on automobiles were scheduled to be imposed in November, and if the additional tariffs were imposed on automobiles, which account for nearly 40% of Japan’s amount of exports to the US, it would greatly impact the automobile industry in Japan.

In the Japan-US joint statement in September 2018 on the start of negotiations, the US side promised not to impose additional tariffs during the period of negotiations. In addition, in the Japan-US joint statement released on September 20, 2019, before the signing of the agreement, the imposition of additional tariffs were virtually sealed off, stating that while the agreement is implemented sincerely, no action shall be taken that violates the spirit of the Japan-US agreement and this joint statement.

In the re-negotiation of the North American Free Trade Agreement (NAFTA), Canada and Mexico accepted quantitative restrictions on exports of automobiles in place of the non-application of additional tariffs on them. Although it is not described in the joint statement or the Japan-US Trade Agreement, it is said that the US promised not to take such measures against Japan.

When we determine negative TPP in the liberalization of agricultural products, a clear description of continued negotiations of the elimination of tariffs on automobiles and auto parts, and virtual sealing off of additional tariffs on automobiles based on Section 232 of the U.S. Trade Expansion Act, Japan yielded results as good as or better than those of the US through the negotiations.

Japan and the US also simultaneously negotiated the rules of digital trade, concluding the Japan-US Digital Trade Agreement. The content of the Agreement is mostly similar to that of Chapter 14 (Electronic Commerce) in the TPP, but new rules were added (positive TPP). The two new rules are: (1) As a condition for the import/sales of software products, no demand for the transfer or access to algorithms (calculation procedure) is allowed; and (2) as a condition for the import/sales of information and communication technology products that use ciphers, no demand for the transfer of information related to ciphers to the manufacturer is allowed.

Digital trade (electronic commerce) was included in this negotiation as the only rule among the rules that the TPP covers along with the Japan-US Trade Agreement, because the negotiations on digital trade rules had been advancing in the World Trade Organization (WTO). A group of eighty countries including, Japan, the US and China, participated in the negotiation, aiming to conclude the negotiation in the WTO ministerial meeting to be held in June 2020.

While based on Chapter 14 of the TPP, Japan and the US seemed likely to indicate a common target and direction for Japan and the US in the negotiations on the digital trade rules of the WTO as they conclude an agreement in which the above-mentioned content of positive TPP that the government regulatory authority on electronic commerce will be restricted further is included. It goes without saying that they target China through the rules of the agreement.

Upon the signing of the Japan-US Trade Agreement, the two countries will implement the domestic procedures for ratification. The Japanese government aims to win approval in an extraordinary Diet session.

Meanwhile, according to the US Trade Promotion Authority (TPA), the President (the administration) has the authority to promise to reduce tariffs by up to 5% without the need for congressional approval. Because this is also applied to the Japan-US Trade Agreement, no congressional approval is required. The Japan-US Digital Trade Agreement is regarded as an administrative agreement that does not require congressional approval. The two agreements are expected to enter into force as early as 2020.

When the two agreements take effect, Japan and the US will enter the next phase of negotiations. According to the joint statement in September 2019, both countries will complete the consultation within four months after the two agreements enter into force and will commence negotiations on other issues including tariffs and other trade limits, and service trade and barriers to investment. There is no doubt that the subject of the continued negotiations of the Japan-US Trade Agreement will be the elimination and reduction of the tariffs on automobiles and auto parts by the US.

The joint statement also referred to service trade and barrier to investment. Both are related to the liberalization of trade and investment. It is uncertain whether the next phase of the negotiations will be limited to the liberalization of trade and investment or will cover a wide range of rules as the TPP does.

With the conclusion of the Japan-US Trade Agreement, the US achieved the demand related to trade liberalization that it strongly claimed, including the tariff reduction on beef. As a result, it seems that there will be less need for the US to return to the TPP.

However, do not overlook the fact that the TPP covers a wide range of rules, including intellectual property, state owned enterprises and corruption prevention. As indicated by the fact that the Japan-US Digital TradeAgreement bears in mind the negotiations on digital trade rules in the WTO, the rules of the TPP are not only shared among the signatory countries, but are also likely to lead to the formation of multinational rules. Japan should continue to urge the US to return to the TPP.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 24 October 2019 under the title, “Nichibei boeki kosho domiruka (I): Jiyuka yakusoku, gokaku ijo no seika (Japan-US Trade Negotiations on Promise of Trade Liberalization (I): Results in Better Than Equal Terms).” The Nikkei, 24 October 2019. (Courtesy of the author)

Keywords

- Nakagawa Junji

- Japan-US Trade Agreement

- Japan-US Digital Trade Agreement

- agricultural products

- beef

- automobiles

- digital trade rules

- electronic commerce

- TPP