Challenges Facing the Abe Administration after the Upper House Election: Social Security Reforms Should Be a Multi-Partisan Discussion

Key points

- Economic policy should return to an orthodox type from an emergency type

- The government should aim to increase worker productivity

- The opposition parties should also make responsible proposals regarding the consumption tax and pension

Prof. Komine Takao

The Upper House election is over. The result of the election does not directly place the Abe administration under pressure to make revisions to its economic policy. On this occasion, however, I would like to point out three basic directions required for the economic policy in the years to come based on challenges taken on before the election and discussions held by the political parties during the election.

The first direction is to return the experimental and venturous economic policy, enacted in an emergency, to an orthodox policy for normal times. For about thirty years following the burst of the bubble, the Japanese economy faced uncharted challenges such as the meltdown of asset values, bad debt problems, deflation, the financial crisis, and the economic downturn precipitated by the 2008 Lehman Brothers bankruptcy, one after another. Because all of them were unprecedented events, it was necessary for the government’s response to be a succession of trial and error experiments.

As a result, the ultralow, zero, or negative interest rates continued, and the Bank of Japan bought up newly issued government bonds, and become a major shareholder of general companies. The fiscal position of Japan has become the worst among the developed nations. One could argue that the monetary and fiscal policy of Japan is unsustainable.

Meanwhile, the current state of the Japanese economy is no longer an emergency that requires an unorthodox policy response. While there are always voices calling for fiscal measures, the government holds the view that the economy is gradually expanding, and the economy is not in deflation in the sense that prices are continuously falling. Employment conditions show almost full employment. The economy is not in a situation that needs the increase of expenditures by expanding the fiscal deficit.

The “different-dimension” monetary easing is maintained with an inflation target of 2%. However, given that the achievement of the inflation target of 2% is not an urgent task from the beginning, the central bank should gradually head toward the normalization of finance (the so-called exit) by positioning the inflation target as a long-term objective without setting a deadline.

The second direction is to make serious efforts to improve productivity. The biggest challenge for the Japanese economy in the long term is to realize sustainable growth by increasing productivity against the trend of the declining working age population (population onus).

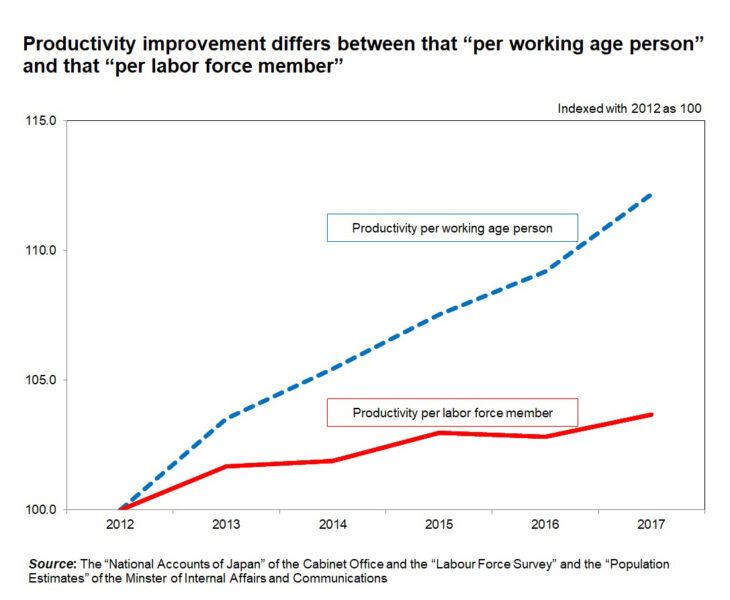

In this regard, this challenge is effectively addressed on the surface. From 2012 to 2018, the working age population (population aged between 15 and 64) in Japan declined 1.0% every year (annual average rate. The same applies hereinafter), but real GDP increased 1.2% during this period. Productivity per working age person increased 2.2%. The Japanese economy appears to have overcome the constraint of the declining working age population by raising productivity. Unfortunately, however, this is not the case in reality.

To overcome the constraint of the declining working age population, there are two types of response: one is a “mobilization” response that increases the labor force population even as the working age population declines, and the other is a “productivity improvement” response that increases the productivity of workers.

During the aforementioned period, the labor force population in Japan increased 0.7%, but productivity per labor force member rose only 0.5% (see Figure). This suggests that Japan responded to the declining working age population mainly by mobilization. The reason for the increase in the labor force population despite the decrease in the working age population is that women, the elderly and foreigners who had not been in the labor force before have entered into it.

Such a mobilization type of response is not sustainable because it will reach its limit at some time in the future. In addition, the working force that has newly entered into the labor force was centered on non-regular workers with low wages and productivity. This is one of the major reasons why the average wage does not rise much and the average labor productivity does not improve despite the tightening employment situation. The government should rethink its growth strategy by setting an increase in productivity per worker as the major target.

The third direction is to work on fiscal and social security reforms in a multi-partisan way. Everybody knows that the most important challenge for the Japanese economy is to build sustainable public finances and social security. However, it was inconceivable that discussions of the political parties during the Upper House election were heading in the direction of solving the issue.

Below, I will discuss the fiscal challenge focusing on the consumption tax hike and the pension problem triggered by the “issue of needing an extra 20 million yen after retirement.”

In my own judgment, I believe that economists with common sense think about these issues as follows. With respect to the public finances, the fiscal deficit and the public debt in Japan stay away from confusion partly because the fiscal authorities are exempt from the interest payment burden of government bonds due to the ultralow interest rates. However, this is not sustainable in the years to come, given that social security spending will increase sharply associated with progress in aging, and the government needs to aim for a reconstruction of the public finances from a long-term perspective. While the rationalization of social security (the control of a natural increase in expenditure for social security) is unavoidable to that end, this is not enough. It is necessary to further raise the consumption tax rate to more than 10%.

Regarding the pension, the government has no other choice but to lower the benefit levels substantively under the macro-economic slide formula that will curb benefits according to the declining population, among other factors. As far as the issue of needing an extra 20 million yen after retirement is concerned, we cannot discuss it uniformly because the specific amount varies from person to person. However, it goes without saying that maintaining life after retirement only on the pension is difficult, and personal preparation is essential.

Discussions held by the ruling and the opposition parties during the Upper House election were moving further and further apart from such common sense. Prime Minister Abe Shinzo said about the public finances that the government would not need to raise the consumption tax rate to more than 10% for the next ten years. It is unclear upon what financial outlook his remark was based.

Meanwhile, all the opposition parties were opposed to the hike of the consumption tax rate. While some parties explained, “The current economic conditions do not allow us to raise the consumption tax,” they did not show under what economic circumstances raising the consumption tax would be possible. There was also an opposition party that proposed the lowering of the tax rate or the abolition of the consumption tax. It would be simple if they don’t mind increasing the fiscal deficit, but if this is not the case, I wonder how they plan to squeeze out the fiscal resources.

The issue of needing an extra 20 million yen after retirement also was extremely difficult. A report from the Financial System Council pointed out the importance of working on asset building from a long-term perspective in preparation for longevity. A trial calculation that showed 20 million yen will run short was only a simple calculation derived from average values and cited as an example. However, the opposition parties criticized it by saying, “It has become clear that we won’t be able to live after retirement on only the pension,” and all of them appealed to voters in the election by saying, “We will not cut the pension.”

However, it is common sense that living after retirement with only the pension is difficult, and even undergraduate students know it. Since the revision of the pension system in 2004, we have known that the pension would be cut based on the macro-economic slide formula, and it looks like the opposition parties have suddenly begun criticizing it.

On the side of the government and the ruling parties, Minister of State for Financial Services Aso Taro also rejected the report and tried to wipe the report out of existence. However, this is disrespectful of the Financial System Council that has been discussing the public pension, among other issues, to make a report to the Minister of State for Financial Services, and gives the impression that the Minister avoided the pension becoming a point at issue.

Challenges such as the public finances, the consumption tax and the pension must require national burdens if they are discussed seriously. If politicians exploit these issues for their own advantage and make them their campaign issues, their public pledges that flatter the people who shy away from burdens will be overissued, and this will only back away from the resolution of these challenges. I would say that this was reconfirmed in the Upper House election.

So what should we do? This is a major task for the future, but it is most desirable to advance multi-partisan discussions under the framework of not making it a campaign issue. What will be called in question at that time is the attitude of the opposition parties, as well as that of the ruling parties. Many of the policies proposed by the opposition parties appeared to be those which they could have proposed only because they did not think that they would hold the responsibility of implementing them on their own in the near future. It is necessary that not only the proposals of the ruling parties, but also those of opposition parties will be checked strictly.

Translated by The Japan Journal, Ltd. The article first appeared in the “Keizai kyoshitsu” column of The Nikkei newspaper on 29 July 2019 under the title, “Saninsen go no Abe Seiken no kadai (1): ‘SHakaihosho kaikaku giron, chotoha de (Challenges Facing the Abe Administration after the Upper House Election [Part 1] – Social Security Reforms Should Be a Multi-Partisan Discussion).” The Nikkei, 28 July 2019. (Courtesy of the author)