Expectations for the New Bank of Japan Regime Setting Sail Amid Financial Uncertainty

Bank of Japan to welcome new Governor Ueda Kazuo on April 9, 2023.

Photo: khadoma/PIXTA

Ito Sayuri, Director, Economic Research Department, NLI Research Institute

Director Ito Sayuri

Has the world, which has experienced turmoil such as the coronavirus pandemic and Russia’s invasion of Ukraine over the past three years, reached the brink of a financial crisis? In March 2023, several banks in the United States went bankrupt, and management problems at Switzerland’s second-largest bank led to a merger with the largest Swiss bank. In the United States, the outflow of deposits continues due to similarities in business models with the banks that have faced problems. There is also a growing movement to reassess the risks associated with a specific type of bonds issued by banks that have been valued at zero in the Swiss bank merger plan. The emergence of a series of management problems at financial institutions and the reassessment of risks associated with financial products are reminiscent of the process leading up to the Global Financial Crisis (GFC) in September 2008.

Expectations for avoiding a global financial crisis

Even if management problems at financial institutions continue to surface sporadically in the future, it is unlikely that the crisis will develop into a global financial system crisis, similar to the GFC. There are several reasons to be so hopeful.

First, as demonstrated by responses to problems that have surfaced so far, central banks and financial supervisory authorities in major countries and regions have the strong will and ability to prevent financial system crises, based on their experiences during the GFC. In handling the bankruptcy of US banks, special measures were taken to protect all deposits in order to prevent chain bankruptcies. The Swiss bank’s merger plans were finalized in a limited amount of time over the weekend, with strong government and supervisory involvement, before the start of the Asian trading session. The central bank of the United Kingdom, the Bank of England, made a temporary purchase of long-term government bonds in response to the “triple decline” in which stocks, currencies and bonds fall simultaneously. This was intended to prevent the dumping of assets that would lead to the expansion of the financial crisis.

Second, through supervisory and regulatory reforms based on the lessons learned from the global financial crisis, banks have become more capitalized and have higher levels of liquidity.

These improvements are particularly noticeable in the eurozone. During the GFC, the eurozone was hit by even greater turmoil than the epicenter, the United States, and allowed it to develop into a sovereign debt crisis. The inconsistencies in supervision and regulation within the single currency area were a major problem, but now the “banking union” has a unified supervision and resolution system.

The required cautious navigation and collaboration between central banks and supervisory authorities

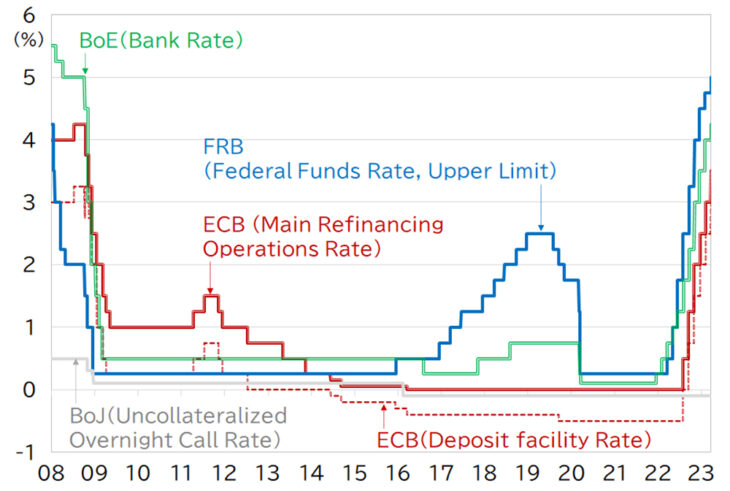

From a different perspective, the stability of the global financial system also depends on the prudent steering of central banks and regulatory authorities. The common background behind the series of problems is that the remarkably loose monetary policies of the US and Europe over the long term have been rolled back at a far faster pace than the market expected in the extremely short period of about one year (see Figure). Central banks in Europe and the United States have decided to continue raising interest rates even as financial instability simmers. This is because they are forced to deal with sticky inflation. The central banks intend to use monetary policy to stabilize prices, and to deal with problems in the financial system by providing liquidity. However, strengthening financial tightening measures can cause solvency problems and undermine the stability of the financial system. Is it possible to strike a good balance? It is undoubtedly a major challenge.

Although regulations and systems have been improved, they are not perfect. Strengthened regulations that have led to the improvement of the banking sector have increased the proportion of non-bank financial institutions (non-banks) in the financial system, but supervision and regulation of non-banks are vulnerable. Banking regulations in the United States also faced problems at small and medium-sized banks that were subject to deregulation in 2018. The euro zone “banking union” was supposed to consist of three pillars: supervision, resolution, and deposit insurance, but the deposit insurance pillar remains missing. The risk of deposit outflows from banks in countries with low creditworthiness to those in countries with high creditworthiness remains.

Figure: Central bank policy rates

The Impact on Japan

The yen is appreciating due to financial instability originating in the United States. This is because Japan is considered to be less susceptible to financial instability. It is true that even after the US and European central banks moved to raise interest rates significantly, which put stress on the financial system, the Bank of Japan (BoJ) has maintained the basic framework of unprecedented monetary easing measures, such as negative interest rates and yield curve control (YCC). The BoJ’s new management team, led by Governor Ueda Kazuo and Deputy Governors Uchida Shinichi and Himino Ryozo, will start on April 9, but is unlikely that there will be a rapid and substantial tightening of policy, even with the change in leadership. The consumer price index has exceeded the BoJ’s monetary policy target of 2%, but it remains at the 3% level due to the effects of the government’s measures. This is because the rate of increase in service prices, which are mainly determined by wages, is low in the low 1% range in Japan. The rate of wage increases in this year’s spring labor offensive (shunto) is expected to be the highest in 26 years. However, with base increases consistent with the price target of 2%, it will not reach the level of over 2%. The challenge is how to maintain the momentum for wage increases so that stable achievement of the price target can be foreseen. In other words, the risk of sticky inflation in Japan is low. The dilemma of price stability or financial system stability faced by central banks in Europe and the United States is unlikely to aggravate.

Expectations for the new Bank of Japan regime

However, the global environment that allowed the BoJ to continue unprecedented monetary easing for a long period of time is changing dramatically. Japan’s economy is open and inseparable from the persistent inflation, rising interest rates, and increasing stress on the financial system in Europe and the United States. BoJ also needs to adjust its monetary policy according to changes in the domestic and international environment. Governor Ueda is the first scholar to lead the BoJ and has experience in monetary policy as a policy board member. Deputy Governor Uchida is from the BoJ and is well versed in monetary policy, while Deputy Governor Himino is an expert on global financial regulation from the Financial Services Agency. This is the most powerful lineup for tackling the difficult task of revising the monetary policy framework in line with changes in the price environment amid simmering financial instability. I believe that new BoJ regime will share a strong will to prevent financial system crises with central banks and supervisory authorities in other countries, and overcome this difficult situation.

Translated from an original article in Japanese written for Discuss Japan. [March 2023]

Keywords

- Ito Sayuri

- NLI Research Institute

- Bank of Japan

- new Governor

- new Bank of Japan regime

- Ueda Kazuo

- Uchida Shinichi

- Himino Ryozo

- financial uncertainty

- financial crisis

- global financial crisis

- central banks

- banks

- bankruptcy

- Swiss bank merger

- Global Financial Crisis

- GFC

- unprecedented monetary easing

- price stability

- financial system stability