Japan’s Economic Outlook for 2016

Komine Takao, Professor, Hosei Graduate School of Regional Policy Design

The economy will continue its moderate recovery, but some economic challenges over the medium and long term will remain unaddressed.” This represents my outlook for the Japanese economy in 2016.

An uncertain economy

First, let me discuss the economic situation in Japan as of the end of 2015. Simply put, our current economy is full of uncertainty. Japan’s GDP, a comprehensive measure of economic activity, for the second quarter (April–June) of this year was down 0.5 percentage points in real terms (annualized) from the preceding quarter, which was followed by an increase of a 1.0 percentage point in the following quarter (July–September) on the same basis. As this shows, thus far, our economy has been hanging in the balance in fiscal 2015, and will most likely end up with annual growth of less than 1% for the entire fiscal year. In view of the fact that the Japanese government expected growth of 1.5%, it is obvious that the economy this year underperformed expectations.

Next, let us examine how the government views the current economic situation in Japan. In fact, its views reflect the uncertainty. According to the Assessment of the Current State of the Japanese Economy in the Monthly Economic Report for November 2015 released by the Cabinet Office, “The Japanese economy is on a moderate recovery, while weakness can be seen in some areas.” This assessment seems to suggest that the government still maintains its view to the effect that the “economy is still recovering.” By contrast, Japan’s Composite Index (CI) indicates that the “economy remains at a standstill.” This statistical view based on the CI is usually seen as highly objective as it is solely based on statistical results precluding human judgment. Therefore, based on the current situation, the Japanese economy remains at a standstill today.

Now, let’s examine how leading economists in the private sector view the situation. I usually refer to the ESP Forecast Survey conducted by the Japan Center for Economic Research as the basis for my forecasts of the economy. In this particular survey, forty economists are usually polled regarding the economic outlook and their forecasts are averaged out and published. The poll contains a question asking them how they see the status quo in the context of the economic cycle.

In the latest survey conducted in December 2015, responses to this question were categorized into three groups, although the process involved some complexities related to the categorization. Those categorized in the first group (22 economists) responded that the Japanese economy has been showing a consistent recovery ever since November 2012. Respondents in the second group (12 economists) answered that the economy has come back on a recovery track after experiencing a temporary slump in 2014. Four other economists grouped in the third category responded that they believe the economy entered a recessionary period following its peak in or around March 2014 and the recessionary economy continues today.

I myself believe that the views presented by the second group of economists will eventually be refuted as the problems regarding the economy become clearer. Consequently, I think we have two options left to choose from regarding the professionals’ assessment of the current Japanese economy. One is the view that “consistent growth in the Japanese economy has been underway ever since Abenomics was launched.” The other view is that “the economy entered a recession in or around April 2014 following the good days of Abenomics, which lasted only a little more than one year, and the situation remains unchanged today.”

The basic scenario assumes that moderate recovery will continue

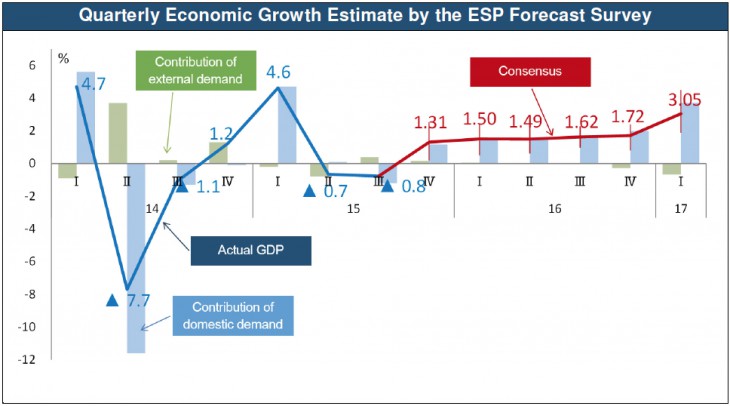

The point is how the economy will develop after the current period of standstill. The view that “moderate recovery will continue” seems to represent a consensus of opinion among the market experts at this point in time. As mentioned above, in the ESP Forecast Survey most economists expect that Japan’s GDP will start growing again after the third quarter (October–December) of fiscal 2015 and will maintain growth at around 1.5% growth over the course of the next fiscal year. (Please refer to the figure below.) In this matter, I share the same view as expressed in the consensus forecast.

The primary reason why I expect that moderate recovery will continue is that corporate earnings as well as the labor situation remain on an uptrend in Japan now. According to the Financial Statement Statistics of Corporations by Industry, which are published quarterly by the Ministry of Finance Japan, corporate earnings in terms of recurring profit continued to show high growth, recording a 9% increase in the second quarter (July–September) of fiscal 2015 on a year-on-year basis.

The labor situation is also improving. The unemployment rate in October 2015 stood at 3.1%, the lowest level recorded in ten years. I believe that the continuation of the current trend in the labor market will have a positive impact on wages and in the capital investments of corporations.

Another piece of good news is that crude oil prices have tended to fall in recent months. I believe that the central bank will extend its drastic monetary easing program for some time to come and the government will remain reluctant to implement fiscal policies that would have a negative impact on the economy. In other words, the trend seen during 2015 will most likely stay unchanged with no particular negative repercussions expected on the economy leading to a setback.

Having said that, the current situation raises some concerns. One of those concerns is that domestic demand has remained sluggish, unlike previously expected, despite record corporate profit. According to the basic economic principles of business cycles, higher corporate earnings will boost capital expenditure, leading to wage increases. This sequential flow beginning with higher corporate earnings is usually expected to lead to higher household income. Unfortunately, this mechanism does not seem to be very strong as of right now.

This phenomenon could be explained by the view shared among corporations seeing the current high profit as temporary without having enough investment opportunities that look attractive to them. It appears that the economic challenges confronting Japan over the long term are having a certain impact on this issue.

Further challenges confronting Abenomics

It seems that it will be quite important for Japan to lay the groundwork for solutions to solve its economic challenges over the medium and long term in 2016. For this very reason, the role to be played by Abenomics will be of supreme importance in the coming years. The Abe administration’s economic policies deserve much appreciation, in part due to the terms of the successful conclusion of the TPP negotiations, but I think Abe’s economic package involves some problems as discussed below.

First, the effects of the original Three Arrows of Abenomics appear to have started facing their limits. Since the end of 2012, when Abenomics was launched, the Japanese economy has made a remarkable recovery that has exceeded general expectations. This was brought about by the government’s message to the public that it had made a drastic change in its economic policy (the “announcement effect”) and had increased public works spending. The announcement effect resulted in a weaker yen and higher stock prices. The rising stock prices help to encourage consumer spending through the “wealth effect,” and the depreciation of the yen helped to increase revenues and profits for export-oriented companies.

But these are merely temporary soluti

ons to encourage growth in the economy. It is not possible for the government to keep sending out a message with a powerful announcement effect and the effects of the weaker yen, higher stock prices and increased public investment will not last long, being seen only during the period in which they occur.

Second, it appears that the “three new arrows” announced recently as part of the second phase of Abenomics are not strong enough. The following is the new set of three arrows. The first arrow is “Creating a strong economy that opens up a brighter future (aiming for real GDP of JPY 600 trillion)”; the second arrow is “Providing childcare support that fosters family dreams (aiming for a fertility rate of 1.8)”; and the third arrow is “Establishing a social security system that leads to a stronger sense of reassurance (a nursing care turnover rate of zero).” This new set of three arrows looks fine as basic policy, but I must say that the policy targets sound rather questionable because all of them seem quite unrealistic and there is no indication of the means by which they are to be achieved.

Third, neither the original three arrows nor the new ones included any specific programs to reform the fiscal budget and the social security system. This suggests to me that it would take the government a much longer time to address the reform agenda, rather than solving the problems.

When it comes to programs to reform the social security system, what is really required must be the initiative to cut social security spending for the elderly. In reality, however, the supplementary budget for fiscal 2015 includes a plan to offer 30,000 yen in lump sum payments to the low-income elderly. I must say that this is nothing but a pork barrel project.

In conclusion, I would like to point out that if the government does nothing specific to address these issues while the economy is seeing a moderate but continuing recovery, there will be a tremendous price to pay at some time in the future.

Note: After this survey was conducted, GDP growth rates have been revised retroactively for the last two quarters (i.e. to a 0.5% decrease for Q2, and a 1.0% increase for Q3 in 2015)

Source: The ESP Forecast Survey (December 2015), Japan Center for Economic Research

Translated from an original article in Japanese written for Discuss Japan. [October 2015]