At a monetary policy meeting on October 5, the Bank of Japan approved a policy of “comprehensive monetary easing.” To hear the media tell it, this is a policy of essentially zero interest rates, and it amounts to inflation targeting and marks a return to the quantitative-easing line. When reading bureaucratese, however, it is generally a good idea to examine the footnotes even more closely than the text, as the notes and the appended material often tell the real story of what is going on. In this case, one discovers that the new policy is not one of essentially zero interest rates, or of rates “from 0% to 0.1%” as advertised, but of essentially 0.1% interest rates. As one of the footnotes indicates, it simply is not possible to move rates below 0.1% as a result of other lending systems. The claim that the... [Read more]

Archives Economy

THE INTERNATIONAL SPACE STATION AND JAPAN

The International Space Station is a joint multinational project involving 15 countries: Japan, the United States, 11 European nations, Canada, and Russia. It entails the construction of an enormous facility, roughly the size of a soccer stadium, that will orbit the Earth at an altitude of around 400 kilometers and weigh approximately 420 tons in total. The space station will normally be inhabited by six astronauts, who will carry out various scientific experiments and tests of technologies, in addition to observing the Earth and outer space. A massive sum of upwards of ¥8 trillion (excluding Russia’s expenditures) has been invested in the ISS by the US, European, and Japanese partners since its construction began in 1998. This can truly be described as a colossal scientific project on a scale unprecedented in human history. In 1987 Japan decided to participate in the ISS project through ... ... [Read more]

JAPAN PLAYS CATCH-UP TO WIN SATELLITE ORDERS

Exactly 40 years ago Japan launched its first satellite. In 1970, after four failed launches, the Ōsumi was successfully sent into orbit, making Japan the fourth country to have its own satellite–after the former Soviet Union, the United States, and France. According to materials published by the Japan Aerospace Exploration Agency (JAXA), Japan has launched 141 rockets as of 2009, placing it fourth after Russia (3,294, including the Soviet era), the United States (1,931), and the European Space Agency (329). In this sense, Japan can be described as a “satellite superpower.” In the realm of business, however, Japanese satellite makers lag behind. There are two companies in Japan that manufacture commercial satellites: Mitsubishi Electric and NEC. Yet of the 20 telecommunication satellite models currently in use, 19 were produced outside of Japan. Mitsubishi Electric, which is Japan’s top satellite maker,... [Read more]

JAPAN'S SATELLITE LAUNCH BUSINESS LIFTS OFF

Japan’s satellite launch business is set to enter a new stage in 2011, when Mitsubishi Heavy Industries uses its H-IIA, a mainstay rocket produced in Japan, to launch the Korea Multipurpose Satellite-3, or Kompsat-3, of the Korea Aerospace Research Institute. This will mark the first time for a Japanese rocket to launch a non-Japanese commercial satellite. Japan’s satellite launch vehicles have been developed with an eye to having 100% of their key technologies produced in Japan. The N-I rocket, first launched in 1975, relied completely on imported technologies, but in advancing to the N-II in 1981 and the H-I in 1986, the levels of Japanese technologies used rose to 20% and 50%, respectively. By 1994, with the first flight of the H-II rocket, the goal of producing all of the key components and technologies in Japan had become a reality. An advanced version of ... ... [Read more]

PROMOTING GROWTH AND RESTORING FISCAL HEALTH SIMULTANEOUSLY

These days people are talking about how Japan’s public finances are in danger of going bankrupt, but I frankly do not understand what they consider to be a state of bankruptcy. Certainly the government has gone heavily into debt, but for the most part, the outstanding government obligations are domestic in nature. That is, they are bonds held by Japanese parties, not by overseas investors. In effect, the Japanese are in debt with each other. It is like a family in which the husband has borrowed money from the wife, not from some loan shark. Under the circumstances, no problem will arise as long as inflation does not set in and interest rates do not rise too high. To be sure, the government needs to keep on meeting interest payments and rolling the debt over, but it has the financial tools for that. The ... ... [Read more]

A GROWTH STRATEGY FOR A NATION RUNNING OUT OF TIME

On June 18 the cabinet of Kan Naoto, Japan’s new prime minister, approved a growth strategy for “a strong economy, robust public finances, and a strong social security system.” Kan’s Democratic Party of Japan suffered an embarrassing setback in the July 11 House of Councillors election, when it was unable to garner a majority of the upper house seats, but his administration remains determined to incorporate the strategy’s policy measures, including a cut in the corporate tax rate to strengthen the competitiveness of Japan-based companies, in the budget for fiscal 2011 (April 2011 to March 2012). The hope is to rescue the nation’s economy and society from the two decades of stagnation that have followed the bubble boom in the second half of the 1980s. Through the combined efforts of the public and private sectors, the administration seeks to realize an average 3% nominal ... ... [Read more]

USING MONETARY POLICY TO END STAGNATION

Subsequent to the outbreak of the global financial crisis symbolized by the bankruptcy of Lehman Brothers in September 2008, the United States, Japan, and other Asian countries have all been recovering, each at its own speed. Even Europe has returned to growth, although the Greek debt crisis has slowed the pace of recovery there. Particularly compared with Britain, which is transitioning into the postindustrial age and has, accordingly, seen a long-term decline in industrial production, Japan’s recovery was quick. Germany also bounced back fast, though its upturn has recently lost momentum. Japan’s real gross domestic product and real consumption bottomed out in the January-March 2009 quarter and have returned to growth. Statistics on Japanese employment do not yet show improvement, but workers are spending more time on the job, and eventually the longer working hours will lead to gains in the... [Read more]

STRIVING TO BE NUMBER ONE IN BATTERIES

ITOH MOTOSHIGE How does the current global business environment look to you? HOMMA MITSURU The American economy has been extremely active of late. And even though unemployment remains high, pricey consumer products in cars and electronics have begun to move, in particular in May and June. If we don’t see a recurrence of the financial problems, I think the recovery will move forward steadily. On the other hand, Europe is still not showing much sign of recovery following the Greek financial crisis. But solar power generation is doing well; this is probably due to the “feed-in tariffs” whereby privately generated power is purchased at a set price. ITOH I heard that FITs had been a failure in Spain. HOMMA Yes, it’s true that the system did collapse in Spain at one stage. Following this failure, countries such as Germany are moving ahead... [Read more]

LESSONS OF JAPAN'S BUBBLE ECONOMY

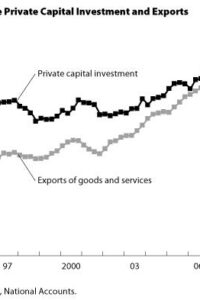

Two decades have passed since Japan’s bubble began to burst in 1990, and throughout this period the economy has been in poor health. It has encountered successive financial crises, experienced price deflation for the first time since World War II, and seen the public debt mushroom, all the while limping along at a very slow growth rate. This has been a bewildering change for a nation that until then was registering spectacular growth. After all, over a period of more than 40 years after the war’s end, Japan’s economy had grown into an entity so weighty that it was even said to have become a threat to the economy of the United States. Why did a speculative bubble with so much destructive power inflate in the second half of the 1980s, and why has the impact of its deflation lasted so long? These are ... ... [Read more]

GAUGING JAPAN'S "SOVERRIGN RISK"

In September 2008 the world economy, hit by the financial crisis symbolized by the bankruptcy of Lehman Brothers, went into a tailspin, but in the second half of 2009 it pulled out of the dive and began to regain altitude. Then in March and April 2010, just when optimistic views were becoming widespread, yields on Greek government bonds suddenly rose, and a crisis of sovereign risk came into view. Confidence in the euro was badly shaken, and worries about European economies and the global economy spread. Once again the future of the world became shrouded in uncertainty. Stock markets tumbled, and many countries in Europe and other parts of the world experienced a mushrooming of fiscal deficits, since tax revenues had declined following the Lehman shock, while government spending had been stepped up to apply stimulus. With Greek government bonds sustaining a crippling blow, ... ... [Read more]