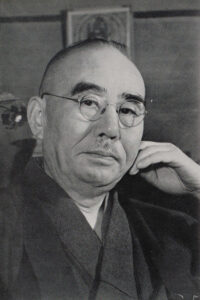

Suzuki Wataru, Professor, Gakushuin University Key points The effects of cash payments and in-kind assistance are unclear Re-examining preferences towards stay-at-home mothers and Japanese employment practices All residents should pay for child insurance to secure financial resources According to the flash report on Vital Statistics released at the end of February 2023, the number of births in 2022 was 799,000, the first time it has ever dropped below 800,000. This includes foreign nationals living in Japan and Japanese nationals living abroad, with an estimated 770,000 or so births among Japanese nationals living in Japan in confirmed reports. (see graph) In the last 50 years, the decline in the number of births has been pretty consistent, but there was a further rapid decline caused by the COVID-19 pandemic. It is concerning that even the recovered total fertility rate has started to decline. ... ... [Read more]