A Compass for the Japanese Economy — Readjusting the Economy by Focusing on Technological Innovation

< Key Points >

- * The distribution of energy, water, and food will become priority issues

- * Now is a good time to move away from finance capitalism based on oil resources

- * Pipelines will serve as a means of readjusting national interests among states

John Maynard Keynes once wrote, “We are suffering, not from the rheumatics of old age, but from the growing-pains of over-rapid changes, from the painfulness of readjustment between one economic period and another.”

IMAI Ken-ichi, Professor Emeritus at Hitotsubashi University and Senior Fellow Emeritus of Stanford University

Most Japanese industries and companies are being forced to engage in a tough struggle as industrial organizations undergo huge changes worldwide. Organizational rigidity due to the aging of corporate employees is certainly one factor behind this trend. However, its direct cause is the pain associated with excessively rapid changes in finance and foreign exchange which have arisen from economic globalization in complex ways.

An essential question here for Japan concerns what it means to readjust to another kind of economy. To answer this question in my own way based on my personal understanding of Keynes’ views, it means to shift from finance capitalism, in which finance, separated from the real economy, drives the economy, to another form of capitalism based on technological innovation that truly satisfies the needs of people worldwide. During this readjustment period, Japan should aim to take is to maintain its strengths and shift to a global framework.

It is well known that Joseph Schumpeter, in considering the question of whether capitalism could survive, answered in the negative. However, with regard to what kind of economic system should follow, Schumpeter only said that capitalism is in the process of changing into one or another kind of system (in Shumpeter’s term “Something Else”) .

It is clear that these other kinds of systems did not include finance capitalism. In this article, I would like to consider the kind of capitalism that is needed, stressing Schumpeter’s warning that capitalism has forced out the “craftsmen” with whom it should naturally coexist.

The first issue capitalism must address is the problem of how to produce, secure, and distribute the energy, water, and food required by more than 7 billion people on the planet. The shape which capitalism assumes in the future will depend on the manner in which this problem is resolved.

The miseries of the world wars from the nineteenth to the twentieth century failed to produce a peaceful economy in the end because of the scramble for oil resources and the territorial disputes this scramble produced.

Fortunately, however, the prospect of the kind of capitalism supported by oil and military power seems to gradually be receding. It seems increasingly apparent that the era of shale gas as a new energy source is indeed the real thing. Investing in the oil industry has until recently been very speculative, almost a gamble, but this now seems to be changing.

For example, the venture capitalist George Mitchell, who developed a technique for breaking up bedrock using high-pressure water, known as fracking, made this technique available to the public without patenting it. This was a symbolic choice that significantly differed from the creation of a monopoly, the logical and traditional base for the oil industry.

I’m not pointing up the significance of the so-called shale revolution based on these facts alone. The discovery of shale gas is significant because it confirms a new economic theory.

I have discovered from various literature that the technology supporting the shale revolution was actually a way of thinking developed by Professor Bruno Latour of the Institut d’études politiques de Paris, who studied the Actor Network Theory (ATN) created by people and nature. Latour’s theories are characterized by the idea that not only human beings, but also robots and sensors behave as “actors” in networks, and that both work together to record research and explorations results.

Applying this approach, shale gas prospectors record the shale strata known to contain gas and their surrounding environs one by one, and mark these shale strata or attach sensors to them. They then analyze the information obtained from these inscriptions to select sites and methods of exploration. This is a groundbreaking approach that enables prospectors to understand the organic relationships between individual data (micro data) and the overall environment (macro data)—in other words, the connection between microtechnologies and macrotechnologies—instead of just seeing information in the quantitative aggregate.

Even in traditional prospecting operations, massive amount of data has also been collected for discovering oil fields, but once it is discovered oil automatically gushes and therefore the oil field generates colossal profits. For that reason, oil assets had been the perfect target for financial speculation. This, in combination with militarism, has allowed finance capitalism to abuse the countries possessing resources. In contrast, shale gas rests on a different industrial foundation from finance capitalism.

Many chemicals are used to treat the wastewater from shale gas exploitation operations. I believe that Japanese companies, such as Kurita Water Industries Ltd. and Ebara Corporation, can assist in these operations through their water treatment technologies, which remain the most advanced in the world. The Waterworks Bureau of the Tokyo Metropolitan Government also has the world’s leading water treatment know-how. This Bureau has the craftsmen Schumpeter said that capitalism should coexist with them.

Needless to say, advanced computer, robotic, and sensor technologies are essential for developing a micro- and macro- loop. This is another field where Japan’s expert engineers have amassed the best technologies in the world. Creative craftsmen develop, maintain, and manage the details. Thus, the shale revolution will rebuild and redirect the real economy in the way Schumpeter wanted.

A framework called “shared national sovereignty” for building pipelines to transport energy and water is another important element of the new capitalism.

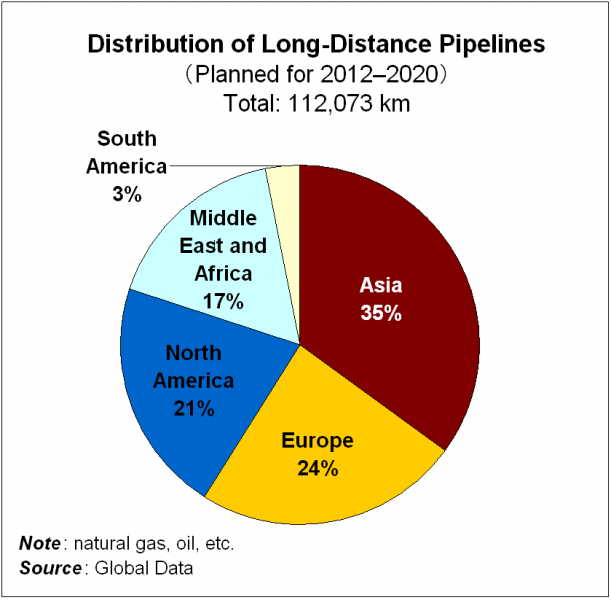

Oil and natural gas pipelines are beginning to change from a simple means of transportation to a means of adjusting interests in national and cooperative ties. Many countries have noticed their importance in this sense. According to a Global Data study, the number of long-distance pipelines to be built by 2020 totals 157 worldwide. As the accompanying graph shows, Asia accounts for a high percentage of these. This point deserves our attention. Looking at Japan, the previously planned project to build a pipeline to transport natural gas from Sakhalin, Russia, is showing signs of revival. This project may lead to a turning point in the resolution of the pending Northern Territories issue between Japan and Russia.

Of course, there are still cases today in which international disputes have caused problems in the use and construction of pipelines. However, an awareness of the need to soften the idea of sovereignty through varied approaches has emerged since Professor Stephen David Krasner of StanfordUniversity in the United States criticized the concept of national sovereignty established in the Peace of Westphalia in the seventeenth century, pointing out how it diverges from actual conditions.

About ten pipelines labeled as “strategic” are currently planned around the world. Their construction plans incorporate the aim of possibility of promoting peaceful relations among the countries that will be connected to each other via these pipelines. Countries are working to restrict their respective sovereignties and build new relationships with a focus on adjusting their interests regarding the supply of energy necessary for their survival.

In this article, I discussed the key points of this new system from the standpoint of the shale revolution using Keynes’ idea of another kind of economy as the point of departure. In conclusion, I would like to highlight the personality of the entrepreneur who forged the path for this new era. As I stated earlier, George Mitchell renounced patenting his technology. As a regional planner in Texas, the United States, when he was young, he created many jobs in a vast community called the Woodlands. Mitchell was totally different from the traditional founders of the oil business. Although he unfortunately passed away recently, he reportedly took a strong interest in shale gas development in China in the last days of his life.

I don’t know what Mitchell’s attitude toward capitalism was. However, the documentation of his career suggests that his views and the ideas I have discussed in this article are quite close. So following in Mitchell’s footsteps and cooperating with China in its shale gas development projects would be the perfect opportunity and responsibility for Japan as a neighboring country that shares this entrepreneur’s goal.

Translated from “Nihon keizai no rashinban (part 1) — Gijutsu kakushin jiku ni ‘Sai-chosei’wo (A Compass for the Japanese Economy — Readjusting the Economy by Focusing on Technological Innovation),” Nihon Keizai Shimbun, August 13, 2013, p. 28. (Courtesy of Nihon Keizai Shimbunsha)